Choosing the right Medicare coverage in New York can feel overwhelming — especially with all the ads, opinions, and “one-size-fits-all” advice out there.

The truth is, there’s no single “best” Medicare plan for everyone.

But there is a best plan for you.

Let’s walk through the real differences between Medicare Advantage and Medicare Supplement (Medigap) in a clear, honest, and easy-to-understand way — with New York–specific details that truly matter.

Key Takeaways

- New York allows you to switch between Medicare Advantage and Medigap without medical underwriting, even years later.

- This flexibility helps consumers — but also leads to higher Medigap premiums in NY.

- Medicare Advantage plans often have $0 monthly premiums and include drug coverage and extra benefits.

- Medicare Supplement plans offer nationwide doctor access and predictable medical costs — at a higher monthly price.

- Everyone pays the $202.90 Medicare Part B premium in 2026, no matter which plan they choose.

The best Medicare choice is based on your doctors, your health, and your budget — not advertising.

First, the Basics

What Is Medicare Advantage?

Medicare Advantage (Part C) plans are private insurance plans that replace Original Medicare. Most include:

- Prescription drug coverage

- Dental, vision, hearing, and gym benefits

- Low or even $0 monthly premiums

- HMO or PPO networks

- Copays for services

- A yearly out-of-pocket maximum

These plans are popular because they bundle coverage together and help keep monthly costs lower.

What Is Medicare Supplement (Medigap)?

Medigap plans work with Original Medicare to help pay the costs Medicare doesn’t cover, like:

- The 20% coinsurance

- Hospital deductibles

- Many out-of-pocket medical expenses

With a Medigap plan, you can:

- See any doctor nationwide who accepts Medicare

- Avoid most surprise medical bills

- Travel freely without worrying about networks

You’ll also need a separate Part D prescription drug plan.

Why New York Is Different

New York has two special Medicare rules:

Community Rating

Everyone pays the same price, no matter their age.

Guaranteed Issue

You can enroll in a Medigap plan any time of year, even with health conditions.

This gives New Yorkers flexibility that most states don’t have — but it also reduces price competition, which leads to higher premiums.

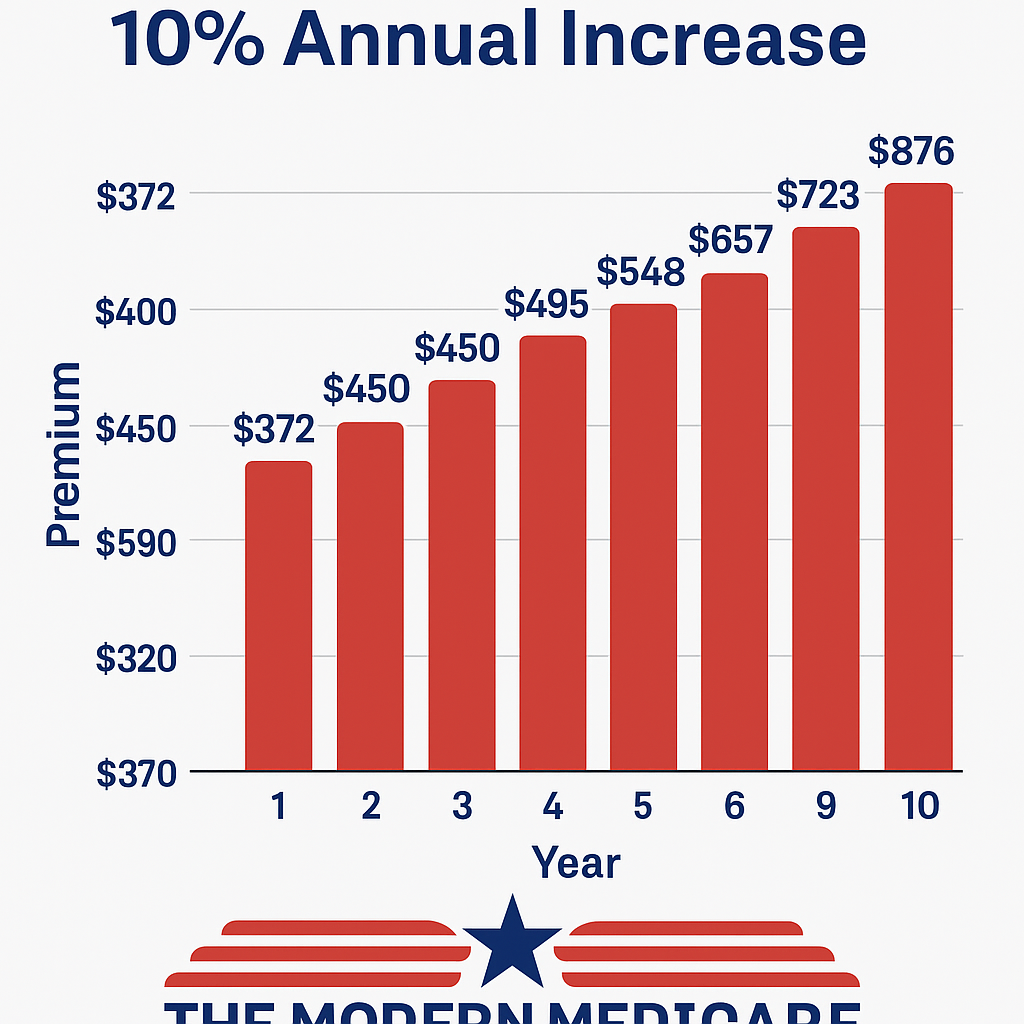

The Reality of Medigap Costs in New York

Common Medicare Myths (And the Truth New Yorkers Need to Know)

New York has some of the highest Medigap premiums in the country.

On Long Island, many Plan G premiums are reaching $372 per month in 2026 — and that’s before:

- The $202.90 Part B premium

- A separate Part D drug plan (New York is second only to California for drug plan costs)

We’ve also seen double-digit Medigap rate increases for the last four years.

Why?

- Medical costs aren’t going down

- Hospitals aren’t charging less

- Medicare usage is rising

- Insurance companies must adjust prices

Medigap offers excellent freedom — but it comes with a real long-term cost.

Medicare Advantage Costs in 2026

More than half of Medicare Advantage plans in New York have $0 monthly premiums.

In 2026:

- Part B premium: $202.90 per month

- Part D deductible: up to $615

- Maximum out-of-pocket limit: $9,250

- Lower monthly costs

- Built-in drug coverage

- Extra benefits

- A financial safety net

Trade-offs include:

- Provider networks

- Copays

- Possible referrals

- Plans can change yearly

For many New Yorkers, Medicare Advantage is a budget-friendly option that still provides solid protection.

The Full Cost Picture

Everyone on Medicare pays Part B — no matter what plan they choose.

Medicare Advantage Example:

- $202.90 Part B

- $0 plan premium

- Drug coverage included

- Copays as needed

Medigap Example:

- $202.90 Part B

- ~$372 Medigap premium

- ~$60+ Part D plan

- Minimal medical bills

That’s often $600+ per month for Medigap in New York.

It’s great coverage — but not affordable for everyone.

Who Each Option Works Best For (And Why New York Is Unique)

One major benefit of living in New York is that you can switch between Medicare Advantage and Medigap without medical underwriting — even years later.

That flexibility protects consumers, but it also contributes to higher Medigap costs.

Medicare Advantage May Be a Better Fit If:

- Your monthly budget is a concern

- Your doctors use major systems like Northwell, Mount Sinai, or NYU Langone

- You like having medical, hospital, and drug coverage on one card

- You want dental, vision, hearing, gym, and OTC benefits

- You’re generally healthy

- You’re comfortable with provider networks

Many New Yorkers choose Medicare Advantage to keep costs manageable while still receiving solid coverage.

Medicare Supplement (Medigap) May Be a Better Fit If:

- You want the widest doctor access nationwide

- You travel often

- You prefer predictable medical costs

- You don’t want referrals

- You value freedom of choice

- You’re comfortable paying higher premiums long-term

Medigap offers peace of mind — especially for those who can afford the ongoing cost.

The New York Advantage

In most states, once you leave Medigap and develop health issues, you may never get back in.

Not in New York.

Here, you can:

- Use a $0 Medicare Advantage plan for years

- Stay healthy

- Then switch to Medigap later — with no medical questions asked

That safety net helps New Yorkers, but it also drives up Medigap prices.

“Medigap is always the better option.”

Truth: Medigap offers excellent coverage and freedom — but in New York, it also comes with some of the highest premiums in the country and ongoing rate increases.

For many people, the long-term cost simply isn’t sustainable, even if the coverage is great.

Better coverage doesn’t always mean better for your budget.

“Medicare Advantage is risky and limits your care.”

Truth: Many Medicare Advantage PPO plans in New York work well with major hospital systems like Northwell, Mount Sinai, and NYU Langone.

When your doctors are in-network, care can be smooth, affordable, and convenient.

The “risk” isn’t the plan — it’s choosing a plan that doesn’t match your doctors or lifestyle.

“The cheapest plan is the smartest choice.”

Truth: Low monthly premiums don’t always mean low overall costs.

Copays, hospital stays, prescriptions, and future medical needs can change the picture quickly.

The smartest plan is the one that balances monthly cost, coverage, and long-term comfort — not just the cheapest sticker price.

“Once you choose a plan, you’re stuck with it.”

Truth: In New York, you can switch between Medicare Advantage and Medigap without medical underwriting, even years later.

That flexibility gives you options — but it also explains why Medigap costs more here than in most states.

“What worked for my neighbor will work for me.”

Truth: Medicare is personal.

Your doctors, prescriptions, travel habits, and budget matter more than anyone else’s experience.

The right plan is the one that fits your life, not someone else’s.

Why Independent Medicare Guidance Matters

Big call centers focus on volume.

Independent agents focus on you.

With personalized guidance:

- Multiple carriers are compared

- Costs are explained clearly

- Long-term impact is discussed

- No pressure is applied

The goal isn’t to sell a plan — it’s to help you understand your options.

Final Thoughts for New Yorkers

New York gives you more Medicare flexibility than most states — and higher costs to match.

The best plan is the one you can:

✔ Afford long-term

✔ Understand clearly

✔ Use confidently

✔ Keep year after year

Whether you choose Medicare Advantage or Medigap, what matters most is making an informed decision.

If you ever want help reviewing your doctors, prescriptions, or costs, I’m always here as a resource.

Clear answers.

No pressure.

Just honest Medicare guidance for New Yorkers.