Navigating Medicare’s coverage can be challenging, especially when it comes to essential services like medical alert systems. Medicare does not cover medical alert systems outright, but some Medicare Advantage plans may offer limited coverage options. Understanding your options is crucial for maintaining your independence and ensuring your safety at home.

Choosing the right Medicare plan can make a significant difference in how you manage your health and well-being. At The Modern Medicare Agency, our licensed agents are dedicated to helping you find Medicare packages that fit your specific needs and budget. You can speak to real people who provide personalized service without any hidden fees, ensuring you get the best possible value.

As you explore your options, it’s important to be informed about what is and isn’t covered. This knowledge will empower you to make decisions that safeguard your health and peace of mind.

Does Medicare Cover Medical Alert Systems?

Medicare coverage for medical alert systems varies based on the type of plan you have. Understanding how Original Medicare and Medicare Advantage plans address this need is crucial for your decision-making.

Coverage Under Original Medicare (Parts A & B)

Original Medicare, which includes Part A and Part B, generally does not cover medical alert systems. These devices are categorized as personal convenience items rather than medical equipment. While Original Medicare supports numerous medical services, it excludes products that fall outside of the defined medical equipment guidelines. You won’t find coverage for system installation, monitoring services, or device rental under these parts. It’s essential to recognize that this limitation can impact individuals seeking reliable emergency response systems.

Coverage Through Medicare Advantage (Part C)

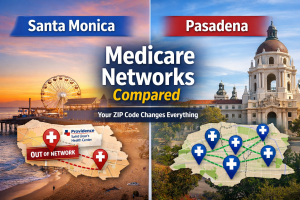

Medicare Advantage plans, also known as Part C, may offer coverage for medical alert systems. These plans are provided by private insurance companies and often include additional benefits not available under Original Medicare. Some plans may partially cover the costs associated with purchasing or renting a medical alert system. However, coverage varies significantly among providers, so it’s important for you to verify specifics with your carrier. Ensure you understand any co-pays or deductibles involved, as these can affect your overall expenses.

Medical Alert Systems and Durable Medical Equipment

Medical alert systems are not classified as durable medical equipment (DME) by Medicare standards. According to Medicare guidelines, DME must be prescribed by a physician for use in the home and is usually intended to assist with medical conditions. Since medical alert systems are viewed as personal safety tools, they do not meet the criteria set for DME coverage. This distinction is vital for you to consider when assessing your needs.

For personalized assistance, The Modern Medicare Agency offers licensed agents who will work with you to find the Medicare packages that suit your needs without additional fees. You deserve clear information and support as you navigate your Medicare options.

Alternative Ways to Get Coverage or Discounts

If you’re seeking ways to obtain coverage or discounts for medical alert systems, various programs and organizations can assist you. Explore options like Medicaid, assistance from Veterans Affairs, long-term care insurance, and senior membership discounts.

Medicaid and Home and Community-Based Services

Medicaid can help cover the costs of medical alert systems, particularly through its Home and Community-Based Services (HCBS) waivers. These waivers are designed for individuals who need assistance in their daily lives but wish to remain in their homes. States vary in their offerings, so you should inquire about specific coverage in your area.

Eligibility typically depends on your income and level of need. Contact your local Medicaid office for details on the application process and what is covered. Keep in mind that some programs may require a doctor’s recommendation to qualify for benefits related to medical alert systems.

Assistance From Veterans Affairs

The Department of Veterans Affairs (VA) provides various resources for veterans, including assistance for medical alert systems. If you are a veteran, you may qualify for benefits that support your healthcare needs. The VA typically covers certain medical devices if they are deemed necessary for your health.

Reach out to your nearest VA office to explore your benefits. They can assist you in understanding what devices may be covered and the process for obtaining those benefits. Available programs can significantly reduce the out-of-pocket costs associated with medical alert systems.

Long-Term Care Insurance Coverage

Some long-term care insurance policies offer coverage for medical alert systems. If you have such a policy, review its details to determine if it includes these devices. Coverage is often contingent on specific criteria, such as the need for personal assistance or supervision.

Consult with your insurance provider to clarify policy terms. Understanding your coverage will help you make informed decisions about which medical alert systems might fit your needs. If your policy does not cover such devices, there may be alternative options available.

AARP and Senior Membership Discounts

Organizations like AARP often provide members with discounts on various services, including medical alert systems. Membership in AARP can give you access to special offers from various providers in the market. Explore the available deals to find a system that suits your budget.

Be sure to check if the discounts apply to the features you need, such as fall detection or GPS tracking. Membership could save you a significant amount on a device that enhances your safety. The Modern Medicare Agency recommends AARP as a valuable resource for seniors looking for financial assistance and discounts.

For personalized guidance on your Medicare Insurance options, The Modern Medicare Agency connects you with licensed agents who provide one-on-one assistance. They help identify Medicare packages that align with your needs without any extra fees.

Types and Features of Medical Alert Systems

Understanding the various types and features of medical alert systems can help you make an informed choice tailored to your specific needs. These systems vary in functionality, design, and monitoring options, providing essential support for seniors and individuals with health concerns.

Personal Emergency Response Systems (PERS)

Personal Emergency Response Systems (PERS) are designed to provide immediate assistance in case of emergencies. They usually consist of a wearable device, such as a pendant or wristband, equipped with a button you can press to alert emergency services or caregivers.

These systems can be lifesaving, especially for those with chronic health issues. With PERS, you maintain independence while ensuring help is just a button press away. Many systems feature two-way communication, allowing you to speak directly with responders who can assess your situation.

Fall Detection and GPS Tracking

Fall detection features in medical alert systems utilize advanced sensors to identify sudden falls. When a fall is detected, the system automatically sends an alert, even if you are unable to press the button. This can be crucial for quick response, especially for seniors at risk of severe injuries.

GPS tracking enhances safety by allowing caregivers to locate users in real-time. This feature is particularly important for individuals who may wander or have cognitive impairments. With a GPS-enabled device, you can ensure that help reaches you, wherever you are.

Mobile Versus In-Home Systems

There are two primary categories of medical alert systems: mobile and in-home. In-home systems typically connect to your landline or a dedicated cellular network, providing coverage within a specific range of your home. These systems are reliable for individuals who spend most of their time indoors.

Mobile systems, on the other hand, utilize cellular technology and can be used outside the home. With portable devices, you gain freedom and flexibility, allowing you to engage in daily activities without sacrificing safety. Mobile options often include tracking features to monitor your location during outings.

Monitored and Unmonitored Options

Medical alert systems can be either monitored or unmonitored. Monitored systems feature 24/7 professional monitoring, ensuring that someone is always available to respond in an emergency. This is an ideal choice for those who want peace of mind knowing that help can be summoned at any time.

Unmonitored systems, while often less costly, require you to identify and contact emergency services on your own. These systems usually rely on your own network of family or friends to respond when necessary. Selecting the right option will depend on your specific needs and comfort level regarding emergency situations.

For tailored Medicare solutions, The Modern Medicare Agency offers personalized assistance to help you choose the best plan for your needs. Our licensed agents work closely with you, finding packages that fit your expectations without hidden fees.

Costs and Ways to Save on Medical Alert Systems

Understanding the expenses associated with medical alert systems can help you make informed decisions. Here are some essential aspects to consider regarding out-of-pocket costs, available discounts, and how insurance choices affect pricing.

Out-of-Pocket Costs and Leasing Options

The average monthly cost for a medical alert system typically ranges from $25 to $50. Factors influencing this cost include features like fall detection, GPS tracking, and 24/7 monitoring.

Leasing is an alternative to outright purchasing a system, which can help manage upfront costs. Many providers offer month-to-month leasing options that allow you to pay a smaller upfront fee, potentially making it easier to fit into your budget.

For instance, Lifeline systems can charge a monthly fee that varies depending on the level of service. Always clarify any extra costs, such as installation fees or cancellation charges.

Provider Discounts and Promotional Offers

Many medical alert system providers, including Life Alert, often offer seasonal discounts and promotional deals to help lower your costs.

Signing up for newsletters or following these companies on social media can provide alerts about limited-time offers. Some companies may also run referral programs where you can earn discounts by introducing new customers.

Additionally, inquire directly with the provider about available discounts for seniors or military members, as they may provide further savings opportunities you can take advantage of.

Impact of Insurance Choices on Pricing

Your choice of Medicare plan can significantly impact the costs associated with medical alert systems. Regular Medicare does not cover these systems, yet some Medicare Advantage plans do offer partial coverage.

When reviewing your options, consider speaking with an agent from The Modern Medicare Agency. Our licensed agents guide you through selecting plans that best meet your needs without unexpected fees. They can help identify Medicare packages that include coverage for medical alert services.

Understanding how your insurance influences pricing is crucial. Look for plans that specifically mention coverage for medical alert systems to ensure you get the most benefit from your insurance.

Choosing the Right Medical Alert System for Your Needs

Selecting a medical alert system requires careful consideration of various factors. By assessing different providers, important features, and making informed choices, you can find the device that best fits your requirements.

Comparing System Providers and Brands

When evaluating medical alert system providers, consider options like Life Alert and Lifeline. Each company has unique offerings which may include different subscription plans, device types, and additional features.

You should also look into customer reviews and ratings to gauge satisfaction. This feedback can help you determine the reliability of each provider’s service. Additionally, consider availability: Some providers may offer nationwide coverage, while others might be limited to specific regions.

Important Features and Accessibility

Key features to consider in a medical alert system include:

- Fall Detection: Automatically alerts emergency services if a fall is detected.

- GPS Tracking: Essential for users who are often on the move.

- 24/7 Monitoring: Ensures help is available at any time.

- Battery Life: Longer battery life reduces the frequency of recharges.

Assessing accessibility is vital as well. Look for systems that offer easy-to-use interfaces, large buttons, and clear voice communication. Some devices may even include smartphone integration for added convenience.

Making an Informed Decision

An informed decision hinges on understanding your unique needs. Evaluate how often you are home alone or the potential for emergencies, which will influence the type of system you require.

Consult with The Modern Medicare Agency for guidance on selecting an appropriate medical alert system that aligns with Medicare coverage. Our licensed agents provide personalized consultations to help you identify package options without hidden fees. This service ensures you maximize your coverage effectively and efficiently.

Frequently Asked Questions

Understanding the specifics of Medicare coverage for medical alert systems can help you find the best options. Here are several frequently asked questions regarding coverage through Medicare Advantage plans, Medicaid, and other relevant points.

Which medical alert systems are covered by Medicare Advantage plans?

Some Medicare Advantage plans may cover specific medical alert systems, but coverage varies. It’s essential to check the details of your particular plan, as not all plans provide this benefit. Be proactive in contacting your insurance provider for personalized assistance.

Are there any medical alert systems provided at no cost to seniors?

While some programs may offer low-cost or subsidized medical alert systems, completely free options are generally rare. You may want to inquire about local community resources or non-profits that may assist seniors in acquiring these systems at reduced costs.

Do Medicaid benefits include coverage for medical alert systems?

Medicaid coverage can differ by state. In some instances, Medicaid may provide benefits for medical alert systems, especially if deemed medically necessary. Check with your local Medicaid office to get accurate information tailored to your state.

What options do AARP members have for medical alert systems?

AARP members can access various discounts and programs related to medical alert systems. Membership may offer benefits from partner organizations that provide special pricing or features. It’s advisable to explore the AARP website or contact them for specific offers.

Can insurance policies provide coverage for Life Alert systems?

Many private insurance policies do not usually cover Life Alert systems directly as they are considered personal convenience products. Some plans may offer partial reimbursement for systems, so reviewing your policy for details is crucial.

What medical services typically fall outside of Medicare coverage?

Medicare does not cover services usually deemed as non-essential or personal convenience items. This includes items like routine dental care, vision tests, and most long-term care services. Familiarizing yourself with these exclusions can help you plan your healthcare expenses effectively.