If you’re feeling lost in a sea of Medicare mailers and confusing jargon, you are not alone. It’s a stressful process that leaves many people feeling overwhelmed and worried about making a costly mistake. This confusion is exactly why so many people search for medicare brokers near me, looking for a trusted guide to bring clarity to their options. But how can you be sure the person you find is truly on your side, offering unbiased advice without hidden fees?

This simple guide is here to give you that peace of mind. We will show you exactly how to find, vet, and choose a reliable independent Medicare broker in your area. You’ll discover how to get personalized, expert guidance to select the best plan for your unique health needs and budget-all at absolutely no cost to you. Let’s replace the anxiety with confidence and make your Medicare enrollment a simple, stress-free experience.

Key Takeaways

- An independent Medicare broker works for you, not a single insurance company, ensuring you get unbiased guidance tailored to your unique needs.

- Learn proven methods for finding trusted medicare brokers near me, moving beyond random online searches to connect with a reliable local expert.

- Discover the essential questions to ask any potential broker to ensure they are qualified, independent, and focused on your best interests.

- Understand how the right broker provides ongoing support long after you enroll, helping you navigate changes and review your plan annually at no cost.

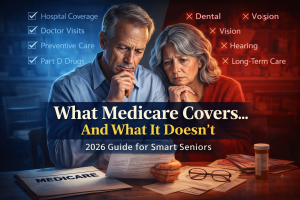

Why a Medicare Broker is Your Best Ally in the ‘Medicare Maze’

Does the word “Medicare” make your head spin? You’re not alone. With its different parts, endless plans, and strict deadlines, the system can feel like a complicated and stressful maze. It’s easy to feel overwhelmed, fearing you’ll make a costly mistake that could affect your health coverage for years to come. But you don’t have to navigate this journey by yourself.

Imagine having a trusted, expert guide by your side-someone whose only job is to understand your unique situation and find the perfect path for you. That’s the role of an independent Medicare broker. Best of all, this expert guidance is available at no cost to you. Brokers are compensated by the insurance carriers, so you get unbiased advice without ever paying a fee.

However, it’s critical to understand that not all agents work for you. When you start looking for medicare brokers near me, knowing the difference between an independent broker and a captive agent is the key to getting the right plan.

Independent Broker: Your Personal Advocate

An independent broker works for you, not an insurance company. They are licensed to represent dozens of different carriers, giving them a complete view of the market. Their goal isn’t to push one specific product; it’s to listen to your needs, compare all your options, and provide unbiased advice to help you select the plan that truly fits your health needs and budget.

Captive Agent: The Company’s Representative

A captive agent, on the other hand, works for a single insurance company. While they can be knowledgeable, they can only present and sell plans from that one carrier. Their primary loyalty is to their employer, which means you won’t see a full comparison of what’s available. You might get a good plan, but you’ll never know if it’s the best plan for you.

Choosing the right partner is your first step toward peace of mind. The best medicare brokers near me are independent advocates dedicated to moving you from confusion to confidence, ensuring your healthcare coverage is a source of security, not stress.

What a Good Medicare Broker Does For You (It’s More Than Just a Sale)

In a world of confusing options and high-pressure sales tactics, a good Medicare broker is your trusted advocate. Their job doesn’t start with a sales pitch; it starts with listening. Instead of pushing a single company’s plan, they invest time to understand your unique situation, your health needs, and your budget. This is about finding the right fit for you, not just making a sale.

The Medicare system is a maze of jargon-Part A, Part B, Part C, Part D, Medigap-and it’s easy to feel overwhelmed. A professional broker cuts through that confusion, explaining your options in simple, clear terms. They provide unbiased, side-by-side comparisons of plans from various carriers that match your specific criteria. This objective guidance is the true value you get when you find the right independent medicare brokers near me; they work for you, not for an insurance company.

The Needs Analysis: A Personalized Approach

Before recommending any plan, a dedicated broker performs a detailed needs analysis. This isn’t a quick checklist; it’s a deep dive into what matters most for your healthcare. This process includes:

- Doctor and Hospital Networks: Verifying that your trusted primary care physician, specialists, and preferred hospitals are in-network to avoid surprise bills.

- Prescription Drug Coverage: Checking your specific medications against plan formularies to ensure they are covered at the most affordable co-pay.

- Lifestyle and Travel: Understanding your travel habits to determine if you need coverage that protects you outside of your local service area or even out-of-state.

Education and Enrollment Assistance

Once your needs are clear, your broker becomes your educator and guide, helping you make an informed decision with confidence. They will help you:

- Understand Your Core Choices: Clearly explaining the pros and cons of different paths, like staying with Original Medicare and adding a Medigap Supplement versus choosing a Medicare Advantage (Part C) plan.

- Avoid Costly Mistakes: Steering you clear of common pitfalls, like late enrollment penalties that can affect your premiums for the rest of your life.

- Ensure a Smooth Application: Guiding you step-by-step through the enrollment process to make sure your application is submitted correctly and on time.

The best part? The support doesn’t end after you enroll. When you find great medicare brokers near me, you gain a partner for the long haul. They provide year-round support for billing questions, coverage issues, and an annual review to ensure your plan remains the best fit as your needs change. It’s about giving you lasting peace of mind.

How to Find a Reputable Medicare Broker Near You: 4 Proven Methods

Finding the right guide for your Medicare journey is the most important step you can take for your peace of mind. It’s not just about finding an office down the street; it’s about connecting with a trusted expert who puts your needs first. The goal is to find someone who can turn confusion into confidence.

Before you start a random online search, let’s explore a few proven ways to find a reputable professional. Remember, ‘near me’ today can mean a local office or a dedicated expert who is just a phone call away.

Method 1: Ask for Personal Referrals

The most reliable recommendations often come from people you already trust. Start by talking to friends, family members, or neighbors who are happy with their Medicare plan and ask who helped them. Your financial advisor or accountant may also have a list of vetted insurance professionals they recommend to clients. A personal referral is a powerful starting point because it comes with a built-in layer of trust.

Method 2: Use Strategic Online Searches

When you search online, be specific. Instead of just ‘agent,’ try searching for an “independent Medicare broker.” This is a key distinction-an independent broker works for you, not a single insurance company, giving you access to all your options. Look for professionals with a strong history of positive Google reviews and a clear, helpful website. Take a moment to read their ‘About Us’ page to see if their philosophy aligns with your values.

Method 3: Consider the ‘Virtual Local’ Broker

In today’s world, the best medicare brokers near me might not have an office in your town. Many top-tier, independent brokers now offer dedicated guidance through phone and video calls. This opens up your options, giving you access to a wider pool of expertise. As long as they are licensed to operate in your state, a virtual broker provides the same personalized, one-on-one service you deserve, without geographic limits.

Method 4: Verify with Official Sources

For an extra layer of confidence, you can verify a broker’s credentials. Every state has a Department of Insurance where you can check if a broker is properly licensed and in good standing. You can also look for affiliations with professional organizations like the National Association of Benefits and Insurance Professionals (NABIP), which often require their members to adhere to a strict code of ethics.

The Vetting Checklist: 7 Questions to Ask Before Choosing a Broker

Finding the right partner to guide you through Medicare is a crucial decision, and you should feel completely comfortable with your choice. Don’t be afraid to interview a potential broker. A dedicated professional will welcome your questions and provide clear, honest answers. Their responses will reveal their experience, their independence, and their commitment to your well-being. This simple conversation is the step that moves you from confusion to confidence.

When you’re evaluating medicare brokers near me, use this checklist to find a trusted advocate.

Questions About Licensing and Experience

- Are you licensed to sell insurance in my state?

This is a non-negotiable starting point. The only acceptable answer is a confident “yes.” It confirms they meet the basic legal and ethical standards to advise you. - How many years have you specialized in Medicare?

Medicare is a complex, ever-changing field. You want an expert who focuses solely on Medicare, not a generalist who dabbles in it. Years of specialization mean they understand the system’s nuances and can help you avoid common, costly mistakes. - How many insurance carriers do you actively work with?

The answer reveals if they are truly independent. A broker who represents many carriers can offer you unbiased options tailored to your specific needs. A “captive” agent working with only one or two companies can only offer you their limited products, which may not be your best fit.

Questions About Their Process and Support

- What is your process for recommending a plan?

A great broker won’t start by talking about plans; they’ll start by talking about you. Their process should involve understanding your healthcare needs, checking that your doctors are in-network, reviewing your prescriptions, and explaining your options in simple terms. - How do you help clients if they have issues after enrolling?

Your relationship shouldn’t end once you sign up. The best brokers provide year-round support. Ask if they will be there to help you with claim questions, billing issues, or to conduct an annual review to ensure your plan remains the right choice. - How are you compensated for your services?

Transparency is key. A broker’s services should be 100% free to you. They are paid a commission by the insurance company you choose, and these rates are fixed and regulated. This ensures their advice is focused on your needs, not their commission.

The Final Gut Check Question

- Why should I choose you to be my broker?

Listen carefully to this answer. Is it about making a quick sale, or is it about building a long-term relationship? A passionate and trustworthy broker will talk about their commitment to service, education, and being your personal advocate for years to come. It’s the answer that should give you true peace of mind.

Ready for a conversation with someone who will patiently answer every one of these questions? Connect with The Modern Medicare Agency today.

Your Journey with a Broker: From First Call to Long-Term Peace of Mind

Choosing a broker isn’t just a one-time transaction; it’s the beginning of a supportive, long-term partnership. Finding trustworthy medicare brokers near me means gaining a dedicated advocate who is committed to your well-being for years to come. The entire process is designed to feel simple, un-rushed, and completely focused on your unique needs. You deserve clarity and confidence, not confusion and pressure.

Here’s a clear look at what you can expect when you partner with a local expert who puts your interests first.

Step 1: The Initial Consultation

It all starts with a simple, no-pressure conversation. This is our opportunity to understand what matters most to you. We’ll discuss your healthcare priorities, including:

- Your preferred doctors and hospitals

- Your current prescription medications

- Your budget and financial comfort zone

- Any upcoming health needs or concerns

This is also your chance to ask questions and ensure you feel comfortable. Our goal is to build trust and show you how we can help, without any obligation.

Step 2: Reviewing Your Personalized Options

After our initial chat, we do the heavy lifting. We’ll research the dozens of plans available in your area and narrow them down to a few top options that perfectly match your criteria. We then review them together, explaining the costs and benefits of each one in plain English. You’ll get straightforward answers about premiums, co-pays, and network access, so you can make an informed decision with complete confidence.

Step 3: Enrollment and Ongoing Support

Once you’ve chosen a plan, we guide you through every step of the application process, ensuring it’s completed correctly and submitted on time to avoid any costly errors. But our partnership doesn’t end there. We confirm your enrollment is active and remain your dedicated point of contact for any questions that arise.

Most importantly, we’re here for you every year. As plans and your needs change, we’ll be ready to conduct an annual review to ensure you’re always in the best possible plan. This ongoing support is what turns a confusing annual task into a simple, reassuring check-in. Ready to experience this level of dedicated service? Learn more about our simple process.

From Confusion to Confidence: Your Next Step to Medicare Clarity

Navigating the Medicare maze doesn’t have to be a stressful or solitary journey. As this guide has shown, a dedicated independent broker is your most powerful ally, translating confusing options into clear, simple choices tailored just for you. The key is finding a true partner-one you can trust for years to come-by asking the right questions and ensuring their guidance is truly unbiased and focused on your unique healthcare needs.

Your search for qualified medicare brokers near me can end right here. Instead of facing another form or a confusing website, let us provide the personal, expert support you deserve. With an A+ rating from the Better Business Bureau and the freedom to compare plans from over 40 insurance carriers, our commitment is to you, not an insurance company. We are proudly licensed in 34+ states, offering trusted guidance to help you make the right decision with confidence.

Ready to feel secure in your coverage? Schedule Your Free, No-Obligation Medicare Plan Review. Let’s build your path to long-term peace of mind, together.

Frequently Asked Questions About Working With a Medicare Broker

How do Medicare brokers get paid if their service is free for me?

This is an excellent and common question. We are paid a commission directly by the insurance company whose plan you choose to enroll in. This payment structure means our expert guidance and support come at no cost to you. The price you pay for your plan is the exact same whether you enroll through a broker or go directly to the carrier. Our goal is to provide unbiased advice to help you find the best fit, not to sell a specific plan.

What is the difference between an independent broker and a SHIP counselor?

An independent broker is a state-licensed insurance professional who can legally provide specific plan recommendations and help you enroll. We represent multiple insurance companies to find a plan that fits your unique needs. A SHIP (State Health Insurance Assistance Program) counselor is a trained volunteer who provides valuable education and information about Medicare. However, they are not licensed to, and cannot, recommend one specific plan over another or help you with the enrollment process itself.

Do I have to meet a Medicare broker in person, or can we work remotely?

You have the flexibility to choose what works best for you. While many people appreciate searching for “Medicare brokers near me” to find someone for a face-to-face meeting, we also offer complete support remotely. We can easily guide you through the entire process over the phone or via a secure video call. Our priority is to make you feel comfortable and confident, whether we meet in your community or from the comfort of your own home.

Can a broker help me with Medicare Advantage, Medigap, and Part D plans?

Absolutely. A key benefit of working with an independent broker is getting help navigating all your options in one place. We are experts in Medicare Advantage (Part C), Medicare Supplement (Medigap), and Prescription Drug Plans (Part D). We will help you compare the pros and cons of each, ensure your doctors are in-network, and check that your prescriptions are covered affordably. Our job is to simplify the choices and find the right combination for your health and budget.

Is there any disadvantage to using a Medicare broker instead of going direct?

There is no disadvantage to using a trusted, independent broker. You pay the exact same premium for your plan, but you gain an expert advocate who provides personalized guidance, more plan choices, and year-round support. The only potential drawback is choosing a “captive agent” who only represents one company. This limits your options and the advice you receive. An independent broker works for you, not for a single insurance company, ensuring your best interests always come first.

What information should I have ready before I talk to a Medicare broker?

To make our meeting as productive as possible, it’s helpful to have a few items ready. Please have your Medicare card (with your red, white, and blue design) for your Medicare number. Also, make a list of your current prescription drugs, including the specific dosages. Finally, jot down the names of your preferred doctors, specialists, and hospitals so we can verify they are in-network with the plans we review for you. This preparation helps us move you from confusion to confidence quickly.