Does the thought of choosing a Medicare Advantage plan feel like trying to solve a puzzle with missing pieces? You’re not alone. With endless options, confusing jargon, and constant sales calls, it’s easy to feel overwhelmed and worry about making a costly mistake. This is why so many people start by searching for qualified “medicare advantage agents near me”-they’re looking for a trusted local guide who can bring clarity to the chaos and put their best interests first.

This simple guide is your roadmap to finding that expert ally. We’ll show you why a local, independent agent is your most powerful resource for navigating your options with confidence. You will learn how to spot a dedicated professional from a captive salesperson, and we’ll give you the essential questions to ask to ensure you’re getting unbiased advice. By the end, you’ll be empowered to find a true partner who can help you secure the right plan for your health and budget, giving you lasting peace of mind.

Key Takeaways

- A local agent simplifies the Medicare maze, helping you avoid costly mistakes and find a plan with confidence.

- Learn the critical difference between an independent broker and a captive agent to ensure you see all your plan options, not just one company’s.

- Finding the best medicare advantage agents near me involves more than a simple search-discover the key signs of a truly trustworthy professional.

- Arm yourself with the essential questions to ask any agent, allowing you to easily gauge their expertise and commitment to your needs.

Why You Need a Local Medicare Advantage Agent

Turning 65 should be a celebration, but for many, it marks the beginning of navigating the Medicare maze. The endless paperwork, confusing jargon, and barrage of mailers can feel overwhelming. You’re faced with a critical decision about your healthcare, particularly when considering plans like Medicare Part C. If you’re asking yourself, “What is Medicare Advantage?” you’re not alone. These plans, offered by private companies, bundle your benefits in different ways, and choosing the right one is crucial.

This is where a trusted, independent agent becomes your most valuable ally. They serve as your personal guide, dedicated to bringing you from confusion to confidence. An expert partner saves you time, prevents costly mistakes, and offers personalized advice tailored to your unique health needs and budget. Best of all, their guidance is typically provided at no cost to you, as they are compensated by the insurance carriers.

The Cost of Going It Alone

Trying to navigate Medicare Advantage on your own can lead to significant and stressful problems. Without professional guidance, you risk:

- Enrolling in a plan where your trusted doctors or preferred hospital are out-of-network.

- Missing out on valuable extra benefits you’re eligible for, like dental, vision, or hearing coverage.

- Facing lifelong late enrollment penalties because of a simple timing mistake.

- Feeling the immense stress of sifting through dozens of complex plan options by yourself.

The Value of Personalized, Local Expertise

When you search for medicare advantage agents near me, you’re looking for more than just an advisor; you’re seeking local expertise. A local agent understands the specific healthcare landscape in your community. They know which plans have strong networks with the best local doctors and hospitals. They can help you compare options from multiple carriers side-by-side, ensuring you get unbiased advice and find a plan that truly fits your life.

Working with local medicare advantage agents near me allows you to build a long-term relationship with a professional in your community who understands state-specific rules and is available for support year after year. This isn’t just a transaction; it’s about gaining peace of mind with a dedicated advocate on your side.

Independent Broker vs. Captive Agent: A Crucial Distinction

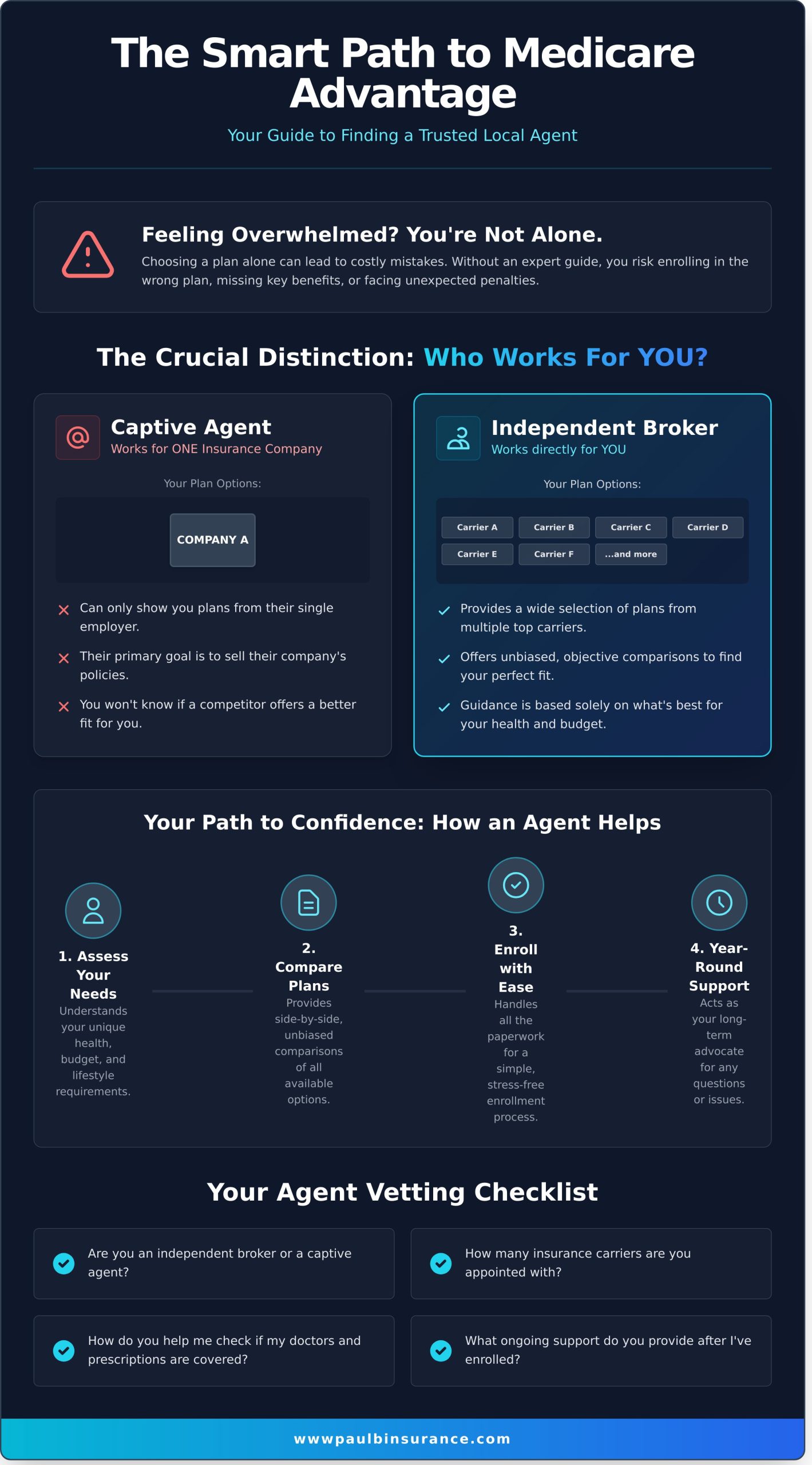

When you begin your search for “medicare advantage agents near me,” it’s easy to assume they all do the same thing. However, this is one of the most common and costly misconceptions. The type of agent you choose directly impacts the number of plans you can compare and the quality of advice you receive. Understanding this difference is the first step toward finding a plan with confidence and peace of mind.

The core distinction is simple: one works for a single insurance company, while the other works for you.

What is a Captive Agent?

A captive agent is employed by and represents only one insurance company, such as a major national carrier. While they may be knowledgeable about their company’s products, their loyalty is to their employer. This creates a significant limitation for you:

- They can only show you plans offered by that single carrier.

- Their primary goal is to sell their company’s policies, not to find your best overall option.

- You will never know if a competing insurance company offers a better plan for your doctors, prescriptions, or budget.

What is an Independent Broker?

An independent broker, like the agents at The Modern Medicare Agency, works for you, the client. We are not tied to any single insurance company. Instead, we are appointed with dozens of different top-rated carriers, giving us a complete view of the market. Our loyalty is to you and you alone.

- We provide a wide selection of plans from multiple insurance companies.

- We offer unbiased, objective comparisons to find the perfect fit for your unique needs.

- Our guidance is based entirely on what is best for your health and financial well-being.

Why an Independent Broker is Your Best Choice

Choosing the right Medicare Advantage plan shouldn’t feel like a gamble. Working with an independent broker removes the guesswork and puts the power back in your hands. Your goal is to receive completely unbiased advice. While government-funded resources like the State Health Insurance Assistance Program (SHIP) provide excellent free counseling, an independent broker offers that same commitment to impartiality while also handling the entire enrollment process for you. When you search for medicare advantage agents near me, you deserve an advocate who provides more choices, personalized guidance, and a single, trusted point of contact for all your questions. Our independent agents are dedicated to putting your needs first, offering a truly client-centric experience.

What a Medicare Advantage Agent Does For You (Step-by-Step)

Working with a Medicare Advantage agent is about more than just signing up for a plan. It’s about building a trusted relationship with an expert who serves as your guide and advocate. The process is designed to bring you clarity and confidence, never pressure. We move at your pace, ensuring you understand every detail before making a decision. From our first conversation to your annual plan check-up, we are here to support you.

Step 1: Understanding Your Unique Needs

The journey begins with a simple, personal conversation. To find the right fit, we first need to understand what matters most to you. There is no one-size-fits-all solution, so we take the time to carefully review your specific situation. Together, we will:

- Review your healthcare providers: We confirm which plans are accepted by your current doctors, specialists, and preferred hospitals.

- List your prescription drugs: We check each plan’s formulary (drug list) to ensure your medications are covered at the lowest possible cost.

- Discuss your budget: We talk openly about what you are comfortable paying for monthly premiums, deductibles, and co-pays.

- Identify important extra benefits: We pinpoint which perks-like dental, vision, hearing, or fitness programs-are most valuable to you.

Step 2: Comparing Your Local Plan Options

Once we have a clear picture of your needs, we do the heavy lifting. While anyone can look up plans on Medicare’s official plan finder, interpreting the fine print is what separates confusion from confidence. This is where the guidance of experienced medicare advantage agents near me becomes invaluable. We analyze all the plans available in your zip code and narrow the options down to the top 2-3 that align with your health and budget needs. We then explain the differences in simple terms, so you can make an informed choice.

Step 3: Seamless Enrollment and Year-Round Support

Our commitment to you doesn’t end after you enroll. We are your dedicated resource for as long as you have your plan. This ongoing support is a core part of our promise. We will:

- Handle the paperwork: We assist you with the entire application and enrollment process to ensure it’s submitted correctly and on time.

- Confirm your coverage: We follow up to make sure your new plan is active and that you’ve received your member ID card and materials.

- Provide ongoing help: If you ever have a question about a claim, a benefit, or a provider, you call us directly. We act as your advocate.

- Conduct an annual review: Every year, we’ll help you review your plan to ensure it’s still the best fit for your needs as they change.

How to Find and Vet the Best Agents in Your Area

Finding the right Medicare Advantage agent is about more than a quick online search; it’s about finding a trusted, long-term partner for your healthcare journey. The goal is to move from confusion to confidence, and that starts with an agent who is experienced, trustworthy, and focused entirely on your needs. A little homework now ensures you have a dedicated advocate in your corner for years to come.

Where to Look for Reputable Agents

The best recommendations often come from people you already trust. Start by asking those in your community for their honest feedback. To expand your search for qualified medicare advantage agents near me, consider these reliable sources:

- Referrals: Ask friends, family members, or even your doctor’s office manager who they recommend.

- Trusted Directories: Use online search tools from major insurance carriers or well-known independent brokerage firms.

- Community Hubs: Check with local senior centers or community organizations that often provide resources and recommendations.

- Online Presence: Look for agents with a professional website that clearly explains their services and features positive client reviews.

What to Check Before You Commit

Once you have a few names, it’s time to verify their credentials. A true professional will be transparent about their qualifications and approach. Here’s what to confirm before making a decision:

- State License: Ensure they are licensed to sell health insurance in your state. This information should be easy to find on their website.

- Client Testimonials: Look for reviews or testimonials that speak to their knowledge, patience, and client-first service.

- Independent Status: Ask if they are an independent broker. This is critical, as it means they represent multiple insurance companies and can offer you unbiased choices, not just one company’s plan.

- Medicare Specialization: Confirm that they specialize specifically in Medicare. This complex field requires a dedicated expert, not a generalist.

Red Flags to Watch Out For

Your peace of mind is the top priority. Unfortunately, not all agents operate with your best interests at heart. Steer clear of anyone who makes you feel uncomfortable or pressured. Be on the lookout for these warning signs:

- High-Pressure Tactics: An ethical agent will never rush you into a decision or use “limited-time offer” scare tactics.

- Lack of Transparency: They should be willing to openly discuss all the insurance companies they represent.

- Requests for Payment: You should never be charged a fee for an agent’s services. They are compensated by the insurance carriers, not by you.

- Unsolicited Contact: Be wary of unsolicited calls, texts, or home visits, which are often against Medicare’s marketing rules.

Choosing the right agent is the most important step in simplifying your Medicare experience. A trustworthy guide will provide the clarity and support you need to make the best choice with confidence. To see what a client-first approach looks like, you can learn more about our commitment to unbiased, no-pressure guidance.

Key Questions to Ask a Prospective Medicare Advantage Agent

Finding the right Medicare Advantage plan starts with finding the right guide. When you search for medicare advantage agents near me, you’re looking for more than a salesperson-you’re looking for a trusted partner. A dedicated, professional agent will welcome your questions and answer them with patience and clarity. This conversation is your opportunity to gauge their expertise, understand their approach, and ensure they have your best interests at heart. Use this simple checklist to interview potential agents and find the perfect fit. The right answers will give you the confidence you need to move forward.

Questions About Their Experience and Practice

First, you need to be sure you’re working with a qualified and unbiased professional. These questions help you understand their background and how their business works. An independent broker, for example, can offer you far more options than a captive agent who only works for one company.

- How long have you been specializing in Medicare?

- Are you an independent broker or a captive agent?

- How many insurance carriers do you represent in my area?

- Do you charge any fees for your services? (The answer should always be no.)

Questions About Their Process

The best agents provide support long after you’ve enrolled. Your healthcare needs can change, and so can the plans available each year. You want an advocate who will be there for you down the road, helping you navigate any challenges and ensuring your plan always meets your needs.

- How will you help me find the right plan for my specific needs?

- What happens after I enroll? What kind of ongoing support do you offer?

- Will you contact me each year to review my plan during the Annual Enrollment Period?

- How do you help if I have a problem with the insurance company?

Questions About Your Plan Options

Finally, the conversation should focus on your personal situation. A great agent will prioritize your unique healthcare needs, from the doctors you trust to the prescriptions you rely on. Their goal is to match you with a plan that truly works for you, not just the most popular one available.

- Can you confirm my doctors, specialists, and prescriptions are covered?

- What are the most popular Medicare Advantage plans in my county?

- What are the key differences between these top plans regarding costs and benefits?

Feeling prepared is the first step toward making a confident decision. When you’re ready to speak with an expert who has all the right answers, we’re here to help. Ready to ask an expert? Schedule your free, no-obligation consultation.

Your Path to Medicare Confidence Starts Here

Navigating your Medicare options shouldn’t feel like a chore. As this guide has shown, the most important decision is choosing the right partner. By understanding the crucial difference between an independent broker and a captive agent, you empower yourself to find an advocate who truly works for you, not for a single insurance company. Your search for dedicated medicare advantage agents near me is the first step toward securing a plan that protects your health and your wallet.

If you’re ready to move from confusion to clarity, our team is here to provide the simple, expert guidance you deserve. As an independent brokerage with an A+ rating from the Better Business Bureau and hundreds of 5-star reviews from satisfied clients, we offer unbiased advice from a selection of over 40 carriers. We simplify the jargon and ensure you understand every option, so you can make a choice with complete peace of mind.

Don’t navigate this journey alone. Schedule a Free, No-Pressure Call with a Trusted Local Agent today and let us help you find the perfect plan for your needs.

Frequently Asked Questions About Medicare Agents

How much does it cost to use a Medicare Advantage agent?

There is absolutely no cost to you for using an independent Medicare agent or broker. Our guidance, expertise, and enrollment support are provided to you for free. We are compensated by the insurance carriers, not by our clients. This means you get unbiased, expert advice to help you navigate your options and find the best plan for your needs without any out-of-pocket expense. It’s our job to bring you clarity and confidence, not another bill.

How do Medicare agents get paid?

Medicare agents and brokers are paid a commission directly from the insurance company whose plan you choose to enroll in. These commission rates are regulated and standardized by the Centers for Medicare & Medicaid Services (CMS). The cost is already built into the plan’s structure, so you never pay more for your premium by using our services. This system allows us to offer our expert guidance to you at no charge, ensuring you receive impartial advice focused on your needs.

What’s the difference between a Medicare agent and a broker?

This is a crucial distinction. A “captive agent” works for a single insurance company and can only offer you that company’s plans. An independent “broker,” like us, is appointed with many different insurance carriers. This independence allows us to compare a wide variety of plans to find the one that truly fits your unique health needs and budget. A broker works for you, not for an insurance company, giving you the power of choice and unbiased guidance.

Can a local agent help me with both Medicare Advantage and Medigap plans?

Yes, a well-qualified independent agent or broker can and should help you understand all of your options, including both Medicare Advantage (Part C) and Medicare Supplement (Medigap) plans. We will simplify the differences, explaining how each type of plan works with Original Medicare. Our goal is to provide a complete picture of your choices so you can confidently select the path that provides the best coverage and peace of mind for your specific situation.

When is the best time to contact a Medicare agent?

The ideal time to connect with an agent is two to three months before your 65th birthday. This gives us plenty of time to review your options without any pressure during your Initial Enrollment Period. If you are already enrolled in Medicare, the Annual Enrollment Period from October 15th to December 7th is another key time to review your coverage. Getting started early is the best way to move from confusion to confidence in your healthcare choices.

Can an agent help me apply for Extra Help or other savings programs?

Absolutely. A caring and knowledgeable agent does more than just help you find a plan; they act as your advocate. We can help you identify and understand potential cost-saving programs like Medicare Savings Programs (MSPs) and the Part D Low-Income Subsidy (LIS), also known as Extra Help. We can guide you to the right resources and assist you in understanding the application process, ensuring you get all the benefits you’re entitled to receive.

Do I have to meet an agent in person, or can we work remotely?

We offer the flexibility to work in whatever way makes you most comfortable. While many clients appreciate finding trusted medicare advantage agents near me for a face-to-face meeting, it is not required. We can provide the same dedicated, personal guidance and complete your enrollment securely over the phone or through a video call. Our commitment is to provide clear, simple advice and support, whether we meet in person at your kitchen table or connect from a distance.