Does the thought of choosing life insurance make your head spin? If you feel overwhelmed by terms like ‘premium,’ ‘cash value,’ and ‘whole life,’ you are not alone. It’s natural to worry about leaving your loved ones with financial burdens, but the fear of choosing the wrong policy-or paying too much for one-can leave you feeling stuck and uncertain. This is a heavy weight to carry, but finding the right protection for your family doesn’t have to be a source of stress.

This simple guide is here to lift that weight. We will walk you through the essentials, cutting through the confusing jargon to give you clarity. We promise to help you understand your options in simple terms so you can confidently choose the right protection for your family’s future. Our goal is to move you from confusion to confidence, providing the trusted guidance you need to secure your legacy and gain the lasting peace of mind you deserve.

Key Takeaways

- At its core, life insurance is a straightforward promise to provide a financial safety net for your family when they need it most.

- Understand the fundamental choice between temporary (“renting”) and lifelong (“owning”) coverage to find the right fit for your goals.

- Move beyond the misleading “10x your salary” rule with a simple method to calculate the amount of protection your family truly needs.

- Gain confidence by learning the clear, step-by-step process of applying for a policy, from initial application to final approval.

What Is Life Insurance and Why Does It Matter?

At its heart, life insurance is a simple promise. It is a contract between you and an insurance company: in exchange for your payments (premiums), the company promises to pay a sum of money to your chosen loved ones (beneficiaries) when you pass away. If you’ve ever wondered, What is life insurance? in its most basic form, that’s it. Think of it as a financial ‘umbrella’ you put in place now to protect your family from life’s worst storm later. This protection offers more than just money; it provides profound peace of mind. While many believe it’s only for covering funeral costs, its true power lies in creating a lasting financial safety net for those you care about most.

The Core Purpose: A Financial Safety Net

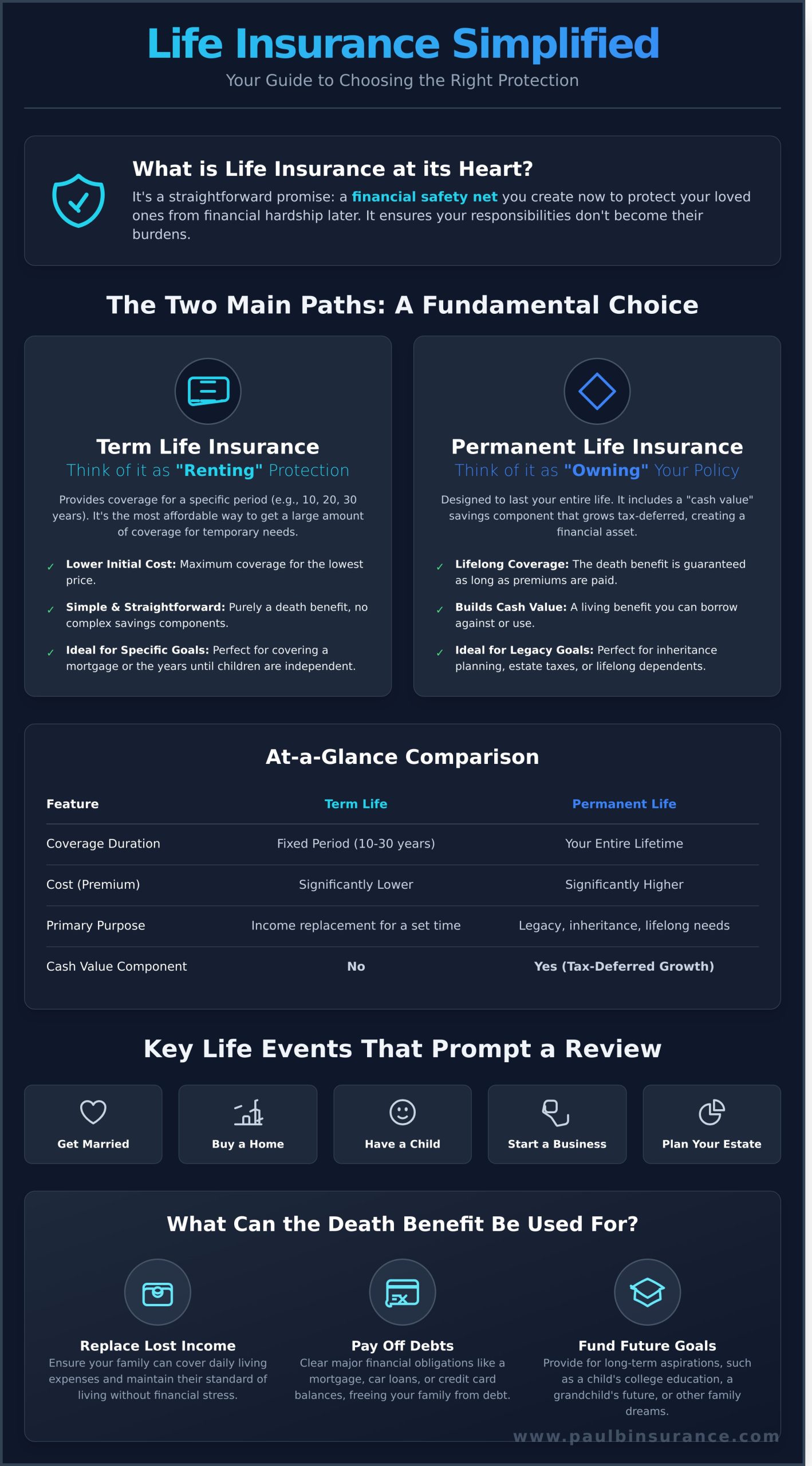

The primary role of a policy is to ensure your financial responsibilities don’t become a burden on your family. It’s a tool for continuity and stability, allowing your loved ones to maintain their standard of living without financial distress. Specifically, the death benefit can be used to:

- Replace lost income for a surviving spouse, ensuring they can cover daily living expenses.

- Pay off significant debts like a mortgage, car loans, or credit card balances.

- Fund future goals, such as providing for a grandchild’s college education or other long-term needs.

Key Life Events That Make You Think About Life Insurance

Life rarely stays the same, and major milestones often highlight the need for financial protection. These are moments when people pause to consider securing their family’s future. You might think about coverage when you get married, buy a home, welcome a child or grandchild, start a business, or begin planning for retirement and the legacy you wish to leave behind. Each of these events changes your financial picture and responsibilities.

Who Truly Needs This Protection?

It’s a common myth that only the primary breadwinner needs coverage. The truth is, many people can benefit from a policy. Consider the immense financial value of a stay-at-home parent, whose contributions to childcare and household management would be costly to replace. Even a single person might need a policy to cover co-signed loans or ensure final expenses don’t fall to relatives. For those with larger estates, it can be a crucial part of a smart plan to cover taxes and ensure assets are passed on smoothly.

The Two Main Paths: Term vs. Permanent Life Insurance

Navigating the world of life insurance can feel overwhelming, but it truly boils down to one fundamental choice: do you need temporary protection or lifelong coverage? Think of it like renting versus owning a home. Term life is like renting protection-it covers you for a specific period at a lower cost. Permanent life is like owning your policy-it’s more of an investment and is designed to last your entire life.

The National Association of Insurance Commissioners (NAIC) offers a detailed consumer guide to life insurance that explores these types, but here is a simple breakdown to give you clarity.

- Term Life Insurance: Lower initial cost, covers a fixed period (e.g., 10 or 20 years), and has no savings component (cash value).

- Permanent Life Insurance: Higher initial cost, provides lifelong coverage, and includes a tax-deferred savings component (cash value) that grows over time.

Term Life Insurance: Affordable Protection for a Specific Time

Term life insurance is straightforward: it provides a death benefit to your beneficiaries if you pass away during a specific “term.” This is often the most affordable way to get the maximum amount of coverage, making it ideal for needs that have a clear end date. Common uses include covering the years you have a mortgage or ensuring your children are financially supported until they become independent. Many term policies also offer “convertibility,” allowing you to switch to a permanent policy later without another medical exam.

Permanent Life Insurance: Lifelong Coverage with a Savings Component

As the name suggests, permanent life insurance is designed to last your entire life, as long as you continue to pay the premiums. The most common type is Whole Life. Its key feature is “cash value,” a savings account built into your policy that grows on a tax-deferred basis. While premiums are significantly higher than term insurance, this policy provides a guaranteed death benefit and a financial asset you can borrow against, offering both protection and stability.

Which Path Is Right for You? A Simple Checklist

The best choice depends entirely on your personal goals, budget, and peace of mind. There is no single right answer, only the one that fits your life.

- Choose Term if: Your primary goal is maximum coverage for the lowest cost, your budget is a key consideration, or you need to cover a specific financial obligation like a mortgage.

- Choose Permanent if: You want guaranteed lifelong coverage, wish to leave a legacy or inheritance, or want to build a cash value asset for long-term financial goals.

Some people even use a combination of both to balance their immediate needs and long-term objectives. Feeling unsure? Let The Modern Medicare Agency help you compare your options with clarity.

How Much Life Insurance Do You Really Need? A Simple Calculation

“How much coverage is enough?” It’s the first question on everyone’s mind, and the answer can feel confusing. You may have heard old rules of thumb like “buy 10 times your salary,” but that simple formula rarely applies to seniors, many of whom are on a fixed income. A much more thoughtful and accurate approach is to calculate what your loved ones will actually need. The goal is simple: to provide enough money to cover every obligation without forcing you to pay for more life insurance than you need.

The DIME Method: A Simple Way to Start

To bring clarity to this process, you can start with a simple framework known as the DIME method. It helps you add up your major financial responsibilities in four clear steps:

- D – Debt: Add up your outstanding debts, such as car loans, credit card balances, and any personal loans.

- I – Income: Calculate how many years of your income your spouse or dependents would need to maintain their standard of living.

- M – Mortgage: Ensure the remaining balance on your mortgage is fully covered so your family has the security of a paid-for home.

- E – Education: Estimate the costs for any children or grandchildren you wish to help with college or vocational training.

Don’t Forget Final Expenses and Other Goals

Beyond day-to-day obligations, it’s important to factor in other costs and goals. Final expenses alone, which include funeral and burial services, can average between $7,000 and $12,000. You may also want your policy to provide a legacy, whether it’s a gift to a beloved charity or a meaningful inheritance for your family to build upon.

Finding the Balance: Underinsured vs. Overinsured

The final step is finding the perfect balance for your budget and your peace of mind. Being underinsured can leave your family with a stressful financial gap, while being overinsured means you’re paying unnecessarily high premiums that could be used for other things. Understanding the different policy types, as detailed in this helpful NAIC guide to life insurance, is a great first step. Ultimately, an independent advisor provides the trusted guidance needed to find that sweet spot, ensuring your policy is both effective and affordable. This clarity is the key to moving from confusion to confidence.

The Process of Getting a Policy: From Application to Approval

Applying for a life insurance policy can feel like a daunting task, filled with paperwork and uncertainty. But it doesn’t have to be. The entire process is simply the insurer’s way of understanding your health and lifestyle to offer you the fairest price for your coverage. While it can take anywhere from a few weeks to a couple of months, having a trusted guide to walk you through each step brings clarity and confidence to the journey.

Step 1: The Application

The first step is completing the application, which provides a snapshot of who you are. You’ll be asked for information about your:

- Health History: Past and present medical conditions, prescriptions, and doctors’ information.

- Lifestyle: Hobbies, driving record, and whether you use tobacco or alcohol.

- Finances: Income and net worth, which helps justify the coverage amount.

It is vital to be completely honest. Insurers use the MIB (Medical Information Bureau) to verify information from previous applications. Think of it as a secure, shared database that helps prevent fraud and ensures accuracy across the industry.

Step 2: The Underwriting Process and Medical Exam

Once submitted, your application goes to an underwriter. This is the expert who evaluates your information to determine the level of risk and calculate your premium. For many policies, this includes a simple paramedical exam, where a technician visits your home to record your height, weight, and blood pressure and collect blood and urine samples. If you prefer to skip this, “no-exam” policies offer a faster, less invasive alternative.

Step 3: Approval and Policy Delivery

After the review, the insurer will approve your application and assign you a risk class, such as “Preferred Plus” or “Standard,” which directly impacts your final price. You will then receive your official policy documents. You are protected by a “free look” period-typically 10 to 30 days-to review every detail. If you’re not completely satisfied, you can cancel for a full refund. This entire journey is simpler when you have a trusted partner to answer your questions and ensure you feel secure in your decision. Navigate the application process with an expert guide by your side.

Secure Their Future with Confidence

We’ve walked through the fundamentals-from understanding the core purpose of life insurance to choosing between term and permanent policies and calculating the right coverage for your family. The goal is to demystify this process so you can make an informed choice, not an overwhelmed one.

But you don’t have to navigate this path alone. As an independent broker, we provide the trusted, unbiased guidance you deserve. With access to policies from over 40 trusted carriers, we offer personalized support to simplify this complex decision and find the perfect fit for your unique situation. We’re here to answer your questions without the pressure.

Ready to move from confusion to clarity? Schedule a no-pressure call to discuss your life insurance needs with confidence. Protecting your loved ones is one of the most important financial decisions you’ll make, and we’re here to help you get it right.

Frequently Asked Questions About Life Insurance

Is the money from a life insurance policy taxable for my beneficiaries?

In nearly all cases, the money your loved ones receive from a life insurance policy is paid out as a lump-sum, income-tax-free benefit. This provides them with the full amount you intended, without worrying about taxes. The only common exception is if the benefit is paid in installments and earns interest; that interest could be considered taxable income. We can help you understand the simplest way to structure your policy for your family’s peace of mind.

Can I still get life insurance if I have a pre-existing health condition?

Yes, you absolutely can. While some health conditions can make policies more expensive, they don’t automatically disqualify you. Many seniors find great comfort and security with ‘guaranteed issue’ or ‘final expense’ life insurance policies, which don’t require a medical exam. These are designed to cover funeral costs and other final debts. Our job is to find the right carrier that will view your health history most favorably, giving you the confidence of coverage.

What happens if I outlive my term life insurance policy?

When a term life insurance policy ends, the coverage simply expires. You stop making payments, and the death benefit is no longer active. Think of it like car insurance-you are covered for the period you pay for. Some policies offer the option to convert your term coverage into a permanent policy before it ends, which can be a valuable strategy. We can help you explore all your options long before your term is set to expire.

At what age does life insurance become too expensive to buy?

There is no magic age where life insurance becomes impossible to buy, but costs do increase as you get older. For most, premiums can become quite high after age 75 or 80 for traditional policies. However, affordable final expense policies are specifically designed for seniors and remain a practical option even later in life. The best strategy is always to secure coverage as early as possible to lock in a lower rate for the protection you need.

What is the difference between a beneficiary and a contingent beneficiary?

This is a simple but vital distinction. Your primary beneficiary is the first person in line to receive the policy’s death benefit. A contingent beneficiary, or secondary beneficiary, is your backup. They only receive the benefit if your primary beneficiary has passed away before you or at the same time. Naming both provides a clear plan and ensures your wishes are carried out without confusion or delay, giving you and your family greater peace of mind.

How long does it take for my family to receive the death benefit?

Once your beneficiary files a claim with the required documents, like the death certificate, most insurance companies process the payment within 30 to 60 days. It’s rarely instant. Delays can occur if the death happens within the first two years of the policy (the ‘contestability period’) while the company verifies the application information. A properly set-up policy helps ensure your family receives the funds smoothly and without unnecessary stress during a difficult time.

Should I buy life insurance for my children?

For most seniors, the primary goal is protecting a spouse or covering final expenses, not insuring children or grandchildren. However, some people choose to buy a small whole life policy for a grandchild as a lasting gift. This can lock in a very low premium for life and guarantee they have coverage as an adult, regardless of their future health. It’s a personal choice, and we can help you decide if it aligns with your financial goals.