In 2022, we saw a significant upsurge in the number of people enrolled in Medicare Advantage plans from 2016. By 2023, about 60% of recipients will have signed up for these plans.

The reason is simple: people want more comprehensive healthcare coverage while keeping costs low.

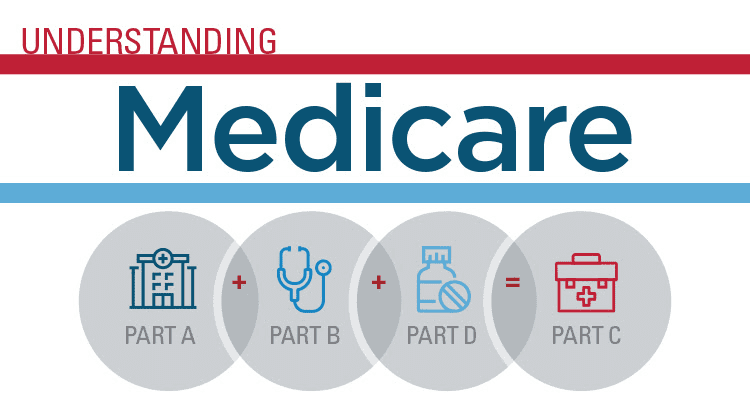

But cost aside, there are several other reasons to choose a Medicare Advantage plan (also known as Medicare Part C) over Original Medicare. We\’ve rounded up the top six below to help you make a well-informed decision that supports your health, lifestyle, and budget.

1. It Offers \”Bundled\” Coverage

With a Medicare Advantage plan, you get all the benefits of Medicare Part A (inpatient care and hospitalization) and B (outpatient care) in one place. Most plans also include part D (prescription drug coverage) unless you don\’t want it.

Many plans also offer add-ons, such as dental, vision, hearing, and fitness perks, allowing people to receive coverage in a very organized and efficient way. Beneficiaries love the convenience of having all parts of their Medicare coverage managed by one card and company instead of getting Original Medicare with a separate Part D and Medicare Supplement plan and then two more plans for dental and vision coverage.

All in all, recipients enjoy comprehensive coverage with a Medicare Advantage plan. It is a more affordable and convenient option that may or may not come with extra benefits, depending on where you live. So, rest assured that you\’ll get coverage that\’s as good as, or perhaps even better than Original Medicare.

2. It Is Designed to Meet Individual Needs

Medicare Advantage plans aim to meet individual needs, unlike Original Medicare, which provides the same coverage for everyone.

Advantage plans come in many shapes to meet the unique needs of various sub-populations of Medicare beneficiaries. See some examples below.

- Health Maintenance Organization (HMO) plans generally have lower copays and out-of-pocket expenses. They provide more extra benefits than PPO plans.

- Preferred Provider Organization (PPO) plans often have larger provider networks and never require referrals. They work best for people who want more freedom but are on a budget.

There are also special needs plans, like:

- Dual Eligible Special Needs Plans (D-SNPs)—the most benefit-rich plans that help coordinate both Medicare and Medicaid coverage. These plans cover the costs of transportation, over-the-counter supplies, dental, vision, and more.

- Chronic Condition Special Needs Plans (C-SNPs)—designed for consumers with a specific chronic illness, such as chronic obstructive pulmonary disease (COPD) or diabetes. These plans offer cost-effective ways to manage these conditions.

All these types of Medicare Advantage plans offer all-in-one coverage—hospital, medical, and drug coverage to meet individual needs. Depending on the consumer\’s needs, the plan may offer a strong part D coverage for breathing medications or insulin and extra coverage for diabetic supplies.

Other plans may put money back into social security checks. Many consumers with VA benefits love this because they already receive most of their medical care from the VA but sometimes want a second opinion when they can\’t use it.

For low-income people, several plans offer many extra benefits like dental, vision, hearing, OTC supplies, healthy food cards, and more.

Discuss your options with a local Medicare agent today to get the personalized coverage you need.

3. Most Medicare Advantage Plans Charge Little to No Premium

One of the biggest reasons people choose a Medicare Advantage plan is that it may have low or $0 monthly premiums.

Additionally, most plans have low copays for doctor visits and common medical services, like primary care checkups, laboratory services, and preventative care, without requiring you to pay a deductible first. On the contrary, Original Medicare requires you to pay a Part B deductible of $226 before it covers doctor visits, and even after that, you\’re responsible for up to 20% of the doctor\’s fee.

Furthermore, Medicare Advantage plans cover annual physicals every year, with many plans offering gift cards to encourage consumers to stay on top of their preventative care. On the other hand, Original Medicare only covers one physical wellness visit—all annual physicals after that aren\’t included in the plan.

That said, please note that the cost of a Medicare Advantage plan is never standardized. Your overall charges will depend on your usage of medical services you need and how often you need them, the healthcare providers you visit, and the specific benefits outlined in your plan.

Medicare\’s base premium is $167.90, though. Typically, plans don\’t offer premium assistance, but with some Medicare Advantage plans, a portion of your premium goes back into your social security check. These plans are not offered everywhere, so talk to a reliable Medicare agent for more information. Many Medicare Advantage plans provide excellent coverage for $0 per month.

4. It Limits Your Out-of-Pocket Costs

All Medicare Advantage plans limit the out-of-pocket costs you pay during a year. Once the plan\’s limit is reached, you\’ll pay nothing for the medical services covered by Part A and Part B for the remainder of the year.

This cap on medical spending is especially beneficial for those with long-term medical conditions. With a Medicare Advantage plan, you\’ll never have to worry about catastrophic medical expenses.

5. It Allows Better Coordination of Care

Medicare insurance companies are putting in more and more effort to provide better coordinated care to beneficiaries to help prevent major illnesses.

Since all Medicare Advantage plans operate on a budget to be profitable, they are generally much better at coordinating care, unlike Original Medicare, which doesn\’t operate with a profit margin in mind.

If you have a Medicare Advantage plan, your doctors and hospitals will actively communicate to avoid issues like medication interactions, eliminate unnecessary expenses, and ensure the best possible preventative care for you.

HMOs and PPOs are great examples, as they mostly require beneficiaries to select a primary care physician who\’ll be responsible for coordinating their care across medical specialties and healthcare institutions. Many of these plans also offer in-home checkups and reward programs for beneficiaries who undergo regular preventative exams.

As confirmed by a study, coordinated medical care results in better patient satisfaction and improves medical staff experiences.

6. It Offers Emergency Care Outside the US

With some Medicare Advantage plans, you can access emergency medical care not only in the US but also when traveling to another country. If you travel frequently or spend much of your time outside the US, you should consider talking to a local Medicare agent regarding a plan that offers an extra benefit to cover urgently needed medical services abroad.

Find the Right Medicare Advantage Plan for Your Needs Today

Medicare Advantage plans are great alternatives to Original Medicare for health and drug coverage, as they allow consumers to get the most out of their health insurance in a bundled package.

Depending on your healthcare needs and the type of Medicare Advantage plan you go for, you\’ll be able to access more services at the exact cost or perhaps even cheaper than the Original Medicare program.

We recommend getting a free Medicare consultation with a local Medicare agent who knows about all the Medicare Advantage plans in your area. They\’ll help you find the best plan that meets your needs and leverage their connections to resolve any customer service issue that may arise.

At the Modern Medicare Agency, we have a team of insurance professionals specializing in Medicare. We have helped thousands of clients navigate Medicare over the last 17 years and would love the opportunity to help you.

During the initial consultation, our local agent will discuss all your needs, wants, and expectations. Based on your budget, they\’ll find a Medicare Advantage plan that meets your requirements and aligns with your health goals. Talk to one of our local Medicare agents today to decide which Medicare Advantage plan may be right for you.