What is Medicare

Medicare is a government-sponsored healthcare program in the United States that provides coverage for medical services for individuals aged 65 and older, as well as certain younger individuals with specific medical conditions. Established in 1965, Medicare aims to ensure that seniors and other eligible individuals can access necessary healthcare services without facing financial burden.

Medicare is divided into different parts, each catering to specific healthcare needs. Part A primarily covers inpatient hospital services, skilled nursing facility care, and some home healthcare services. Part B is optional and covers outpatient services such as doctor visits, preventive care, and medical equipment. Part D is a prescription drug coverage program that assists beneficiaries in obtaining necessary medications.

To qualify for Medicare, individuals typically need to have paid into the program through payroll taxes for at least ten years (approximately 40 quarters). However, individuals who do not meet this requirement may still be eligible, albeit with additional costs.

While Medicare offers critical healthcare coverage, it does not cover all medical expenses. Beneficiaries are responsible for paying certain deductibles, coinsurance, and copayments. Hence, many beneficiaries choose to purchase supplementary private insurance plans, often referred to as Medigap, to help cover these out-of-pocket expenses.

To administer Medicare, the Centers for Medicare & Medicaid Services (CMS) work closely with healthcare providers, insurance companies, and various stakeholders. This collaboration ensures that Medicare beneficiaries have access to a broad range of healthcare services to help maintain their well-being.

In conclusion, Medicare is a government-sponsored healthcare program that offers coverage for eligible individuals, primarily seniors aged 65 and older. Its various parts cater to different healthcare needs, such as hospital services, outpatient care, and prescription drugs. While Medicare is a crucial safety net, beneficiaries should be aware of potential out-of-pocket costs and explore supplementary coverage options.

Who Qualifies for Medicare in Huntington, N.Y

Senior people leading positive lifestyle

Medicare is a federal health insurance program in the United States that provides coverage for eligible individuals who are 65 years of age or older, as well as certain younger individuals with disabilities and those with end-stage renal disease (ESRD).

To qualify for Medicare based on age, an individual must be at least 65 years old and either a U.S. citizen or a legal permanent resident who has lived in the country for at least five consecutive years. This age requirement also applies to individuals who have not paid into the Social Security system.

For individuals under 65, Medicare eligibility is generally determined based on disability status. Those who have received Social Security Disability Insurance (SSDI) payments for at least 24 months, or who have been diagnosed with Amyotrophic Lateral Sclerosis (ALS) or ESRD, are typically eligible for Medicare before the age of 65.

Individuals with ESRD, also known as kidney failure, can qualify for Medicare regardless of age. This includes individuals who require regular dialysis or have received a kidney transplant. Certain citizenship and residency requirements may still apply in these cases.

In addition to age and disability criteria, Medicare eligibility may also be tied to work history. Individuals who have paid Medicare taxes while working, or who are married to someone who has, may be eligible for premium-free Medicare Part A (hospital insurance) based on their work record. Others who do not meet these requirements may still be able to enroll in Medicare, but they may have to pay a premium for Part A coverage.

It is worth noting that Medicare has different parts and coverage options, each with specific eligibility requirements. While this essay focuses on general qualifications, individuals are encouraged to seek further guidance from the official Medicare website or a Medicare representative to determine their specific eligibility and coverage options.

Medicare Advantage Plans in Huntington, N.Y

Medicare Advantage plans have a long history, starting in 1966 when private HMO companies partnered with Medicare to provide an alternative to original Medicare. Over time, these plans have grown and improved, leading to the creation of Medicare Part C in 1997 through the balanced budget act. Today, Medicare Advantage plans hold a significant share of the Medicare market, capturing 51%.

In Huntington, New York, there is a wide selection of Medicare Advantage Plan options available, with major carriers like Humana, Cigna, Aetna, United healthcare, BCBS, Health First, Wellcare, Emblem Health, and VNS participating. Each carrier offers multiple options to cater to different consumer needs. Currently, Aetna, Humana, and Cigna are the most popular Medicare Advantage plans in the area.

When it comes to choosing a Medicare Part C plan in Huntington, there are around 30 options to consider. This can be overwhelming if you’re not prepared. Comparing plan options based solely on premiums and copays can be misleading. It’s crucial to look beyond the numbers. Make sure that your preferred doctors accept the plan you’re considering, and also ensure that the Medicare Advantage plan covers all of your prescriptions. These factors are just as important as the cost-sharing details.

So how do you compare Medicare Advantage Plans in Huntington, NY without losing your mind or making a terrible mistake.

Side by side comparison

First you want to get organized, create a list of all your must have doctors along with daily Medications you take and what hospital you would like to use god forbid you needed one.

Create a list of must haves or most important benefits you would really like to have.

Educate yourself on the ABC’s of Medicare so you understand what you are comparing.

Make sure you have a valid election period, in layman’s terms make sure you enroll when you have eligibility. Medicare enrollment periods can be tricky.

Before you start looking at cost sharing, make sure you check to see which plans your doctors work with.

Rinse and repeat with the daily prescriptions. You do not want to get a plan with no premium and all your doctors but pay a ridiculous amount for daily prescriptions.

When searching for doctors, hospitals, and medications with Medicare Advantage plans, the options can quickly become limited. It’s crucial to be aware that even if the cost sharing seems similar to other plans, each plan has different providers and drugs in their directories.

In Huntington, NY, there are several excellent Medicare Advantage plans to consider. However, it’s important to remember that there is no one-size-fits-all plan. Before choosing a Medicare Advantage plan, ensure that it meets all your important requirements. Avoid being swayed by someone claiming their plan is the best.

Understanding Medicare Supplement Insurance in Huntington, NY

A Medicare supplement, also known as Medigap, is a type of insurance policy designed to provide additional coverage for costs not covered by Medicare. It is offered by private insurance companies and helps to fill in the gaps left by Medicare, such as deductibles, copayments, and coinsurance.

Medicare, the federal health insurance program for people aged 65 and older, provides basic coverage for hospital stays, doctor visits, and other medical expenses. However, there are certain out-of-pocket costs that individuals are still responsible for, and that’s where a Medicare supplement can be beneficial.

By purchasing a Medicare supplement policy, individuals can ensure that they have greater financial protection against unexpected healthcare expenses. These plans work alongside original Medicare and help to cover costs that would otherwise be their responsibility. This can include things like prescription drugs, vision and dental care, and even medical expenses incurred while traveling abroad.

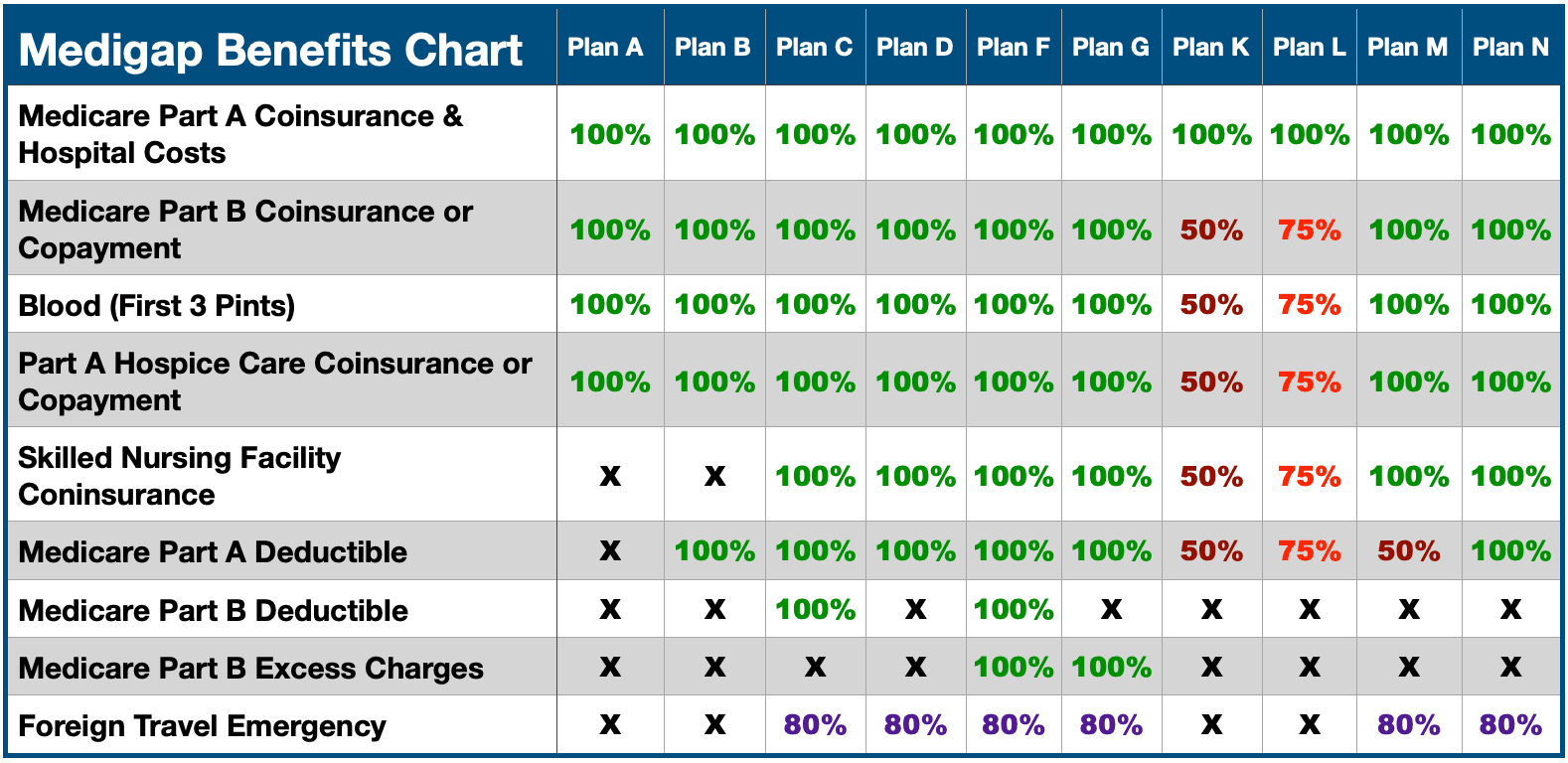

It is important to note that Medicare supplement plans are standardized and come in various lettered categories, such as Plan A, B, C, and so on. Each plan provides different levels of coverage, with Plan F being the most comprehensive. However, starting in 2020, Plan F will no longer be available to new enrollees, but those who already have it can keep it.

In summary, a Medicare supplement is an insurance policy that fills the gaps in coverage left by original Medicare. It provides additional financial protection for certain out-of-pocket expenses, ensuring that individuals have more comprehensive healthcare coverage. It is vital to carefully consider the available plans and choose the one that best meets individual needs and budget.

Now we know what a Medicare supplement plan is, let’s talk about a couple of important facts.

Fact # 1 Enroll in a Medicare supplement plan worry-free in Huntington, NY, as New York is a guarantee issue state. If you meet the eligibility criteria for Medicare and have both parts A and B, you can easily enroll in a Medicare supplement without having to answer any medical questions. This guarantee issue is available year-round in only four states: Maine, Connecticut, Massachusetts, and New York.

Fact # 2 Medicare supplements in Huntington, NY are standardized, ensuring that all carriers offering Plan G provide identical coverage. The only variation lies in the price and name displayed on your card.

Fact # 3 If you enroll in a plan K which has some decent cost sharing involved, you can change to a more comprehensive Medicare supplement plan anytime of the year. You don’t have to wait for a special enrollment period.

Fact # 4 Community Ratings Benefit Medicare Consumers in Huntington, NY: Get Your Supplement Plan Rate Based on Location, Not Health or Age.

Fact # 5 Medicare supplemental plans can be great but they don’t cover some services you can get with a Medicare Advantage plan like Part D drug coverage, Vision & Dental.

Discover the millions of individuals benefiting from Medicare supplemental coverage, just like Medicare advantage plans. Shopping and comparing Medigap Plans has never been simpler, thanks to their standardization and secondary payer status. Forget about worrying over networks, as Medicare operates without one. In New York alone, a minuscule 1.7% of doctors chose to opt out of Medicare in 2023, with the majority of those being psychiatrists at 7.7%. Rest assured, Medicare offers a comprehensive and accessible healthcare solution.

Let’s recap What we learned about Medicare Supplements In Huntington, NY

Discover the unified world of Medicare supplement and Medigap plans. Every carrier that offers Plan G provides identical coverage, ensuring consistency and reliability.

Living in Huntington NY, you are guaranteed Medicare supplement coverage, regardless of any pre-existing health conditions. Say goodbye to concerns about being declined for your medical needs.

While Medigap plans are comprehensive, it’s important to note that they do not include part D prescription coverage. Ensure you have suitable coverage for your medications.

To enroll in these plans, you must have both Medicare parts A and B. Additionally, your rate will be determined based on your specific zip code, allowing for personalized and localized benefits.

Getting the most out of Medicare Part D in Huntington NY

To do this first we must understand what exactly is Medicare Part D?

white pills coming out of prescription pill bottle on black background

Medicare Part D: Essential Information You Need to Know

Discover the key points about Medicare Part D, the prescription drug coverage program offered by the U.S. government through Medicare.

Voluntary Enrollment: If you’re eligible for Medicare, you have the option to enroll in a Part D plan.

Stand-Alone or Part of Medicare Advantage: Part D plans can be obtained on their own or as part of a Medicare Advantage plan.

Costs Involved: Part D plans may have monthly premiums, deductibles, and copayments. The specific costs depend on the plan you choose.

Closing the Coverage Gap: The Affordable Care Act is gradually closing the coverage gap, referred to as the “donut hole,” where beneficiaries had to pay more for prescription drugs.

Enrollment Periods: There are enrollment periods for Part D plans, including the initial enrollment period and the annual open enrollment period.

Prescription Drug Formularies: Each Part D plan has its own list of covered prescription drugs. It’s crucial to choose a plan that covers the medications you need.

Extra Help: Those with limited income and resources may qualify for Extra Help, a program that assists with prescription drug costs.(Huntington Residents can also apply for the NYS EPIC program)

Huntington, N.Y residents will have 15 different part D plans to choose from. These plans will vary greatly from one plan to another. When you are trying to compare Part D plans you need to have your list of monthly prescriptions handy and then you can visit Medicare.gov and do a side by side comparison of plans to see which one will fit your needs best. All part D plans will offer at least two drugs in every class and use Medicare’s official formulary plus whatever drugs they decide want to include on top of that. When it comes to Medicare Part D after your initial enrollment you may only change your plan one time a year the Medicare annual enrollment period October 15th – December 7th with the exception of a special election period. (like Moving)

Conclusion:

Huntington residents have a plethora of Medicare choices, with 10 standardized Medicare supplement plans, at least 30 Medicare Advantage plans plus 15 part D stand alone drug plans to choose from. With guaranteed issue rights here in NY it gives us more of a chance to try out both a Medicare Advantage plan and a Medigap plan with a stand alone drug plan. This is nice gives people more options knowing you are not trapped in any plan or type of coverage for life.

If you find yourself in need of some help or advice either myself or one of my team members would be happy to answer all your questions and help you feel comfortable to choose the best plan for your situation.

References