- Serving Los Angeles County Since 2007

Los Angeles

Medicare Expert

Compare 50+ Medicare Advantage Plans & Multiple Medigap Options from 10+ Top-Rated Carriers-All in One Place.

- Phone & Zoom Appointments Available

- 100% Free Consultation

Get Your Free Plan Comparison

Compare plans based on YOUR doctors & drugs

New to Medicare in Los Angeles? Already Enrolled? Turning 65? I’m Here to Help.

- I proudly help every type of Medicare consumer in the Los Angeles area:

- Turning 65 — first-time enrollment, deadlines, penalties, and choosing the right plan

- Still working past 65 — coordinating Medicare with employer insurance

- Retiring after 65 —avoiding gaps and costly mistakes

- Already on Medicare —annual reviews, cost comparisons, network checks

- Under 65 with disability —specialized support and plan options

- Caregivers & family members —help understanding benefits and coverage changes

- Don't Miss Out

Important Deadlines

Turning 65?

Annual Enrollment Period

Medicare Advantage OEP

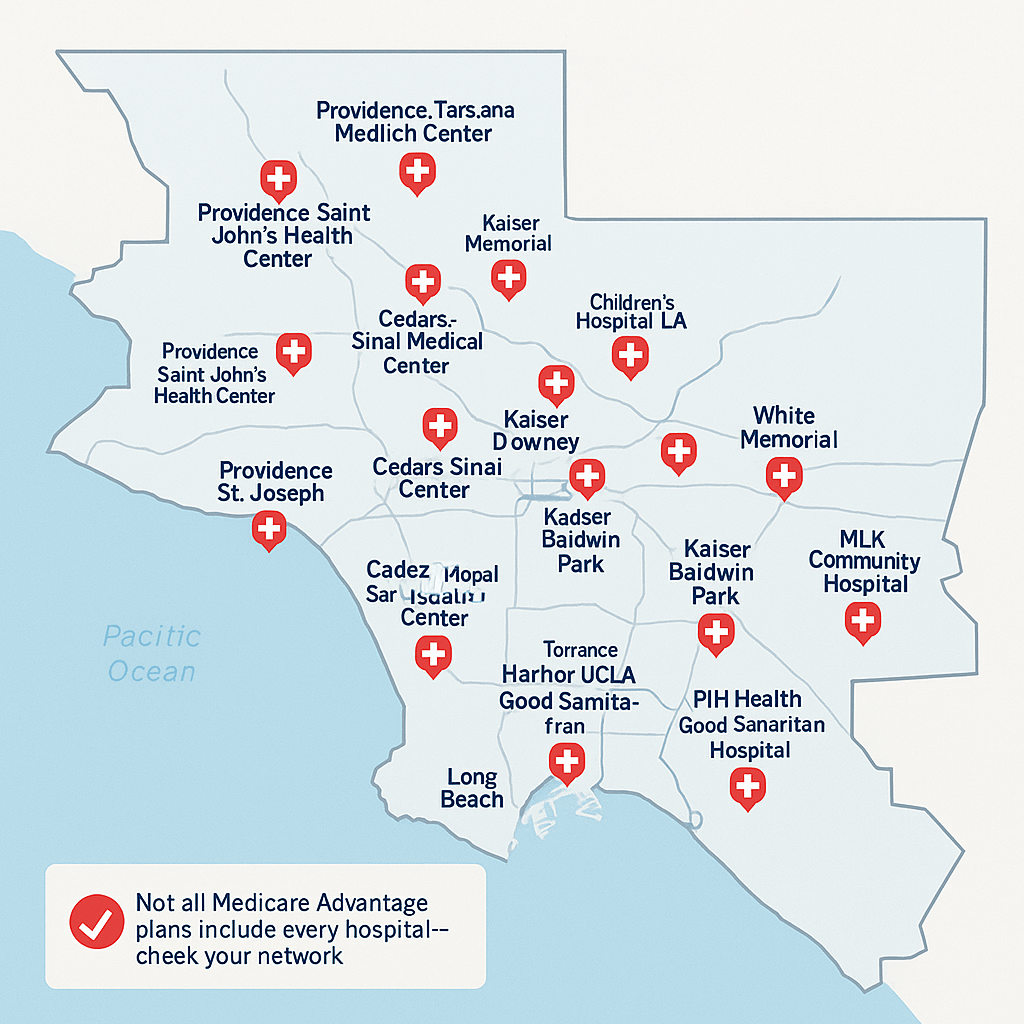

Medicare Advantage Plans in Los Angeles

Why So Many Plan Choices Matter

- During our consultation, I evaluate:

- Does the plan include YOUR doctors and specialists?

- Which hospitals are in-network (Cedars-Sinai, UCLA, USC, Kaiser, etc.)?

- What are the REAL out-of-pocket costs (copays, coinsurance, max limits)?

- Are your prescriptions covered, and at what cost tier?

- What extra benefits do you actually value (gym, dental, vision, OTC allowance)?

- Does the carrier have good ratings for customer service?

- Overwhelmed by Choices?

Medicare Supplement (Medigap) Plans in Los Angeles, CA

Prefer the freedom to see ANY doctor or specialist who accepts Medicare—without networks or referrals? A Medicare Supplement plan might be your best choice.

Los Angeles Medigap Carriers I Represent:

- UnitedHealthcare (AARP)

- Humana

- Continental Life

- Anthem Blue Cross

- Aflac

- Blue Shield of California

- Globe Life

- Mutual of Omaha

- Manhattan Life

- American Retirement Life

- Transamerica

- Bankers Life

- California's Unique Advantages

Birthday Rule

Guaranteed Issue Rights

Rate Stability Focus

Trusted Medicare Advisor Paul Barrett

Paul Barrett offers expert Medicare advice, professionalism, savings, reliability, and peace of mind for clients.

Paul Barrett

About Paul Barrett

Common Medicare Questions from Los Angeles Residents

Local insights you won't find in national commercials.the time to ensure you're covered.

There’s no universal “best” plan. Medicare Advantage works well if your doctors are in networks like Kaiser, UCLA, or Cedars. Medigap is ideal for snowbirds or those wanting nationwide access. Most clients choose based on their specific doctor and prescription needs.

LA County is huge. Networks vary heavily between Santa Monica, the Valley, and Long Beach. Carriers like Kaiser, SCAN, and Blue Shield have different footprints. Your friend in Burbank may have totally different options than someone in El Segundo.

Big systems like Cedars-Sinai and UCLA have limited participation in certain networks. If keeping a specific doctor is non-negotiable, we must confirm network status. I check this for you every time.

Yes. As of 2023, Medicare Part D covers the Shingrix vaccine at no cost to you at major pharmacies like CVS, Walgreens, Costco, and Ralphs.

For 2026, Part A is $0 for most. Part B standard premium is $202. High-income residents (IRMAA) may pay more based on tax returns from two years prior.

Absolutely. From Santa Monica & West LA to the San Fernando Valley, Long Beach, Pasadena, and Lancaster. I serve the entire county via phone and Zoom.

Yes. You have the Annual Enrollment Period (Oct 15–Dec 7), Medicare Advantage OEP (Jan 1–Mar 31), and California’s unique Birthday Rule which allows you to switch Medigap plans around your birthday without medical underwriting.

It varies. Cedars, UCLA, and Providence participate in select plans. Kaiser only accepts Kaiser Advantage. I help you find plans that truly support your preferred providers.

Nationwide ads promote generic benefits. In LA, dental/vision allowances and HMO penetration differ. Ignore the commercials and focus on what’s actually available in your ZIP code.

Cost of living, higher provider reimbursement rates, and high healthcare utilization drive prices up. I compare carriers to find the most stable rates for you.

Yes. Every carrier can modify MOOP, copays, and networks. LA residents often see shifts due to contract renegotiations. I review this for you every fall.

If you travel often, Medigap may be better for nationwide access. However, some PPO Advantage plans work for travelers. We’ll compare based on your travel patterns.