Having “the talk” about Medicare Supplements in Downstate New York

You know that moment when you’re sitting with a friend over coffee, and they start asking you about Medicare? For those of us who live and breathe this stuff, it happens all the time. And lately, the conversation keeps coming back to one thing: “How can I keep my Medicare coverage solid without my premiums eating me alive?”

If you live in Westchester, Staten Island, Queens, Brooklyn, the Bronx, or anywhere on Long Island, I want to have that coffee conversation with you right now. Because there’s a Medigap option that most New Yorkers have never heard of, and it might just be the answer you’re looking for.

The Three Players: What We’re Actually Comparing

Let’s talk real numbers for downstate New York in 2025:

Plan F – $419/month ($5,028/year)- The “Cadillac” plan that covers everything

- Only available if you were eligible for Medicare before 2020

- Total annual cost: $4,746

- The current “gold standard” for comprehensive coverage

- Total maximum annual cost: $4,042

- The option nobody’s talking about (but should be)

Why Plan F Still Matters (Even Though It’s “Closed”)

If you were eligible for Medicare before January 1, 2020, you’re part of an exclusive club. You can still get Plan F, and many of you are paying $419/month for it.

Here’s what you love about it: everything’s covered. You swipe your Medicare card, and there’s no deductible, no coinsurance, no surprises. It’s simple, it’s predictable, and you never think about it.

The problem? That $5,028 you’re paying each year is only going one direction: up. For the past four straight years, we’ve seen double-digit increases in this area. And because no new people can join Plan F, that pool of members keeps getting smaller and older, which means the insurance companies keep raising rates to cover claims.

Who should stick with Plan F? If you have significant ongoing health issues and visit doctors constantly, that predictability might be worth the premium. But if you’re relatively healthy, you might be leaving money on the table.

Plan G: The Current Favorite (For Good Reason)

When Plan F closed to new enrollees, Plan G became the new standard. At $372/month, it’s $47 less than Plan F. The only difference? You pay the $282 Part B deductible once a year before your coverage kicks in.

Let’s do the math: $372 × 12 = $4,464 + $282 deductible = $4,746 total annual cost.

Compare that to Plan F at $5,028, and you’re saving $282 per year. Not life-changing, but it’s something.

The appeal of Plan G: It’s comprehensive coverage with a tiny bit of skin in the game. After you meet that $282 deductible (usually happens in January or February), you’re covered at 100% for the rest of the year. You get the freedom to see any doctor who accepts Medicare anywhere in the country, no networks, no referrals, no prior authorizations.

The cons? Same issue as Plan F – those premium increases aren’t stopping. We’ve watched Plan G premiums climb year after year, and there’s no sign of it slowing down. At $372/month now, where will it be in five years? Ten years?

High Deductible Plan G: The Best-Kept Secret in New York Medicare

Okay, here’s where I get excited. Because this is the option that most people have never heard of, and when I show them the numbers, their eyes get wide.

High Deductible Plan G works just like regular Plan G, except you have a $2,950 annual deductible. Here’s what that means in real life:

You pay $91/month ($1,092/year) in premiums. Then, you’re responsible for your Medicare-approved costs until you hit $2,950 for the year. After that, the plan covers everything at 100%, just like regular Plan G.

Here’s the critical part most people miss: You’re not paying full price for those medical costs. You’re paying the Medicare-approved amounts, which are significantly lower than what uninsured people pay. Medicare has already negotiated the rates down.

Let’s Look at Real-World Scenarios

Scenario 1: You’re Pretty Healthy Let’s say you see your primary care doctor four times a year, have some routine labs, maybe a specialist visit or two. Your total Medicare-approved costs for the year are $1,200.

- High Deductible Plan G: $1,092 (premium) + $1,200 (your costs) = $2,292

- Regular Plan G: $4,746

- You save: $2,454

Scenario 2: You Have a Moderate Health Year You had some issues this year – maybe a small procedure, some additional specialist visits, more tests. Your Medicare-approved costs hit $2,000.

- High Deductible Plan G: $1,092 (premium) + $2,000 (your costs) = $3,092

- Regular Plan G: $4,746

- You save: $1,654

Scenario 3: You Hit the Deductible This was a tough year – maybe you had surgery, a hospital stay, extensive treatment. You hit that full $2,950 deductible.

- High Deductible Plan G: $1,092 (premium) + $2,950 (deductible) = $4,042

- Regular Plan G: $4,746

- You still save: $704

The Freedom Factor: Why This Matters in New York

Here’s something that doesn’t get talked about enough: New York has some of the best Medicare Supplement protections in the country. Because of community rating and guaranteed issue rights, you have flexibility that people in other states don’t have.

What does this mean for you? If you start with High Deductible Plan G and decide later it’s not working for you, you can switch to regular Plan G or Plan N during your birthday month each year – no health questions asked. That’s a New York advantage.

So you can try High Deductible Plan G, bank those savings, and if life throws you a curveball health-wise, you can switch to more comprehensive coverage. It’s like having a safety net under your safety net.

Who Is High Deductible Plan G Right For?

This plan makes tremendous sense if you:

- Are relatively healthy and don’t visit doctors frequently

- Are comfortable with some year-to-year variability in your healthcare costs

- Want the freedom of a Medigap plan (any doctor, no networks, no referrals)

- Are looking at your overall financial picture and want to reduce fixed monthly expenses

- Like having control over your healthcare dollars

- Are good about setting aside money for potential medical expenses

Who Should Probably Stick with Regular Plan G or Plan F?

You might want the predictability of a comprehensive plan if you:

- Have multiple chronic conditions requiring frequent care

- See specialists regularly

- Prefer knowing your exact costs upfront with no surprises

- Have significant ongoing prescription needs (though remember, that’s Medicare Part D, not your supplement)

- Want the absolute simplest healthcare experience possible

- Really value peace of mind over potential savings

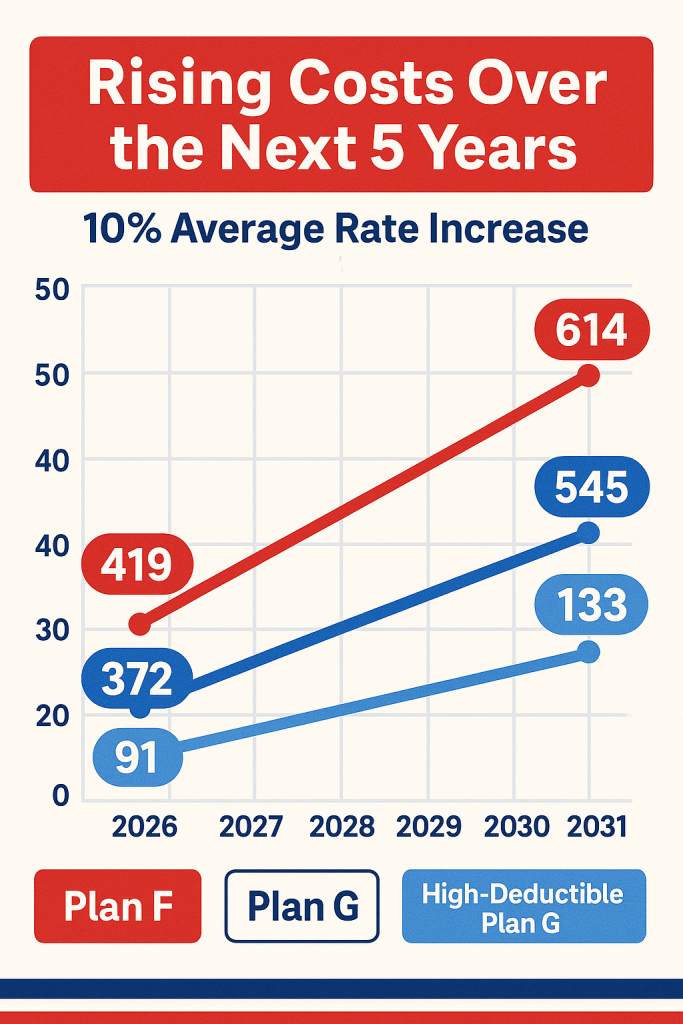

The Harsh Reality About Medicare Supplement Premiums

Here’s the conversation nobody wants to have, but we need to: Medicare Supplement premiums in downstate New York have been increasing by double digits for four straight years. Plan G has gone from affordable to expensive. Plan F is even worse.

And there’s no indication this trend is stopping. Insurance companies are watching their claims costs rise, they’re seeing more utilization, and they’re passing those costs along to you in the form of higher premiums.

Five years ago, that Plan G premium might have been $250/month. Now it’s $372. Where will it be in another five years? $500? $600?

This is exactly why High Deductible Plan G deserves your attention. At $91/month, even if premiums increase, you’re starting from a much lower base. A 10% increase on $91 is $9.10. A 10% increase on $372 is $37.20.

The Numbers Are the Numbers

Look, I can’t tell you which plan is “right” for you – that depends on your health, your finances, your comfort level with risk, and your personal preferences. But I can tell you this: the numbers don’t lie.

If you’re paying $419/month for Plan F, that’s over $5,000 a year. If you’re healthy enough to consider alternatives, you owe it to yourself to at least look at the math.

If you’re on Plan G at $372/month, you’re spending nearly $4,750 a year for coverage. High Deductible Plan G caps your maximum annual spending at $4,042, and for many people, the actual cost is far less.

What Should You Do Next?

First, don’t panic. If you’re on Plan F or Plan G and it’s working for you, that’s perfectly fine. You have great coverage, and there’s something to be said for peace of mind.

But if you’re tired of watching those premium increases year after year, or if you’re just curious about whether you could save money without giving up the freedom and flexibility of a Medigap plan, let’s have a real conversation about whether High Deductible Plan G might make sense for your situation.

Here’s what I’d recommend:

- Look at your actual healthcare usage – Pull out last year’s Medicare Summary Notices and add up your Medicare-approved costs (not what the doctor billed, but what Medicare approved). This will give you a realistic picture of what you’d pay under High Deductible Plan G.

- Consider your comfort level – Some people sleep better knowing they’ll never see a medical bill. Others are fine with some variability if it means saving thousands of dollars a year.

- Remember you have options –This is New York. You can change plans during any month of the year. You’re not locked in forever.

- Think long-term –If you’re 65 today, you might have 20+ years of Medicare premiums ahead of you. Small decisions now can add up to enormous differences over time.

Final Thoughts

Medicare Supplements were designed to give you freedom – freedom to see any doctor, freedom to travel, freedom from networks and referrals. But they shouldn’t trap you in premiums that keep climbing with no end in sight.

High Deductible Plan G isn’t the right answer for everyone, but for many New Yorkers, it’s the best-kept secret in Medicare. It offers real coverage, real protection, and real savings – sometimes thousands of dollars a year.

The numbers are the numbers. What you do with them is up to you.

Questions about your specific situation?

Every person’s healthcare needs — and budget — are different. If you want to talk through your options with someone who’s been guiding New Yorkers through Medicare for more than 18 years, I’m here to help.

No pressure. No sales pitch.

Just a real conversation — whether over coffee or on the phone — about what makes the most sense for you.

I’m Paul Barrett, founder of The Modern Medicare Agency (Paul B Insurance). I’m an independent Medicare broker licensed in New York and 33 other states, representing 40+ carriers and more than 200 plan options. My approach is simple: educate first, recommend second.

If you want clarity, confidence, and coverage that truly fits, I’d be honored to help you navigate the maze.