Does the thought of choosing a Medicare plan feel like navigating a maze in the dark? You’re not alone. With a sea of options, confusing insurance jargon, and the constant worry of making a costly mistake, it’s easy to feel completely overwhelmed. The fear of losing access to your trusted doctor or facing unexpected costs is real, and it can make this important decision feel stressful and uncertain.

But finding the best medicare advantage plans for your unique situation doesn’t have to be this complicated. This simple 2026 guide is designed to give you clarity and control. We will walk you through exactly what to look for, helping you understand how to keep your doctors, ensure your prescriptions are covered, and find a plan that truly fits your budget. Our promise is to move you from a place of confusion to one of confidence, so you can make a choice that brings you complete peace of mind for the year ahead.

Key Takeaways

- Learn to define what ‘best’ means for you by balancing three critical factors: your budget, your health needs, and your preferred doctors.

- See which national carriers consistently earn top marks for member satisfaction, but understand why star ratings are only the beginning of your search.

- Follow our simple 3-step checklist to confidently compare coverage and find the best medicare advantage plans for your unique situation.

- Discover how unbiased expert guidance can help you avoid costly enrollment mistakes and choose your plan with total peace of mind.

What ‘Best’ Really Means: Key Factors for Choosing Your Plan

You see the advertisements everywhere, each one promising the “best” coverage. But the truth is, the search for the best medicare advantage plans isn’t about finding a single, perfect plan for everyone. It’s about finding the one plan that is perfect for you. The right choice is a deeply personal balance of three key factors: cost, coverage, and convenience.

Navigating this on your own can feel overwhelming, but it doesn’t have to be. Instead of relying on flashy commercials, we’ll help you focus on what truly matters for your health and budget. Understanding these core components is the first step from confusion to confidence. An unbiased expert can provide the trusted guidance you need to weigh these factors and find a plan that brings you peace of mind.

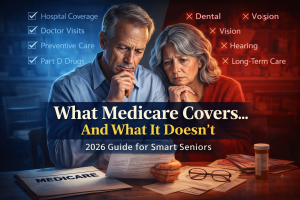

CMS Star Ratings Explained

Medicare uses a simple 1-to-5 Star Rating system to measure the quality and performance of Advantage plans. These ratings are based on member experiences, customer service, and the quality of care provided. A plan with 4 or 5 stars is generally a strong, reliable choice. However, think of the Star Rating as a starting point-a high rating is great, but it doesn’t guarantee the plan’s network or drug list is right for you.

Understanding the True Costs

A $0 monthly premium is appealing, but it’s only one piece of the financial puzzle. To understand the true cost, you must look at the details:

- Deductible: The amount you pay before your plan starts paying.

- Copayments/Coinsurance: Your share of the cost for doctor visits and services.

- Maximum Out-of-Pocket (MOOP): This is your financial safety net. It’s the absolute most you will pay for covered medical services in a year. A lower MOOP provides stronger protection against unexpected health costs.

Your costs will also be lower when you see doctors who are in-network versus out-of-network.

Doctor & Hospital Networks (HMO vs. PPO)

Does your plan let you see the doctors you already know and trust? This depends on the network type. The two most common are:

- HMO (Health Maintenance Organization): These plans require you to use doctors, hospitals, and specialists within their network and get a referral from your primary care physician to see a specialist. They often have lower out-of-pocket costs.

- PPO (Preferred Provider Organization): These plans offer more flexibility. You can see both in-network and out-of-network doctors without a referral, but your costs will be higher if you go out-of-network.

Crucial step: Always use the plan’s official online directory or call them directly to confirm your specific doctors and preferred hospitals are in-network before you enroll.

Coverage for Prescriptions and Extra Benefits

Most Medicare Advantage plans include prescription drug coverage (Part D). To learn more about the fundamentals of these plans, you can start with this helpful overview of What is Medicare Advantage?. Every plan has a unique list of covered medications called a “drug formulary.” It is essential to check this list to ensure your specific prescriptions are covered at a price you can afford.

Beyond that, many of the best medicare advantage plans offer valuable extra benefits not covered by Original Medicare. These can include:

- Routine dental, vision, and hearing care

- Fitness memberships (like SilverSneakers)

- Allowances for over-the-counter health items

These extras vary widely, so compare them carefully to see which plan adds the most value to your life.

Top-Rated Medicare Advantage Companies for 2026

Navigating the sea of insurance carriers can feel overwhelming, but our goal at The Modern Medicare Agency is to bring you clarity and confidence. It’s important to remember that the best medicare advantage plans are not one-size-fits-all; they depend entirely on your health needs, budget, and location. This guide provides a starting point by highlighting major national carriers known for their quality and service. Before diving in, you can review the full landscape of official Medicare plan options directly on the government’s website to understand the different structures available.

Best for Network Size & Flexibility: Leading National Providers

If you travel frequently or simply want the freedom to choose from a wide range of doctors and hospitals, many leading national providers are excellent starting points. They are known for offering extensive national PPO networks, which provide more flexibility than restrictive HMOs. A variety of trusted options are available for seniors seeking broad coverage. These carriers often provide a spectrum of plans, from comprehensive $0-premium options to those with richer benefits for a higher monthly cost.

Best for Member Satisfaction & High Ratings: Top-Tier Service Providers

For those who prioritize top-tier service and proven quality, several highly-rated providers consistently earn high star ratings from Medicare. Some offer unique integrated care models—where your insurance and your medical care come from the same organization—which are highly regarded for coordinated service, though typically available in select areas. Other top performers focus on member wellness programs, fitness benefits like SilverSneakers, and dedicated customer support resources.

Best for $0 Premium & Extra Benefits: Value-Focused Carriers

If keeping monthly costs low is your top priority, various value-focused carriers are leaders in offering competitive $0-premium plans in many markets. These plans are often packed with valuable extra benefits not covered by Original Medicare, such as generous allowances for dental, vision, and hearing services. Some of their plans even include a Part B Premium Reduction (or ‘Giveback’) benefit, which puts money back into your Social Security check each month. These are fantastic options for budget-conscious individuals seeking solid coverage.

How to Compare Plans Based on Your Personal Needs

Knowing the top-rated insurance companies is a great start, but it doesn’t tell you which plan is right for you. Finding the best Medicare Advantage plans is a deeply personal journey, not a one-size-fits-all solution. To move from confusion to confidence, you need a simple action plan. This three-step checklist will help you gather the exact information needed to make a clear, informed choice.

Feeling overwhelmed by the details? The Modern Medicare Agency offers a free consultation to simplify this process.

Step 1: Make Your Healthcare List

Your specific health needs are the foundation of your decision. Before you look at a single plan, create a master list of your essentials. This is your non-negotiable starting point. Once you have this information, you can use tools like Medicare’s official plan comparison tool to verify which plans cover what matters most to you.

- Your Providers: List every doctor, specialist, and preferred hospital or clinic you use.

- Your Prescriptions: Write down every medication you take, including the exact dosage and frequency.

- Your Conditions: Note any chronic conditions you manage, such as diabetes, heart disease, or arthritis.

Step 2: Define Your Budget and Risk Tolerance

Next, it’s time for an honest look at your finances. There’s no right or wrong answer here-only what gives you peace of mind. Would you prefer a lower monthly premium, knowing you’ll pay more for copays when you need care? Or does a higher premium with more predictable, lower costs feel safer? Also, consider the plan’s maximum out-of-pocket limit-the absolute most you’d pay in a year-and make sure that number fits comfortably within your savings.

Step 3: Prioritize Your ‘Wants’

If two plans cover your doctors and drugs and fit your budget, the extra benefits become the deciding factor. These are the “wants” that can significantly improve your quality of life. This final step ensures you don’t just get a good plan, but one that truly supports your lifestyle and helps you find the best Medicare Advantage plans for your unique needs.

- Do you need comprehensive dental, vision, and hearing coverage?

- Is a fitness program or gym membership (like SilverSneakers) important to you?

- Do you travel often and need a plan with a nationwide network?

Why You Don’t Have to Navigate This Maze Alone

After reviewing all these details, you might feel more confused than when you started. That’s completely normal. Comparing star ratings, drug formularies, and provider networks is a complex, often stressful task. The good news is, you don’t have to face this maze alone and hope for the best. There is a simpler, more confident path forward.

Independent Broker vs. Captive Agent

Imagine having a personal guide whose only job is to look out for your best interests. That’s an independent Medicare broker. A broker works for you, not for a single insurance company. We represent many different carriers, which allows us to shop the entire market on your behalf and provide truly unbiased advice. This is the key to finding the best medicare advantage plans that truly fit your life.

A captive agent, on the other hand, works for just one specific insurance company. While they may be knowledgeable, they can only offer you plans from that one brand. If that company’s plan isn’t the right fit for your doctors or prescriptions, you would never know what other, better options are available. With an independent broker, your needs always come first.

The Value of a Personalized Plan Review

An expert broker does the time-consuming research for you. We take the time to understand your unique situation-your doctors, your prescriptions, and your health priorities-to find a plan tailored specifically to you. This personalized review ensures nothing gets missed.

- We confirm your doctors are in the plan’s network to avoid surprise bills.

- We verify your prescriptions are covered at the lowest possible co-pay.

- We identify plans with extra benefits you’ll actually use, like dental, vision, or fitness programs.

This detailed approach provides more than just a plan; it provides peace of mind and confidence in your choice. Best of all, this expert guidance and year-round support comes at no cost to you. Brokers are compensated by the insurance companies, so your premium is the same whether you enroll with our help or go it alone. You get an expert advocate in your corner for free.

You deserve to move from confusion to confidence with your healthcare. To get the trusted, unbiased guidance needed to secure one of the best Medicare Advantage plans for 2026, we’re here to help.

From Confusion to Confidence: Finding Your Perfect Plan

Choosing your healthcare coverage is one of the most important decisions you’ll make. As we’ve covered, the key is understanding that the best medicare advantage plans are deeply personal-they must align with your specific health needs, medications, and budget. Comparing details like doctor networks and out-of-pocket costs is crucial, but you never have to navigate this complex maze by yourself.

Why face this complexity alone when expert guidance is available at no cost to you? As a licensed independent broker in over 34 states, I provide truly unbiased advice by comparing options from more than 40 top carriers. My goal is simple: to give you clarity and peace of mind with personalized, year-round support.

Ready to find the perfect plan with zero stress? Schedule your free, unbiased consultation with Paul. Let’s work together to secure the healthcare coverage and confidence you deserve.

Frequently Asked Questions About Medicare Advantage

What is the highest-rated Medicare Advantage plan?

While Medicare uses a 5-star rating system to measure quality, the “highest-rated” plan isn’t always the best for you personally. The right plan depends entirely on your location, your doctors, your prescriptions, and your budget. Our goal isn’t just to find a 5-star plan; it’s to find your 5-star fit. We provide the trusted, unbiased guidance needed to compare the best Medicare Advantage plans for your specific health and financial needs, ensuring you feel confident in your choice.

Is there a downside to Medicare Advantage plans?

Understanding the trade-offs is key to making a confident choice. The primary consideration with Medicare Advantage plans is the provider network. Most plans require you to use doctors and hospitals within their network to get the lowest costs, and you may need referrals to see specialists. Some services might also require prior authorization from the plan. We help you look closely at these rules so there are no surprises and you maintain access to the care you need.

Can I switch my Medicare Advantage plan if I’m unhappy with it?

Yes, you absolutely have options if your plan isn’t working for you. You are never permanently locked into a choice you don’t love. Each year, you can switch plans during the Annual Enrollment Period, which runs from October 15 to December 7. There is also a Medicare Advantage Open Enrollment Period from January 1 to March 31 where you can make a one-time switch to a different plan. This gives you the flexibility to find a better fit.

How do I find out for sure if my doctor is in a plan’s network?

This is a critical step, and you should always confirm it directly. First, use the plan’s official online provider directory to search for your doctor’s name. Then, for complete peace of mind, take the extra step of calling your doctor’s office. Ask the billing department a simple question: “Do you accept the [Insert Plan Name] Medicare Advantage plan for 2026?” This direct confirmation is the only way to be 100% certain before you enroll.

What happens if I choose a plan that doesn’t cover my prescriptions?

This can be a very costly and stressful mistake. If your plan does not cover a specific medication, you will be responsible for paying the full retail price out-of-pocket until you can switch plans during an enrollment period. That is why it is essential to check the plan’s drug formulary (its list of covered drugs) for every single one of your prescriptions *before* you enroll. This simple step protects you from unexpected and significant expenses later on.

Do all Medicare Advantage plans include prescription drug coverage (Part D)?

No, but the great majority of them do. Plans that bundle health and drug coverage are called Medicare Advantage Prescription Drug plans (MA-PD). These are the most common type and offer the convenience of an all-in-one plan. However, a small number of “MA-only” plans are available that do not include drug coverage. These are typically for people who already have credible drug coverage from another source, such as the VA or an employer.