Are you worried that a single, unexpected medical bill could threaten the savings you’ve worked so hard to build? It’s a common fear, especially when you realize Original Medicare doesn’t cover 100% of your healthcare costs. The deductibles, copayments, and coinsurance can add up quickly, leaving you with a stressful financial burden. This is precisely why understanding what is a medicare supplement plan is one of the most important steps you can take for a secure retirement.

These plans, also known as Medigap, are designed to fill those costly gaps. In this simple guide, we will provide the clear, trusted guidance you need, without the confusing jargon. You will learn exactly how a Medigap plan works to cover your out-of-pocket expenses, protecting you from unpredictable costs. Our goal is to replace worry with confidence, empowering you to make an informed decision and enjoy the true peace of mind you deserve.

Key Takeaways

- Understand exactly what is a medicare supplement plan and how it fills the costly gaps left behind by Original Medicare parts A and B.

- Discover why a Plan G from one company offers the same core benefits as a Plan G from another, which greatly simplifies your comparison process.

- Learn about the most important one-time enrollment window to secure your coverage and avoid being denied or charged more for a plan.

- Find out how unbiased guidance can help you navigate your options with confidence, ensuring you choose the right plan without the usual stress and confusion.

The Simple Answer: What is a Medicare Supplement (Medigap) Plan?

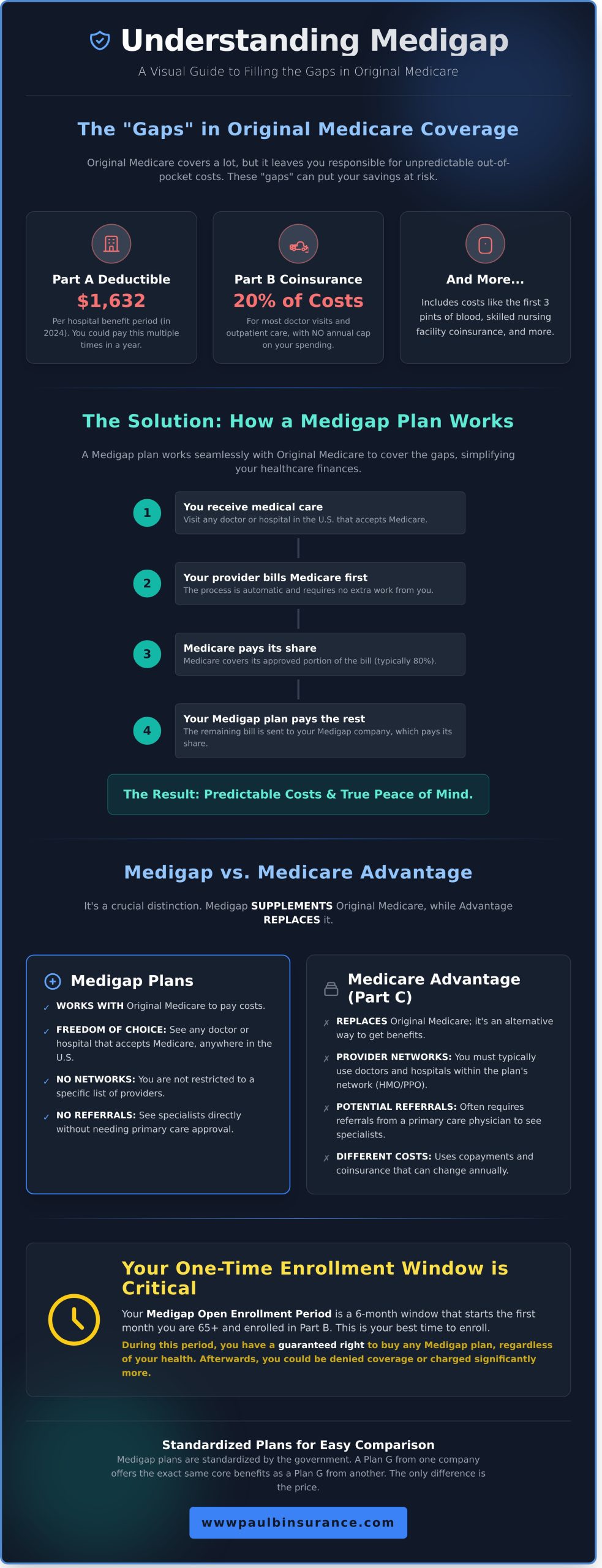

A Medicare Supplement plan, often called Medigap, is private insurance that helps pay for the healthcare costs that Original Medicare (Part A and Part B) doesn’t cover. Think of Original Medicare as your primary coverage that handles the big bills, but it leaves behind certain “gaps” like deductibles and coinsurance. A Medigap policy is designed specifically to fill those gaps, giving you predictable costs and greater peace of mind.

Understanding what is a medicare supplement plan is the first step toward building a secure healthcare future. These plans are standardized by the government, which means that a Plan G from one company offers the exact same core benefits as a Plan G from another. This standardization, which you can learn more about in Wikipedia’s Guide to Medigap, is designed to protect you and simplify comparisons. It’s important to remember that Medigap and Medicare Supplement are just two different names for the same thing.

How Medigap Works With Original Medicare

The process is refreshingly simple. When you receive medical care, your doctor or hospital bills Medicare first. After Medicare pays its approved share, the remaining bill is automatically sent to your Medigap insurance company, which then pays its portion. To be eligible, you must be enrolled in both Medicare Part A and Part B. One of the biggest advantages is freedom of choice: you can see any doctor or visit any hospital in the U.S. that accepts Medicare, with no network restrictions or referrals needed.

Understanding the ‘Gaps’ in Original Medicare Coverage

Without a supplement, your out-of-pocket costs can be unpredictable and significant. These “gaps” are the expenses you are responsible for paying:

- Part A Deductible: A substantial amount you must pay for each hospital stay benefit period.

- Part B Coinsurance: You are typically responsible for 20% of the cost for most doctor services, outpatient therapy, and medical equipment with no annual limit.

- Other Costs: This can include copayments for hospital stays, the first three pints of blood, or skilled nursing facility care.

For example, if you had a medical procedure that cost $20,000, your 20% coinsurance would be $4,000. A Medigap plan could cover that entire amount for you.

Medigap vs. Medicare Advantage: The Key Difference

It’s easy to confuse these two, but their roles are completely different. The most important distinction is this: a Medigap plan supplements and works alongside your Original Medicare benefits. In contrast, a Medicare Advantage (Part C) plan is an alternative that replaces your Original Medicare. It’s a different path to receiving your healthcare coverage, often with different rules, networks, and costs.

(For a detailed breakdown, please see our complete guide: Medicare Supplement vs. Medicare Advantage: Making the Right Choice.)

What Exactly Do Medicare Supplement Plans Cover?

One of the most common sources of confusion for people new to Medicare is understanding what Original Medicare (Parts A and B) doesn’t cover. Those gaps-deductibles, coinsurance, and copayments-can lead to unpredictable and overwhelming medical bills. This is precisely where a Medicare Supplement, or Medigap, plan steps in to provide financial security and peace of mind.

To simplify things, the federal government standardized these plans. They are identified by letters, such as Plan G or Plan N. This standardization is a crucial protection for you, a fact you can confirm on the Official Medicare Website. It means that a Plan G from one insurance company offers the exact same basic benefits as a Plan G from any other company. The only difference is the price you pay for it. So, when asking what is a medicare supplement plan, the answer lies in the specific, predictable costs it’s designed to cover.

Covering Your Hospital Stays (Part A Gaps)

A Medigap plan can significantly reduce or even eliminate your out-of-pocket costs for hospital care covered by Medicare Part A. Most plans cover:

- The Part A hospital deductible ($1,632 in 2024 per benefit period)

- Hospital coinsurance for extended inpatient stays

- Skilled nursing facility care coinsurance

- The first three pints of blood each year

Reducing Your Doctor and Outpatient Costs (Part B Gaps)

For your regular medical needs, from doctor’s visits to outpatient procedures, Medigap helps cover the costs that Part B leaves behind. This provides a stable, predictable budget for your healthcare. Key coverages include:

- The 20% Part B coinsurance for doctor visits and other outpatient services

- Part B excess charges (if a doctor charges more than the Medicare-approved amount)

- Hospice care coinsurance or copayments

Benefits for Peace of Mind

Beyond just paying bills, what is a medicare supplement plan if not a tool for confidence? These plans offer powerful benefits that give you freedom and control over your healthcare. You get:

- The freedom to see any doctor or specialist in the U.S. who accepts Medicare

- No referrals needed to see a specialist

- Foreign travel emergency coverage (up to plan limits), so you can travel with confidence

What Do Medigap Plans *Not* Cover?

To find the right coverage, you need the complete picture-not just what a plan covers, but what it doesn’t. We believe in total clarity because understanding the limits of your plan is just as important as knowing its benefits. This helps you avoid unexpected bills and feel confident in your healthcare decisions.

A Medicare Supplement (Medigap) plan is designed to do one job perfectly: fill the “gaps” in Original Medicare (Part A and Part B). It is not a comprehensive, all-in-one health plan. Let’s walk through the main services that Medigap policies do not cover.

The Big One: Prescription Drugs

This is the most common point of confusion, so let’s be crystal clear: Medigap plans sold today do not include prescription drug coverage. If you need coverage for your medications, you must enroll in a separate, standalone Medicare Part D Prescription Drug Plan. While some older Medigap plans sold before 2006 included this benefit, it is no longer available for new enrollees.

Routine Dental, Vision, and Hearing Care

Original Medicare doesn’t cover most routine care for your teeth, eyes, or ears, and Medigap plans don’t either. This means services like the following are typically not covered:

- Routine dental cleanings, fillings, or dentures

- Eye exams for glasses or contact lenses

- Hearing aids and the exams for fitting them

Many people purchase separate, affordable dental, vision, and hearing (DVH) insurance plans to cover these essential needs.

Long-Term Care and Other Exclusions

It’s important to understand the difference between short-term skilled care and long-term custodial care. While Medigap helps cover coinsurance for a limited stay in a skilled nursing facility after a hospital visit, it does not cover long-term custodial care. Custodial care involves help with daily activities like bathing, dressing, and eating. As the official Medicare website explains, Medigap is meant to cover Medicare-approved cost-sharing, not services Medicare doesn’t cover in the first place. Medigap also does not cover private-duty nursing.

Knowing these boundaries is a key part of answering the question, what is a Medicare Supplement plan, and building a complete financial protection strategy for your retirement.

Who Is Eligible and When Is the Best Time to Enroll?

Understanding your eligibility and, more importantly, when to enroll are two of the most critical steps in your Medicare journey. Getting the timing right can save you money and guarantee your access to coverage for life. Getting it wrong can have lasting consequences. Let’s walk through this simply and clearly.

Basic Medigap Eligibility Requirements

To purchase a Medigap plan, you generally must meet a few simple criteria. You must:

- Be enrolled in Medicare Part A and Part B.

- Be 65 years of age or older.

While most Medigap plans are designed for those 65 and up, some states have specific rules requiring insurance companies to offer at least one plan to beneficiaries under 65 with disabilities. The rules vary, so it’s important to check your state’s specific guidelines.

Your Golden Window: The Medigap Open Enrollment Period

If there is one piece of advice to take away, it is this: do not miss your Medigap Open Enrollment Period. This is a one-time, 6-month window that begins on the first day of the month you are both 65 and enrolled in Medicare Part B. It is your golden ticket to getting any Medigap plan you want.

During this protected period, you have what are called “guaranteed issue rights.” This is a powerful advantage. It means an insurance company:

- Cannot deny you coverage for any Medigap policy it sells.

- Cannot charge you a higher premium because of pre-existing health conditions like diabetes or heart disease.

This is the only time you have this absolute right. Understanding this enrollment period is a core part of answering the question, what is a medicare supplement plan and how do I secure one with peace of mind?

What Happens if You Miss This Window?

Once your 6-month Medigap Open Enrollment Period ends, it does not come back. If you decide to apply for a plan later, you will likely have to go through medical underwriting. This means the insurance company can ask you detailed health questions and review your medical history.

Based on their review, they can legally charge you a higher monthly premium or, in some cases, deny your application for coverage altogether. Navigating these dates can feel overwhelming, but making a mistake here can be costly. Confused about your dates? We can help clarify your enrollment window.

How an Independent Broker Simplifies Your Medigap Choice

Understanding what is a medicare supplement plan is the first step. The next-and often most overwhelming-is choosing the right one. With dozens of insurance companies offering the same standardized plans (like Plan G or Plan N) at wildly different prices, how can you be sure you’re making the right decision? This is where many people feel stressed and confused. You don’t have to navigate this alone.

The crucial difference lies in who your advisor works for. A captive agent works for one specific insurance company, meaning they can only offer that company’s products. An independent broker, on the other hand, works for you. Our loyalty is to you, not to an insurance carrier.

Why Working With an Independent Broker is Different

As your independent advocate, our entire focus is on your peace of mind. We are dedicated to finding the perfect fit for your unique situation. Our promise to you includes:

- Unbiased Guidance: We work for you, not an insurance company. Our advice is always based on your best interests.

- Complete Market Access: We shop for plans from over 40 top-rated carriers, ensuring you see the best options available.

- Personalized Solutions: Our goal isn’t to sell a policy; it’s to find the plan that best protects your health and your budget.

- No Cost to You: Our expert guidance and support are completely free. You pay the exact same premium as you would going directly to the carrier.

Our Simple Process: From Confusion to Confidence

We’ve designed a straightforward, stress-free process to help you find the right Medigap plan with absolute certainty.

- A Simple Conversation: We start by listening. We take the time to understand your healthcare needs, budget, and priorities in a friendly, no-pressure call.

- We Do the Research: We compare dozens of plans and rates from trusted carriers in your specific area, doing all the heavy lifting for you.

- Clear, Simple Explanations: We present your best 2-3 options in plain English. We’ll explain the pros and cons so you know exactly what you’re getting.

- Stress-Free Enrollment: Once you’ve made a confident choice, we handle the entire enrollment process for you, ensuring it’s seamless and correct.

Navigating your Medicare options shouldn’t be a source of anxiety. With the right partner, you can move from wondering what a Medicare Supplement plan is to feeling confident you have the best possible protection. If you’re ready for clarity, schedule a free, no-obligation consultation today.

Find Your Medigap Clarity and Confidence

Understanding your options is the first step toward peace of mind. We’ve seen that Medicare Supplement plans are designed to fill the coverage “gaps” left by Original Medicare, helping you control unpredictable out-of-pocket costs. Most importantly, enrolling at the right time-especially during your Medigap Open Enrollment Period-is crucial for locking in your best rates and options without medical questions.

But knowing what is a medicare supplement plan is only the beginning. The real challenge is choosing the right one from dozens of carriers, and you don’t have to navigate this maze alone. We provide personalized, unbiased guidance by comparing plans from over 40 trusted carriers to find the perfect fit for your needs and budget.

Our simple process is designed to move you from confusion to confidence. Ready to feel secure in your healthcare coverage? Schedule Your Free, No-Obligation Medicare Consultation today and let our team in over 34 states simplify your path forward.

Frequently Asked Questions About Medicare Supplement Plans

Do I still need to pay my Medicare Part B premium if I have a Medigap plan?

Yes, absolutely. You must continue to pay your Medicare Part B premium directly to the government. A Medicare Supplement plan works alongside your Original Medicare (Parts A and B) to help cover out-of-pocket costs; it does not replace it. Think of your Medigap premium as a separate payment to a private insurance company for that extra layer of financial protection and peace of mind.

Are all Plan G policies the same, no matter which company I choose?

Yes, the core benefits are identical. Medigap plans are standardized by the federal government, meaning a Plan G from one company must offer the exact same medical coverage as a Plan G from any other. The only differences are the monthly premium you pay, the company’s history of rate increases, and its customer service reputation. This is why comparing companies is so important to find the best value for the same great coverage.

Can an insurance company cancel my Medigap policy if I get sick?

No, they cannot. All Medigap policies are “guaranteed renewable.” This is a powerful protection that means as long as you pay your premiums on time, the insurance company can never cancel your policy, regardless of your health status or how much you use your benefits. This ensures your coverage is there for you when you need it most, giving you true security and confidence in your healthcare future.

What is the difference between Medicare Supplement and ‘Medicare Part C’?

This is a common point of confusion we help simplify. A Medicare Supplement (Medigap) plan works *with* Original Medicare, paying for costs that Medicare leaves behind. In contrast, Medicare Part C (an Advantage Plan) is an *alternative* to Original Medicare. It replaces your Part A and B benefits with a private plan, often with network restrictions. Understanding what is a Medicare supplement plan versus an Advantage plan is a critical first step.

Can I be denied a Medigap plan because of my health history?

It depends entirely on when you apply. During your one-time Medigap Open Enrollment Period (the six months after you turn 65 and enroll in Part B), you have “guaranteed issue rights.” This means companies cannot deny you coverage or charge more due to your health. Outside of this protected window, you will likely have to answer health questions (medical underwriting) and could be denied coverage for pre-existing conditions.

Is it possible to switch my Medigap plan to a different one later on?

Yes, you can apply to switch your Medigap plan at any time. However, after your initial enrollment period, you typically have to go through medical underwriting, which means answering health questions. An insurance company can deny your application based on your health history. Some states have special rules that create annual opportunities to switch, so it’s wise to seek expert guidance to understand the specific options available to you.