Clear, Honest Guidance to Help You Decide If Medicare Advantage Is Right for You

Medicare Advantage plans work extremely well for millions of Medicare beneficiaries — and poorly for others.

The difference is almost never the plan itself.

It’s whether the person enrolling understands how Medicare Advantage actually works.

This page is designed to give you the full picture — clearly, calmly, and without sales pressure — so you can decide whether Medicare Advantage fits your healthcare needs, lifestyle, and budget.

What Medicare Advantage Is — and What It Is Not

Medicare Advantage (also called Medicare Part C) is a federally regulated Medicare program administered by private insurance companies.

When you enroll:

- You are still in Medicare

- Medicare pays the insurance company to manage your care

- The plan must follow strict CMS rules

By law, Medicare Advantage plans must cover everything Original Medicare covers — at least as well.

Many plans also include additional benefits.

What changes is how care is accessed, not whether it is covered.

Why Medicare Advantage Exists (Context Matters)

Medicare Advantage was created to:

- Offer alternatives to Original Medicare

- Control rising healthcare costs

- Provide coordinated care models

- Expand access to prescription drug coverage

- Add cost protection through spending limits

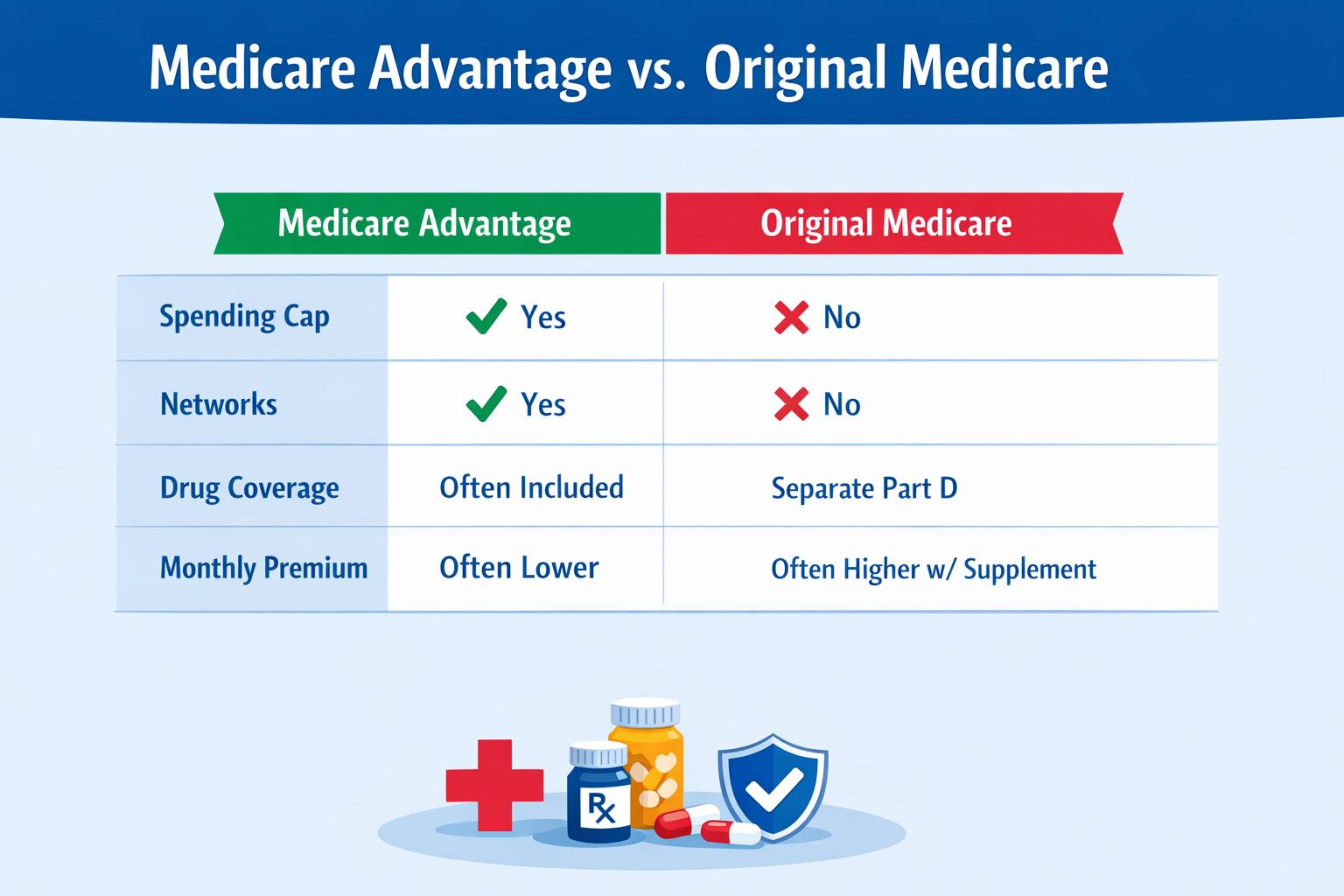

It exists because Original Medicare alone has no out-of-pocket maximum and can expose beneficiaries to unlimited costs without a supplement.

Coverage vs. Access: The Most Important Distinction

This is where confusion usually begins.

Coverage

Medicare Advantage plans must cover all Medicare-approved services.

Access

Plans manage how and where those services are delivered through:

- Provider networks

- Referral requirements

- Prior authorizations

Most dissatisfaction with Medicare Advantage comes from access expectations, not coverage gaps.

Networks: Why They Matter More Than Premiums

Medicare Advantage plans use provider networks.

Depending on plan type:

- HMO plans require in-network care and referrals

- PPO plans allow more flexibility but still rely on preferred networks

Important realities:

- Networks vary by region and ZIP code

- Networks can change annually

- Hospitals matter just as much as doctors

For people who want unrestricted provider choice, networks can feel limiting.

For others, they provide structure and lower costs.

Referrals and Prior Authorizations — The Why, Not Just the What

Medicare Advantage plans often require:

- Referrals to specialists

- Prior authorization for certain services

This isn’t unique to Medicare Advantage — it’s how most managed healthcare works in the U.S.

For some people:

- It’s a non-issue

For others: - It feels restrictive

Neither reaction is wrong.

It’s about compatibility with your healthcare style.

Understanding the True Cost of Medicare Advantage

Low or $0 premiums are real — but they are not the full story.

Costs may include:

- Copays for doctor and specialist visits

- Daily hospital copays

- Coinsurance for outpatient procedures

- Out-of-network costs (if allowed)

However…

The Built-In Spending Cap (A Major Advantage)

Medicare Advantage plans include an annual maximum out-of-pocket limit for medical services.

Once that limit is reached:

- The plan pays 100% of covered medical costs for the rest of the year

Original Medicare does not have this protection unless you add a Medicare Supplement.

For many people, this cap provides meaningful financial security.

Prescription Drug Coverage: Often Stronger Than Stand-Alone Part D

Most Medicare Advantage plans include Part D prescription coverage.

In many regions, these plans:

- Offer competitive drug formularies

- Provide lower copays for common medications

- Perform better than some standalone Part D plans

Drug coverage should always be reviewed individually — but it is often a strength, not a weakness.

Why Plans Change Every Year (And Why Reviews Matter)

Medicare Advantage plans are renewed annually.

Each year, plans may change:

- Provider networks

- Drug formularies

- Copays and benefits

- Out-of-pocket limits

This is why annual plan reviews are essential, even if you’re happy today.

Who Medicare Advantage Often Works Best For

Medicare Advantage may be a strong fit if you:

- Want lower monthly premiums

- Are comfortable with managed care

- Prefer bundled coverage (medical + drugs)

- Value a spending cap

- Are open to reviewing your plan annually

When Medicare Advantage May Not Be the Best Fit

It may be less ideal if you:

- Want unrestricted provider access

- See many specialists

- Travel frequently across states

- Prefer minimal administrative rules

- Want long-term predictability above all else

This is when Medicare Supplement options are often explored.

A Smarter Way to Decide (Education First)

Instead of asking:

“Is Medicare Advantage good or bad?”

A better question is:

“How does Medicare Advantage fit the way I use healthcare?”

When that question is answered honestly, good decisions follow.

Medicare Advantage FAQs — Straight Answers You Deserve

Do Medicare Advantage plans really cover everything Original Medicare covers?

Yes. By law, Medicare Advantage plans must cover all medically necessary services that Original Medicare Part A and Part B cover.

This requirement is written directly into their contract with Medicare.

The difference is not what is covered — it’s how the coverage is accessed, such as networks, referrals, and prior authorizations.

If Medicare Advantage covers the same things, why do people complain?

Most complaints are about access and process, not coverage.

Common frustration points include:

- A doctor leaving the network

- Referral requirements

- Prior authorization delays

- Unexpected copays

These issues don’t mean care isn’t covered — they mean the plan has rules around how care is delivered.

Are Medicare Advantage plans bad?

No — and saying they are is misleading.

Medicare Advantage plans work very well for millions of people.

They work poorly when someone enrolls without understanding:

- Networks

- Prescription coverage

- How referrals and authorizations work

The plan isn’t the problem — the fit is.

Why do Medicare Advantage plans vary so much by ZIP code?

Medicare Advantage plans are local plans.

They are built around:

- Local hospitals

- Local doctor groups

- Regional healthcare costs

That’s why a plan that works great in one county may be unavailable — or ineffective — in another. This is also why national TV ads can be misleading.

What’s the difference between an HMO and a PPO Medicare Advantage plan?

- HMO plans usually require referrals and limit care to in-network providers (except emergencies).

- PPO plans allow more flexibility and may cover out-of-network care at higher cost.

Neither is “better.”

The right choice depends on how important provider flexibility is to you.

Do Medicare Advantage plans require prior authorization?

Most do — especially for:

- Imaging (MRI, CT scans)

- Surgeries

- Infusions

- Skilled nursing facility stays

This is common in managed care. Some people are comfortable with this structure; others prefer fewer administrative steps.

Do Medicare Advantage plans have a spending limit?

Yes — and this is one of their biggest advantages.

Medicare Advantage plans include an annual maximum out-of-pocket limit for medical services. Once you reach it, the plan pays 100% of covered medical costs for the rest of the year.

Original Medicare does not have this protection unless you add a Medicare Supplement.

Are prescription drugs covered with Medicare Advantage?

Most Medicare Advantage plans include Part D prescription drug coverage.

In many areas, Medicare Advantage drug coverage is as good as or better than standalone Part D plans — but this varies by plan and medication list.

Prescription coverage should always be reviewed drug by drug, not assumed.

Why do Medicare Advantage plans change every year?

Medicare Advantage plans are renewed annually with Medicare.

Each year, insurance companies may adjust:

- Doctor networks

- Drug formularies

- Copays

- Out-of-pocket limits

This is why reviewing your plan every year is critical — even if nothing changed for you personally.

Can I switch Medicare Advantage plans later?

Yes, but when you can switch matters.

Most people can change plans during:

- The Annual Enrollment Period (fall)

- The Medicare Advantage Open Enrollment Period (early in the year)

Certain life events may also trigger Special Enrollment Periods.

Is Medicare Advantage cheaper than a Medicare Supplement?

It often is — monthly.

Medicare Advantage usually has lower premiums, while Medicare Supplements typically cost more monthly but offer more predictable medical costs.

The better option depends on:

- Budget

- Health usage

- Comfort with networks

- Desire for predictability

Why do some people leave Medicare Advantage after a few years?

Common reasons include:

- Increased medical needs

- Desire for broader provider access

- Frustration with authorizations

- Preference for predictability

This doesn’t mean Medicare Advantage “failed” — it means needs changed.

Is Medicare Advantage right for me?

That depends on:

- Your doctors and hospitals

- Your prescription medications

- Your travel habits

- Your budget

- How you prefer healthcare to work

There is no universal answer — only a right fit.

Final Thought on Medicare Advantage

Medicare Advantage is neither a shortcut nor a mistake.

It’s a legitimate Medicare option that works extremely well when chosen with clarity and realistic expectations.

Education is what makes the difference.

Medicare Advantage Glossary

Clear Definitions for Common Medicare Terms (Plain English)

Medicare uses a lot of unfamiliar language.

This glossary explains the most common Medicare Advantage terms in a way that actually makes sense — so you can feel confident, not confused.

Annual Enrollment Period

The time each fall (October 15 – December 7) when most Medicare beneficiaries can change Medicare Advantage or Part D plans for the following year.

Annual Notice of Change (ANOC)

A letter your Medicare Advantage plan sends each fall explaining what’s changing next year, including premiums, copays, networks, and drug coverage. This document matters more than most people realize.

Copay

A fixed dollar amount you pay for a service, such as a doctor visit or specialist appointment. For example, “$20 per visit.”

Coinsurance

A percentage of the cost you pay for a service. For example, paying 20% of the cost of an outpatient procedure.

Deductible

The amount you must pay out of pocket before the plan begins covering certain services. Some Medicare Advantage plans have no medical deductible, but may have a drug deductible.

Drug Formulary

The list of prescription medications a Medicare Advantage plan covers. Drugs are placed into different tiers, which affect your cost.

Drug Tier

A category used by plans to group medications. Lower tiers usually cost less; higher tiers typically cost more. A drug’s tier can change from year to year.

HMO (Health Maintenance Organization)

A type of Medicare Advantage plan that typically requires you to:

- Use in-network doctors

- Get referrals to see specialists

Emergency care is covered outside the network.

PPO (Preferred Provider Organization)

A type of Medicare Advantage plan that offers more flexibility. You can usually see out-of-network providers, but at a higher cost. Referrals are often not required.

Maximum Out-of-Pocket (MOOP)

The most you’ll pay in a year for covered medical services on a Medicare Advantage plan. Once you reach this limit, the plan pays 100% of covered medical costs for the rest of the year.

This is a major difference from Original Medicare.

Network

The group of doctors, hospitals, and providers that have contracts with a Medicare Advantage plan. Staying in network usually means lower costs.

Original Medicare

Medicare Part A (hospital insurance) and Part B (medical insurance) provided directly by the federal government. Original Medicare does not include a spending cap unless you add a Medicare Supplement.

Out-of-Network

A provider or hospital that does not have a contract with your Medicare Advantage plan. Some plans allow out-of-network care at higher cost; others do not (except emergencies).

Part A

Hospital insurance that helps cover inpatient hospital stays, skilled nursing care, hospice, and some home health services.

Part B

Medical insurance that helps cover doctor visits, outpatient care, preventive services, and medical equipment.

Part C

Another name for Medicare Advantage. It combines Part A and Part B coverage and is offered by private insurance companies approved by Medicare.

Part D

Prescription drug coverage. Many Medicare Advantage plans include Part D, but not all.

Prior Authorization

Approval required from the plan before certain services or medications are covered. Common for imaging, surgeries, and specialty treatments.

Referral

Permission from your primary care doctor to see a specialist. Often required in HMO Medicare Advantage plans.

Service Area

The geographic region where a Medicare Advantage plan is offered. Plans are local and vary by county and ZIP code.

Special Enrollment Period (SEP)

A time outside the standard enrollment periods when you may be allowed to change plans due to certain life events, such as moving or losing other coverage.

Star Ratings

A rating system used by Medicare to measure plan quality, based on factors like customer service and care coordination. Helpful — but not the only thing to consider when choosing a plan.

Supplemental Benefits

Extra benefits not covered by Original Medicare, such as dental, vision, hearing, fitness memberships, or over-the-counter allowances. These vary by plan and location.

TrOOP (True Out-of-Pocket Costs)

A Medicare term used mainly for prescription drug coverage. It tracks how much you personally spend on medications and helps determine when you move through different drug coverage phases.

Utilization Management

How a plan manages care through tools like networks, referrals, and prior authorization. This helps control costs but can feel restrictive for some people.

Why This Glossary Matters

Medicare decisions are hard enough without unfamiliar language getting in the way.

Understanding these terms helps you:

- Ask better questions

- Avoid surprises

- Compare plans more confidently

- Make choices that truly fit your needs

Want Help Reviewing Medicare Advantage the Right Way?

If you’d like help understanding:

- Which Medicare Advantage plans are available to you

- How networks and prescriptions affect your costs

- Whether Medicare Advantage or Medicare Supplement coverage fits you better

I’m happy to help.

No pressure.

No sales tactics.

Just clear, expert guidance.

Call or Text: 631-358-5793

Schedule a Medicare review