Clear, Honest Answers to Help You Choose the Right Coverage

Medicare can feel overwhelming — especially with all the ads, mailers, and conflicting advice out there.

This guide was created to give you clear, honest answers about how Medicare works in 2026, so you can make confident decisions without pressure or confusion.

In this guide, you’ll learn:

- What Medicare covers (and what it doesn’t)

- Your plan options

- How to avoid costly mistakes

- How to choose coverage that fits your needs

Medicare is not one-size-fits-all — and neither is good guidance.

🔑 Key Takeaways: Medicare in 2026

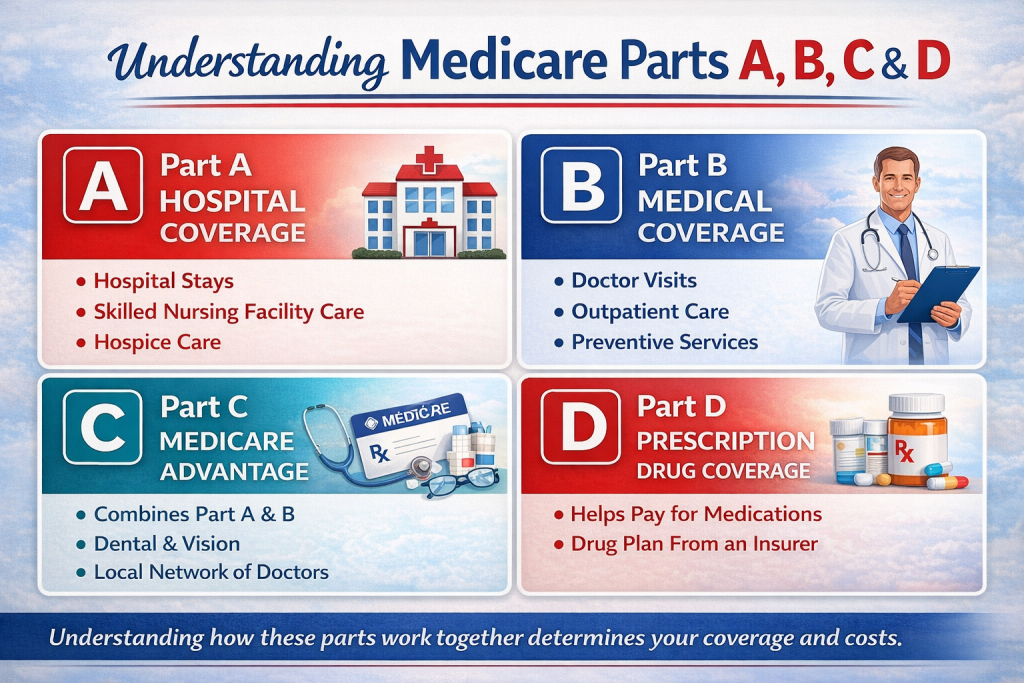

- Medicare has four main parts (A, B, C, and D), and how they work together determines your coverage and costs.

- Original Medicare offers nationwide doctor access, while Medicare Advantage plans use local provider networks.

- Medicare does not fully cover routine dental, vision, hearing aids, or long-term nursing home care.

- Prescription drug costs are now capped at $2,100 per year in 2026, providing meaningful relief for many seniors.

- Choosing the right plan depends on your doctors, medications, lifestyle, and budget — not TV ads or mailers.

- Many people qualify for Extra Help or Medicaid, which can significantly reduce Medicare costs.

Getting clear, personalized guidance helps you avoid costly mistakes and unnecessary confusion.

Who This Guide Is For

This guide was created for real people — not insurance experts.

Note: This guide is for educational purposes only and does not replace personalized advice from a licensed Medicare professional.

It’s especially helpful if:

- You’re turning 65 and trying to understand your Medicare options

- You’re reviewing your current plan and wondering if it still fits your needs

- You feel confused by TV ads, mailers, or online information

- You want clear, honest answers without sales pressure or jargon

Whether you’re brand new to Medicare or just want to make sure you’re on the right path, this guide is here to help you feel informed, confident, and in control of your healthcare decisions.

What Medicare Really Is (And Why It Feels So Confusing)

Medicare is a federal health insurance program primarily for people age 65 and older, as well as some younger individuals with disabilities.

But here’s what most people don’t realize:

Medicare isn’t just “one plan.”

It’s a system of different parts and coverage options, and how they work together determines your costs, flexibility, and access to care.

Add in:

- TV commercials

- Mailers

- Online ads

- Advice from friends

- Conflicting information

And it’s no surprise so many people feel overwhelmed.

Let’s simplify it.

The Four Parts of Medicare (In Plain English)

Medicare Part A – Hospital Coverage

Part A helps pay for:

- Inpatient hospital stays

- Skilled nursing facility care (short-term)

- Hospice care

- Some home health services

Most people don’t pay a monthly premium for Part A if they worked and paid Medicare taxes long enough.

Medicare Part B – Medical Coverage

Part B helps pay for:

- Doctor visits

- Outpatient care

- Preventive services

- Lab work, X-rays, MRIs

- Medical equipment

In 2026, most people pay a monthly Part B premium (based on income) plus an annual deductible before Medicare starts paying its share.

Medicare Part C – Medicare Advantage

Medicare Advantage plans are offered by private insurance companies approved by Medicare.

They:

- Replace Original Medicare (Parts A & B)

- Usually include prescription drug coverage

- Often include dental, vision, and hearing

- Use provider networks (HMO or PPO)

These plans can offer great value — if the network fits your needs.

Medicare Part D – Prescription Drug Coverage

Part D helps pay for medications.

In 2026, Medicare includes:

- A $2,100 annual out-of-pocket cap for prescriptions

- Monthly insulin limits

- $0 vaccines

- Extra Help for low-income beneficiaries

Drug coverage varies by plan and pharmacy.

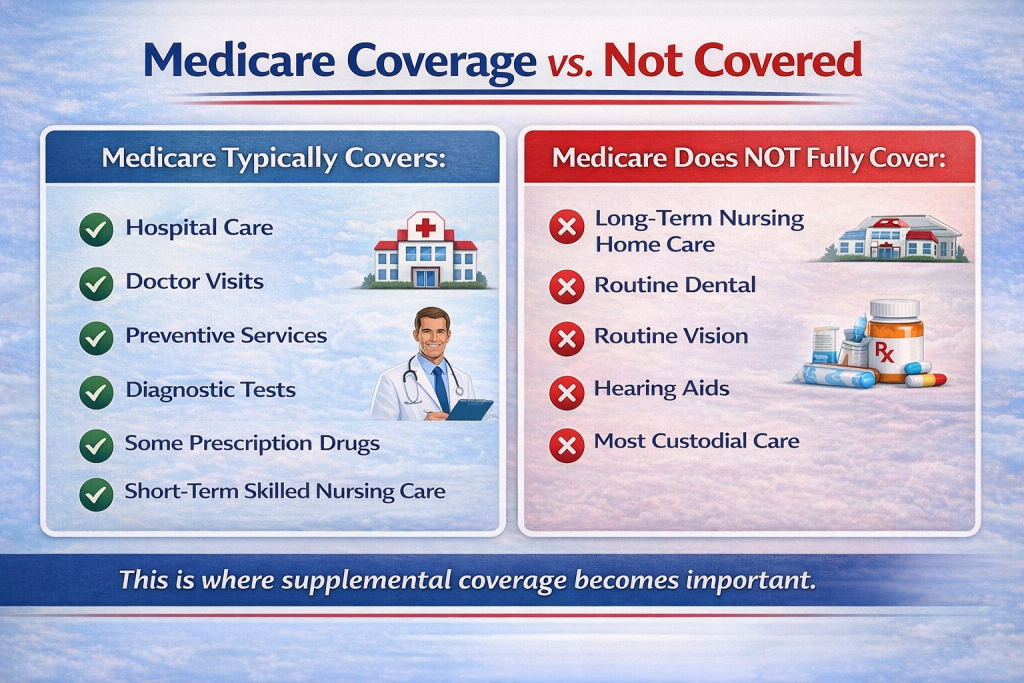

What Medicare Covers (And What It Doesn’t)

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Medicare Typically Covers:

- Hospital care

- Doctor visits

- Preventive services

- Diagnostic tests

- Some prescription drugs

- Short-term skilled nursing care

Medicare Does NOT Fully Cover:

- Long-term nursing home care

- Routine dental

- Routine vision

- Hearing aids

- Most custodial care

That’s where supplemental coverage becomes important.

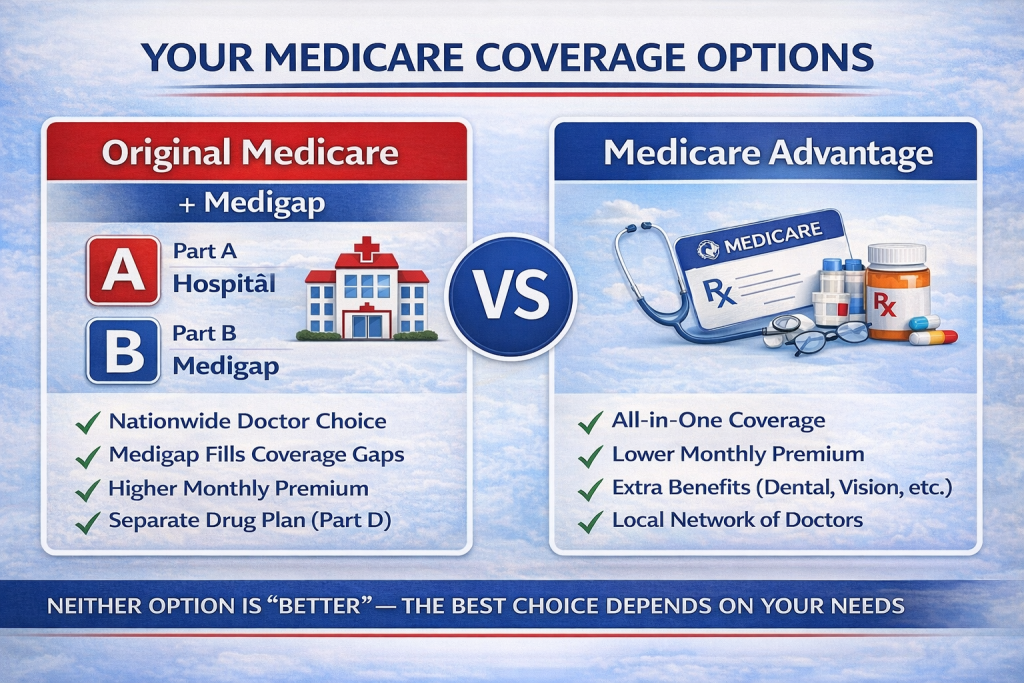

Your Medicare Coverage Options in 2026

Option 1: Original Medicare + Supplements

This includes:

- Part A + Part B

- A Medicare Supplement (Medigap)

- A Part D drug plan

Best for people who want:

- Maximum doctor choice

- Nationwide access

- Predictable medical costs

Option 2: Medicare Advantage (Part C)

All-in-one coverage through a private insurer.

Best for people who want:

- Lower monthly premiums

- Extra benefits

- Simpler coverage

- Comfort with provider networks

Neither option is “better” — the best choice depends on you.

The Biggest Medicare Mistakes People Make

- Choosing a plan based on TV ads

- Not checking doctor networks

- Ignoring prescription drug costs

- Missing enrollment deadlines

- Assuming “free” means “fully covered”

- Taking generic advice

- Not reviewing coverage annually

Medicare decisions affect your health and finances. Guessing is expensive.

Medicare Costs in 2026 (What to Expect)

Your Medicare costs may include:

- Monthly Part B premium

- Annual deductibles

- Copays and coinsurance

- Prescription drug costs

- Income-related adjustments (IRMAA)

Some people qualify for:

- Extra Help

- Medicaid

- Dual-Eligible plans

Understanding your cost structure can save you thousands.

When You Can Enroll or Change Plans

Key enrollment periods include:

- Initial Enrollment Period (around age 65)

- Annual Enrollment Period (fall)

- Special Enrollment Periods (life changes)

Missing these windows can lead to:

- Penalties

- Delays

- Limited choices

How to Choose the Right Medicare Coverage

Instead of asking,

“What’s the best plan?”

Ask:

- Which doctors do I want to keep?

- What medications do I take?

- Do I travel often?

- What’s my budget?

- Do I want flexibility or simplicity?

The right Medicare plan fits your life, not a commercial.

Why Most People Want Guidance

Medicare rules change.

Plans change.

Costs change.

Networks change.

But your health needs don’t.

That’s why working with an independent Medicare advisor who educates first can make all the difference.

Final Thoughts: Medicare Doesn’t Have to Be Confusing

You deserve:

- Clear answers

- Honest guidance

- No pressure

- No confusion

Medicare can be simple — when it’s explained the right way.

Want Personalized Medicare Help?

If you have questions about:

- Medicare Advantage

- Medigap

- Prescription costs

- Turning 65

- Out-of-state coverage

You don’t have to figure it out alone.