That moment of uncertainty when a medical bill arrives can be incredibly stressful. You have Medicare, but you also have another insurance plan from an employer or spouse-so who is responsible for paying first? This common question is at the heart of the medicare secondary payer (MSP) rules, a system that often feels like a complicated puzzle. The fear of a claim being denied or receiving an unexpected bill due to a simple coordination mistake is very real, and navigating the official jargon only adds to the anxiety.

We believe you deserve clarity and complete peace of mind when it comes to your healthcare. This straightforward guide is designed to remove the confusion. We will walk you through exactly how Medicare works with your other insurance, helping you understand when it acts as the primary or secondary payer. By the end, you’ll feel confident that your claims will be paid correctly and know precisely what to do to prevent costly billing issues. It’s time to go from confusion to confidence with your coverage.

Key Takeaways

- Learn the simple rule that determines whether Medicare or your other insurance is responsible for paying your medical bills first.

- Discover how common life situations, like still working with employer coverage, affect your medicare secondary payer status.

- Follow a clear checklist to proactively communicate with your providers and insurers, helping you prevent surprise bills and claim denials.

- Understand the exact steps to take if a claim is paid incorrectly, giving you the confidence to resolve issues quickly.

What is Medicare Secondary Payer? The Basics Explained

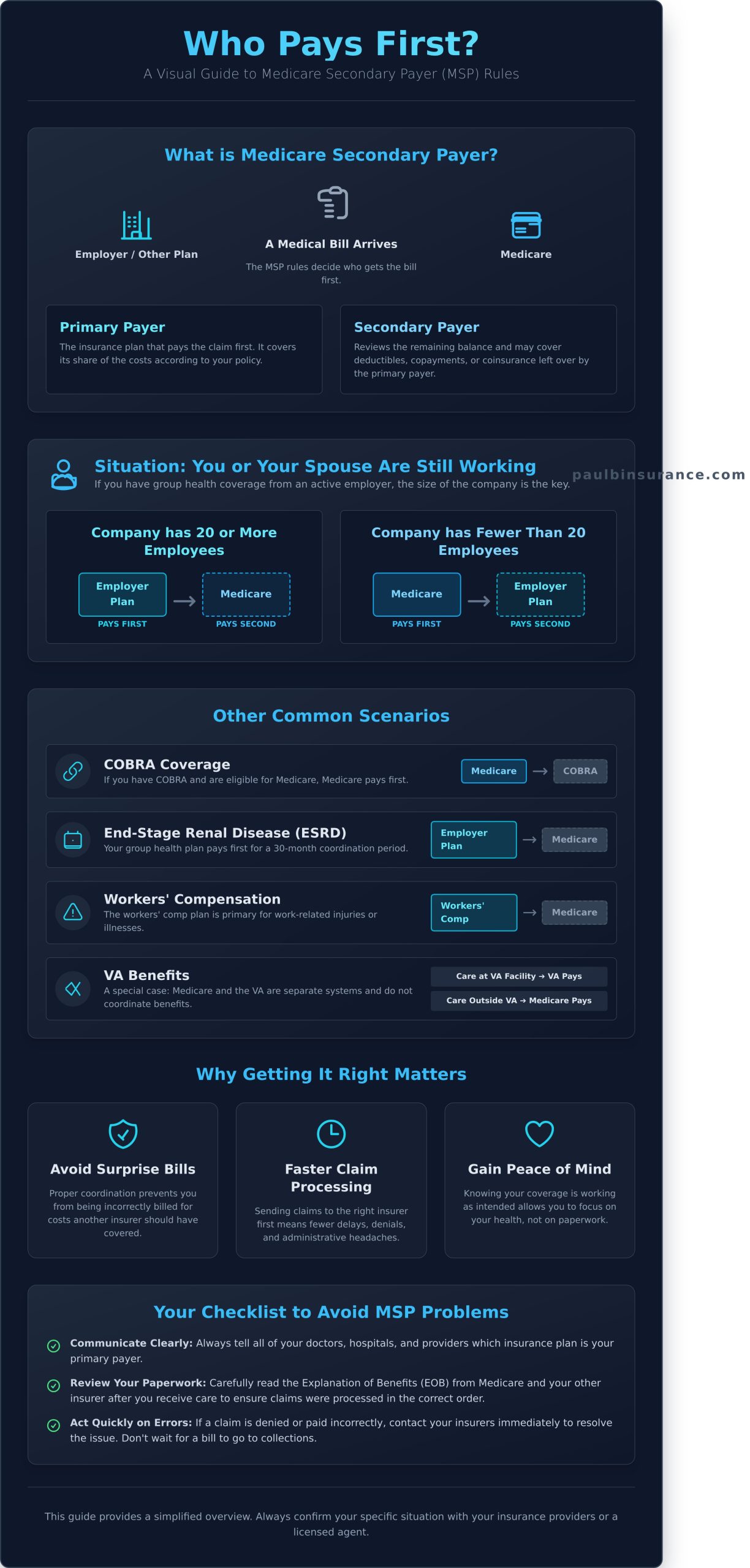

Navigating the world of Medicare can often feel like trying to solve a complex puzzle, but understanding some key concepts can bring instant clarity. Think of the medicare secondary payer (MSP) rules like car insurance after an accident. If another driver is at fault, their insurance is the ‘Primary Payer’-they are responsible for the bill first. Your insurance then acts as the ‘Secondary Payer,’ stepping in to help with costs the primary insurer didn’t cover.

In healthcare, the same logic applies. The primary payer is the insurance plan that pays a claim first. The secondary payer then reviews the remaining balance and covers some or all of the leftover costs, such as deductibles or coinsurance. The main goal of these rules is to ensure your medical bills are paid correctly and on time. This system, officially known as Coordination of Benefits, is a crucial part of how Medicare in the United States operates, preventing duplicate payments and helping control costs for the entire program.

Primary vs. Secondary Payer: A Simple Analogy

When you receive care, your doctor’s office sends the bill to your designated primary insurer first. That plan processes the claim and pays its share according to your coverage terms. Only after the primary plan has paid does the remaining balance get sent to your secondary insurer. This structured process ensures every claim is handled in the right order, which is essential for lowering costs for everyone involved-from you to the insurance carriers and the Medicare program itself.

Why These Rules Are Important for You

Understanding how your coverage works isn’t just about memorizing rules; it’s about empowering you to manage your healthcare with confidence. When you know which plan pays first, you can move from confusion to confidence. Here’s why it matters:

- Avoid surprise bills: Proper coordination of benefits helps prevent you from being incorrectly billed for costs that another insurer should have paid.

- Ensure faster claim processing: When your providers send claims to the right insurer first, there are fewer delays, denials, and administrative headaches.

- Gain peace of mind: Knowing your coverage is working as it should allows you to focus on what’s most important-your health.

Who Pays First? 7 Common Medicare Secondary Payer Scenarios

Understanding who pays your medical bills first-Medicare or another insurance plan-is one of the most confusing parts of your healthcare journey. These coordination of benefits are guided by a specific set of federal Medicare Secondary Payer (MSP) rules. To bring you clarity and confidence, we’ve broken down the most common situations you might encounter.

Quick Reference: Who Pays First?

- Still Working (20+ employees): Your employer’s plan

- Still Working (<20 employees): Medicare

- On a Spouse’s Plan (20+ employees): Your spouse’s plan

- COBRA Coverage: Medicare

- End-Stage Renal Disease (first 30 months): Your employer’s plan

- Workers’ Compensation: The workers’ comp plan

- VA Benefits: Depends on where you receive care

Situation 1: You’re 65 or Older and Still Working

If you are still working and have group health coverage through your employer, the key factor is the size of your company. It’s a simple rule to remember:

- 20 or More Employees: Your employer’s group health plan pays first. Medicare is the secondary payer.

- Fewer Than 20 Employees: Medicare pays first, and your employer’s plan pays second.

Situation 2: You’re Covered by a Spouse’s Employer Plan

The exact same “20 or more employees” rule applies if you are covered by your spouse’s active employer health plan. If your spouse’s employer has 20 or more employees, their plan is your primary insurance. If the company has fewer than 20 employees, Medicare will be your primary coverage.

Situation 3: You Have Veterans Affairs (VA) Benefits

This is a unique case because Medicare and the VA do not coordinate benefits. They are two separate systems. The VA will pay for services you receive at a VA hospital or facility. If you choose to see a doctor or go to a hospital outside the VA system, Medicare will be your primary coverage, provided that provider accepts Medicare.

Other Key Scenarios: COBRA, ESRD, and More

A few other situations have clear-cut rules:

- COBRA: If you have COBRA coverage after leaving a job and are eligible for Medicare (typically age 65 or older), Medicare will pay first.

- End-Stage Renal Disease (ESRD): If you have ESRD, your employer or former employer’s group plan is the primary payer for the first 30 months. After that, Medicare becomes the primary payer.

- Workers’ Compensation: For any healthcare related to a work-related injury or illness, the workers’ compensation plan is always the primary payer.

How It Works: The Coordination of Benefits Process

When you have more than one insurance plan, it can feel like your medical bills are entering a confusing maze. But behind the scenes, there’s a logical system called the Coordination of Benefits that directs which plan pays first. Understanding this process will give you the confidence to know your claims are being handled correctly. It’s the key to making the medicare secondary payer system work for you, not against you.

The process involves three key players: you, your doctor’s office, and Medicare. Each has a simple but vital role to play.

Your #1 Job: Tell Your Doctors About ALL Your Insurance

Your most important task is also the simplest: always present both your Medicare card and your other insurance card at every single appointment. This single step is the best way to prevent billing headaches and rejected claims. When you first enroll in Medicare, you’ll also receive an Initial Enrollment Questionnaire (IEQ). It’s crucial to fill this out accurately, as it’s your first official opportunity to tell Medicare about any other health coverage you have.

How Medicare Knows You Have Other Coverage

Medicare doesn’t just rely on your doctor’s office for this information. A dedicated contractor, the Benefits Coordination & Recovery Center (BCRC), is responsible for keeping Medicare’s records up to date about your other insurance. If your coverage situation changes-for example, if you retire and lose your employer plan-it is essential to report it. You can do this by contacting the Social Security Administration or the BCRC directly to ensure their information is always accurate.

What Happens When a Claim Is Submitted

Once your providers have your correct insurance information, the billing process follows a clear, step-by-step path to make sure the right plan pays. Here is what that looks like:

- Step 1: Your doctor’s office submits the bill to your primary insurance plan first.

- Step 2: The primary payer processes the claim. It pays its share and sends an Explanation of Benefits (EOB) to both you and your doctor, showing what was covered and what amount remains.

- Step 3: Your doctor’s office then sends the remaining bill, along with the primary plan’s EOB, to your secondary payer to cover its portion of the costs.

By keeping your information current, you ensure this process flows smoothly, preventing unexpected bills and giving you peace of mind.

A Simple Checklist to Avoid MSP Problems

Navigating the rules for medicare secondary payer can feel complex, but preventing billing headaches is often more straightforward than you might think. By building a few simple habits, you can gain peace of mind and ensure your claims are paid correctly and on time. Think of this as your personal checklist for a smooth healthcare experience.

Here are a few proactive steps you can take to stay ahead of any potential issues, broken down by timing.

Before Every Doctor Visit

A little preparation before you even see the doctor can make all the difference. Your goal is to make sure the billing office has the right information from the very start.

- Carry all current insurance cards. Always bring both your Medicare card and your other insurance card (like from an employer) to every appointment.

- Verbally confirm your coverage. When you check in, simply ask the front desk staff to confirm they have both of your insurance plans on file.

- Ask which plan is primary. A quick question like, “Can you just confirm for me which plan you have listed as primary?” can catch a mistake before a claim is ever filed.

When You Receive Mail from Your Insurer

It’s tempting to let mail pile up, but those envelopes from your insurance plans contain vital information. Take a moment to review your Explanation of Benefits (EOB) from both Medicare and your other insurer.

- Check who paid first. Look for the “primary payer” listed on the EOB. Does it match what you expect? If Medicare paid first when it should have been secondary, it’s a red flag.

- Don’t panic over a surprise bill. If you receive a bill for a service you believe should be covered, your first call should be to your doctor’s billing office. It’s often a simple clerical error they can fix.

When Your Coverage or Employment Changes

This is the most critical time to be proactive. Life changes like retiring or losing employer coverage directly impact which plan pays first. Taking immediate action is key to a seamless transition.

For example, when you retire and your employer coverage ends, you must notify the Social Security Administration right away. This is the official step that tells the system to update Medicare to your primary insurance. Failing to do so can cause significant claim delays and billing confusion.

Navigating these changes can feel overwhelming, but you don’t have to do it alone. Not sure who to call? An expert broker can guide you.

Solving Common MSP Issues with Confidence

Navigating the rules of Medicare can feel overwhelming, and it’s natural to worry about what happens if a claim is paid incorrectly. The good news is that billing errors can be fixed, and you don’t have to figure it all out on your own. Understanding a few key concepts and knowing who to call can turn confusion into confidence.

When you have another insurance plan, the coordination between payers is complex, but there are systems in place to resolve issues when they arise.

What is a ‘Conditional Payment’?

Sometimes, Medicare pays a bill for a service when another insurer was supposed to be the primary payer. This is called a conditional payment. It’s a temporary measure to ensure your doctor or hospital gets paid promptly, preventing any disruption to your care. Medicare then works directly with the primary insurer to get reimbursed. You will receive letters about this process, but it’s designed to happen behind the scenes without causing you financial stress.

Who to Contact for Help

Knowing who to call is the first step to solving any billing problem. Trying to get answers from the wrong place can be frustrating, so here is a simple guide to point you in the right direction:

- For general questions about who pays first: If you need to understand the official medicare secondary payer rules or update your insurance information, call the Benefits Coordination & Recovery Center (BCRC).

- For questions about a specific bill: If you have a question about a particular service or charge, the best place to start is your doctor’s billing department. They can see exactly how the claim was submitted.

- For guidance on your options: When you feel stuck between your insurance plans and your provider, a trusted broker can help you understand the situation and advocate on your behalf.

How a Trusted Broker Removes the Confusion

While government agencies and billing departments can provide information, they can’t offer personalized advice. That’s where we come in. Our support goes far beyond just helping you enroll in a plan. We help you understand these complex rules from day one to prevent problems before they start. When questions do arise, you have a dedicated expert to turn to for year-round support. Our goal is to give you clarity and peace of mind, ensuring you can use your coverage with confidence. For straightforward guidance, visit us at paulbinsurance.com.

From MSP Confusion to Medicare Confidence

Navigating the world of health insurance can feel like a maze, especially when another plan is involved alongside Medicare. As we’ve covered, understanding who pays first is the key to avoiding unexpected bills and frustrating claim denials. The right answer depends entirely on your specific circumstances-whether you’re still working, have coverage from a spouse, or qualify for VA benefits. By remembering these scenarios and keeping Medicare updated on your other insurance, you can confidently manage the medicare secondary payer process.

Even with a checklist, these rules can be complex. You deserve clear, straightforward answers tailored to your situation. If you’re ready to move from confusion to confidence, we’re here to help. With 18+ years of trusted experience, our independent agency has provided unbiased guidance on over 40 insurance carriers to more than 5,000 clients. We simplify the jargon so you can make the best choice for your health and budget. Schedule your free, unbiased Medicare plan review today.

You don’t have to navigate this journey alone. Let’s ensure your coverage works for you, not against you.

Frequently Asked Questions About Medicare Secondary Payer

What happens to my coverage when I retire? Does Medicare automatically become primary?

When you retire and lose your employer’s group health plan, Medicare will automatically become your primary insurer. This transition can feel confusing, but it’s designed to be seamless. Your former employer reports the change in your coverage status, which updates Medicare’s system. This ensures that your medical bills are sent to Medicare first, providing you with continuous primary coverage and the peace of mind you deserve as you begin your retirement.

Do I have to enroll in Medicare Part B if I have health insurance from my job?

You may be able to delay enrolling in Medicare Part B without penalty if you have “creditable” health coverage from an employer where you or your spouse are still actively working. This usually applies if the employer has 20 or more employees. Making the right choice is crucial to avoid lifelong late enrollment penalties. We can provide trusted guidance to help you navigate this decision with confidence and ensure you make the best choice for your unique situation.

How do I report a change in my health insurance to Medicare?

You can report changes in your health insurance by contacting the Benefits Coordination & Recovery Center (BCRC). Your employer’s benefits administrator may also report the change on your behalf when your employment ends. Keeping your information current is essential for the medicare secondary payer system to work correctly. This simple step helps prevent billing errors and ensures your claims are processed by the right insurer without frustrating delays, giving you one less thing to worry about.

My spouse is still working. Is their insurance primary for me?

Yes, if you are covered by your actively working spouse’s employer group health plan (from a company with 20 or more employees), that plan is considered your primary insurance. Medicare then acts as the secondary payer. This is a very common situation that falls under the standard coordination of benefits rules. Understanding this order of payment is key to making sure your medical bills are handled smoothly and correctly from the start.

What should I do if I think a claim was denied by mistake?

If a claim is denied, your first step is to carefully review your Medicare Summary Notice (MSN) or the Explanation of Benefits (EOB) from your other insurer. These documents will provide a reason for the denial. From there, you have the right to file an appeal with the insurance company that denied the claim. Navigating the appeals process can feel daunting, but expert support can simplify the steps and help you get the resolution you need.

Can Medicare ever be a secondary payer to a Medigap plan?

No, this is a common point of confusion we help our clients understand. Medicare is always the primary payer before a Medigap (or Medicare Supplement) plan. A Medigap policy is specifically designed to fill the “gaps” in Original Medicare by covering costs like deductibles and coinsurance. It works together with Medicare but never pays before it. This fundamental rule ensures your core medical bills are processed by Medicare first.