A Local Guide for Huntington, NY Residents

Key Takeaways

A Local Guide for Huntington, NY Residents

If you live in Huntington, NY and rely on Huntington Hospital for your care, one important question can make or break your Medicare experience:

Will my Medicare plan actually work there — and with the doctors I want to see?

For many residents, the answer is yes.

But for others, the answer comes with surprises, extra costs, or unexpected provider changes.

After helping Huntington residents navigate Medicare since 2007, I’ve seen where the confusion happens — and how to avoid it.

This guide will walk you through what really matters when it comes to Huntington Hospital, Medicare Advantage plans, and Medigap coverage.

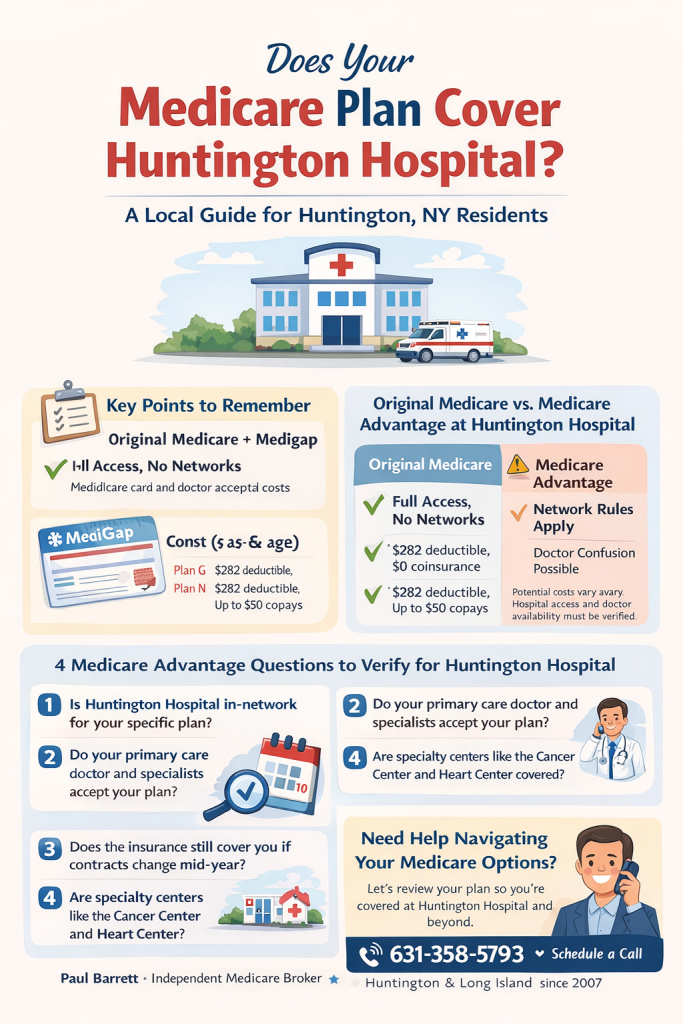

Key Takeaways for Huntington Residents

✓ Original Medicare + Medigap gives you automatic access to Huntington Hospital and its doctors

✓ Most Medicare Advantage plans include Huntington Hospital, but networks vary by plan

✓ The hospital and the doctors have separate contracts

✓ Medicare Advantage networks can change mid-year

✓ Standard Plan G in Huntington runs $372–$500+/month with rising rates

✓ High Deductible Plan G (~$91/month, $2,950 deductible) is growing in popularity

✓ Emergency care is always covered, but ongoing care follows network rules

Bottom line:

Always verify that Huntington Hospital AND your doctors accept your specific Medicare plan.

Original Medicare vs Medicare Advantage at Huntington Hospital

Huntington Hospital participates in Original Medicare. Always has.

If you have Original Medicare (Parts A & B) with a Medigap plan, you can walk into Huntington Hospital, show your red-white-and-blue card, and receive care.

No networks.

No referrals.

No prior authorizations for your surgeon.

Your out-of-pocket costs depend on your Medigap plan:

-

Plan G: You pay only the Part B deductible ($282 in 2026)

-

Plan N: You may have a $50 ER copay (waived if admitted) or $20 doctor copays

With Medicare Advantage, the rules change.

Why “Accepting Medicare” Doesn’t Always Mean In-Network

Here’s where most Huntington residents get confused:

The hospital and the doctors who practice there are not the same thing.

Huntington Hospital is the building.

The doctors are independent providers.

Each one decides which Medicare Advantage plans they accept.

So even if:

The hospital is in your plan’s network

The hospital is in your plan’s network Your doctor accepts your plan

Your doctor accepts your plan

Another provider involved in your care — like an anesthesiologist, radiologist, or pathologist — may not.

And yes, these contracts can change mid-year.

Real-World Scenarios Huntington Residents Face

The Cardiologist Surprise

Your plan includes Huntington Hospital.

The cardiologist who reads your test results does not accept your plan.

You receive an unexpected bill.

The Surgical Surprise

Your surgeon and hospital are in-network.

The anesthesiologist is not.

Higher cost-sharing applies.

The Mid-Year Contract Drop

You enroll in October.

In April, Huntington Hospital drops your plan.

You’re stuck until Annual Enrollment unless you qualify for a Special Enrollment Period.

The MRI Shuffle

The imaging center is covered.

The radiologist reading the scan is not.

You get a separate bill.

The Emergency Exception

Emergency care is covered everywhere.

But once stabilized, network rules apply.

What Huntington Residents Should Verify Before Choosing a Plan

1. Is Huntington Hospital In-Network for MY Plan?

Not just the carrier — the specific plan.

-

PPO: Can go out-of-network, but pay more

2. Do Your Doctors Accept Your Plan?

Ask:

“Do you accept [full plan name] Medicare Advantage?”

Not just “Medicare.”

3. Do Specialists at Huntington Hospital Accept Your Plan?

Doctors practicing there are independent.

Some accept your plan.

Some don’t.

4. What About Specialty Centers?

Cancer Center

Fortunato Breast Health Center

Cardiac services

The facility may be covered — the doctors may not.

A True Huntington Story: Margaret’s Colonoscopy

Margaret had:

-

In-network gastroenterologist

-

In-network Huntington Hospital

-

In-network procedure

But the anesthesiology group did not accept her plan.

Result: $450 bill

Three providers.

Three contracts.

One procedure.

With Original Medicare + Medigap, this never happens.

Comparing Two Huntington Residents

Jean – Original Medicare + Plan G

Total out-of-pocket: $282

No networks.

No referrals.

No surprises.

Robert – Medicare Advantage HMO

Total out-of-pocket: $550+

Referrals required.

Prior authorization delays.

Limited rehab facility choices.

The Huntington Hospital Network Reality

As of 2026:

-

Most major Medicare Advantage plans include Huntington Hospital

-

PPO plans usually cover it (higher cost)

-

HMO plans often include it locally

-

Specialists may not accept your plan

-

Contracts can change mid-year

This is why annual review matters.

The Medigap Alternative: Freedom vs Cost

Standard Plan G in Huntington

$372–$500+/month

$4,464–$6,000+ per year

Plus Part B premium and deductible

Rates rising annually

High Deductible Plan G

~$91/month

$2,950 deductible

Same provider freedom

Much lower premiums

Many healthy Huntington residents are choosing this option.

Why Some Residents Still Choose Standard Plan G

Guaranteed access to Huntington Hospital

Guaranteed access to Huntington Hospital No provider network worries

No provider network worries Works nationwide (snowbirds love it)

Works nationwide (snowbirds love it) No mid-year surprises

No mid-year surprises Predictable costs

Predictable costs

But that freedom comes at a growing price.

What If You Discover Coverage Gaps?

Mid-Year

You’re usually locked in unless you qualify for a Special Enrollment Period.

You can:

-

File appeals

-

Request QIO reviews

-

Challenge early discharges

During Annual Enrollment (Oct 15 – Dec 7)

You can:

-

Switch Medicare Advantage plans

-

Return to Original Medicare

-

Apply for Medigap (underwriting may apply)

New York offers strong protections — but you still need guidance.

The Question That Really Matters

Not:

“What’s the cheapest plan?”

But:

“What works best for my health, doctors, and lifestyle?”

Because the wrong plan isn’t just inconvenient — it can be expensive, stressful, and disruptive.

Frequently Asked Questions (Huntington Hospital & Medicare)

Does Huntington Hospital accept Medicare?

Yes. Huntington Hospital accepts Original Medicare.

Do all doctors there accept Medicare Advantage plans?

No. Doctors contract independently.

Can the hospital drop my plan mid-year?

Yes. Contracts can change.

Is emergency care always covered?

Yes, but ongoing care follows network rules.

Can I switch plans anytime in New York?

You can switch Medicare Advantage plans annually.

Medigap changes may still require underwriting.

What if my doctor leaves my plan?

You may need to switch doctors or wait for Annual Enrollment.

Does Medigap cover all doctors at Huntington Hospital?

Yes, as long as they accept Medicare assignment.

Final Thoughts for Huntington Residents

Huntington Hospital is an excellent facility.

You deserve to use it without surprises.

Whether you choose:

-

Original Medicare + Medigap

-

Or Medicare Advantage

Make sure you understand how your coverage works before you need care.

Need Help Reviewing Your Coverage?

A quick, no-pressure conversation can help you:

Verify Huntington Hospital access

Verify Huntington Hospital access Confirm your doctors are covered

Confirm your doctors are covered Compare costs

Compare costs Avoid network surprises

Avoid network surprises

631-358-5793

631-358-5793 www.paulbinsurance.com

www.paulbinsurance.com Or schedule a free Medicare review

Or schedule a free Medicare review