Medicare Explained

If you’re looking for the most affordable Medicare Advantage Plan with the best coverage it’s time to speak with us. We are the specialists in Medicare Advantage Plans.

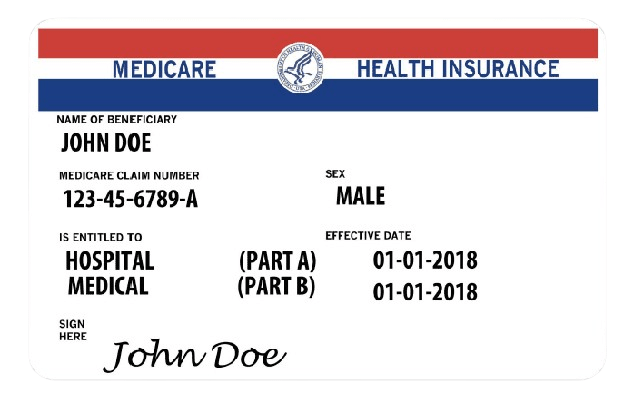

What is Medicare?

Medicare is the United States’ federal health insurance program for people who are 65 or older.

It is also available for certain people younger than 65 with disabilities or people with End-Stage Renal Disease. There are several parts to Medicare that contain different coverage.

What Are the Parts of Medicare?

There are several “parts” to Medicare that contain different coverage. Most people are familiar with “Part A” and “Part B”, which are a part of Original Medicare. Medicare also includes “Part C” and “Part D”.

1. Hospital Insurance: Medicare Part A is often referred to as hospital insurance because it primarily covers inpatient hospital stays, as well as certain skilled nursing facility care, hospice care, and some home health care services.

2. Automatic Enrollment for Most: Most individuals become eligible for Medicare Part A automatically when they turn 65 years old and are either receiving Social Security benefits or are eligible to receive them. Some individuals under 65 with certain disabilities or specific medical conditions may also qualify for Medicare Part A.

3. Coverage Benefits: – Inpatient Hospital Care: Part A covers the costs associated with semi-private rooms, meals, general nursing, and other hospital services and supplies during an inpatient stay.

Skilled Nursing Facility Care: Part A covers skilled nursing care and rehabilitation services in a skilled nursing facility under certain conditions, typically after a hospital stay.

Hospice Care: Part A provides coverage for hospice care for individuals with a terminal illness, including medical and support services for managing pain and symptoms, as well as emotional and spiritual support for both the individual and their family.

Home Health Care: Part A covers limited home health care services for individuals who are homebound and require skilled nursing care, physical therapy, occupational therapy, or speech-language pathology services.

4. Costs and Premiums: – Most people do not pay a premium for Medicare Part A if they or their spouse have worked and paid Medicare taxes for a certain period. – However, beneficiaries may be responsible for deductibles, coinsurance, and copayments for certain services covered under Part A.

5. Enrollment: – As mentioned earlier, most individuals are automatically enrolled in Medicare Part A when they turn 65 if they are receiving Social Security benefits. – Those who are not automatically enrolled can sign up for Medicare Part A during their Initial Enrollment Period, which typically starts three months before their 65th birthday and lasts for seven months.

6.Medicare Advantage (Part C): – While Medicare Part A provides coverage for hospital services under Original Medicare, beneficiaries also have the option to enroll in Medicare Advantage (Part C) plans offered by private insurance companies approved by Medicare. These plans often include coverage for hospital services along with additional benefits such as prescription drug coverage and routine dental or vision care. In summary, Medicare Part A plays a crucial role in providing coverage for hospital and related care for eligible individuals aged 65 and older, as well as certain individuals under 65 with disabilities. It offers essential coverage for inpatient hospital stays, skilled nursing facility care, hospice care, and limited home health care services, helping to ensure access to necessary medical care for Medicare beneficiaries.

Surgeries, lab work, and preventative services are all covered under Part B.

- Provider services:

Services deemed medically necessary are covered under Part B. - Durable medical equipment:

Equipment that serves a medical purpose, able to withstand repeated use, and appropriate for home use, is covered. For example, diabetic supplies. - Home health services:

If you are home-bound and need skilled nursing or therapy care, you’re covered under Part B. - Ambulance services:

Emergency transportation by ambulance. Limited coverage for non-emergency transportation is available in which there is no safe alternative as long as it is medically necessary. Preventative services: Outpatient physical, speech, and occupational therapy services are covered as long as they are administered by a Medicare-certified therapist. - X-rays and lab tests:

All doctor ordered x-rays and lab tests are covered. - Chiropractic care:

Only when medically necessary to fix subluxation of the spine. - Certain prescription drugs:

Certain drugs such as immunosuppressants, select anti-cancer, select antiemetic, select dialysis, and other typical drugs administered by a physician.

1. All-in-One Coverage: Medicare Advantage plans provide all the benefits of Original Medicare (Part A and Part B) and often include additional coverage such as prescription drugs (Part D), dental, vision, hearing, and wellness programs. Some plans may also offer benefits not typically covered by Original Medicare, like fitness memberships or transportation to medical appointments.

2.Managed Care Models: Most Medicare Advantage plans operate under managed care models such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), or Private Fee-for-Service (PFFS) plans. These plans typically have networks of healthcare providers (doctors, hospitals, and other healthcare facilities) that participants must use to receive coverage, although some plans offer out-of-network coverage at higher costs.

3. Premiums and Cost-Sharing: Medicare Advantage plans often have their own monthly premiums in addition to the Part B premium, although some plans offer premiums as low as $0. Participants may also be responsible for additional costs such as deductibles, copayments, and coinsurance, which can vary among plans.

4.Enrollment: Medicare beneficiaries can enroll in a Medicare Advantage plan during certain enrollment periods, including the Initial Enrollment Period (when first eligible for Medicare), the Annual Enrollment Period (from October 15 to December 7 each year), or during a Special Enrollment Period if they qualify due to certain life events.

5.Coverage Options: Medicare Advantage plans may offer different coverage options, including Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, Private Fee-for-Service (PFFS) plans, Special Needs Plans (SNPs), and Medical Savings Account (MSA) plans. Each type of plan has its own rules and restrictions regarding network providers, referrals, and out-of-pocket costs.

6. Extra Benefits: Many Medicare Advantage plans offer extra benefits beyond what Original Medicare provides, such as coverage for vision, dental, hearing, and wellness programs. Some plans also include prescription drug coverage (Part D) as part of their package, while others may require participants to enroll in a separate Part D plan.

7. Quality Ratings: Medicare Advantage plans are rated on a five-star scale by the Centers for Medicare & Medicaid Services (CMS) based on factors such as quality of care and customer satisfaction. These ratings can help beneficiaries compare plans and make informed decisions about their healthcare coverage. Overall, Medicare Part C (Medicare Advantage) offers beneficiaries an alternative way to receive their Medicare benefits through private insurance companies. While these plans may provide additional benefits and cost-saving opportunities, it’s important for individuals to carefully compare plan options and consider their healthcare needs and budget before enrolling.

1.Purpose: Medicare Part D was created to make prescription medications more affordable for Medicare recipients. It provides coverage for prescription drugs, helping beneficiaries manage the costs of necessary medications.

2.Coverage through Private Insurance Companies: Part D plans are not directly provided by the government. Instead, private insurance companies approved by Medicare offer these plans. These private companies offer a variety of Part D plans with different lists of covered drugs and pricing options. Beneficiaries have the flexibility to choose the Part D plan that best suits their needs.

3. Enrollment: Enrolling in Medicare Part D is optional but highly recommended, especially for individuals who regularly take prescription medications. You can enroll in a Part D plan during your Initial Enrollment Period (IEP) when you first become eligible for Medicare, during the Annual Enrollment Period (AEP) that takes place from October 15 to December 7 each year, or during a Special Enrollment Period (SEP) if you meet the criteria.

4.Costs: Part D plans have varying monthly premiums, depending on the plan and the insurance company. Beneficiaries may also be responsible for additional costs, including an annual deductible and copayments or coinsurance for their prescriptions. Those with low incomes may qualify for Extra Help (Low-Income Subsidy), which can assist in reducing their Part D expenses.

5.Coverage Tiers: Part D plans typically classify prescription drugs into different tiers, such as generic drugs, preferred brand-name drugs, and non-preferred brand-name drugs. The tier to which your drug belongs determines the amount you will have to pay for it.

6. Coverage Gap (Donut Hole): In the past, there was a coverage gap known as the “Donut Hole,” where beneficiaries had to pay a higher percentage of their medication costs. The Affordable Care Act (ACA) has made significant changes to the Donut Hole, gradually closing it. Now, beneficiaries pay a reduced percentage for both brand-name and generic drugs during this coverage gap.

7.Catastrophic Coverage: Once you have spent a certain amount on prescription drugs in a calendar year (known as the out-of-pocket threshold), you enter the catastrophic coverage phase. During this phase, you pay a reduced cost for your medications for the remainder of the year.

8. Drug Formularies: Each Part D plan has its own formulary, which is a list of drugs covered by the plan. It is crucial to review the formulary of a Part D plan before enrolling to ensure that it covers the medications you require.

9.Choosing a Part D Plan: Beneficiaries should carefully compare Part D plans to find one that covers their specific medications and fits their budget. The Medicare Plan Finder tool on the Medicare website can help you compare plans and make an informed decision.

10.Continuous Eligibility: Once you enroll in a Part D plan, you will have continuous eligibility and can switch plans during the Annual Enrollment Period if necessary. In summary, Medicare Part D is a valuable program that helps Medicare beneficiaries access affordable prescription medications. When selecting a Part D plan, it is important to consider your prescription drug needs, current medications, and budget. Additionally, reviewing your Part D coverage annually during the Annual Enrollment Period is crucial to ensure that your plan continues to meet your requirements.

Frequently Asked Questions

I hear this question a lot, Medicare used to be timed with receiving 100% of social security benefits at age 65. Now to collect 100% of your entitled social security benefits you will need to be older than 65, so many people are opting to wait past 65 to collect. If you decide to collect social security benefits before or on your 65th birthday Medicare is automatic. For those who opt to receive social security after 65 Medicare is not automatic and you have to enroll yourself.

Yes, most people will have to pay for Medicare part B the base premium for 2022 is $170.10. Some people may pay more based on their income. Medicare has established a sliding scale.

Original Medicare can leave you with a lot of out-of-pocket costs. Part A covers your hospital and inpatient stays after $1556 deductible that gets paid per occurrence. Part B of Medicare has a smaller deductible $233 and then covers up to 80% of doctors and outpatient bills. Original Medicare does not have a maximum out of pocket, which means there is no cap or limit to your out-of-pocket cost with original Medicare. Plus, original Medicare does not cover prescription drugs.

Medicare advantage plans are federally funded, and they may set up their premiums and fees the way they want to. Many carriers offer zero premium plans across the country and many times the plans have just as good or even better benefits than plans with a monthly premium.

For most people Medicare enrollment should happen during your initial enrollment period, which begins three months before you turn 65 and runs three months after the month you turn 65. There are several different special election periods as well depending on your circumstances. Click here to learn more

The good news is that Medicare brokers get paid by the insurance companies they represent. And you pay the same rate for your insurance if you use a Medicare consultant (broker). There is no extra fee or cost for enrolling through a broker. This means you pay ABSOLUTELY NOTHING for our help.

That depends on how many employees are on the group health insurance. If 20 or more employees are covered on the group plan you can delay your Medicare enrollment without any penalties. If the group is smaller than 20 you will need to enroll to avoid pHow does a Medicare broker get paid?

NO, it does not. Neither Medicare nor Medicare advantage plans will cover long term care. Long term care insurance is a completely different insurance policy.

In general Medicare does not cover dental unless it is considered medically necessary. Ex, oral cancer, or infection. Medicare does not cover routine dental, or anything cosmetic.