Feeling overwhelmed by the sheer number of Medicare Advantage plans? You’re not alone. The jargon, the hidden costs, the fear of choosing the wrong plan—it’s enough to make anyone anxious. But what if you could trade that confusion for confidence?

Go from overwhelmed to confident by learning the 5 key factors to compare in any Medicare Advantage plan, ensuring you choose the right coverage for your health and budget.

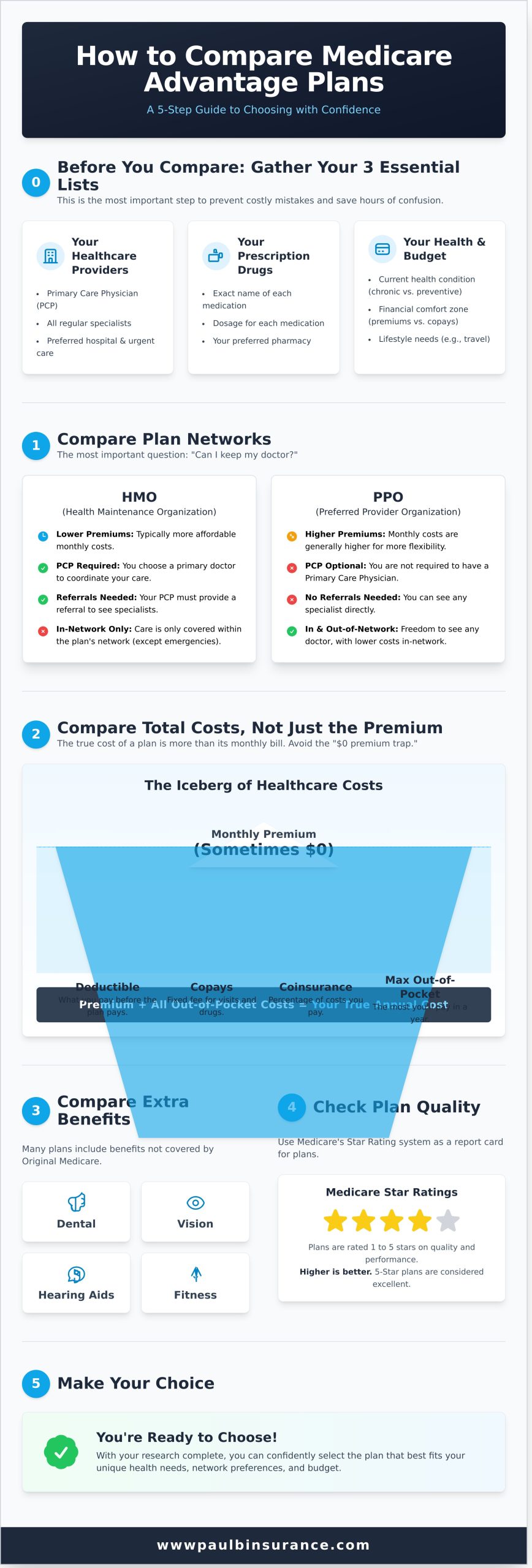

Before You Compare: Gather Your 3 Essential Lists

A good decision starts with good preparation. Trying to compare plans without knowing your specific needs is like going to the grocery store without a list—you’re likely to forget something important and spend more than you planned.

Taking a few minutes to create your personal "Medicare blueprint" will save you hours of frustration and help you avoid costly mistakes.

List 1: Your Healthcare Providers

Your relationship with your doctors is important. Let’s make sure you can keep them.

- List every doctor, specialist, and hospital you want to continue using.

- Include their office addresses to help verify their network status.

- Note which providers are "must-haves" and which are "nice-to-haves."

List 2: Your Prescription Drugs

This is one of the most critical and often overlooked parts of a plan comparison.

- Write down the exact name and dosage for every medication you take regularly.

- Include the pharmacy you prefer to use (e.g., Walgreens, CVS, a local pharmacy).

- This information is essential for checking a plan’s formulary (its list of covered drugs) and estimating your yearly drug costs.

List 3: Your Health Needs & Budget

A plan that’s perfect for your neighbor might be a terrible fit for you. Be honest about your lifestyle and financial situation.

- Health: Do you have chronic conditions that require frequent specialist visits? Or are you in excellent health and only see a doctor for annual check-ups?

- Budget: Are you more comfortable with a predictable, slightly higher monthly premium in exchange for lower copays when you need care? Or do you prefer a $0 premium plan, understanding you might pay more per visit?

- Lifestyle: Do you travel often within the U.S.? This could make a PPO plan with out-of-network flexibility more appealing than a restrictive HMO.

Step 1: Compare Plan Networks (HMO vs. PPO)

For most people, the plan’s network is the first and most important factor. The network is simply the group of doctors, hospitals, and clinics that have agreed to accept the plan’s payment rates. Choosing a plan with the wrong network can mean losing access to your trusted doctors or facing huge out-of-network bills.

Let’s break down the two most common types: HMOs and PPOs. Think of it this way: an HMO is like a private club with a strict guest list, while a PPO is a more flexible club that lets you bring guests, but at a higher cost.

What is an HMO (Health Maintenance Organization)?

HMO plans are designed to manage care within a specific network to keep costs down.

- In-Network Only: You must use doctors and hospitals within the plan’s network, except for true emergencies.

- Primary Care Physician (PCP): You are required to choose a PCP from the network to coordinate your care.

- Referrals: You typically need a referral from your PCP before you can see a specialist.

- Cost: HMOs often have lower monthly premiums.

What is a PPO (Preferred Provider Organization)?

PPO plans offer more freedom and flexibility in exchange for potentially higher costs.

- In-Network & Out-of-Network: You have the flexibility to see both in-network and out-of-network doctors.

- Lower Costs In-Network: You will always pay less when you use providers from the plan’s "preferred" network.

- No Referrals: You generally do not need a PCP or referrals to see specialists.

- Cost: PPOs often have higher monthly premiums to pay for this flexibility.

Key Questions to Ask About the Network

- Are my "must-have" doctors, specialists, and hospitals in the network?

- How can I check? (You can use the plan’s online provider directory or, even better, call your doctor’s office directly and ask which specific plans they accept).

- If I choose a PPO, what are the actual costs for seeing my out-of-network specialist?

Step 2: Compare Total Costs—Not Just the $0 Premium

The biggest mistake people make is choosing a plan based on a $0 monthly premium alone. A low premium is tempting, but it tells you nothing about what you’ll actually pay when you need medical care. The true cost of a plan is the premium plus all your out-of-pocket expenses throughout the year.

Premiums, Deductibles, and Copays

First, it’s important to remember that even with a $0 premium Medicare Advantage plan, you are still responsible for your Medicare Part B premium. For 2026, the standard Part B premium is $202.90 per month (some individuals with higher incomes may pay more).

Beyond that, here are the costs set by the Advantage plan itself:

- Premium: The fixed amount you pay the insurance plan each month. This can be $0 or higher.

- Deductible: The amount you must pay for medical services before your plan starts to pay.

- Copays/Coinsurance: Your share of the cost for each doctor visit, hospital stay, or service after you’ve met your deductible. A copay is a flat fee (e.g., $25 for a specialist visit), while coinsurance is a percentage (e.g., 20% of the cost).

The Most Important Number: Maximum Out-of-Pocket (MOOP)

If you only look at one number, make it this one. The MOOP is a safety net that represents the absolute most you will have to pay for covered medical services in a single year. Once you hit this limit, the plan pays 100% for the rest of the year. A plan with a lower MOOP offers you stronger financial protection against catastrophic health events. Comparing the MOOP between two plans is one of the best ways to understand your total financial risk.

Checking Your Prescription Drug Costs

For Medicare Advantage plans that include drug coverage (MAPD), you need to look at more than just the medical costs.

- Formulary: Check if all your medications are on the plan’s approved drug list (the formulary).

- Tiers: See which "tier" your drugs are on. Drugs in lower tiers (like generics) have low copays, while drugs in higher tiers (specialty drugs) cost much more.

- 2026 Part D Changes: The federal government has made significant updates for 2026. There is now a $2,100 annual cap on out-of-pocket drug costs. Once you spend that amount, you’ll pay $0 for your drugs for the rest of the year. Plans may also have a drug deductible, up to a maximum of $615 in 2026.

Step 3: Compare Coverage & Extra Benefits

By law, all Medicare Advantage plans must cover everything that Original Medicare (Part A and Part B) covers. The real difference between plans lies in the "extras" they offer. These benefits can provide significant value, but only if you’ll actually use them.

Confirming Core Medical Coverage

You can rest assured that any plan you choose will cover the essentials:

- Hospital stays (Part A benefits)

- Doctor visits and outpatient care (Part B benefits)

- This includes things like lab work, surgeries, durable medical equipment, and preventative screenings.

Evaluating the ‘Extras’: Dental, Vision, and Hearing

Don’t just check the box. Dig into the details of these common benefits.

- Dental: Does the plan cover only cleanings, or does it include fillings, crowns, and dentures? What is the annual dollar limit (e.g., $1,500 per year)?

- Vision: Is it just a routine eye exam, or is there an allowance for glasses or contacts?

- Hearing: Does the plan cover hearing tests and provide an allowance for hearing aids, which can be very expensive?

Other Valuable Perks to Look For

Many plans compete by offering creative benefits designed to keep you healthy and save you money.

- Over-the-Counter (OTC) Allowance: A quarterly allowance (e.g., $50 every three months) to buy health items like vitamins, bandages, and cold medicine.

- Fitness Programs: Memberships to gyms or access to fitness programs like SilverSneakers.

- Transportation: Non-emergency transportation to and from medical appointments.

- Meal Delivery: A service that provides meals delivered to your home after a hospital stay.

Step 4 & 5: Check Plan Quality and Make Your Choice

Once you’ve narrowed your options based on network, cost, and benefits, it’s time for a final quality check. Medicare provides an objective tool to help you do this: the Star Rating system. Think of it like a restaurant rating—it’s a simple way to gauge quality based on member satisfaction and clinical outcomes.

What Are Medicare Star Ratings?

- A simple 1-to-5-star rating assigned to each plan by Medicare itself.

- The rating is based on dozens of factors, including customer service, member complaints, and how well the plan helps members stay healthy.

- Plans with 4 or 5 stars are generally considered high-quality.

How to Find and Use Star Ratings

You can find the Star Rating for any plan on the official Medicare Plan Finder website. While you shouldn’t choose a plan based on the rating alone, it’s an excellent tie-breaker. If you’re torn between two plans that both fit your needs and budget, the one with the higher Star Rating is often the better choice.

Making Your Final Decision with Confidence

It’s time to put it all together. Take your top two or three plans and hold them up against the essential lists you created at the beginning.

- Does the plan include your must-have doctors and hospital?

- Does it cover all your prescription drugs at a cost you can afford?

- Does the total potential cost, including the MOOP, fit within your budget?

- Does it have a strong Star Rating?

The plan that checks all these boxes is the one that will give you security and peace of mind.

Feeling stuck? A free, unbiased review of your options can provide the clarity you need. Talk to an expert today.

The Easiest Way to Compare: Let an Expert Do It For You

While this 5-step process makes comparing plans manageable, it can still be a time-consuming and stressful task. You don’t have to do it alone. Working with an independent broker is like having a personal guide to navigate the Medicare maze for you.

Why Online Tools Aren’t Enough

Government websites and online tools are great for providing raw data, but they can’t offer personalized advice. They can’t answer your specific "what if" questions or understand the nuances of your unique health situation. It’s far too easy to overlook a critical detail that could cost you thousands down the road.

The Independent Broker Advantage

Unlike a "captive agent" who works for a single insurance company and can only offer their products, an independent broker works for you.

- We are your advocate, not a salesperson for one company.

- We have access to dozens of plans from over 40 different carriers to find the plan that is truly the best fit for your needs.

- We help you avoid common and costly enrollment mistakes and late-enrollment penalties.

From Confusion to Confidence: Our Simple Process

- Listen: We start with a brief, no-pressure phone call to understand your doctors, prescriptions, and priorities.

- Research: We do all the heavy lifting, researching and comparing dozens of plans on your behalf.

- Advise: We present you with clear, unbiased options, explain the pros and cons of each, and help you enroll with confidence.

Let us handle the hard work. Our guidance is always 100% free and comes with no obligation.

Schedule your free, no-obligation plan comparison.

Frequently Asked Questions

Can I switch my Medicare Advantage plan if I choose the wrong one?

Yes, you can. The main opportunity to switch plans is during the Annual Enrollment Period (AEP), which runs from October 15th to December 7th each year. There are also Special Enrollment Periods (SEPs) for qualifying life events, like moving to a new service area.

What’s the main difference between an HMO and a PPO plan?

The main difference is flexibility. HMOs generally require you to use their network of doctors and get referrals to see specialists, often resulting in lower premiums. PPOs give you the freedom to see out-of-network doctors (at a higher cost) and typically don’t require referrals, but their premiums may be higher.

Does it cost anything to work with an independent Medicare broker?

No, our services are 100% free to you. We are compensated by the insurance carriers if you decide to enroll in a plan, but this does not affect your premium or plan benefits in any way. You get expert, unbiased guidance at no cost.

How do I check if my specific doctor is in a plan’s network before I enroll?

The most reliable way is to call your doctor’s office directly. Ask the billing department, "Do you accept [Plan Name] from [Insurance Company Name]?" While online provider directories are helpful, they are not always up-to-date, so calling is the best confirmation.

Why do some Medicare Advantage plans have a $0 monthly premium?

These plans are able to offer a $0 premium because they receive payments from the federal government to provide your Medicare Part A and Part B benefits. They often manage costs by using specific provider networks (like HMOs) and cost-sharing structures. Remember, you must still pay your monthly Part B premium to be enrolled in a Medicare Advantage plan.

Where can I find the official Star Rating for a plan I’m considering?

The official Star Ratings are published on the Medicare Plan Finder tool at Medicare.gov. You will see the rating prominently displayed next to the plan’s name as you compare your options.