Does the thought of navigating the maze of Medicare deadlines fill you with anxiety? You’re not alone. With a calendar full of confusing acronyms like AEP, OEP, and IEP, the fear of missing a critical date-and facing potential penalties-is a real and stressful concern. We believe you deserve clarity and peace of mind, which is why we’ve created this simple guide to all the key medicare enrollment period 2026 dates. Think of it as your personal roadmap to making confident decisions without the overwhelm.

In this guide, we will cut through the jargon and give you a simple, easy-to-read calendar of every important deadline. We’ll explain what each enrollment period is for and provide a helpful checklist so you can prepare to make the right choices for your health and budget. Our only goal is to provide the trusted guidance you need to feel secure and in control, ensuring you never miss an opportunity to get the best possible coverage. Let’s make this simple, together.

Key Takeaways

- Understanding the key medicare enrollment period 2026 dates, especially the main fall window, is the first step to ensuring your coverage meets your needs for the year ahead.

- If you’re turning 65, your Initial Enrollment Period is a critical one-time window. Learn how it works to avoid costly, lifelong penalties.

- Discover how major life events, like moving or losing other coverage, can qualify you for a Special Enrollment Period to change your plan outside of the standard deadlines.

- Move from confusion to confidence with a simple checklist that shows you how to review your current plan and compare new options before it’s time to enroll.

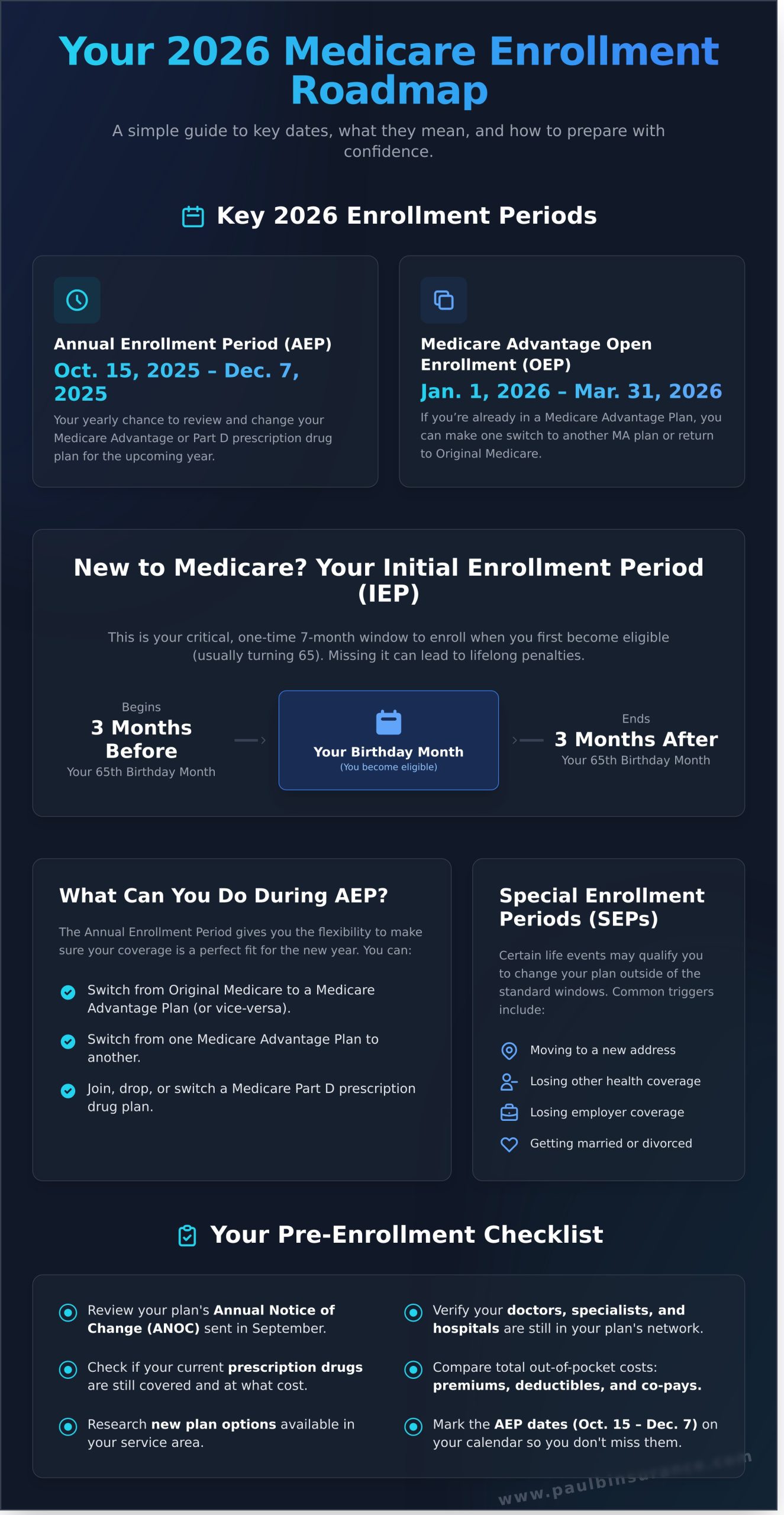

Key 2026 Medicare Enrollment Dates at a Glance

Navigating the world of Medicare can feel overwhelming, especially when it comes to deadlines. Missing a key date can lead to coverage gaps or lifelong penalties, and we are here to ensure that doesn’t happen. To help you prepare with confidence, here is a simple guide to the key medicare enrollment period 2026 dates you need to know. Understanding the vast Medicare system begins with knowing when you can act.

This simple table provides a quick overview to help you plan your year.

2026 Enrollment Period Timeline

Each enrollment window serves a distinct purpose. Think of them as specific opportunities to manage your healthcare coverage throughout the year. Here’s a simple breakdown:

- Initial Enrollment Period (IEP): This is your personal 7-month window to sign up for Medicare when you first become eligible, typically around your 65th birthday.

- Annual Enrollment Period (AEP): Often called “Open Enrollment,” this is the time for all Medicare beneficiaries to review their coverage and make changes for the upcoming year.

- Medicare Advantage Open Enrollment (OEP): If you are enrolled in a Medicare Advantage Plan, this period gives you a chance to make a single change, such as switching to another Advantage Plan or returning to Original Medicare.

- Special Enrollment Periods (SEPs): Life changes, such as moving to a new service area or losing employer coverage, can trigger an SEP, allowing you to adjust your plan outside of the standard timeframes.

Why These Dates Matter for Your Healthcare

Marking these medicare enrollment period 2026 dates on your calendar is about more than just avoiding paperwork-it’s about taking control of your health and financial well-being. Missing a deadline can lock you into a plan that no longer fits your needs for a full year. More importantly, failing to enroll when you’re first eligible can result in permanent late enrollment penalties. Understanding this timeline empowers you to make thoughtful, timely decisions, ensuring your coverage aligns perfectly with your life.

The Main Event: Medicare Annual Enrollment Period (AEP) for 2026 Coverage

For most people already enrolled in Medicare, this is the most important time of the year. Think of the Annual Enrollment Period (AEP) as your yearly opportunity to review your health and prescription drug coverage and make sure it still fits your life. It’s your chance to move from confusion to confidence, knowing you have the best possible plan for the year ahead.

The key medicare enrollment period 2026 dates for AEP run from October 15, 2025, to December 7, 2025. Any plan changes you make during this window will take effect on January 1, 2026. This timing is a crucial detail confirmed by the Official Medicare coverage start dates, ensuring you can start the new year with seamless coverage you’ve chosen with care and not by default.

What You Can Do During the 2026 AEP

This period offers you complete flexibility to optimize your coverage. We provide simple, unbiased guidance to help you navigate these choices without pressure. During AEP, you have the power to:

- Switch from Original Medicare (Part A and Part B) to a Medicare Advantage (Part C) plan.

- Leave a Medicare Advantage plan and return to Original Medicare.

- Change from one Medicare Advantage plan to another that better suits your needs.

- Enroll in, drop, or switch your Medicare Part D prescription drug plan.

Who Should Pay Close Attention to AEP?

While everyone should review their plan, some individuals have a more urgent need. If you find yourself in any of these situations, marking these medicare enrollment period 2026 dates on your calendar is essential. You should pay close attention if:

- Your prescription needs have changed. A new medication could mean your current Part D plan is no longer the most cost-effective.

- Your doctor or hospital is no longer in-network. Don’t risk losing access to trusted healthcare providers.

- You are unhappy with your plan’s costs or service. Your premiums, deductibles, or customer service experience may be better with a different carrier.

- You simply want to ensure you have the best coverage. New plans with better benefits become available every year.

New to Medicare in 2026? Understanding Your Initial Enrollment Period (IEP)

Turning 65 is an exciting milestone, but it also brings you to the doorstep of Medicare-a system that can feel complex and overwhelming. Your first and most important step is understanding your Initial Enrollment Period (IEP). This is your personal, one-time 7-month window to sign up for Medicare without penalties. Getting these dates right is critical, as it sets the foundation for your healthcare coverage for years to come. We’re here to simplify the jargon and give you the clarity you need to move forward with confidence.

Calculating Your Personal IEP Window

Your IEP is a 7-month period built around your 65th birthday. It includes the three months before your birthday month, the month you turn 65, and the three months after. Here’s how it works:

- Example 1: If your birthday is June 15, 2026, your IEP runs from March 1, 2026, to September 30, 2026.

- Special Rule: If your birthday is on the first of the month (e.g., June 1), Medicare treats your birthday as if it were in May. Your IEP would then start and end one month earlier, running from February 1 to August 31.

When does coverage start? To ensure your coverage begins on the first day of your birthday month, you must enroll during the three months before you turn 65. If you wait to enroll during your birthday month or the three months after, your coverage will be delayed.

What to Do During Your IEP

Your IEP is the time to make several key decisions. Missing this window can lead to lifelong late enrollment penalties for Part B and Part D, so it’s vital to act. During this period, you will:

- Enroll in Original Medicare: Sign up for Part A (Hospital Insurance) and Part B (Medical Insurance).

- Explore Your Options: Decide if you want to add a Medicare Supplement (Medigap) plan, get your benefits through a Medicare Advantage (Part C) plan, or enroll in a Part D prescription drug plan.

Navigating these choices and understanding all the different medicare enrollment period 2026 dates can feel like a full-time job. You don’t have to figure it out alone. If you’re feeling confused or want to ensure you make the best choice for your needs without pressure, we can help. Get personalized help with your IEP dates.

Other Key 2026 Windows: MA-OEP and Special Enrollment Periods (SEPs)

Feeling overwhelmed by the main enrollment periods? It’s a common concern, but rest assured, your Initial Enrollment Period (IEP) and the Annual Enrollment Period (AEP) are not your only opportunities to adjust your Medicare coverage. Life is unpredictable, and Medicare provides specific windows to accommodate changes. Think of these not as complex rules, but as safety nets designed to ensure you always have the right coverage for your situation.

Medicare Advantage Open Enrollment Period (MA-OEP)

If you’re already enrolled in a Medicare Advantage (MA) plan and realize it isn’t the right fit, the MA-OEP is your chance for a change of heart. This period runs from January 1 to March 31, 2026.

During the MA-OEP, you can make one of the following changes:

- Switch from your current Medicare Advantage Plan to a different one.

- Drop your Medicare Advantage Plan and return to Original Medicare (Part A and Part B). If you do this, you can also join a standalone Medicare Part D prescription drug plan.

It’s important to remember you only get to make one change during this window, so it’s crucial to make it count with confident, well-informed guidance.

Qualifying for a Special Enrollment Period (SEP)

Life events don’t always align with the calendar. A Special Enrollment Period (SEP) is a critical safety net that allows you to change your coverage outside of the standard enrollment periods when you experience a qualifying life event. These special medicare enrollment period 2026 dates are triggered by specific circumstances.

Common events that may qualify you for an SEP include:

- Moving out of your current plan’s service area.

- Losing health coverage from an employer or union.

- Qualifying for, or losing, Medicaid or Extra Help.

- Moving into or out of a skilled nursing facility or long-term care hospital.

Determining if your situation grants you an SEP can feel confusing. It’s one of the most common questions we hear. Instead of guessing, let us help you navigate the rules with clarity. To get simple, unbiased answers about your eligibility, you can get trusted guidance at www.paulbinsurance.com and move from confusion to confidence.

How to Prepare for the 2026 Enrollment Periods: A Simple Checklist

Knowing the key medicare enrollment period 2026 dates is the first step, but preparing ahead of time is what empowers you to make a confident, cost-effective decision. Navigating Medicare can feel overwhelming, but it doesn’t have to be. Instead of waiting until the deadline, use this simple checklist to proactively review your options and ensure your coverage continues to serve you well.

This is your path from confusion to confidence.

Step 1: Review Your Current Coverage

Every September, your current plan provider will mail you an important document called the Annual Notice of Change (ANOC). Don’t set it aside. This letter outlines every change to your plan for the upcoming year. As you review it, ask yourself:

- Have my monthly premiums, deductibles, or copays increased?

- Are the benefits I rely on still included in the plan?

- Am I still happy with the overall value and service I’m receiving?

Step 2: Check Your Doctors and Prescriptions

Your health needs can change, and so can your plan’s network and drug list (formulary). Before any enrollment period begins, it’s critical to verify that your plan still fits your life. Confirm the following for 2026:

- Are your primary care doctor and any specialists you see still in your plan’s network?

- Are all of your prescription medications still covered on the plan’s formulary?

- Have the costs for your specific drugs changed? Check their pricing tier.

Step 3: Get Unbiased, Expert Guidance

You don’t have to navigate this maze alone. The single best way to prepare for the medicare enrollment period 2026 dates is to get trusted, unbiased advice. A captive agent can only offer plans from one company, but an independent broker works for you. We can compare plans from over 40 carriers to find the one that truly fits your healthcare needs and your budget, ensuring you never overpay for coverage you don’t need. Let us do the heavy lifting for you. Schedule your free, no-pressure plan review today.

From Confusion to Confidence: Mastering Your 2026 Medicare Enrollment

Navigating Medicare can feel overwhelming, but understanding the key deadlines is the first step toward clarity. Remember, whether you’re enrolling for the first time during your Initial Enrollment Period or making changes during the Annual Enrollment Period, knowing the specific medicare enrollment period 2026 dates is crucial to avoiding coverage gaps and penalties. These windows are your opportunity to secure the health coverage that best fits your life.

But you don’t have to figure it all out alone. As an independent broker with The Modern Medicare Agency, I provide the unbiased guidance a captive agent simply can’t. We will compare plans from over 40 trusted insurance carriers, offering personalized support to help you steer clear of costly enrollment mistakes. My goal is to simplify the process and give you complete peace of mind.

Are you ready to make a confident, informed decision for your health? Schedule a Free Call to Discuss Your 2026 Medicare Options today. Let’s ensure you have the right plan in place for a healthy and secure year ahead.

Frequently Asked Questions About Medicare Enrollment

What happens if I miss the Medicare Annual Enrollment deadline?

Missing a deadline can be stressful, but it’s important to understand the consequences. In most cases, you will be locked into your current plan for another year, even if it no longer fits your needs or budget. While certain life events may qualify you for a Special Enrollment Period, relying on this is risky. Staying on top of the key medicare enrollment period 2026 dates is the best way to avoid costly mistakes and ensure your coverage always works for you.

Do I have to re-enroll or change my Medicare plan every year?

This is a common source of confusion, but the answer is simple: no, you are not required to re-enroll. If you are happy with your plan and do nothing, it will typically renew automatically. However, we strongly recommend a yearly review. Insurance plans can change their benefits and costs each year, and so can your health needs. An annual check-in is your path to confidence, ensuring your plan continues to provide the protection you deserve.

Can I change my Medigap (Medicare Supplement) plan during these periods?

This is a critical distinction that prevents a lot of frustration. The Annual Enrollment Period is for changing Medicare Advantage (Part C) and Prescription Drug (Part D) plans. Medigap plans have different rules. You can apply to change your Medigap policy at any time of year, but after your initial open enrollment window, you will likely have to answer health questions to be approved. We can provide clear guidance on the right time and way to approach this.

When will my new plan coverage start if I make a change during AEP?

We believe in making things simple and predictable. When you choose a new Medicare Advantage or Part D plan during the Annual Enrollment Period (October 15 – December 7), your new coverage will always begin on January 1 of the following year. This provides peace of mind, as you know exactly when your new benefits will kick in without any gaps in your healthcare. No surprises, just clarity and confidence in your coverage.

Is there a penalty if I don’t enroll in a Part D drug plan when I’m first eligible?

Yes, and this is one of the most important rules to understand to avoid a lifelong financial penalty. If you go without a Part D plan or other creditable drug coverage for 63 consecutive days or more after you’re first eligible, you will likely face a permanent late enrollment penalty. This penalty is added to your monthly Part D premium for as long as you have coverage. Our guidance is designed to help you steer clear of these costly mistakes.

How do I know which enrollment period applies to me?

Navigating the maze of enrollment periods can feel overwhelming, but we can make it simple. Your Initial Enrollment Period is when you first become eligible (usually around your 65th birthday). The Annual Enrollment Period is your yearly chance to switch plans. Special Enrollment Periods are for specific life changes, like moving or losing other coverage. Understanding the key medicare enrollment period 2026 dates is the first step, and our trusted, unbiased guidance will ensure you always act at the right time.