Look, I’ve been helping LA County seniors navigate Medicare for nearly two decades, and one of the most common questions I get is: “Does it really matter where I live?”

The answer? Absolutely.

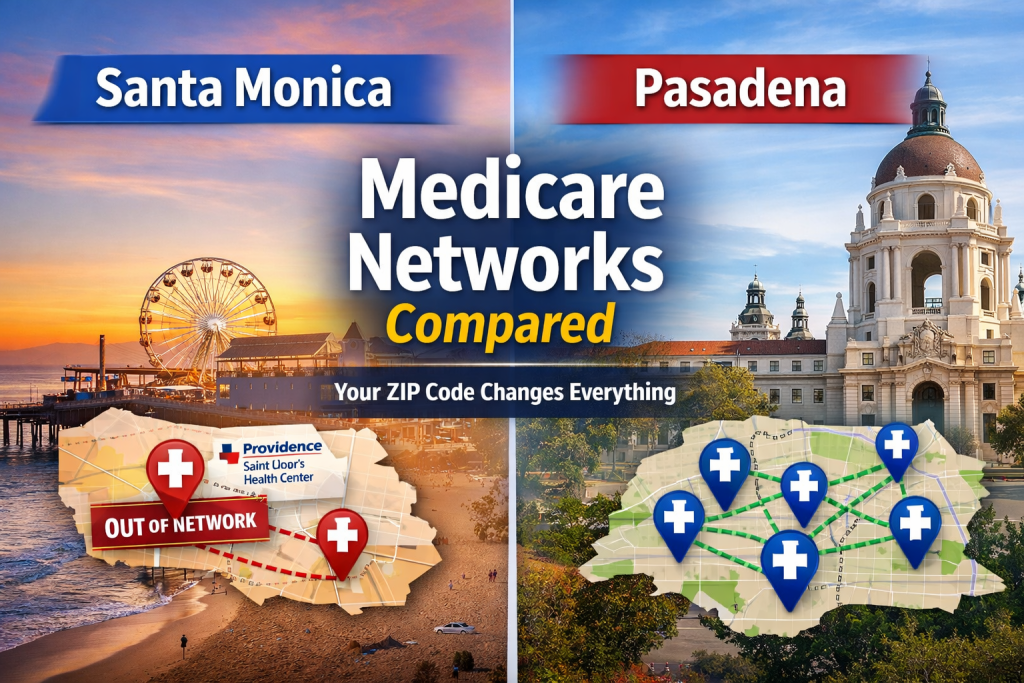

Let me tell you what’s happening right now in Santa Monica versus Pasadena—because the differences aren’t just interesting, they could cost you thousands of dollars or, worse, access to your doctors.

Key Takeaways: What You Need to Know Right Now

If you only remember 5 things from this article, make it these:

- Santa Monica’s Big 2026 Problem: Providence Saint John’s Health Center is OUT of UnitedHealthcare Medicare Advantage networks as of January 1, 2026. If you’re a UHC member in Santa Monica, you need to act during the MA Open Enrollment Period (Jan 1 – Mar 31, 2026) or you’ll lose access to your hospital.

- Pasadena Is More Stable: Huntington Hospital has strong relationships with most major carriers (UnitedHealthcare, SCAN, Anthem, Aetna, Alignment, and more). Network disruptions are less common in Pasadena because there’s more provider diversity.

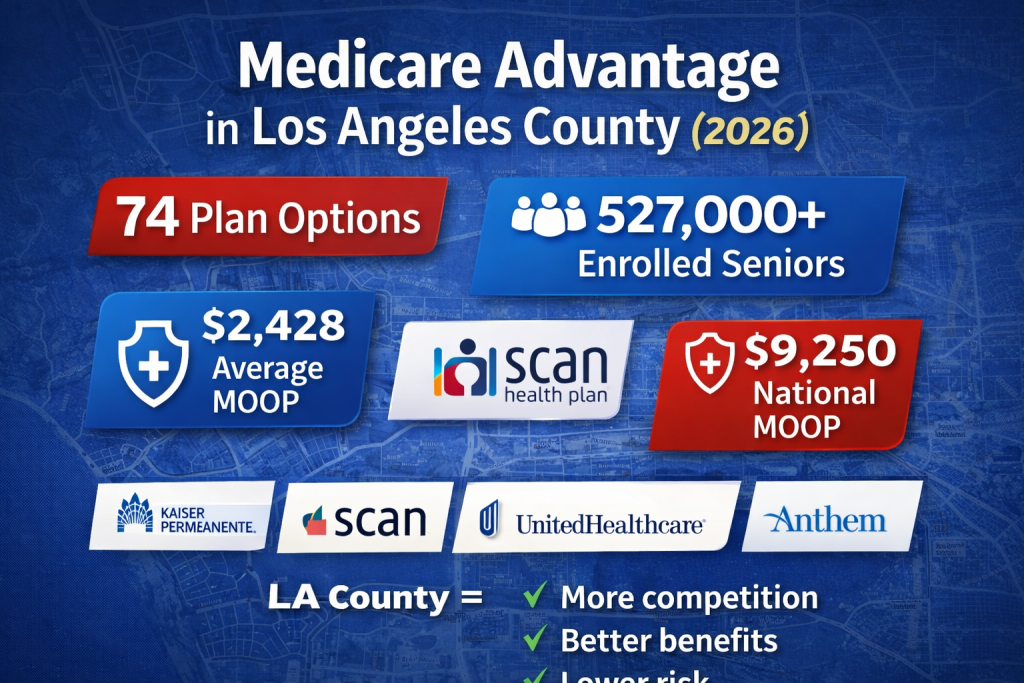

- LA County Has Insanely Good Medicare Advantage Plans: With 527,000+ MA members and 74 different plans competing for your business, LA County offers some of the lowest maximum out-of-pocket limits in the country (average $2,428 vs. $9,250 national max) and benefit-rich extras you won’t find elsewhere—Social Security givebacks, robust dental, OTC allowances, and more.

- Not All Plans Want You (And That’s Okay): Every Medicare Advantage plan is designed for a specific type of member. Some want healthy seniors. Some specialize in chronic conditions. Some target dual-eligible beneficiaries. The key is finding which plan wants someone like YOU—and whether that plan includes YOUR doctors.

- Medigap = Freedom, Medicare Advantage = Savings: If you want to see any doctor anywhere (Providence, UCLA, Cedars, Huntington—doesn’t matter), Medigap Plan G ($162-$250/month) gives you total freedom. If you’re healthy and want low costs with rich extras, Medicare Advantage ($0-$45/month) can save you thousands—but you’re locked into networks that can change.

Bottom line: Your ZIP code determines which hospitals are nearby, which medical groups dominate, how many plan options you have, and how much risk you face from network changes. Santa Monica = fewer options, higher disruption risk. Pasadena = more options, more stability.

The 2026 Wake-Up Call: Santa Monica Just Got Complicated

If you live in Santa Monica and you’re on a UnitedHealthcare Medicare Advantage plan, we need to talk.

Here’s what happened: Effective January 1, 2026, Providence Saint John’s Health Center—Santa Monica’s premier hospital—is out-of-network for UnitedHealthcare Medicare Advantage HMO members. This isn’t a small change. This affects every Providence-affiliated doctor, every specialist at Saint John’s, and thousands of Santa Monica seniors who thought their coverage was locked in.

What This Means for You

If your cardiologist practices at Saint John’s, if you’ve been seeing a Providence specialist for years, if you planned on using that hospital because it’s 10 minutes from your house—you now have a decision to make:

- Switch Medicare Advantage plans during the Medicare Advantage Open Enrollment Period (January 1 – March 31, 2026) to a carrier that still includes Providence

- Find new doctors who accept your current UnitedHealthcare plan

- Consider switching to a Medigap plan where you can see any doctor who accepts Medicare (including all of Providence)

This is exactly why I always tell people: Medicare Advantage networks are the single biggest variable in your coverage. And when you live in a place like Santa Monica where one major health system dominates, a network change like this is seismic.

Meanwhile, in Pasadena: Business as Usual (Mostly)

Now let’s drive 20 minutes east to Pasadena.

Pasadena seniors with Medicare Advantage haven’t experienced the same network earthquake. Huntington Hospital—Pasadena’s flagship medical center—has strong, stable relationships with the major carriers. Through its partnership with Optum Care Network, Huntington accepts:

- UnitedHealthcare Medicare Advantage plans

- SCAN Health Plan

- Anthem Blue Cross

- Blue Shield of California

- Aetna

- Alignment Health Plan

- Molina Healthcare

- WellCare

- And a few other regional carriers

The key difference? Pasadena doesn’t rely as heavily on one single health system. You’ve got Huntington, you’ve got access to UCLA Health, you’re close to Methodist Hospital in Arcadia, and you’ve got medical groups spread throughout the San Gabriel Valley.

Translation: If one carrier drops a network, you’ve got options. Santa Monica? Not so much.

The Real Reason ZIP Codes Matter: Hospital Networks

Here’s something most people don’t realize until it’s too late: Medicare Advantage plans are built around medical groups and hospitals.

In Santa Monica, the healthcare landscape looks like this:

- Providence Saint John’s Health Center (now OUT of UnitedHealthcare MA)

- UCLA Health Santa Monica Medical Center (IN-network for UCLA’s own MA plans, Kaiser, SCAN, others)

- Saint John’s Physician Partners (follows Providence network rules)

In Pasadena, you’ve got:

- Huntington Hospital (widely accepted, Optum partnership)

- Huntington Health Physicians (contracted with most major MA plans)

- Access to Glendale, Arcadia, and Alhambra facilities

- UCLA Health Pasadena locations

The bottom line: Santa Monica has fewer hospitals and more network concentration risk. Pasadena has more diversity and network stability.

Why LA County Has So Many Medicare Advantage Options (And Why That Actually Matters)

Here’s something you need to understand about the Medicare Advantage market: insurance companies follow the money.

Los Angeles County has over 527,000 people enrolled in Medicare Advantage plans—that’s a massive market. And when you have that kind of senior population density, carriers compete hard for your business.

What that means for you:

In LA County, you’re not choosing between 3 or 4 plans. You’re choosing from 74 different Medicare Advantage plans in 2026. That includes:

- National carriers (Kaiser, UnitedHealthcare, Humana, Aetna)

- Regional powerhouses (SCAN, Anthem, Blue Shield of California)

- Innovative newcomers (Alignment Health Plan, Clever Care)

- Safety-net plans (Molina, WellCare, LA Care)

- Specialty carriers (UCLA Health MA, Providence Health Assurance)

But here’s the catch: All those options don’t mean all those plans are available in YOUR specific ZIP code—or that they’re all worth considering.

The ZIP Code Reality Check

Change your ZIP code by 10 miles in LA County and your plan options can shift dramatically.

Example: A 90402 Santa Monica ZIP code might have access to 60+ plans, but only 15 of those include Providence Saint John’s. A 91101 Pasadena ZIP code might have 65+ plans, with 40+ including Huntington Hospital.

Why? Because Medicare Advantage plans contract with specific medical groups and hospital systems. Santa Monica is dominated by Providence and UCLA networks. Pasadena has Optum/Huntington, plus UCLA, plus access to Glendale and San Gabriel Valley providers.

More seniors in an area = more plan choices. But more plan choices ≠ better if those plans don’t include YOUR doctors.

Not All Plans Want Everybody (And Not Every Plan Is Right for You)

Let me be blunt about something the TV commercials won’t tell you: Every Medicare Advantage plan is designed for a specific type of member.

Some plans are hunting for healthy, low-utilization seniors who won’t rack up claims. Other plans specialize in complex, chronically ill patients. Some want dual-eligible beneficiaries (Medicare + Medicaid). Others want affluent seniors willing to pay premiums for richer benefits.

Here’s how to decode which plan wants you:

$0 Premium HMO Plans with Rich Extras

These plans are betting you’re healthy and won’t use much healthcare, so they load up on attractive supplemental benefits to get you to enroll:

- Social Security giveback (get money back in your check—some plans offer up to $185/month)

- Over-the-counter (OTC) allowances ($50-$200/quarter for toiletries, first aid, vitamins)

- Dental allowances ($1,000-$3,000/year)

- Vision coverage (eye exams + $200-$400 for glasses)

- Hearing aids ($500-$2,500/year)

- Gym memberships (SilverSneakers, Renew Active, One Pass)

- Healthy food cards ($25-$100/month for groceries)

- Transportation (Lyft/Uber rides to appointments)

Examples in LA County: SCAN Classic, Alignment Health Plan, Clever Care, some Anthem plans

Who they’re good for: Healthy seniors who want extras and low monthly costs, don’t mind HMO restrictions, and are okay with moderate maximum out-of-pocket limits ($4,500-$6,000).

Low MOOP “Cadillac” Plans

These plans have shockingly low maximum out-of-pocket limits compared to most of the country—some as low as $1,500-$2,500 annual MOOP. In LA County, the average MOOP is $2,428, but plenty of plans come in well under that.

Who they’re good for: Seniors with chronic conditions, those who see specialists regularly, anyone worried about catastrophic medical costs.

PPO Plans for Snowbirds and Travelers

If you split time between LA and Arizona, or you travel extensively, PPO plans let you see out-of-network doctors (at higher cost-sharing) without being locked into one service area.

Examples: Aetna PPO, UnitedHealthcare PPO plans

Who they’re good for: People who won’t stay in LA County year-round, those who want maximum flexibility.

Special Needs Plans (D-SNPs)

If you qualify for both Medicare and Medi-Cal (dual-eligible), you have access to D-SNP plans that are loaded with benefits and have little to no cost-sharing.

Examples: Molina Dual Options, WellCare D-SNP, LA Care PASC-SEIU plans

Who they’re good for: Low-income seniors who qualify for both programs.

What About the Big Carriers? Here's How They Stack Up in Each City

Let me break down the major Medicare Advantage carriers and how they work differently in Santa Monica versus Pasadena.

Kaiser Permanente (4.5 Stars, 179,888 LA County Members)

Santa Monica: Kaiser has a medical center in West LA and accepts members throughout Santa Monica. But here’s the catch—Kaiser is a closed system. You must use Kaiser doctors and Kaiser hospitals. Period.

Pasadena: Same story. Kaiser is Kaiser everywhere. If you love the integrated model, it’s great. If you want flexibility, it’s limiting.

Who it’s good for: People who don’t mind staying in-network and value Kaiser’s integrated care model. Kaiser dominates LA County Medicare Advantage enrollment for a reason—it works really well for a lot of people.

SCAN Health Plan (4 Stars, Nonprofit, 72,344 Members)

Santa Monica: SCAN Classic is the second-most popular plan in LA County. It contracts with both UCLA Health and many community providers. With Providence out of UnitedHealthcare, SCAN has become more attractive for Santa Monica residents who want Saint John’s access.

Pasadena: SCAN has strong networks in Pasadena, including Huntington Hospital and the Optum network.

What’s special about SCAN: They’re a California-based nonprofit that’s actually expanding in 2026 while other carriers are pulling back. They offer culturally-tailored plans (SCAN Allied for Asian communities, SCAN Affirm for LGBTQ+ seniors, SCAN Inspired for women). Their benefits are legitimately generous—many plans include Part B givebacks, robust dental, and low MOOPs.

Who it’s good for: People who want a nonprofit plan, solid star ratings, strong supplemental benefits, and a carrier that’s committed to California long-term.

UnitedHealthcare (4 Stars, AARP Partnership, 47,965 Members)

Santa Monica: This is where it gets messy. UnitedHealthcare has the largest Medicare Advantage network in the country, BUT they just lost Providence. So if you’re in Santa Monica and you need Saint John’s, you must switch plans or switch carriers.

Pasadena: UnitedHealthcare still has excellent access through Huntington Hospital and the Optum network. No major disruptions here.

Who it’s good for: Pasadena residents who want PPO flexibility or the AARP-branded HMO-POS plans. Santa Monica residents should proceed with caution and verify their doctors are still in-network.

UCLA Health Medicare Advantage (New in 2025, Not Yet Rated)

This is the wildcard.

Santa Monica: UCLA Health launched its own Medicare Advantage plans in 2025, and if you want UCLA Santa Monica Medical Center or UCLA providers, this is your direct path. Two plans:

- Principal Plan: $0 premium, $0 copays for primary and specialty care

- Prestige Plan: $45/month premium, $0 copays, richer benefits

Pasadena: UCLA Health MA plans cover Pasadena (it’s all LA County), but Pasadena residents have historically used Huntington, not UCLA. Still, it’s an option.

Who it’s good for: Santa Monica residents who want UCLA access without worrying about network changes. It’s a 7,000+ provider network built specifically for LA County.

Alignment Health Plan (4 Stars, Tech-Forward)

Alignment is one of the newer, innovative carriers that’s grown fast in California. They’re big on their “Alignment Care Anywhere” digital platform and personalized care teams.

Who it’s good for: Tech-savvy seniors who like apps, virtual visits, and modern healthcare delivery. Strong in Orange County and expanding in LA.

Aetna (4.5 Stars)

Aetna offers both HMO and PPO options in LA County with competitive benefits and strong star ratings.

Who it’s good for: People who want a national brand with solid ratings and PPO flexibility options.

Anthem Blue Cross & Blue Shield of California (3-4 Stars)

Anthem has huge market share in LA County with multiple HMO and PPO options. Benefits vary widely by specific plan, so you really need to compare.

Who it’s good for: People who want a California-based carrier with extensive networks and lots of plan choices.

Molina & WellCare (Safety Net Carriers)

These carriers specialize in dual-eligible and lower-income beneficiaries. If you qualify for both Medicare and Medi-Cal, their D-SNP plans are incredibly comprehensive.

Who it’s good for: Dual-eligible seniors, those with limited income.

The Benefits Arms Race: What LA County Plans Are Offering in 2026

Because LA County has so much competition for Medicare beneficiaries, carriers are loading plans with extras you won’t find in other parts of the country. Here’s what’s actually available:

Social Security Giveback (Part B Premium Reduction)

Some plans will give you money back—up to $185/month—credited directly to your Social Security check. That’s real money. Some carriers offering this: SCAN, Alignment, Clever Care.

Over-the-Counter (OTC) Allowances

Many plans offer $50-$200 per quarter to spend on approved items: bandages, pain relievers, vitamins, toothpaste, etc. This adds up—that’s $200-$800/year in free stuff.

Comprehensive Dental

We’re not talking about just cleanings. Some plans cover up to $3,000/year in dental services including fillings, extractions, root canals, even dentures. Examples: SCAN plans, some Aetna plans.

Vision Coverage

Annual eye exams plus $200-$400 allowances for glasses or contacts. Some plans even cover a portion of LASIK.

Hearing Aids

This is huge—quality hearing aids can cost $2,000-$6,000 out-of-pocket. Many LA County plans cover $500-$2,500/year toward hearing aids.

Gym Memberships

SilverSneakers (most carriers), Renew Active (UnitedHealthcare), One Pass (SCAN)—free gym memberships at thousands of locations plus virtual fitness classes.

Healthy Food Benefits

Some plans give you $25-$100/month on a card to buy healthy groceries. This is a big deal if you’re managing diabetes or heart disease.

Transportation to Appointments

Free or low-cost Lyft/Uber rides to medical appointments. Some plans offer unlimited rides, others cap it at 24-48 rides/year.

In-Home Support Services

For members recovering from surgery or managing chronic conditions, some plans offer temporary in-home care assistance, meal delivery, even respite care for caregivers.

But here’s the thing: Not every plan offers all of this. And the plans with the richest extras sometimes have higher MOOPs or tighter networks. You have to actually compare what YOU value versus what YOU’ll use.

Out-of-Pocket Risk: LA County vs. The Rest of the Country

Let’s talk about something really important: maximum out-of-pocket limits (MOOP).

The MOOP is the absolute most you’ll pay in a calendar year for Medicare-covered services (excluding premiums and prescriptions). Once you hit it, the plan pays 100% of everything else.

National maximum MOOP for 2026: $9,250

LA County average MOOP: $2,428

Yeah, you read that right. LA County plans, on average, cap your risk at less than half the national average. And plenty of plans come in even lower—$1,500, $2,000, $2,500 annual MOOPs are common here.

Why? Competition. With 527,000 Medicare Advantage members in LA County and dozens of carriers fighting for market share, they’re undercutting each other on out-of-pocket risk to win enrollment.

What this means for you: If you have a bad health year—cancer diagnosis, major surgery, lengthy hospitalization—you’re financially protected at levels that would shock people in other states.

Medigap: The Zip Code Wild Card

Now let’s talk about the elephant in the room: Medigap Plan G.

Unlike Medicare Advantage, Medigap doesn’t have networks. You can see any doctor in the country who accepts Medicare. That means Providence, UCLA, Huntington, Cedars-Sinai—doesn’t matter. You’re covered.

But here’s where your ZIP code comes into play: Medigap premiums vary by location, age, gender, and tobacco use.

What Plan G Costs in LA County (2026)

While I can’t give you exact rates without running a quote (because every carrier prices differently), here’s what I see for 65-year-old non-smokers in the LA area:

- Standard Plan G: Ranges from $162/month to $250+/month depending on carrier

- High Deductible Plan G: Ranges from $44/month to $88/month (with a $2,950 annual deductible)

Santa Monica vs. Pasadena: Does It Change Your Medigap Rate?

Short answer: Sometimes, but not dramatically.

California uses community rating for most Medigap pricing, which means everyone in the same area pays similar premiums. However, some carriers price slightly differently by region within LA County.

Practical impact: A Santa Monica 90402 ZIP code versus a Pasadena 91101 ZIP code might see a $10-$30/month difference with certain carriers. Not huge, but over 20 years of retirement, that adds up to thousands.

The bigger point: With Medigap, your ZIP code doesn’t affect your access—only your price. With Medicare Advantage, your ZIP code affects both.

The Demographic Factor: Why Age and Income Matter

Let’s get real about who lives where and how that impacts Medicare choices.

Santa Monica

- Median age: 42.9 years

- 65+ population: 19.2%

- Median household income: $109,739

- Vibe: Coastal, affluent, older retirees who value provider choice and are willing to pay for it

What this means for Medicare: Santa Monica seniors often have the financial flexibility to choose Medigap Plan G ($200+/month) to keep access to top-tier providers like UCLA, Cedars-Sinai, and Providence. They value freedom of choice over low premiums.

Pasadena

- Median age: 39.9 years

- Median household income: $97,818

- Vibe: More diverse, slightly younger overall, strong middle-class senior population

What this means for Medicare: Pasadena seniors often compare Medicare Advantage $0 premium plans more carefully. They want good value and stable networks, which is why SCAN, UnitedHealthcare, and Anthem HMO plans are popular here.

So What Should You Actually Do?

Let me give you the straight talk based on where you live.

If You Live in Santa Monica:

Option 1: Go Medigap (Plan G or High Deductible Plan G)

- Best for: People who want total freedom to see any doctor, including Providence Saint John’s, UCLA, Cedars-Sinai, or any specialist without network restrictions

- Cost: $162-$250/month for standard Plan G, or $44-$88/month for High Deductible Plan G (plus the $2,950 deductible)

- Pros: Never worry about networks again. Travel anywhere in the U.S. and you’re covered.

- Cons: Higher monthly premium, need to add a separate Part D drug plan

Option 2: UCLA Health Medicare Advantage

- Best for: People who primarily use UCLA providers and want low or $0 copays

- Cost: $0/month (Principal) or $45/month (Prestige)

- Pros: Built for LA County, no network surprises with UCLA

- Cons: HMO restrictions, must stay in-network

Option 3: SCAN, Anthem, or Blue Shield Plans

- Best for: People who want a Medicare Advantage plan that still includes Providence Saint John’s

- Cost: Varies by plan, many $0 premium options

- Pros: Nonprofit option available (SCAN), stable networks, good supplemental benefits

- Cons: Still subject to network changes down the road

If You Live in Pasadena:

Option 1: Stick with Medicare Advantage (SCAN, UnitedHealthcare, Anthem, Aetna, Alignment)

- Best for: People who are healthy, use Huntington Hospital or Optum providers, and want low out-of-pocket costs

- Cost: Many $0 premium plans, average MOOP around $2,428 (some plans much lower)

- Pros: Low monthly cost, includes extras like dental/vision/gym, incredibly low MOOPs compared to national averages

- Cons: Must stay in-network, subject to plan changes

Option 2: Medigap Plan G

- Best for: People who want flexibility to see specialists at UCLA, Cedars, or Huntington without referrals

- Cost: $162-$250/month

- Pros: Total freedom, predictable costs, no network restrictions

- Cons: Higher premium, need separate Part D

Option 3: High Deductible Plan G

- Best for: Healthy Pasadena residents who want the security of Medigap but lower monthly costs

- Cost: $44-$88/month + $2,950 deductible

- Pros: Best of both worlds—freedom + low premium

- Cons: Need to budget for the deductible if you have a bad health year

The One Thing Most People Miss: Part D Costs

Whether you’re in Santa Monica or Pasadena, if you choose Medigap, you MUST add a standalone Part D prescription drug plan.

Medicare Advantage plans include drug coverage. Medigap does not.

2026 Part D changes you need to know:

- $2,000 out-of-pocket cap on drug costs (this is HUGE—used to be no cap)

- Monthly premiums vary wildly by plan ($0-$100+/month in LA County)

- You need to check YOUR drugs in the plan’s formulary

I’ve seen people save $3,000/year just by switching Part D plans. Don’t sleep on this.

My Take After 18 Years Doing This

Here’s what I tell my Santa Monica and Pasadena clients when they sit down with me:

If you’re in Santa Monica and you value Providence Saint John’s: Either switch to a carrier that includes them (SCAN, Anthem, Blue Shield), or go Medigap so you never have to worry about network changes again.

If you’re in Pasadena and healthy: Medicare Advantage can save you a ton of money. Your networks are stable. Huntington isn’t going anywhere. LA County has some of the lowest MOOPs in the country. Just review your plan every year during Annual Enrollment.

If you’re anywhere and you have chronic conditions or see multiple specialists: Seriously consider Medigap Plan G. The freedom to see any doctor without referrals or network restrictions is priceless when your health is on the line.

If you’re overwhelmed by 74 plan choices: That’s literally why I exist. Not every plan wants you, and not every plan is right for you. My job is to cut through the noise and find the 2-3 plans that actually make sense for YOUR situation.

What’s Happening Right Now (January 2026)

If you’re reading this during the Medicare Advantage Open Enrollment Period (January 1 – March 31, 2026), you have ONE CHANCE to switch your Medicare Advantage plan without waiting until fall.

Santa Monica UnitedHealthcare members: This is your window. Don’t wait.

Everyone else: Review your 2026 plan. Check if your doctors are still in-network. Compare your drug costs. See if there’s a better option with lower MOOP or richer benefits.

Let’s Make This Simple

Your ZIP code determines:

- Which hospitals are nearby (and which Medicare Advantage plans include them)

- Which medical groups dominate (Optum in Pasadena, Providence in Santa Monica)

- How many plan options you have (more seniors = more carriers competing for you)

- How much network disruption risk you face (high in Santa Monica, lower in Pasadena)

- What your Medigap premiums might be (varies slightly by location and carrier)

- What extra benefits are available (LA County plans are loaded compared to most of the country)

But here’s the thing: You have options.

With 74 Medicare Advantage plans in LA County, plus all the Medigap carriers, plus every Part D plan—yeah, it’s overwhelming. But it also means there’s almost certainly a plan that fits your specific situation perfectly.

That’s what I do—I help people in Santa Monica, Pasadena, and across LA County cut through the noise and find the Medicare plan that actually fits their life.

Because Medicare shouldn’t be confusing. It should just work.

Questions? Let’s Talk.

I’ve been doing this since 2007. I’ve helped over 5,000 Medicare consumers. I represent 40+ carriers with 200+ plan options across 34+ states.

And I don’t do high-pressure sales. I do education.

If you’re in Santa Monica, Pasadena, or anywhere in LA County and you want someone to actually explain your options (not just sell you something), let’s talk.

📞 631-358-5793

📧 medicare@paulbinsurance.com

🌐www.paulbinsurance.com

Because your ZIP code might change everything—but the right plan changes everything more.

Paul Barrett

Independent Medicare Insurance Broker

The Modern Medicare Agency

Serving Los Angeles County Since 2007