Feeling lost in the Medicare ‘alphabet soup’ of Plan G, Plan N, and all the rest? You are not alone. The stress of choosing the wrong coverage can be overwhelming, especially when you’re trying to find the best medicare supplement plans to protect both your health and your savings. The fear of making a costly mistake is real, but it doesn’t have to be your story.

This simple guide for 2026 is here to replace that confusion with confidence. We promise to provide the clear, unbiased guidance you deserve. We’ll break down the most popular plans in plain English, helping you understand exactly what you’re buying so you can find the perfect fit for your specific needs and budget.

By the end of this article, you’ll know how to compare companies for long-term rate stability and feel empowered to make a choice that brings you true peace of mind. Let’s begin the journey from confusion to clarity.

Key Takeaways

- The “best” plan isn’t a one-size-fits-all solution; it’s about finding the right personal balance between coverage, cost, and peace of mind.

- Our simple, step-by-step framework removes the guesswork from finding the best medicare supplement plans, guiding you from confusion to a confident choice.

- Learn why the insurance company you choose is just as important as the plan letter, especially for avoiding unpredictable rate increases down the road.

- Discover how using an independent broker provides expert, unbiased guidance at no cost to you, helping you avoid common and costly enrollment mistakes.

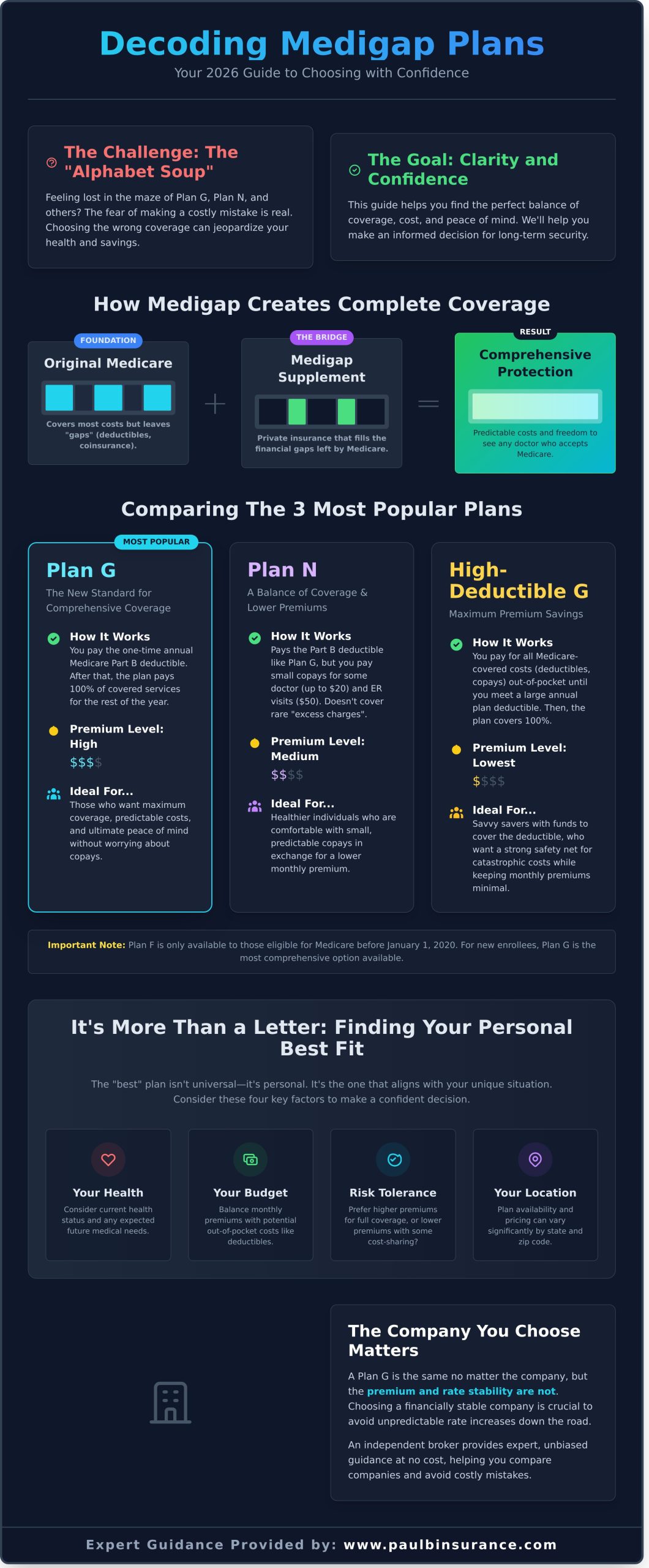

What ‘Best’ Really Means When Choosing a Medigap Plan

When you start your search, it’s natural to look for the single “best” Medigap plan on the market. But the simple truth is, a one-size-fits-all solution doesn’t exist in Medicare. The plan that’s perfect for your neighbor or friend may not be the right fit for your unique needs.

Finding the best medicare supplement plans is a personal journey. The goal is to find the right balance between comprehensive coverage, a monthly premium that fits your budget, and the invaluable peace of mind that comes from knowing you’re protected from unexpected medical bills. Because the government standardizes plan benefits, a Plan G from one company offers the exact same medical coverage as a Plan G from another. This means your real choice comes down to two things: the monthly premium and the long-term stability and service record of the insurance company offering it.

Key Factors That Define Your ‘Best’ Plan

Your ideal plan is a direct reflection of your life. To uncover the right fit, we look at your personal situation from every angle. These are the core factors that guide you to a confident decision:

- Your Health: We consider your current health and any expected medical needs you might have in the near future.

- Your Budget: It’s about balancing what you’re comfortable paying in monthly premiums versus what you could afford for out-of-pocket costs like a deductible.

- Your Risk Tolerance: Do you prefer paying a higher premium for predictable, near-total coverage, or are you comfortable with some cost-sharing (like copays) in exchange for a lower premium?

- Your Location: Medigap plan availability and, more importantly, pricing can vary significantly depending on your state and even your zip code.

Original Medicare + Medigap: The Foundation of Your Coverage

Think of Original Medicare (Part A and Part B) as your strong foundation. It covers a large portion of your hospital and medical costs but was never designed to cover everything. It leaves behind “gaps” that are your financial responsibility-costs like deductibles, coinsurance, and copayments. If you’re asking, What is Medigap?, it is simply private insurance designed to fill those financial gaps. This powerful combination of Original Medicare plus a Medigap plan provides you with comprehensive protection and the freedom to see any doctor or visit any hospital in the country that accepts Medicare-no network restrictions and no referrals needed.

The Most Popular Medigap Plans: A Clear Comparison

Navigating the “alphabet soup” of Medigap can feel overwhelming, but the truth is much simpler. While there are up to 10 standardized plans available, the vast majority of people find their perfect fit among just three main choices. By focusing on these top contenders, you can confidently find the best medicare supplement plans without getting lost in the details. While the official government guide to comparing Medigap plans outlines every option, we’ll break down the most popular ones right here.

These plans are Plan G, Plan N, and the well-known Plan F. It is important to note: Plan F is only available to individuals who were eligible for Medicare before January 1, 2020. For everyone else, Plan G has become the new standard for comprehensive coverage.

Medicare Supplement Plan G: The New Standard

Often considered the best value for new enrollees, Plan G offers nearly complete coverage. It pays for everything that Original Medicare doesn’t cover, with one simple exception: the annual Medicare Part B deductible. Once you meet that small, once-a-year deductible, your plan pays 100% of the costs for Medicare-approved services. This plan is ideal for those who want predictable healthcare costs and the peace of mind that comes with robust protection.

Medicare Supplement Plan N: A Lower Premium Option

If you’re looking for a balance between strong coverage and lower monthly premiums, Plan N is an excellent choice. In exchange for a lower premium, you agree to some minor cost-sharing. This typically includes:

- A copay of up to $20 for some office visits.

- A $50 copay for emergency room visits (waived if you’re admitted).

Plan N does not cover Part B excess charges, but these are very rare. It’s a great fit for healthier individuals who are comfortable with small, predictable copayments to save money each month.

High-Deductible Plans: For Maximum Premium Savings

For those who want the lowest possible monthly premium, a high-deductible version of Plan G (or F, if eligible) is available. With this option, you must first pay a significant annual deductible out-of-pocket before the plan begins to cover costs. This plan is best suited for savvy savers who are financially prepared to handle the deductible but want a strong safety net in place to protect against major, unexpected medical events.

How to Compare Plans Beyond the Letters: Price & Company

It’s one of the most common points of confusion: if a Plan G from one company is identical in coverage to a Plan G from another, does it matter which one you choose? The answer is a resounding yes. Since benefits are standardized by the government, the two most important factors in finding the best medicare supplement plans are the price you pay and the company you choose.

The company with the lowest premium today might not be the most affordable in five years. Making a confident choice requires looking deeper at the company’s stability and pricing strategy. This is where a little guidance can save you from costly mistakes down the road.

Understanding Medigap Pricing Methods

Insurance companies use three methods to set their premiums, and knowing which one a company uses helps you predict how your rate might change over time. This isn’t just jargon; it’s the key to understanding your future costs.

- Community-Rated: Everyone in a specific area pays the same premium, regardless of their age. Rates may still go up due to inflation, but not because you had a birthday.

- Issue-Age-Rated: Your premium is based on your age when you first buy the policy. It won’t increase just because you get older, but it can rise for other reasons.

- Attained-Age-Rated: Your premium starts low but increases as you age. These plans often have the lowest initial cost but can become the most expensive over time.

Researching Carrier Reputation and Rate History

A stable, reliable insurance carrier is your partner in healthcare for years to come. Look for companies with high financial strength ratings from independent agencies like A.M. Best (an “A” rating is a strong indicator). Since the federal government standardizes the benefits for each plan letter, as explained on the official page for What is Medicare Supplement Insurance (Medigap)?, the company’s long-term pricing strategy becomes the most important factor.

A carrier’s rate increase history tells a powerful story. A company with a history of stable, predictable increases is often a much safer bet than one with a low introductory rate and a pattern of sharp, sudden spikes. This information can be hard to find on your own. The Modern Medicare Agency can provide rate histories for 40+ carriers. Schedule a call with us today.

Household Discounts and Other Perks

Many carriers offer a household discount if you and your spouse or partner both enroll in a plan with them. These discounts, often ranging from 5% to 12%, can add up to significant savings over the years. Beyond discounts, some of the best medicare supplement plans include valuable wellness perks like free gym memberships (such as SilverSneakers) or access to nurse hotlines, adding extra value to your policy and supporting your long-term health.

Your Step-by-Step Guide to Choosing the Best Supplement Plan

Navigating the world of Medicare can feel overwhelming, but finding the right Medigap plan doesn’t have to be a struggle. We’ve created a simple, three-step framework to move you from confusion to confidence, helping you organize your thoughts and make a smart, informed decision. For the best results, start this process during your Medigap Open Enrollment Period. This is your one-time, 6-month window after enrolling in Medicare Part B where you have guaranteed issue rights-meaning companies cannot deny you coverage for any reason.

Step 1: Assess Your Health and Budget

Before you can compare plans, you need a clear picture of your personal needs. Taking a few moments to evaluate your situation provides the clarity you need to choose wisely. Start by considering:

- Your Healthcare Team: List your current doctors and specialists. Since Medigap plans don’t have networks, you can see any doctor who accepts Medicare.

- Future Health Needs: Think about your family health history and your tolerance for risk. Do you prefer predictable costs or are you comfortable with some out-of-pocket expenses?

- Your Monthly Budget: Determine a monthly premium that fits comfortably into your retirement budget without causing financial stress.

Step 2: Compare Your Top Plan Options (G vs. N)

For most people becoming eligible for Medicare today, the search for the best medicare supplement plans narrows down to two excellent choices: Plan G and Plan N. Plan G offers more comprehensive coverage with very little out-of-pocket exposure. Plan N provides great protection but requires you to pay small copays for some doctor and ER visits in exchange for a lower monthly premium.

The decision is a simple calculation: Calculate the annual premium difference between Plan G and Plan N. Is that yearly savings worth the potential copays you might face with Plan N? Your answer will point you to the right plan.

Step 3: Get Quotes from Multiple Carriers

Once you’ve picked your plan letter (like G or N), the final step is to find the best price. Medigap plan benefits are standardized by the government-a Plan G from one company is identical to a Plan G from another. The only difference is the price you pay and the company’s service reputation.

You should gather quotes for your chosen plan from 3-5 top-rated carriers. This is often the most time-consuming part of the process. Instead of spending hours on the phone, you can get our expert, unbiased help for free. Let us do the shopping for you. Get unbiased quotes in minutes.

Why an Independent Broker Is Your Best Tool for Finding a Plan

Navigating the Medicare maze can feel overwhelming, confusing, and stressful. But you do not have to do it alone. The single most important decision you can make is choosing how you shop for a plan. Working with a dedicated, independent expert costs you absolutely nothing-the insurance companies pay us, so our guidance is always free to you.

It’s crucial to understand the difference. A captive agent works for one insurance company. Their job is to sell you that company’s products, whether or not they are the best fit for your needs or budget. An independent broker, like us, works for you. Our loyalty is to you, not to an insurance carrier.

The Independent Advantage: Choice and Unbiased Advice

Because we represent over 40 top-rated carriers, we can shop the entire market on your behalf. This allows us to compare every option and find the perfect intersection of price and value for your specific situation. Our advice is 100% unbiased, tailored to your health needs and financial goals. We serve as your advocate for the life of your policy, always here to help.

Saving You Time, Money, and Stress

Our goal is to remove the burden from your shoulders and provide complete peace of mind. We simplify the entire process from start to finish. Here’s how our expert guidance helps you:

- We instantly compare every plan. Our advanced tools compare all available plans in your zip code in seconds, saving you hours of frustrating research.

- We provide insider knowledge. We don’t just look at today’s premium; we analyze a company’s rate increase history and customer service reputation to protect you from future surprises.

- We handle all the paperwork. From application to enrollment, we manage the entire process to ensure it’s submitted correctly and on time.

- We help you avoid costly mistakes. We ensure you enroll during the correct window to avoid lifelong penalties and coverage gaps.

Finding the best medicare supplement plans is about more than just a monthly premium; it’s about securing your financial future with confidence. Let us help you find the right coverage with clarity and ease. To get started, you can schedule a no-obligation consultation with our team.

Your Final Step to Medicare Confidence

Navigating your Medicare options can feel overwhelming, but it doesn’t have to be. As we’ve explored, the key is understanding that ‘best’ is personal-it’s the plan that fits your health, budget, and peace of mind. Finding the best medicare supplement plans isn’t about a secret letter or company; it’s about a personalized strategy. Most importantly, you now know that partnering with an unbiased, independent broker is your most powerful tool for success.

You are not alone in this process. Our mission is to replace confusion with clarity. With unbiased access to over 40 trusted insurance carriers, we do the complex comparison work for you. You won’t just get a policy; you’ll gain a dedicated agent for lifetime support, ensuring your questions are always answered by someone who knows you and has your back.

Take the final step toward a secure, worry-free retirement. Schedule a free, no-obligation call to find your best plan with confidence.

Frequently Asked Questions

What is the most popular Medicare Supplement plan?

For new Medicare enrollees, Plan G is by far the most popular choice. It offers incredibly comprehensive coverage, paying for nearly all of your out-of-pocket costs after you meet the annual Medicare Part B deductible. This simple, predictable coverage provides tremendous peace of mind. For those eligible for Medicare before 2020, Plan F remains a popular all-inclusive option, as it covers the Part B deductible as well.

Can I be denied a Medigap plan if I have health problems?

This is a common worry, but you are protected during your Medigap Open Enrollment Period. This one-time, six-month window begins the month you are 65 and enrolled in Part B. During this critical time, insurance companies cannot use your health history to deny you coverage or charge you a higher premium. Outside of this protected period, approval is not guaranteed, which is why planning ahead is so important.

Do Medicare Supplement plan premiums increase every year?

Yes, it is normal to expect your Medigap premiums to increase over time. These increases are typically due to two factors: general healthcare inflation and your age. Most plans are “attained-age rated,” meaning the rate goes up as you get older. While this is standard, we can help you find a carrier with a history of more stable and predictable rate adjustments, giving you confidence in your long-term budget.

What is the real difference between Plan G and Plan N?

The key difference is small, predictable out-of-pocket costs. When choosing between these two excellent options, consider this: Plan G covers everything after you pay the annual Part B deductible. Plan N often has a lower premium but requires small copays for some doctor visits (up to $20) and ER trips (up to $50). Deciding between them is a key step in finding the best medicare supplement plans for your budget and healthcare needs.

Is it difficult to switch from one Medigap plan to another?

The application process itself is straightforward, but getting approved can be the challenge. If you are past your initial Open Enrollment Period, you will likely have to answer health questions, a process called medical underwriting. The new insurance company can review your health history and may deny your application. We can help you understand your state’s specific rules and see if switching makes sense for you, ensuring you never risk losing coverage.

Does it cost anything to use an independent Medicare broker?

No, our expert guidance costs you absolutely nothing. Independent brokers like us are paid a commission directly by the insurance company after you enroll. Your premium is the exact same price whether you use our free service or go directly to the carrier. The clear advantage is you get unbiased support to help you confidently compare all your options and find the right plan without any of the stress or guesswork.