If you live in Huntington, New York, Medicare decisions can feel overwhelming — not because Medicare itself is confusing, but because how Medicare works here is very different from much of the country.

Huntington residents have access to some of the best healthcare systems on Long Island. That’s a great thing — but it also means Medicare choices must be made carefully. A plan that works well elsewhere, or looks great on TV, may not work the same way with the doctors, hospitals, and pharmacies you rely on locally.

This article is designed to help Huntington residents understand how provider networks, coverage options, and rising costs all come together — so you can make a decision that’s both medically and financially practical.

Why Medicare Decisions in Huntington Are Different

Medicare is a federal program, but healthcare is local.

In Huntington, Medicare decisions are shaped by:

- Which provider networks you use

- Which hospital systems matter to you

- Long Island’s high cost of living

- Rising healthcare and insurance costs

Unlike areas dominated by one hospital system, Huntington residents often receive care across multiple major networks. Medicare plans do not treat these networks equally — and that’s where problems often arise.

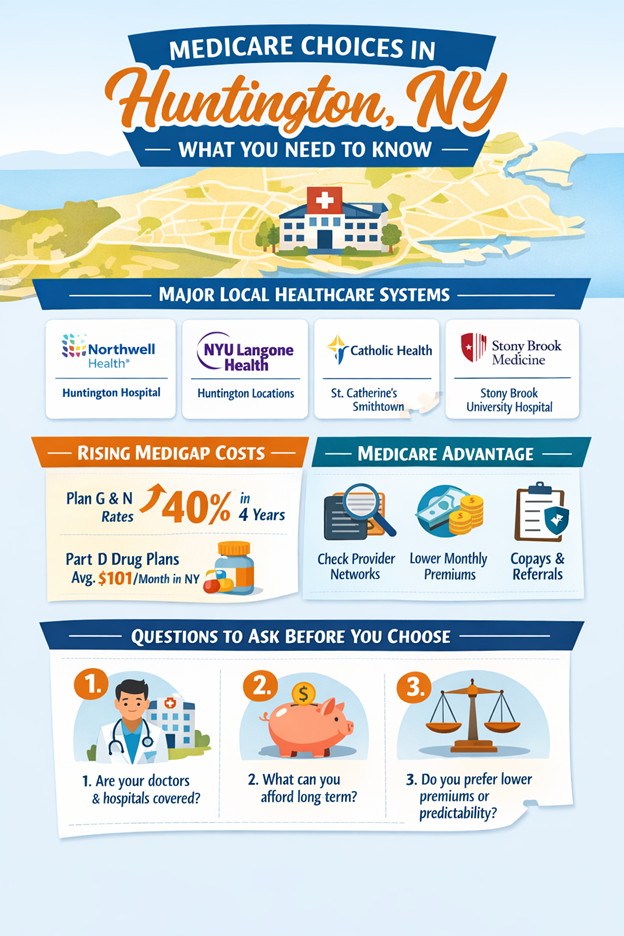

The Major Healthcare Systems Huntington Residents Use

Northwell Health (Dominant Local System)

Northwell Health is the largest healthcare system on Long Island and plays a central role in Huntington.

Local access includes:

- Huntington Hospital (371 beds, Level III Trauma Center, located right in town)

- Numerous Northwell-affiliated physician practices

- Family Health Center at Huntington

Because Huntington Hospital is literally in town, many residents assume it’s covered by all Medicare plans. That assumption can be costly if not verified.

NYU Langone Health (Rapidly Growing Presence)

NYU Langone has expanded significantly in and around Huntington.

Local and nearby facilities include:

- NYU Langone Huntington Medical Group (multiple locations in Huntington)

- Perlmutter Cancer Center in Huntington

- NYU Langone Hospital—Long Island (Mineola)

- NYU Langone Hospital—Suffolk (Patchogue)

Coverage for NYU Langone varies widely by plan.

Catholic Health (Major Regional Network)

Many Huntington residents rely on Catholic Health for specialty and hospital care.

Nearby facilities include:

- St. Catherine of Siena Hospital (Smithtown)

- St. Charles Hospital (Port Jefferson)

- St. Francis Hospital & Heart Center (Roslyn — renowned for cardiac care)

- St. Joseph Hospital (Bethpage)

- Multiple ambulatory centers across Long Island, including Melville

Some Medicare plans include Catholic Health broadly; others do not.

Stony Brook Medicine (Academic & Specialized Care)

For advanced or academic care, many residents turn to:

- Stony Brook University Hospital

Access to Stony Brook providers is highly plan-dependent and should always be reviewed in advance.

Original Medicare: Broad Access — But Rising Costs

One of the biggest advantages of Original Medicare (Part A & Part B) is access.

Approximately 94% of doctors nationwide accept Medicare, which means:

- No provider networks

- No referrals required

- Nationwide access to care

When paired with a Medicare Supplement (Medigap) plan like Plan G or Plan N, coverage can feel simple and predictable — with very few bills at the time of care.

However, this convenience comes with a growing cost.

The Rising Cost of Medigap in Huntington

Over the past four years, Medigap Plan G and Plan N premiums have increased by more than 40% for many Long Island residents.

This has created a real affordability issue:

- Premiums are rising faster than many Social Security increases

- A plan that felt affordable at 65 may feel very different at 75

- Long-term sustainability has become a concern for many Huntington seniors

Even though New York offers community rating and guaranteed issue, premium increases still happen — and Huntington has felt them more than many other areas.

Don’t Forget Medicare Part D Costs in New York

When choosing Original Medicare, prescription coverage is handled separately through Medicare Part D.

In New York:

- The average Part D premium is now around $101 per month

That means many Huntington residents considering Original Medicare are stacking:

- A Medigap premium

- A Part D premium

- The Part B premium

- Plus Long Island living expenses like property taxes and utilities

The coverage is excellent — but it is not practical for everyone.

Medicare Advantage: Networks Matter — But Costs Can Be More Predictable

Medicare Advantage plans bundle medical and often prescription coverage together and typically offer:

- Lower monthly premiums

- Defined copays for services

- Extra benefits like dental, vision, and hearing

However, these plans rely on provider networks.

In Huntington, that means:

- Not all plans include Northwell, NYU Langone, Catholic Health, or Stony Brook equally

- Referrals and prior authorizations may apply

- Costs are paid as care is used, rather than upfront in premiums

For many residents, Medicare Advantage is a financially practical option — but only if the plan works with their local providers.

The Medicare Advantage TV Ads vs. Huntington Reality

Those celebrity-endorsed commercials are everywhere. But what works well in lower-cost regions doesn’t always translate to Long Island.

Huntington is a:

- High-cost healthcare area

- Provider-dense market

- High-utilization region

Plans must be evaluated locally, not nationally.

Prescription Drug Coverage: A Growing Concern

With recent Medicare Part D changes:

- Formularies are shifting

- Pharmacy networks matter more than ever

- A plan that worked last year may not work the same way this year

Huntington residents using CVS, Walgreens, or local independent pharmacies should verify coverage annually — by drug and by pharmacy.

The Three Questions I Ask Every Huntington Resident Before Recommending Anything

Before discussing plans, these questions matter most:

1️⃣ Which doctors and hospital systems matter to you?

Especially Northwell, NYU Langone, Catholic Health, and Stony Brook.

2️⃣ How do you realistically use healthcare?

Specialists, frequency of visits, travel, and comfort with referrals all matter.

3️⃣ What matters more to you: lower monthly cost or predictability?

Some prefer higher premiums with minimal bills. Others prefer lower premiums and pay-as-you-go care.

There’s no right answer — only the right fit.

The Balanced Truth Huntington Residents Deserve

Medicare is not about choosing the “best” plan — it’s about choosing the most sustainable one.

✔ Original Medicare + Medigap offers outstanding access

✔ Medicare Advantage can offer meaningful cost control

✔ Rising Medigap and Part D costs must be acknowledged

✔ Local provider networks must be verified

Coverage that looks great on paper must also work financially and locally.

Final Thoughts for Huntington Residents

The best Medicare plan is not:

- The one on TV

- The one your neighbor chose

- The one with the most benefits listed

The best plan is the one that:

- Works with Huntington-area providers

- Fits Long Island’s cost of living

- Matches how you prefer to experience healthcare costs

- Holds up over time

With the right information, Medicare decisions don’t have to be stressful — even in a complex market like Huntington.

Helpful Next Steps

- Review your doctors, hospitals, and pharmacies

- Understand how each option works locally

- Ask questions before enrolling

- Re-review coverage each year

Medicare is manageable when local reality is part of the conversation.

Medicare in Huntington, NY – Frequently Asked Questions

Can I see any doctor in Huntington with Medicare?

If you have Original Medicare, you can see any doctor who accepts Medicare, and about 94% of doctors nationwide do. This gives Huntington residents broad access to local providers.

If you have a Medicare Advantage plan, you must usually stay within the plan’s provider network. This makes it important to confirm that your doctors, specialists, and hospitals are included before enrolling.

Do Medicare Advantage plans in Huntington include Huntington Hospital?

Some do — and some do not.

Huntington Hospital (Northwell Health) is included in certain Medicare Advantage plans, but not all. Even when the hospital is in-network, specific doctors or services may not be.

Always verify:

- The hospital

- Your primary care doctor

- Your specialists

before choosing a Medicare Advantage plan.

Is Medigap better than Medicare Advantage for Huntington seniors?

Neither option is automatically better.

- Medigap offers broad provider access and fewer out-of-pocket costs at the time of care.

- Medicare Advantage often has lower monthly premiums but requires using provider networks and paying copays as care is used.

For Huntington residents, the “better” option depends on budget, provider preferences, and comfort with cost-sharing.

Why are Medigap Plan G and Plan N premiums so high on Long Island?

Medigap premiums in Huntington and across Long Island have increased significantly in recent years — with Plan G and Plan N rising over 40% in the last four years for many residents.

Contributing factors include:

- High healthcare utilization on Long Island

- Rising hospital and specialist costs

- Regional medical pricing trends

Even with New York’s community rating protections, premiums can still increase annually.

Can I switch from Medicare Advantage to Medigap later in Huntington, NY?

Yes.

New York is a guaranteed issue state, meaning Huntington residents can enroll in a Medigap plan at any time, regardless of health conditions.

However, switching from Medigap to Medicare Advantage (or vice versa) can involve an adjustment in how healthcare costs are paid — from higher premiums with minimal bills to lower premiums with copays and per-service costs.

How much does Medicare Part D cost in New York?

In New York, the average Medicare Part D premium is around $101 per month, though costs vary by plan.

This is in addition to:

- The Medicare Part B premium

- Any Medigap premium (if applicable)

For Huntington seniors, Part D costs are an important part of the overall Medicare budget.

Why do Medicare TV ads not reflect the reality in Huntington?

Many Medicare Advantage plans are marketed nationally and designed for lower-cost healthcare regions.

Huntington is a:

- High-cost healthcare area

- Provider-dense region

- Market dominated by large systems like Northwell, NYU Langone, and Catholic Health

Plans must be evaluated based on local provider access, not national advertising.

Which healthcare systems should Huntington residents check before enrolling?

Before choosing a Medicare plan, Huntington residents should confirm access to:

- Northwell Health (including Huntington Hospital)

- NYU Langone Health

- Catholic Health

- Stony Brook Medicine

Not all Medicare Advantage plans treat these systems the same way.

Why do Medicare plans work differently for people living in the same town?

Two Huntington residents can have very different experiences with the same plan because:

- They use different doctors or specialists

- They rely on different hospital systems

- Their prescription needs differ

Medicare is highly individual — even at the local level.

Is Medicare Advantage a good option for Huntington residents on a fixed income?

For many Huntington seniors, yes.

Medicare Advantage plans can offer:

- Lower monthly premiums

- Predictable copays

- Built-in prescription coverage

However, they require careful review of provider networks and cost-sharing to ensure the plan works locally.

What is the biggest Medicare mistake Huntington residents make?

The most common mistake is choosing a plan based on:

- TV commercials

- Monthly premium alone

- Advice that doesn’t consider local doctors or hospitals

Local provider access and long-term affordability matter far more.

How often should Huntington residents review their Medicare coverage?

At least once a year, especially if:

- Your plan premiums increased

- Your doctors or prescriptions changed

- Your health needs changed

- Medicare plans change annually — even if you don’t.

What should I do before choosing a Medicare plan in Huntington?

Before enrolling, it’s important to:

- List your doctors, specialists, and hospitals

- Review prescription coverage and pharmacies

- Understand how costs are structured

- Compare options based on local provider access and budget