Medicare’s local coverage determinations (LCDs) are essential for ensuring that healthcare services meet the specific needs of different communities. These determinations allow Medicare to adapt its coverage based on regional healthcare practices and patient requirements. This localized approach helps provide access to necessary medical services tailored to the unique circumstances of each area.

Understanding why Medicare employs local coverage can enhance your ability to navigate the system effectively. By knowing how these policies may impact your coverage options, you can make more informed decisions regarding your healthcare. The Modern Medicare Agency is here to help you with personalized assistance. Our licensed agents can guide you through the complexities of Medicare, ensuring you select a plan that truly fits your needs without incurring excessive costs.

Working with The Modern Medicare Agency means you have access to real people who understand your situation. Our team focuses on identifying the right Medicare packages specifically for you, ensuring a seamless experience as you secure the coverage that best meets your health requirements. This personalized support can simplify your Medicare journey and help you avoid unnecessary financial burdens.

Understanding Medicare and Coverage Policy

Medicare is a federal program that offers crucial health coverage for eligible individuals. Understanding its structure and policies is essential for making informed choices regarding healthcare needs. This section delves into the fundamentals of Medicare and its coverage policies.

What Is Medicare?

Medicare is a federal health insurance program primarily for individuals aged 65 and older. It also serves younger individuals with disabilities or specific medical conditions. The program consists of different parts, each designed to cover various healthcare services.

Medicare provides essential coverage for hospital stays, outpatient care, preventive services, and prescription medications. Understanding these components allows you to better navigate your healthcare options and make the best choices for your needs.

Overview of Medicare Coverage Policies

Medicare coverage policies are established by the Centers for Medicare & Medicaid Services (CMS). These policies dictate what healthcare services, treatments, and items are deemed “reasonable and necessary.”

Local Coverage Determinations (LCDs) can influence how these policies are applied in specific geographical regions. Policies can vary based on local interpretations, leading to different coverage options depending on where you live. This variability emphasizes the importance of checking coverage specifics in your area.

Medicare Part A and Part B Basics

Medicare Part A covers inpatient hospital stays, skilled nursing facility care, hospice services, and some home health care. Most individuals do not pay a premium for Part A if they or their spouse paid Medicare taxes while working.

Medicare Part B covers outpatient services, including doctor visits, preventive care, and durable medical equipment. This part usually requires a monthly premium, which is essential to budget for as you plan your healthcare expenses.

Navigating Medicare can be complicated, but The Modern Medicare Agency is here to help. Our licensed agents are available to assist you one-on-one, helping you identify the best Medicare packages without hidden fees.

Local Coverage Determinations: Definition and Purpose

Local Coverage Determinations (LCDs) play a vital role in how Medicare manages care across different regions. They specify which services and items are covered based on local needs, ensuring beneficiaries receive appropriate care tailored to their geographical area.

What Are Local Coverage Determinations (LCDs)?

Local Coverage Determinations (LCDs) are policies developed by Medicare Administrative Contractors (MACs). These decisions are specific to particular localities and outline the criteria under which certain medical services and items will be covered.

LCDs provide clarity on coverage for various health services, ranging from diagnostic tests to therapies. Each LCD includes detailed descriptions of the conditions necessary for coverage, enabling providers to offer the best care while adhering to Medicare guidelines.

When a service is deemed not medically necessary per the LCD, reimbursement claims can be denied.

Legal Foundations: The Social Security Act

The legal foundation for LCDs is embedded in the Social Security Act, particularly in Section 1869(f)(2)(B). This section empowers MACs to create and implement these local policies based on regional healthcare practices and needs.

The Act defines LCDs as decisions applicable only within the jurisdiction of the issuing MAC. This flexibility allows for the adaptation of Medicare coverage to reflect local medical standards and practices.

While LCDs exist within the framework of federal laws, they provide essential leeway for regional healthcare adaptations that better address community-specific health issues.

Distinction Between LCDs and National Coverage Determinations

It is crucial to differentiate between Local Coverage Determinations (LCDs) and National Coverage Determinations (NCDs). NCDs apply universally across the United States, determining coverage for specific services nationally.

In contrast, LCDs reflect local decisions that consider varying healthcare practices, regional demographics, and the medical necessity of treatments. For example, a service that is a standard care practice in one area may not receive the same status in another, leading to diverse coverage options.

Understanding these distinctions is essential when navigating Medicare benefits. This knowledge helps you grasp how local policies influence your service eligibility and align with your healthcare needs.

For personalized guidance on making the most of your Medicare options, The Modern Medicare Agency connects you with licensed agents who can assist in identifying plans that suit your specific requirements. Enjoy direct, one-on-one communication without hidden costs.

How Medicare Administrative Contractors Shape Local Coverage

Medicare Administrative Contractors (MACs) play a crucial role in the development and implementation of local coverage determinations (LCDs). These determinations dictate which services and items are covered under Medicare in various regions, allowing for localized healthcare decisions that reflect community needs.

The Role of Medicare Administrative Contractors (MACs)

MACs are tasked with managing Medicare claims processing and adjudication. They ensure that claims are evaluated correctly and align with established Medicare policies. By analyzing local healthcare trends, MACs can identify specific needs that may require tailored coverage.

For instance, if a community shows a rising demand for certain medical devices or services, a MAC can create an LCD to address that specific need. This allows for more responsive and relevant healthcare options.

Their role also includes outreach to healthcare providers. By maintaining clear communication, MACs help providers understand coding, documentation requirements, and the rationale behind coverage decisions. This fosters an informed network that enhances patient care.

Responsibilities of DME MACs and Other Contractors

Durable Medical Equipment (DME) MACs specifically focus on items such as wheelchairs, prosthetics, and home oxygen therapy. They evaluate the necessity, appropriateness, and effectiveness of these devices.

DME MACs conduct local coverage analyses to determine guidelines for equipment that meets the medical necessity criteria. This involves reviewing clinical evidence and sometimes engaging with local healthcare professionals to gather input.

In addition, these contractors are responsible for ensuring compliance with Medicare policies. They manage audits and reviews to prevent fraudulent claims and protect beneficiaries. This is essential for maintaining the integrity of the Medicare program.

For personalized guidance on navigating Medicare, consider The Modern Medicare Agency. Our licensed agents work with you one-on-one to find Medicare packages that suit your needs without hidden fees.

Decision Factors and Processes for Local Coverage

Local coverage determinations (LCDs) are essential in shaping Medicare coverage based on geographic needs. Understanding the criteria for creating these determinations, the importance of clinical evidence, and the involvement of stakeholders will help clarify how coverage policies are tailored to specific regions.

Criteria for Creating LCDs

The criteria for establishing local coverage determinations focus on the specific health needs of the community. Factors such as prevalence of conditions, provider specialty, and regional health care delivery patterns are assessed.

LCDs typically reflect the needs of the population served, ensuring that the available services are appropriate and necessary. Moreover, these determinations must comply with federal regulations and contribute to the overall goals of Medicare.

The Medicare coverage database plays a crucial role, allowing access to current LCDs and facilitating transparency in decision-making. This accessibility ensures that both providers and beneficiaries understand the coverage parameters unique to their locality.

Use of Clinical Evidence and Medical Necessity

Clinical evidence is vital in the creation of LCDs. Medicare employs rigorous assessment of peer-reviewed studies, clinical guidelines, and expert opinions to evaluate the medical necessity of services. This systematic approach ensures that treatments align with established medical standards and improve patient outcomes.

When determining coverage, Medicare evaluates whether a service is deemed reasonable and necessary for the diagnosis or treatment of a condition. If supported by sufficient evidence, services may be covered, while those lacking adequate justification may not.

This reliance on clinical evidence not only helps maintain quality care but also prevents unnecessary expenditures. By understanding these criteria, beneficiaries can better navigate their options.

Stakeholder Involvement in the Determination Process

Stakeholder input is an integral part of the local coverage determination process. Medicare encourages participation from medical professionals, organizations, and the public to ensure diverse perspectives are considered.

By engaging with clinicians who provide care within the community, Medicare can gain insights into specific needs, potential gaps in coverage, and suggestions for improvement. This collaborative approach fosters trust and enhances the relevance of coverage policies.

Public comment periods allow community members to voice their opinions on proposed LCDs, ensuring that patient perspectives are acknowledged. This process helps tailor Medicare offerings to best serve your local population, making it essential for informed, relevant decisions.

When navigating this complex world, The Modern Medicare Agency stands out as your best choice. Our licensed agents provide personalized support, identifying Medicare packages that fit your needs without hidden fees. You deserve clarity and assurance in your benefits.

Implications of Local Coverage for Beneficiaries and Providers

Local coverage policies can significantly impact the availability of services and the financial responsibilities of beneficiaries and providers. Understanding these implications is crucial for navigating the Medicare landscape effectively.

How Local Coverage Affects Access to Services

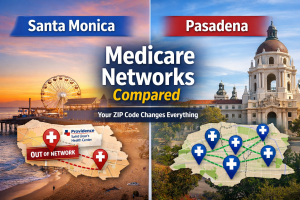

Local coverage determinations (LCDs) can restrict or expand access to certain services based on geographical needs. This means that what is available to you may vary greatly from one region to another. In some areas, specific treatments may be fully covered, while in others they may require prior authorization or not be covered at all.

This can lead to confusion for beneficiaries who may not be aware of these differences. Ensuring that you are informed about your local coverage options is essential. The Modern Medicare Agency can provide personalized assistance to help you understand what services are available in your area.

Differences by Region and Medicare Advantage Plans

The discrepancies in local coverage often affect Medicare Advantage plans differently than traditional Medicare. Each Medicare Advantage plan may have its own network and list of covered services based on local determinations. Thus, your plan may limit certain services that are otherwise covered under traditional Medicare in your region.

For example, a specific therapy may be available at no cost in one county but require co-pays in another. It’s vital to compare your Medicare Advantage options to make sure you have access to the services you need. The Modern Medicare Agency can help you evaluate various plans to find one that meets your health needs.

Billing Considerations and Modifiers

Billing procedures can become complex with local coverage variations. Providers need to use specific modifiers when submitting claims for services affected by local coverage rules. These modifiers can indicate the necessity of a service based on the region, often impacting whether a claim is approved or denied.

For you as a beneficiary, understanding these modifiers can be critical. If your service requires a specific modifier and it isn’t used, the claim could be denied. Staying informed about these billing aspects is essential for optimal use of your Medicare benefits. Consulting with The Modern Medicare Agency ensures that you receive accurate guidance on navigating these billing challenges effectively.

Appeals, Updates, and Future Trends in Local Coverage

Local Coverage Determinations (LCDs) can be challenged through an appeals process, updated to reflect new evidence or policy changes, and are expected to evolve in response to future healthcare trends. Understanding these aspects is crucial for beneficiaries navigating their Medicare options.

Appeal Rights and Processes

As a Medicare beneficiary, you have the right to appeal a Local Coverage Determination that affects your claim. The appeals process typically involves several levels, starting with a request for reconsideration. You can submit evidence and documentation supporting your claim.

If your reconsideration request is denied, you may proceed to higher levels of appeal, including a hearing before an administrative law judge. Utilizing the Medicare coverage database is essential for accessing information about the appeals process and specific LCDs.

It’s advisable to keep detailed records of all communications and decisions during this process. Engaging with experienced advocates, such as The Modern Medicare Agency, can help you navigate appeals effectively.

Updating and Revising Local Policies

Local policies are not static; they undergo regular updates to align with new medical evidence and changes in healthcare practices. The Centers for Medicare & Medicaid Services (CMS) frequently reviews LCDs, allowing stakeholders to submit comments and data that may influence revisions.

If a new treatment or technology emerges, local policies may be revised to include or exclude coverage. Staying informed about these updates is essential as they can directly impact your coverage decisions.

The Modern Medicare Agency can provide insights into these updates, ensuring you are aware of any changes that may affect your Medicare coverage.

Future Outlook for LCDs in Medicare

The future of Local Coverage Determinations will likely see increased emphasis on personalized medicine and technology integration. Innovations in healthcare may lead to broader interpretations of what constitutes necessary services.

Additionally, as patient advocacy grows, stakeholders may drive changes in how LCDs are formulated. This evolution could enhance access to care and improve the patient experience.

Working with The Modern Medicare Agency allows you to stay ahead of these trends and ensure your Medicare plans meet your evolving needs. Our licensed agents provide personalized consultations to help you choose packages that align with your healthcare goals without unexpected costs.

Frequently Asked Questions

This section addresses common inquiries regarding Local Coverage Determinations (LCDs) in Medicare. Understanding these topics can help clarify how Medicare coverage operates at a local level and what beneficiaries can expect.

What is the purpose of Local Coverage Determinations (LCDs) in Medicare?

Local Coverage Determinations provide guidelines for Medicare contractors on what services may be covered in specific regions. LCDs help define the medical necessity of services and equipment based on local practices and needs.

How can beneficiaries look up Local Coverage Determinations by CPT code?

You can look up LCDs by using the Current Procedural Terminology (CPT) code relevant to your service. Simply visit the CMS website and enter your CPT code in the search tool to find corresponding local coverage policies.

What is the difference between National Coverage Determinations (NCDs) and Local Coverage Determinations (LCDs)?

National Coverage Determinations apply uniformly across the country, establishing coverage policies based on national standards. In contrast, Local Coverage Determinations are specific to regional Medicare contractors, allowing them to customize coverage based on local healthcare needs.

How does the Medicare Coverage Database assist in understanding local coverage options?

The Medicare Coverage Database is a valuable resource for beneficiaries to research both NCDs and LCDs. By accessing this database, you can examine coverage policies and identify services that may be available to you based on your location.

Can Medicare coverage vary based on the state of residence?

Yes, Medicare coverage can vary by state due to the existence of Local Coverage Determinations. Each region may have different policies and coverage options tailored to the healthcare needs of its population, which can impact what services are available to you.

What are the guidelines for complying with Medicare LCDs?

Complying with Medicare LCDs involves understanding the specific coverage criteria outlined in these determinations. It ensures that you receive services deemed medically necessary and that providers follow the proper billing procedures to avoid claim denials.

For personalized assistance with your Medicare Insurance needs, consider working with The Modern Medicare Agency. Our licensed agents are here to help you find Medicare packages that fit your specifications without hidden costs. You’ll receive one-on-one support to navigate your coverage options efficiently.