I’ve worked with San Fernando Valley seniors for 18 years, and I can tell you this with complete honesty:

If you’re choosing a Medicare plan based on a TV commercial or a door-hanger flyer, you could be making a $5,000+ mistake.

The Valley is home to more than 1.5 million people across Northridge, Encino, Tarzana, Van Nuys, Woodland Hills, Sherman Oaks, Chatsworth, and dozens of other communities. That includes over 222,000 Medicare beneficiaries — all with different doctors, hospitals, budgets, and health needs.

And here’s what most people don’t realize:

Your neighbor in Chatsworth may have completely different Medicare options than your friend in Studio City — not because the plans are different, but because the hospitals and doctors that accept those plans are different.

Let’s walk through what’s happening in the Valley right now, which Medicare plans actually work here in 2026, and how to avoid the biggest Medicare mistakes Valley seniors are making.

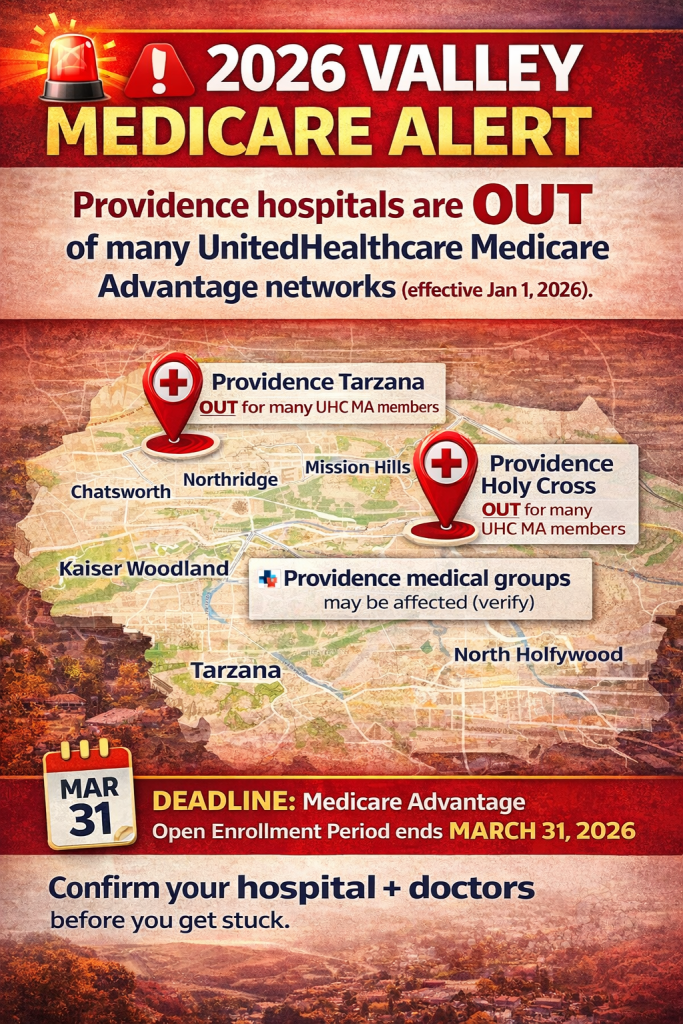

Breaking: The 2026 Providence Network Disruption Hitting the Valley

If you live near Tarzana or Mission Hills and you’re enrolled in a UnitedHealthcare Medicare Advantage plan, this is critical.

As of January 1, 2026:

Providence Cedars-Sinai Tarzana Medical Center is OUT of the UHC Medicare Advantage network

Providence Holy Cross Medical Center (Mission Hills) is OUT

Providence-affiliated medical groups (Facey, Axminster, Providence Medical Associates) are OUT

These are two of the top-rated hospitals in the Valley:

Providence Tarzana: #49 in California, #19 in Los Angeles

Holy Cross: America’s 50 Best Hospitals award

If you’re on UnitedHealthcare and these are your hospitals, you have until March 31, 2026 (Medicare Advantage Open Enrollment Period) to switch plans — or you’ll lose in-network access.

This is why hospital networks matter more than premiums.

Key Takeaways for Valley Seniors (Read This First)

If you only remember five things from this guide, make it these:

The Valley has outstanding hospitals — but not every plan includes them all.

UnitedHealthcare and Providence split in 2026 is a big deal.

LA County has some of the lowest Medicare Advantage out-of-pocket limits in the country.

There are 74 Medicare Advantage plans available in the Valley.

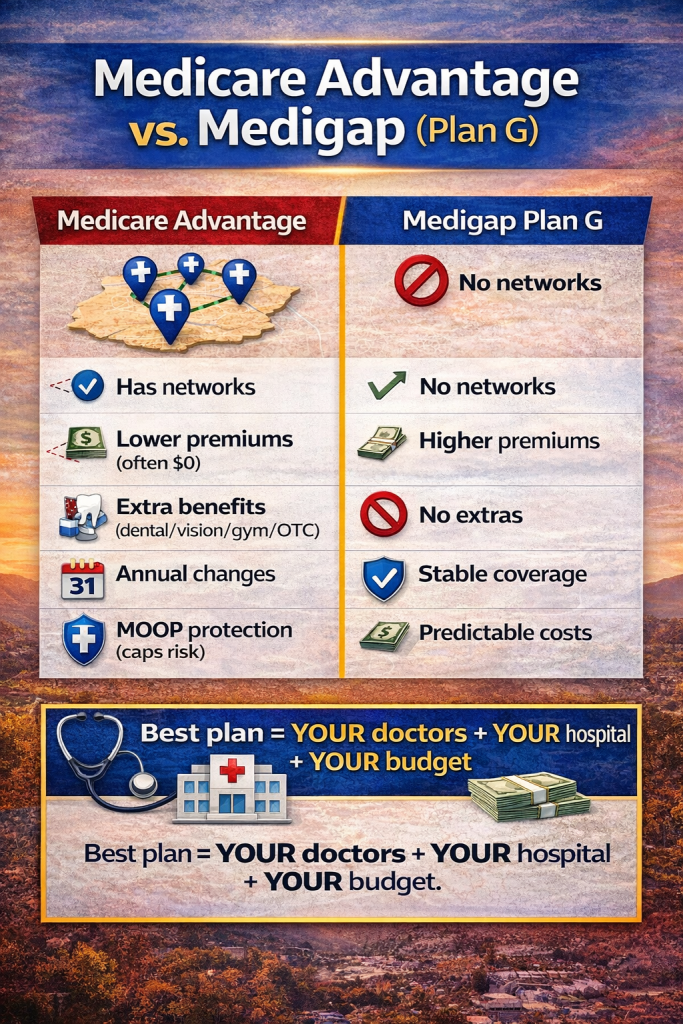

Medigap gives freedom. Medicare Advantage gives savings (usually).

The San Fernando Valley Medicare Landscape

The Valley has serious healthcare firepower:

Northridge Hospital Medical Center

America’s 50 Best Hospitals, accepts most major plans

Providence Tarzana & Holy Cross

Top-rated, no longer in UnitedHealthcare networks

Kaiser Woodland Hills & Panorama City

Kaiser-only closed system

West Hills Hospital, Sherman Oaks, Encino Hospital

Strong community care

What this means for your Medicare plan:

You don’t start with the plan — you start with the hospital.

Which hospital do you want to use?

Which medical groups serve that hospital?

Which plans contract with those groups?

That’s how you find the right plan.

Valley Demographics & What Seniors Actually Want

The Valley is:

More diverse

More working-class

More family-oriented

Younger than coastal LA

That means Valley seniors care about:

Value

Local networks

Dental & vision

Spanish-language support

Practical benefits

This is why plans like SCAN, Anthem, and Kaiser perform so well here.

Best Medicare Advantage Plans in the San Fernando Valley (2026)

Kaiser Senior Advantage (4.5 Stars)

Best for:

People who want coordinated care and don’t mind using only Kaiser doctors and hospitals.

Avoid if:

You want access to Providence, Cedars-Sinai, UCLA, or Northridge.

SCAN Health Plan (4 Stars, Nonprofit)

Best for:

Valley seniors who want Providence access, strong dental, Part B givebacks, and low MOOPs.

Why SCAN stands out:

Includes Providence Tarzana & Holy Cross

Nonprofit

Expanding in 2026

Excellent Valley networks

Anthem Blue Cross

Best for:

People who want HMO or PPO options with wide Valley coverage.

Blue Shield of California (4 Stars)

Best for:

California-focused care with solid hospital access and wellness benefits.

UnitedHealthcare AARP (4 Stars)

Best for:

People who do NOT use Providence and want PPO or HMO-POS flexibility.

Avoid if:

You use Providence hospitals or medical groups.

Aetna (4.5 Stars)

Best for:

High-quality PPO options and strong ratings.

UCLA Health Medicare Advantage (New)

Best for:

People who want UCLA access and physician-led care.

Alignment Health Plan

Best for:

Tech-savvy seniors who like digital care tools.

Molina & WellCare (D-SNP)

Best for:

Dual-eligible seniors (Medicare + Medi-Cal).

When Medigap Makes More Sense in the Valley

Medicare Advantage networks change.

Medigap doesn’t.

Any doctor who accepts Medicare

No networks

No referrals

Nationwide access

Predictable costs

Typical Valley costs:

Plan G: $162–$250/month

High Deductible Plan G: $44–$88/month + $2,950 deductible

Who should choose Medigap:

Chronic conditions

Frequent travelers

Multiple specialists

People tired of network surprises

The Valley’s Secret Weapon: Low Out-of-Pocket Risk

National MOOP: $9,250

LA County average: $2,428

Some Valley plans: $1,500–$2,500

That’s massive protection if you have a bad health year.

What Valley Plans Offer in 2026

Part B givebacks (up to $185/month)

Dental up to $3,000

Vision & hearing aids

Gym memberships

Food cards

Transportation

In-home care

But benefits only matter if your doctors are in-network.

The Valley Decision Framework

Step 1: Choose your hospital

Step 2: Confirm your doctors

Step 3: Check your prescriptions

Step 4: Compare MOOP

Step 5: Decide flexibility vs savings

Special Situations

Dual-eligible: D-SNP plans

Spanish-speaking: SCAN, Molina

Chronic conditions: C-SNP plans

Under 65 on Medicare: Medigap guaranteed issue

If I Lived in the Valley, Here’s What I’d Do

Healthy & budget-focused → SCAN

Chronic conditions → Medigap Plan G

Want Medigap cheap → High Deductible G

Use Providence on UHC → Switch now

Want Kaiser → Kaiser Senior Advantage

Dual-eligible → D-SNP

Bottom Line for Valley Seniors

Networks matter more than premiums

UHC + Providence split is serious

Valley has great Medicare Advantage value

Medigap offers freedom

Your plan must match your life

Let’s Make This Simple

Medicare shouldn’t feel like a law school exam.

You deserve clear answers.

I’ve helped Valley seniors since 2007.

5,000+ clients.

40+ carriers.

Education, not pressure.

If you’re in Northridge, Encino, Tarzana, Van Nuys, Woodland Hills, Sherman Oaks, Chatsworth, Reseda, Canoga Park, Granada Hills, Mission Hills, Panorama City, North Hollywood, Studio City, Valley Village, Toluca Lake, or Burbank — let’s talk.

📞 631-358-5793

🌐 www.paulbinsurance.com

Because the right Medicare plan should work for your Valley lifestyle — not some corporate spreadsheet.

Paul Barrett

Independent Medicare Insurance Broker

The Modern Medicare Agency

Serving the San Fernando Valley Since 2007