Is the thought of navigating Medicare leaving you feeling stressed and overwhelmed? You’re not alone. Trying to understand the rules for medicare eligibility can feel like deciphering a secret code, filled with confusing jargon and deadlines where a simple mistake could lead to lifetime penalties. Whether you’re approaching 65, still working, or qualifying through a disability, you deserve clear, simple answers, not more questions.

This guide was created to give you that clarity. We believe you should approach this important milestone with confidence, not confusion. We will walk you through the process step-by-step, providing a simple checklist to determine your eligibility for 2026. You will learn the key deadlines you absolutely cannot miss and gain the peace of mind that comes from knowing you are making the right choices. It’s time to move from uncertainty to a clear, confident path forward.

Key Takeaways

- Understand the three main paths to qualify for Medicare, so you can confidently identify which one applies to you.

- Clarify whether you qualify at age 65 or sooner due to a disability, ensuring you know your specific timeline.

- See how your core medicare eligibility for Parts A and B is the key that unlocks your options for Part C and Part D plans.

- Follow simple, actionable steps to officially confirm your status and prepare for a smooth, penalty-free enrollment.

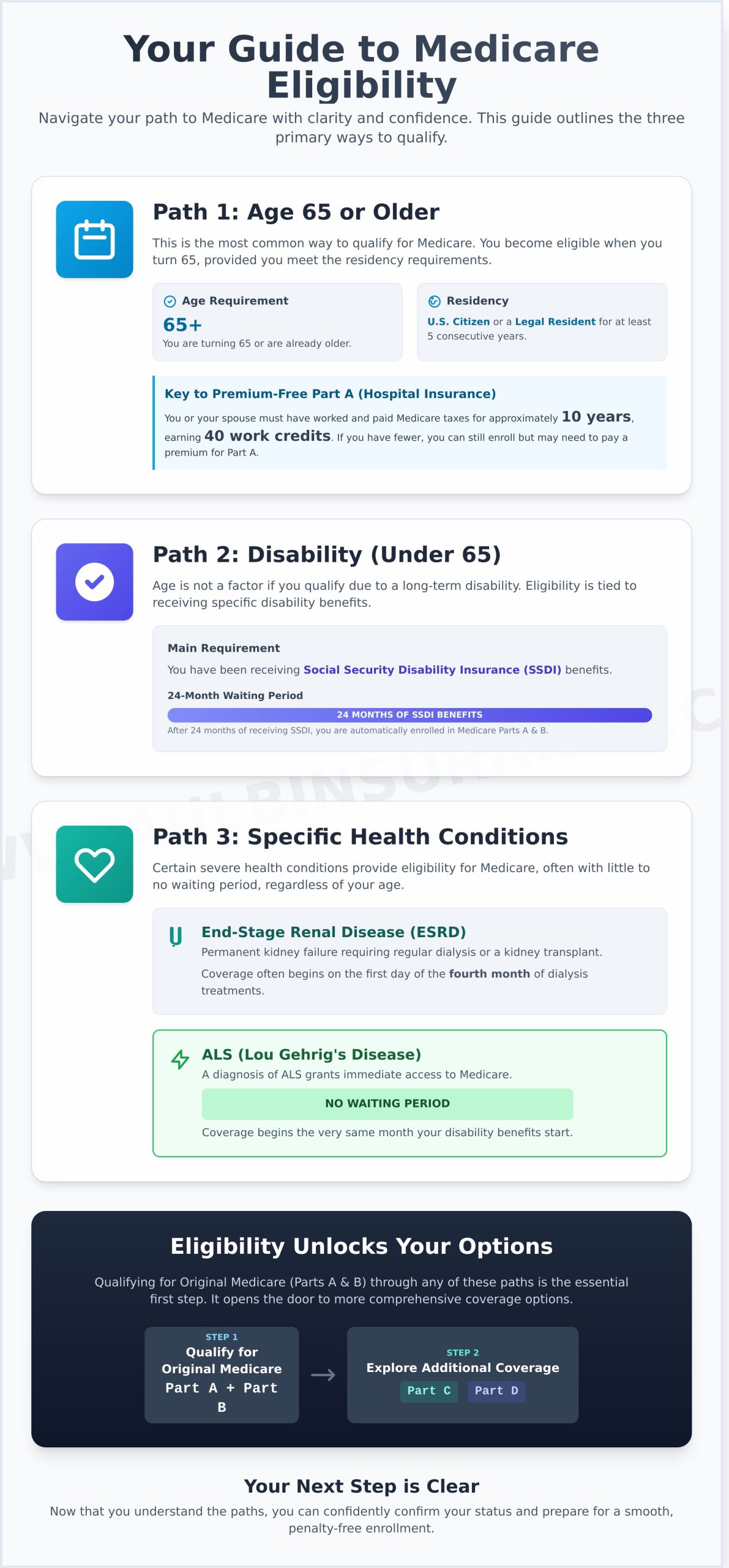

The 3 Main Paths to Medicare Eligibility: An Overview

Figuring out if you qualify for Medicare can feel like solving a complex puzzle, but it doesn’t have to be. We’re here to provide the simple, trusted guidance you need to move from confusion to confidence. At its core, the federal health insurance program is designed to serve specific groups of Americans. For a complete historical and structural background, you can review this Overview of Medicare, but for now, let’s focus on what matters most to you.

There are three primary ways you can qualify. This section serves as your quick-reference guide to see which path applies to you before we dive into the details later in the article.

Your Quick Eligibility Checklist

- Path 1: Age — Are you turning 65 or are you already 65 or older?

- Path 2: Disability — Have you been receiving Social Security Disability benefits for at least 24 months?

- Path 3: Specific Illness — Have you been diagnosed with End-Stage Renal Disease (ESRD) or ALS (Lou Gehrig’s Disease)?

Are You Turning 65 Soon?

This is the most common path to Medicare. If you are a U.S. citizen or a legal resident who has lived in the United States for at least five consecutive years, you are eligible for Medicare when you turn 65. Most people also qualify for premium-free Part A (Hospital Insurance) if they or their spouse worked and paid Medicare taxes for at least 10 years, earning what the government calls 40 “work credits.”

Qualifying Through Disability

What if you’re under 65? You can still gain medicare eligibility if you have a qualifying long-term disability. If you’ve been receiving Social Security Disability Insurance (SSDI) benefits, you will be automatically enrolled in Medicare Parts A and B after a 24-month waiting period. Your age is not a factor here; the key is the two-year period of receiving disability payments.

Qualifying with ESRD or ALS

Certain medical conditions grant you access to Medicare without the standard age or disability waiting periods. These are critical exceptions:

- End-Stage Renal Disease (ESRD): If you have permanent kidney failure requiring regular dialysis or a kidney transplant, your Medicare coverage can often begin as early as the first day of the fourth month of dialysis.

- ALS (Lou Gehrig’s Disease): For those diagnosed with ALS, there is no waiting period. Your eligibility begins the very same month your disability benefits start, ensuring immediate access to care.

Medicare Eligibility at Age 65: The Details

Turning 65 is the most common milestone for joining Medicare, but it’s not just about your birthday. The system can feel confusing, with rules about work history and residency that leave many people feeling uncertain. Let’s walk through the key details that determine your medicare eligibility at age 65, so you can move forward with confidence and clarity.

The Role of ‘Work Credits’ (Quarters of Coverage)

Think of work credits as the building blocks of your Medicare benefits. You earn them by working and paying Medicare taxes. For most people, the magic number is 40 credits-roughly equivalent to 10 years of work. If you (or your spouse) have earned these 40 credits, you will qualify for premium-free Medicare Part A (Hospital Insurance).

But what if you have fewer than 40 credits? Don’t panic. You may still be able to buy Part A. In many cases, you can also qualify based on your spouse’s work record, even if they are still working or younger than you. Feeling unsure about your work history? The Modern Medicare Agency can help clarify your status.

Citizenship and Residency Requirements

To qualify for Medicare, you must be a U.S. citizen or a legal resident who has lived continuously in the United States for at least five years. This 5-year rule is a critical requirement for non-citizens, ensuring a consistent residency history before benefits are granted. These official rules are outlined on the Official Medicare Website, but understanding how they apply to your unique situation is where expert guidance from The Modern Medicare Agency becomes invaluable.

What if I’m Still Working at 65?

This is one of the most important questions The Modern Medicare Agency helps people navigate. If you are still working at 65 and have “creditable” health coverage from a current employer, you can often delay enrolling in Medicare Part B without facing a penalty. However, the rules are very specific and depend on factors like the size of your employer. Getting this wrong can lead to gaps in your coverage and lifelong late enrollment penalties. It is absolutely essential to understand your obligations before you decide to delay.

Eligibility Under 65: Qualifying with a Disability or Health Condition

Navigating Medicare can feel overwhelming, especially when your situation doesn’t fit the standard age-based rules. But you are not alone, and there is a clear path forward. If you are under 65, specific health conditions or disabilities can grant you access to Medicare benefits, providing vital coverage when you need it most. Understanding these special circumstances is the first step toward securing your peace of mind and confirming your medicare eligibility.

Let’s walk through the three main ways you can qualify for Medicare before your 65th birthday.

Qualifying with Social Security Disability Insurance (SSDI)

If you qualify for Social Security Disability Insurance (SSDI), you will be automatically enrolled in Medicare Part A and Part B after you have received disability benefits for 24 months. This waiting period begins from the date your disability payments start. You don’t need to do anything to sign up; you’ll receive your Medicare card in the mail about three months before your 25th month of benefits. While enrollment is automatic, you still have important choices to make about supplementing your coverage with a Medigap or Medicare Advantage plan.

Qualifying with End-Stage Renal Disease (ESRD)

ESRD, which is permanent kidney failure that requires regular dialysis or a kidney transplant, is another qualifying condition. Unlike with SSDI, enrollment is not automatic. You must actively sign up for Medicare. Coverage timing can vary, but it often starts on the first day of the fourth month of your dialysis treatments. To get started, the Social Security Administration provides trusted instructions on How to Enroll in Medicare for your specific situation. Taking this step yourself is critical to ensure your coverage begins without delay.

Qualifying with Amyotrophic Lateral Sclerosis (ALS)

For individuals diagnosed with Amyotrophic Lateral Sclerosis (ALS), also known as Lou Gehrig’s disease, Medicare provides immediate support. In this specific case, there is no 24-month waiting period. Your Medicare Part A and Part B coverage begins the very first month you receive your SSDI disability benefits. This accelerated path to medicare eligibility ensures that you get the comprehensive care you need right away, removing one less worry from your plate.

Understanding Eligibility for Each Part of Medicare (A, B, C, & D)

Navigating the different “parts” of Medicare can feel confusing, but it’s simpler than it looks. Think of it this way: qualifying for Original Medicare (Parts A and B) is the foundation. Once you have that in place, you unlock your eligibility for other types of coverage, like Part C and Part D. Understanding this progression gives you the clarity and confidence to see all your options.

Let’s break down the medicare eligibility requirements for each part, one step at a time.

Eligibility for Part A (Hospital Insurance)

For most people, Part A is premium-free. You earn this by working and paying Medicare taxes for at least 10 years (or 40 quarters). If you don’t have enough work credits, you may still be able to buy into Part A. This essential coverage helps pay for:

- Inpatient hospital stays

- Care in a skilled nursing facility

- Hospice care

- Home health care

Eligibility for Part B (Medical Insurance)

Part B is your medical insurance for doctor visits, outpatient care, and preventive services. It is optional and has a standard monthly premium. The good news is that if you are eligible for premium-free Part A, you are automatically eligible to enroll in Part B. Keep in mind that individuals with higher incomes may pay a larger premium, which is known as an Income-Related Monthly Adjustment Amount (IRMAA).

Eligibility for Part C (Medicare Advantage) & Part D (Drug Plans)

This is where your choices expand. To enroll in a Medicare Advantage (Part C) plan or a standalone Prescription Drug Plan (Part D), you must first be enrolled in both Part A and Part B. These plans are offered by private, Medicare-approved insurance companies and often bundle your coverage. You must also live in the plan’s specific service area to be eligible. These plans can offer extra benefits, but choosing the right one requires careful guidance.

Ready to explore Advantage plans? Compare your options with an expert.

Your Next Steps: How to Confirm Eligibility and Enroll

Understanding the rules is the first step. Now, it’s time to take action. Moving from asking “Am I eligible?” to confidently enrolling can feel like a huge leap, but it doesn’t have to be overwhelming. Taking the right steps in the right order ensures you get the coverage you’ve earned without facing costly penalties down the road. Here is a simple, clear path forward.

Using the Official Medicare Eligibility Tool

Your first official step is to confirm your status directly with the source. The official Medicare website offers a simple, secure eligibility calculator. This tool provides a definitive answer based on your personal information. Before you begin, have these details ready:

- Your date of birth

- Your work history and your spouse’s work history

- Information about any disability benefits you may receive

You can access the tool here: Official Medicare.gov Eligibility & Premium Calculator.

Key Enrollment Periods You Cannot Miss

Timing is everything with Medicare. Missing your enrollment window can lead to lifelong penalties and gaps in your health coverage. Here are the most important periods to know:

- Initial Enrollment Period (IEP): This is your primary 7-month window to sign up. It begins 3 months before the month you turn 65, includes your birthday month, and ends 3 months after.

- Special Enrollment Period (SEP): If you are still working past 65 and have credible health coverage from an employer, you may qualify for an SEP. This allows you to enroll later, typically after you stop working, without penalty.

A crucial warning: If you miss your IEP and don’t qualify for an SEP, you could face a permanent late enrollment penalty for Medicare Part B. This penalty is added to your monthly premium for as long as you have coverage. We help our clients avoid this mistake every day.

From Confusion to Confidence: How an Advisor Can Help

Confirming your Medicare eligibility is just the beginning. Next, you have to navigate the maze of choices: Original Medicare, Advantage Plans, Medigap, Part D… which path is right for you? This is where true peace of mind comes from trusted guidance.

An independent advisor works for you, not an insurance company. Unlike a captive agent who can only offer one company’s products, an independent expert provides unbiased comparisons of all your options. We simplify the jargon, help you avoid common enrollment mistakes, and ensure the plan you choose truly fits your healthcare needs and budget. Let us help you move from confusion to confidence. You can get started with a no-pressure consultation by visiting us at www.paulbinsurance.com.

Your Path to Medicare Clarity Starts Now

Understanding your medicare eligibility is the foundational step toward securing your healthcare future with confidence. As this guide has shown, your path might begin at age 65, or it could start earlier due to a qualifying disability or health condition. It’s also vital to remember that the requirements for each part of Medicare-from hospital coverage in Part A to prescription drugs in Part D-are distinct, making it crucial to know exactly where you stand.

But you should never have to navigate this maze alone or feel pressured into a decision. As an unbiased, independent broker, our commitment is to you, not an insurance company. We listen to your needs and help you compare plans from over 40+ carriers to find the one that truly fits your life and budget. Our goal is simple: to help seniors move from confusion to confidence.

Take the next step toward complete peace of mind. Schedule Your Free, No-Obligation Medicare Consultation Today and let our team provide the simple, clear guidance you deserve.

Frequently Asked Questions About Medicare Eligibility

What if I don’t have enough work credits for premium-free Part A?

This is a common worry, but you still have options. If you don’t qualify for premium-free Part A through your own work history, you may be eligible based on your spouse’s record. If that’s not an option, you can buy Part A coverage. The monthly premium depends on how many work credits you have accumulated. We can help you look at the specific costs and determine the most affordable path forward, ensuring you get the hospital coverage you need.

Can I get Medicare if I am a non-citizen or legal resident?

Yes, you can qualify for Medicare as a legal resident. To meet the medicare eligibility requirements, you must have lived in the U.S. legally for at least five consecutive years and be age 65 or older (or qualify through a disability). Navigating the documentation can feel overwhelming, but it doesn’t have to be. We are here to provide simple, clear guidance to help you confidently complete your enrollment and secure the healthcare coverage you deserve.

I’m still working at 65 with employer health insurance. Do I need to sign up for Medicare?

This is a critical question where making the right choice saves you from costly penalties. If your employer has 20 or more employees, you can likely delay enrolling in Part B without a penalty. However, for smaller companies, you may need Part B to avoid gaps in coverage. Most people still enroll in premium-free Part A. We can help you analyze your specific situation to make the right decision and avoid any costly missteps with complete confidence.

How much does Medicare cost if I am eligible?

Understanding costs is key to peace of mind. For most people, Part A (Hospital Insurance) is premium-free. Part B (Medical Insurance) has a standard monthly premium, which is $174.70 in 2024 for most individuals, though this amount can be higher depending on your income. Beyond premiums, you’ll also have deductibles and coinsurance. We simplify these costs so you can budget effectively and choose a plan that fits your financial needs without any surprises.

What is the penalty for enrolling in Medicare Part B late?

The Part B late enrollment penalty is a costly and permanent mistake we help our clients avoid. For each full 12-month period you could have had Part B but didn’t sign up, your monthly premium will permanently increase by 10%. For example, delaying for two years means a 20% penalty added to your premium for life. Getting trusted guidance during your Initial Enrollment Period is the best way to steer clear of these expensive errors.

I am eligible for Medicare due to a disability. What happens when I turn 65?

When you turn 65, your reason for eligibility simply shifts from disability to age. This transition gives you a new Initial Enrollment Period, which is a valuable opportunity to review and change your coverage. You can switch from Original Medicare to a Medicare Advantage plan, or vice versa, or select a new Part D plan. This is the perfect time to ensure your plan still meets your health and budget needs as you enter a new phase of life.