Does the thought of choosing a Medicare plan feel like navigating a maze blindfolded? If you’re feeling overwhelmed by confusing jargon, endless mailers, and the nagging fear of making a costly mistake, you are not alone. Many people begin their journey by searching for independent medicare agents near me, hoping to find a clear path forward. This search is the first and most important step toward trading stress for security, and you’ve come to the right place for trusted guidance.

An agent who works for just one insurance company has limited options. An independent agent, however, works for you. In this simple guide, we’ll show you exactly why an independent agent is your best ally. You will learn how to find an unbiased expert who can help you compare every option, avoid expensive enrollment penalties, and choose the perfect plan for your health needs and budget. It’s time to move from confusion to confidence and find a partner you can count on for years to come.

Key Takeaways

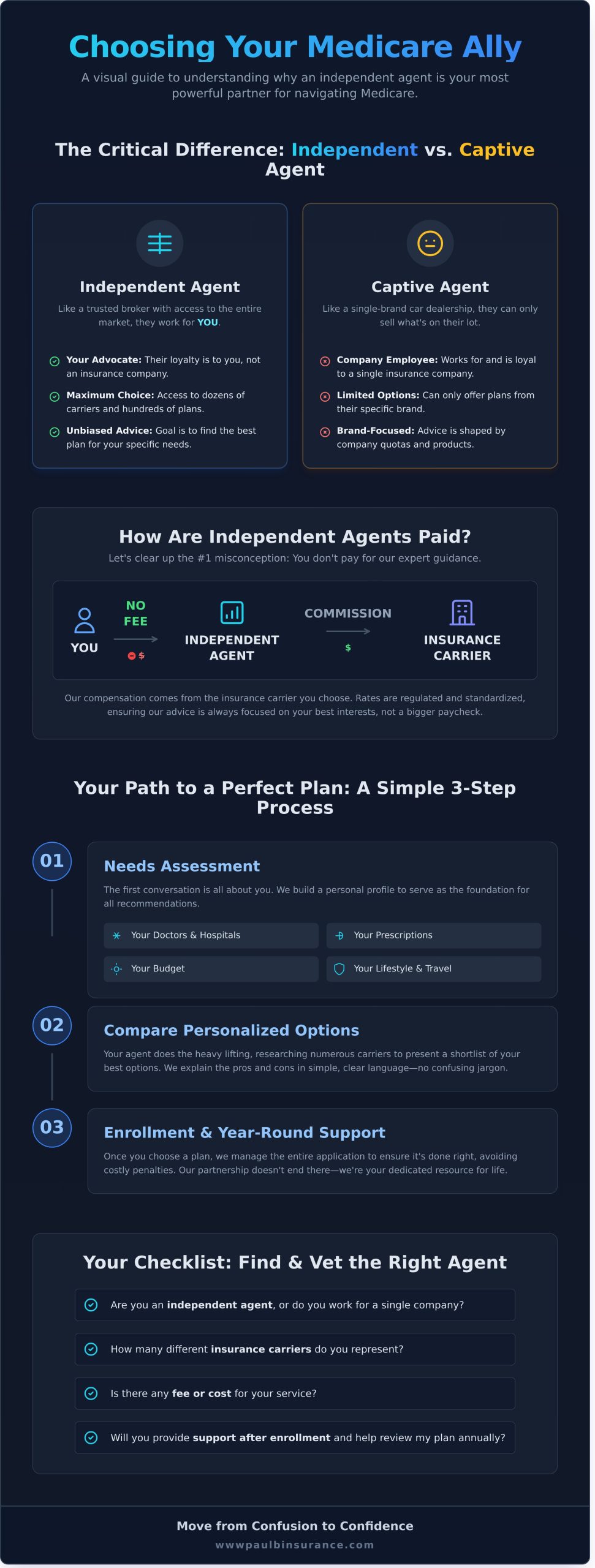

- Understand the critical difference between an independent agent who works for you and a captive agent who works for an insurance company.

- Discover the simple, step-by-step process of working with an agent, from the first conversation to confident enrollment in the right plan for your needs.

- Learn what to consider when searching for independent medicare agents near me, including the benefits of both local, in-person guidance and licensed remote expertise.

- Get an actionable checklist of key questions to ask any agent to ensure you’re partnering with a trusted, unbiased expert who puts your interests first.

Why an Independent Medicare Agent is Your Most Powerful Ally

Navigating the world of Medicare can feel overwhelming. With so many plans, rules, and deadlines, it’s easy to feel lost. This is why finding trusted guidance is so important. Your search for the best independent medicare agents near me is the first step toward gaining an advocate who works for you, and only you.

So, what makes an agent “independent”? It means we are not employees of any single insurance company. Unlike agents who are “captive” to one brand, our loyalty is to our clients. This freedom allows us to put your health needs and financial well-being first, without being pressured by sales quotas. Our mission is to provide unbiased, expert advice that helps you move from confusion to confidence.

The Key Difference: Independent Agent vs. Captive Agent

Think of it this way: a captive agent is like a single-brand car dealership. They can be very knowledgeable about their specific brand, but they can only sell you what’s on their lot. An independent agent, on the other hand, is like a trusted auto broker with access to every brand. We can shop the entire market-comparing dozens of carriers and hundreds of plans-to find the one that is truly the best fit for your life and budget. This choice almost always leads to better coverage, lower costs, and complete peace of mind.

The #1 Misconception: How Independent Agents Are Paid

Many people worry that this level of personalized service comes with a high price tag, but that is simply not true. Let’s be perfectly clear: you do not pay a fee for our guidance. Our services are provided at no extra cost to you. We are compensated by the insurance carrier you ultimately choose, and these commission rates are highly regulated and standardized. This is a fundamental part of what an insurance broker does; it ensures our advice remains focused on your best interests, not a bigger paycheck. Our only goal is to find the right plan for you.

What to Expect: The Process of Working With an Independent Agent

Working with an independent Medicare agent isn’t a quick sales call; it’s the beginning of a partnership focused entirely on your unique needs. The journey is designed to move you from a state of confusion to one of complete confidence. Instead of pushing one company’s plan, a true advocate invests time in understanding your life, your health, and your budget. This comprehensive needs analysis is the key to finding a plan that doesn’t just work, but works for you. When you connect with the right independent medicare agents near me, you can expect a simple, three-step process built on trust and clarity.

Step 1: The Needs Assessment

The first conversation is all about you. Your agent will act as a guide, asking thoughtful questions to build a personal profile that serves as the foundation for all recommendations. We will discuss:

- Your Healthcare Team: We list your preferred doctors, specialists, and hospitals to ensure they are in-network. You can also verify providers yourself using Medicare’s official provider comparison tool for added peace of mind.

- Your Prescriptions: We review your current medications to find a plan with a formulary that covers them affordably.

- Your Budget: We’ll have an honest conversation about what you’re comfortable paying in monthly premiums and what you need for out-of-pocket cost protection.

- Your Lifestyle: We consider your travel habits and overall health to ensure your coverage fits how you live.

Step 2: Comparing Your Personalized Options

Once your profile is complete, your agent does the heavy lifting. They will research plans from numerous insurance carriers and present you with a shortlist of the best options that match your needs. You won’t be handed a stack of confusing brochures. Instead, your agent will sit with you and explain the pros and cons of each choice in simple, clear language. This unbiased, side-by-side comparison demystifies the jargon, showing you exactly how networks, drug costs, and extra benefits like dental or vision stack up.

Step 3: Seamless Enrollment and Year-Round Support

After you’ve confidently selected your plan, your agent manages the entire application process for you. This expert guidance helps you steer clear of common mistakes and avoid costly late enrollment penalties. But our partnership doesn’t end once you’re enrolled. Your agent remains your dedicated resource for any questions that arise during the year, from understanding a bill to reviewing your coverage during the Annual Enrollment Period. This is the value that local independent medicare agents near me provide: a lifelong advocate. Ready for a simple process? Schedule a free, no-obligation call.

Defining ‘Near Me’: Local In-Person vs. Licensed Remote Experts

When you search for “independent medicare agents near me,” you’re looking for trusted, personal guidance. For many, that brings to mind sitting across a desk from a local professional, shaking their hand, and reviewing paper documents together. We understand that comfort and a local connection are important.

However, in today’s world, the most important factor isn’t an agent’s physical address-it’s whether they are licensed to provide expert advice in your state. This opens up a world of possibilities, allowing you to connect with the best expert for your needs, not just the closest one.

The Comfort of a Truly Local Agent

For some, nothing replaces a face-to-face meeting. A local agent can be the perfect fit if you prefer handling paper applications, feel less comfortable with technology, or want someone with deep-rooted knowledge of your town’s specific hospital systems and doctor groups. This traditional approach provides a tangible sense of security and a personal touch that many people value.

The Power of a Licensed Remote Agent

Working with a remote independent agent offers a powerful combination of convenience and expertise, ensuring you get the best guidance without leaving your home. This modern approach puts you in control and broadens your access to top-tier support.

- Access to a Wider Pool of Experts: You are no longer limited to the handful of agents in your immediate area. You can partner with a nationally recognized Medicare specialist who is licensed in your state.

- Ultimate Convenience: Receive guidance from the comfort of your couch. With simple phone calls or video chats, you can review your options without the hassle of travel or scheduling in-person appointments.

- Efficient Digital Tools: We use screen-sharing technology to review plan details together, side-by-side, just as if we were in the same room. This makes comparing benefits and costs simple and crystal clear.

When you look for independent medicare agents near me, remember that the best partner is the one who is licensed to serve you and is committed to your best interests. A top-tier agent licensed in 34 states has the experience and unbiased perspective to guide you to the right plan just as effectively-and often more efficiently-than someone down the street.

Your Checklist: How to Find and Vet the Right Medicare Agent

Finding the right partner for your Medicare journey is about more than a quick search for “independent medicare agents near me.” It’s about finding a trusted guide who puts your needs first. This simple checklist is designed to empower you, helping you interview potential agents with confidence and clarity. Use these points to ensure you’re choosing an expert who is truly on your side.

Credentials and Experience to Look For

A great agent is both qualified and committed to their clients. Before you commit, look for these signs of a dedicated professional:

- State Licensing: First and foremost, confirm they are licensed to sell insurance in your state. You can easily verify this on your state’s Department of Insurance website.

- Carrier Appointments: Ask how many different insurance carriers they represent. A true independent agent works with dozens of companies, giving you unbiased access to the best options.

- Client Testimonials: Look for positive online reviews. Hearing from other happy clients is a powerful indicator of the service you can expect.

- Medicare Specialization: Inquire about their years of experience working specifically with Medicare. This isn’t a field for generalists; you deserve a specialist.

Key Questions to Ask Your Potential Agent

The right agent will welcome your questions and answer them patiently. Use these questions to understand their process and dedication:

- How will you help me compare plans based on my specific prescription drugs and preferred doctors?

- How many people do you help with Medicare enrollment each year?

- What does your client support look like after I enroll? Will you be there for me next year?

- Can you explain the difference between Medigap and Medicare Advantage in a simple way?

Red Flags to Watch Out For

Just as important as knowing what to look for is knowing what to avoid. Steer clear of any agent who exhibits these behaviors:

- Only Pushes One Plan: If an agent seems focused on plans from just one or two companies, they are likely a captive agent, not an independent advocate.

- Uses High-Pressure Tactics: Medicare decisions should never be rushed. Be wary of anyone claiming “limited-time offers” or pressure you to sign up on the spot.

- Is Vague or Impatient: A good agent simplifies the complex. If they can’t or won’t answer your questions clearly, they are not the right partner for you.

- Asks for Payment: Remember, an independent agent’s services should be completely free to you. They are compensated by the insurance carriers, not their clients.

Finding the right independent Medicare agent is the first step toward peace of mind. At The Modern Medicare Agency, we believe an educated client is an empowered one. Learn more about our simple, no-pressure process.

The Modern Medicare Agency: Your Partner for Confidence and Clarity

Navigating the complexities of Medicare can feel overwhelming, but you don’t have to do it alone. After exploring the differences between captive and independent agents, you understand the value of having a true advocate on your side. At Paul Barrett & Associates, we built our agency on the principles of trust, simplicity, and unwavering client support. We are the modern solution for seniors who want clear answers and personalized care, delivered with genuine empathy.

Your search for independent medicare agents near me doesn’t have to be limited by your zip code. We are proud to be licensed in over 34 states, offering the same dedicated, one-on-one guidance to clients remotely as we do in person. Our goal is to bring you peace of mind, ensuring you have the right coverage no matter where you call home.

Unbiased Guidance from Over 40 Carriers

Unlike captive agents who work for a single company, our loyalty is exclusively to you. We are not tied to any one carrier. Instead, we partner with more than 40 of the nation’s top insurance companies. This independence allows us to meticulously shop the market and compare plans, ensuring we find the absolute best fit for your unique health needs, prescription requirements, and budget. Our advice is always 100% unbiased.

A Simple 5-Step Process, From Confusion to Confidence

We’ve transformed a confusing maze into a straightforward path. Our proven 5-step process is designed to eliminate stress and empower you with knowledge. We start with a personalized analysis of your needs and provide clear, simple recommendations you can actually understand. Our philosophy is built on patience and education-you will never feel rushed or pressured into a decision. It’s about finding what’s right for you. Meet Paul Barrett and see how we can help you.

Choosing your Medicare plan is one of the most important healthcare decisions you will make. With the right partner, you can move forward with total confidence, knowing you have an expert advocate dedicated to protecting your health and your finances for years to come. Your journey from confusion to clarity starts here.

Your Path from Medicare Confusion to Confidence

Navigating the Medicare maze doesn’t have to be overwhelming. The most important takeaway is that an independent agent is your unbiased advocate, dedicated to finding the right plan for your unique needs-not the needs of a single insurance company. Your search for qualified independent medicare agents near me can end with a trusted partner who provides clarity, whether they are down the street or a licensed remote expert.

At Paul Barrett Insurance, we are committed to being that partner for you. With an A+ rating from the Better Business Bureau, access to over 40 of the nation’s top carriers, and licenses to serve you in more than 34 states, our goal is simple: to protect your health and your wallet. Stop the stressful searching and let our team provide the simple, expert guidance you deserve.

Ready to feel certain about your coverage? Schedule Your Free, No-Obligation Medicare Plan Review Today and take the first step toward a confident healthcare future. You deserve a partner who is never rushed, never pressured, and always on your side.

Frequently Asked Questions About Working With an Independent Agent

Do I have to pay an independent Medicare agent for their help?

No, you never pay a fee for our guidance. Our expert services are provided at no cost to you. The price for any Medicare plan is fixed by law, meaning you pay the exact same premium whether you enroll through us or directly with the insurance carrier. Our goal is to provide trusted, unbiased advice to help you find the right plan without adding any financial burden, giving you complete peace of mind.

How do independent Medicare agents get paid if I don’t pay them?

Independent agents are compensated directly by the insurance company, but only after we help you enroll in a plan. These commission rates are regulated and standardized, so there is no financial incentive to favor one company’s plan over another. This structure allows us to focus entirely on your unique needs and find the best possible fit for your health and budget, ensuring our guidance remains completely unbiased and centered on you.

When is the best time to contact an independent Medicare agent?

The ideal time to contact independent medicare agents near me is about two to three months before you turn 65. This gives us ample time to review your options so you never feel rushed or pressured. You can also contact us during the Annual Enrollment Period (October 15 – December 7) to review your coverage or if you qualify for a Special Enrollment Period due to a life event, like moving or losing other coverage.

What’s the difference between a Medicare agent and a Medicare broker?

These terms are often used interchangeably, which can be confusing. Generally, a “broker” is independent and represents many different insurance companies, just like us. An “agent” can also be independent, but the term is sometimes used for “captive” agents who only work for a single company. We operate as independent brokers to ensure you have access to a wide range of choices, not a limited, one-size-fits-all solution from one carrier.

Can an independent agent help me with both Medicare Advantage and Medigap plans?

Absolutely. A key benefit of working with an independent agent is our ability to provide clear, simple guidance on all your options. We are certified to help you compare and enroll in Medicare Advantage (Part C), Medicare Supplement (Medigap), and Prescription Drug Plans (Part D). Our job is to simplify the jargon, explain the pros and cons of each, and help you find the combination that best protects your health and finances.

What happens if I’m not happy with the plan I choose?

Your satisfaction and confidence are our top priorities. If your plan isn’t working for you, we are here to help. An independent agent is your advocate for the long term. We will connect during the Annual Enrollment Period to review your plan’s performance, discuss any changes in your needs, and explore new options available. We can help you switch to a different plan that better suits your life, ensuring your coverage provides continuous protection.

Can an agent help me apply for Extra Help or other savings programs?

Yes, we can certainly help you navigate these valuable programs. Many people are unaware they may qualify for assistance programs like Extra Help (for prescription drug costs) or Medicare Savings Programs (which help with premiums and deductibles). We can help you understand the eligibility requirements and guide you toward the resources you need to apply, ensuring you receive all the financial benefits you are entitled to.