Clear, Unbiased Help With Prescription Drug Coverage

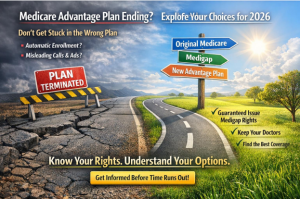

Prescription drug costs are one of the most stressful and confusing parts of Medicare — and in 2026, choosing the wrong Medicare Part D plan can lead to higher costs, frustration at the pharmacy, and a poor overall Medicare experience.

This page exists for one simple reason:

Medicare consumers often make poor choices when they’re forced to navigate Part D on their own — not because they’re careless, but because the system is complex and unforgiving.

Here, you’ll find clear explanations, up-to-date 2026 information, and help making sure your prescription coverage actually works when you need it.

What Is Medicare Part D?

Medicare Part D is the part of Medicare that helps cover prescription medications you pick up at the pharmacy.

Part D coverage is offered by private insurance companies approved by Medicare and works alongside:

- Original Medicare (Part A & Part B), or

- Medicare Advantage plans that include prescription drug coverag

If you take medications — now or in the future — having the right Part D coverage matters.

How You Can Get Medicare Part D Coverage

There are two main ways Medicare beneficiaries receive prescription drug coverage:

Stand-Alone Medicare Part D Plans (PDPs)

These plans pair with Original Medicare and are often the best option for people who want flexibility and nationwide access to doctors and hospitals.

Medicare Advantage Plans With Drug Coverage (MA-PD)

These plans combine medical and prescription coverage into one plan. They may include extra benefits, but often involve provider networks, formularies, and plan rules.

The right option depends on your medications, pharmacies, doctors, and budget — not just the monthly premium.

Medicare Part D in 2026 — What You Need to Know

You don’t need to understand every technical rule. You just need to know what affects your costs and coverage.

Annual Out-of-Pocket Cap

In 2026, Medicare Part D has a hard annual out-of-pocket limit of $2,100 for covered prescription drugs.

Once you reach this amount:

- Your Part D plan pays 100% of covered drug costs for the rest of the year

This is one of the most important improvements Medicare has ever made to prescription drug coverage.

Stand-Alone Medicare Part D Plans (PDPs)

These plans pair with Original Medicare and are often the best option for people who want flexibility and nationwide access to doctors and hospitals.

Medicare Advantage Plans With Drug Coverage (MA-PD)

These plans combine medical and prescription coverage into one plan. They may include extra benefits, but often involve provider networks, formularies, and plan rules.

The right option depends on your medications, pharmacies, doctors, and budget — not just the monthly premium.

Medicare Part D in 2026 — What You Need to Know

You don’t need to understand every technical rule. You just need to know what affects your costs and coverage.

Annual Out-of-Pocket Cap

In 2026, Medicare Part D has a hard annual out-of-pocket limit of $2,100 for covered prescription drugs.

Once you reach this amount:

- Your Part D plan pays 100% of covered drug costs for the rest of the year

This is one of the most important improvements Medicare has ever made to prescription drug coverage.

Deductibles

Some Part D plans include a deductible, while