Does the ‘alphabet soup’ of Parts A, B, C, and D leave you feeling overwhelmed? If you’re worried about making a costly mistake or simply don’t know where to begin with Medicare, take a deep breath. You are not alone. Navigating the maze of deadlines, plans, and confusing jargon is a common source of stress, but getting clear, simple answers is the first step toward peace of mind.

This guide is designed to provide that clarity. We are here to translate the complexities of the system into easy-to-understand language. In the next few minutes, we will break down what each part covers, explain the key differences between your options, and outline the important decisions you need to make. Our promise is simple: to help you move from a place of confusion to a state of confidence, fully prepared to choose the right path for your healthcare future.

Key Takeaways

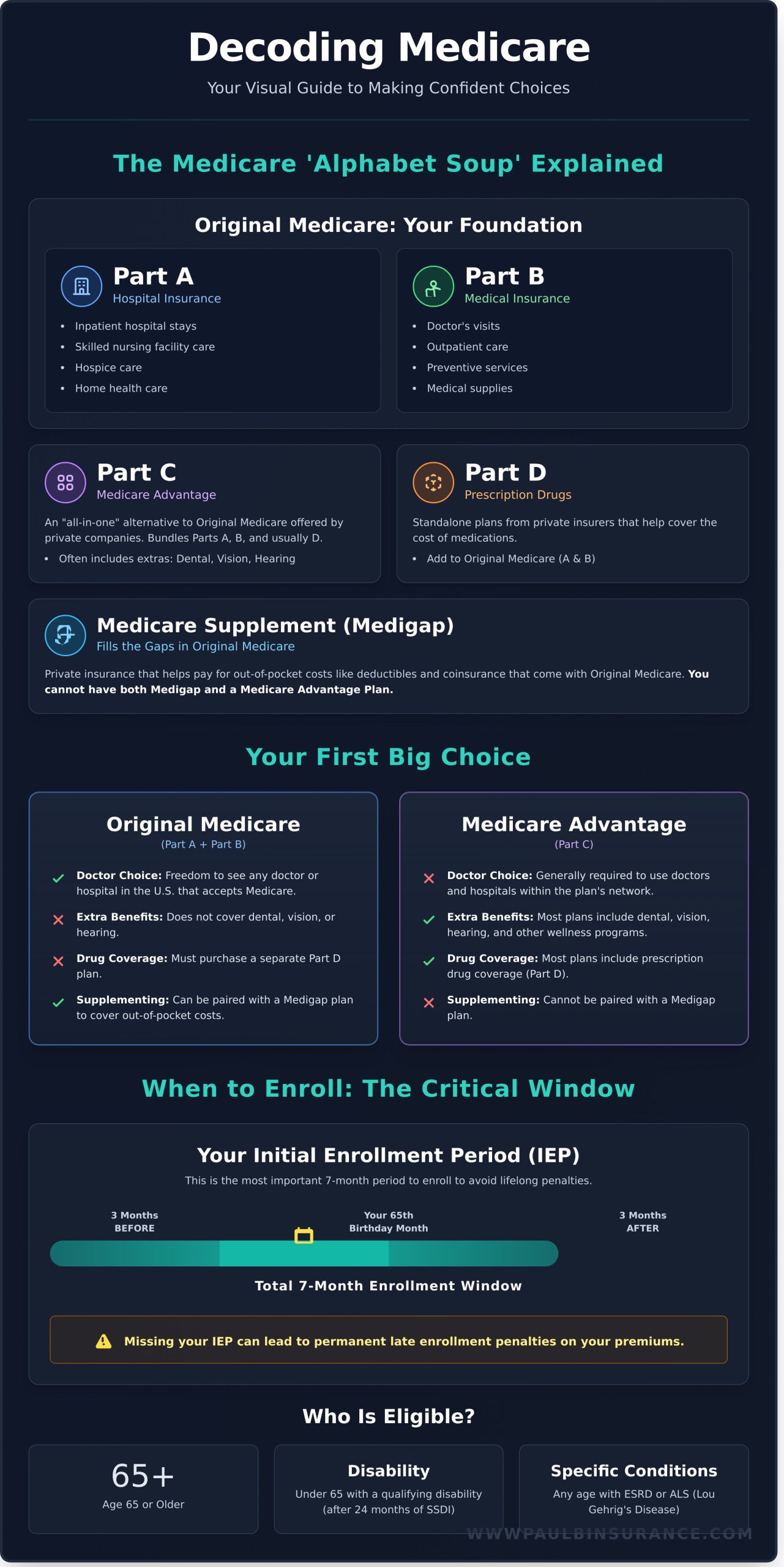

- Discover how the four main parts of Medicare work together to cover your hospital, medical, and prescription drug needs.

- Learn the critical enrollment deadlines to avoid lifelong penalties and ensure your coverage starts exactly when you need it.

- Grasp the key differences between Original Medicare and Medicare Advantage to make this important decision with confidence.

- Get a clear picture of what you will actually pay so you can budget for your healthcare in retirement without any surprises.

The Four Main Parts of Medicare: The ‘Alphabet Soup’ Explained

Navigating the world of Medicare can feel like trying to solve a puzzle with letters instead of pieces. It’s completely normal to feel overwhelmed by this “alphabet soup.” But I promise, it’s simpler than it looks. Think of it like a meal: you have a main course, and then you can add different side dishes to complete your plate. For a deep dive, you can find a comprehensive overview of Medicare and its history, but for now, let’s focus on the four key parts you need to know. This simple breakdown will give you the solid foundation you need to move forward with confidence.

Part A & Part B (Original Medicare): Your Foundation

This is the main course and the starting point for most people. Original Medicare is made up of two parts that work together:

- Part A (Hospital Insurance): Think of this as your ‘hospital stay’ coverage. It helps pay for inpatient care in a hospital, skilled nursing facility care, hospice care, and home health care.

- Part B (Medical Insurance): This is your ‘doctor visit’ coverage. It helps cover medically necessary services like doctor’s appointments, outpatient care, preventative services, and medical supplies.

Part C (Medicare Advantage): The All-in-One Alternative

If Original Medicare is ordering a la carte, Part C is like choosing a ‘combo meal.’ These are all-in-one plans offered by private insurance companies approved by Medicare. They bundle your Part A and Part B benefits and usually include Part D prescription drug coverage. Many plans also offer extra benefits not covered by Original Medicare, like dental, vision, and hearing. You must be enrolled in Parts A and B to join a Part C plan.

Part D (Prescription Drug Coverage): Covering Your Medications

Part D is your ‘side dish’ for medications. These are standalone plans sold by private companies that help cover the cost of prescription drugs. You can add a Part D plan to Original Medicare (Parts A & B). As mentioned, most Medicare Advantage (Part C) plans already include this drug coverage, so you wouldn’t need a separate Part D plan.

Medicare Supplement (Medigap): Filling the Gaps

Medigap is exactly what it sounds like: private insurance that helps fill the “gaps” in Original Medicare. It helps pay for out-of-pocket costs like your deductibles, coinsurance, and copayments. Think of it as ‘gap insurance’ that works alongside your Part A and Part B coverage to reduce your financial risk. Important: You cannot have both a Medicare Advantage plan and a Medigap policy.

Who is Eligible and When Should You Enroll?

Understanding the “who” and “when” of Medicare is the first checkpoint on your journey to confident healthcare coverage. Many people worry about missing a deadline and facing penalties for the rest of their lives. We’re here to remove that anxiety. This guide breaks down eligibility and enrollment into simple, clear steps, ensuring you know exactly when to act to secure your benefits and avoid costly mistakes.

The Basic Eligibility Requirements

Eligibility for Medicare isn’t just about age. While turning 65 is the most common path, there are other ways to qualify. You are generally eligible if you are a U.S. citizen or a legal resident who has lived in the U.S. for at least five consecutive years and one of the following applies to you:

- You are age 65 or older.

- You are younger than 65 but have a qualifying disability. You typically qualify after receiving Social Security Disability Insurance (SSDI) benefits for 24 months.

- You have a specific medical condition. Individuals of any age with End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS, also known as Lou Gehrig’s disease) are eligible.

Your Initial Enrollment Period (IEP): The Critical 7-Month Window

Your Initial Enrollment Period is your primary and most important window to sign up for Medicare. This 7-month period begins 3 months before the month you turn 65, includes your birthday month, and ends 3 months after. For example, if your birthday is in July, your IEP runs from April 1 to October 31. Enrolling during this time helps you avoid late enrollment penalties that can last a lifetime. You can always find personalized tools and timelines on the official Medicare website, but your IEP is the key to a smooth start.

What if you’re still working? If you have qualifying health coverage from your or your spouse’s current employer, you may be able to delay enrollment without penalty.

Other Key Enrollment Periods to Know

Life is unpredictable, and Medicare has other enrollment periods to accommodate different situations. Here are the main ones to know:

- General Enrollment Period (GEP): If you miss your IEP, you can sign up between January 1 and March 31 each year. However, your coverage won’t start until July 1, and you may face late penalties.

- Special Enrollment Period (SEP): Triggered by specific life events, like losing employer health coverage. This gives you a window to enroll in Medicare outside of the standard periods without penalty.

- Annual Enrollment Period (AEP): This runs from October 15 to December 7 each year. It’s your yearly opportunity to review your coverage and make changes to your Medicare Advantage or Part D prescription drug plan.

Original Medicare vs. Medicare Advantage: Your First Big Choice

Once you’ve confirmed your Medicare eligibility and enrollment, you face your first and most important decision. This choice determines the very foundation of how you receive your healthcare through medicare. Think of it as standing at a fork in the road, with two distinct paths ahead. There is no single “best” option-the right path depends entirely on your personal health needs, budget, and lifestyle. We’re here to help you understand each path with clarity so you can move forward with confidence.

Path 1: Original Medicare (Part A & Part B)

This is the traditional, government-administered health plan. Its greatest strength is freedom. With Original Medicare, you can see any doctor or visit any hospital in the U.S. that accepts the coverage, without needing a referral to see a specialist. To cover costs that Parts A and B don’t, you can add a separate Part D plan for prescriptions and a Medigap policy to help with out-of-pocket expenses. This path is often ideal for those who value flexibility and want nationwide coverage, especially frequent travelers.

Path 2: Medicare Advantage (Part C)

Medicare Advantage plans are offered by private insurance companies and bundle your Part A, Part B, and usually Part D prescription drug coverage into one simple plan. Many of these plans, like HMOs or PPOs, require you to use a network of doctors and hospitals. In exchange for less flexibility, they often include extra benefits not covered by the original government program, such as dental, vision, and hearing services. This path is often a good fit for those who prefer lower monthly premiums and the convenience of an all-in-one plan.

How to Decide? Key Questions to Ask Yourself

Choosing the right path forward can feel overwhelming, but it becomes much clearer when you ask the right questions. Take a moment to consider your own situation:

- Your Doctors: Do my current doctors and specialists accept Original Medicare, or are they in a specific plan network?

- Travel Plans: Do I travel often within the U.S. or spend part of the year in another state?

- Prescriptions: What medications do I take, and how would they be covered under each option?

- Extra Benefits: How important are dental, vision, or hearing benefits to my overall health and budget?

Feeling stuck? You don’t have to figure this out alone. A trusted advisor can help you compare your options. At The Modern Medicare Agency, we provide simple, unbiased guidance to help you find the plan that truly fits your life.

Understanding Your Medicare Costs: What Will You Actually Pay?

One of the biggest sources of confusion is the cost. A common question we hear is, “Isn’t Medicare free?” The simple answer is no. While it provides essential coverage, it’s not without costs. Understanding what you might have to pay is the first step toward gaining confidence and making a smart financial decision for your retirement.

Most out-of-pocket costs for your medicare coverage fall into three main categories. Let’s break them down in plain English so you know exactly what to expect.

Premiums: Your Monthly Bill

A premium is a fixed amount you pay each month to keep your insurance active, similar to a subscription. For most people, it works like this:

- Part A (Hospital Insurance): Usually premium-free if you or your spouse worked and paid Medicare taxes for at least 10 years.

- Part B (Medical Insurance): Has a standard monthly premium set by the government each year ($174.70 per month in 2024).

- Part C (Advantage) & Part D (Drugs): Premiums vary widely depending on the private insurance plan you choose.

Deductibles: What You Pay Before Coverage Kicks In

A deductible is the amount you must pay for your health care services before your plan starts to pay its share. Think of it as your initial out-of-pocket responsibility for the year. Both Part A and Part B have their own separate deductibles that you must meet. Medicare Advantage plans also have deductibles, but the amounts can differ significantly from one plan to another.

Coinsurance & Copayments: Your Share of the Cost

After you’ve met your deductible, you will still share the cost of your care. This is where coinsurance and copayments come in.

- A copayment is a fixed dollar amount you pay for a service, like $25 for a doctor’s visit.

- Coinsurance is a percentage of the cost. For example, under Original Medicare Part B, you typically pay 20% of the cost for most services.

These unpredictable out-of-pocket expenses are the primary reason why many people choose to add a Medigap (Supplement) plan or enroll in a Medicare Advantage plan. Navigating these choices to find the right financial protection can feel overwhelming, but you don’t have to do it alone. Getting unbiased, expert guidance ensures you find a path from confusion to confidence.

How to Get Help: Navigating Your Medicare Journey with Confidence

The Medicare system can feel like a maze, filled with confusing terms and critical deadlines. But you don’t have to navigate it alone. Understanding where to turn for trusted guidance is the first step toward making a confident choice that protects your health and your budget. Choosing the right partner can save you countless hours of research, prevent costly mistakes, and provide invaluable peace of mind.

The DIY Approach: Using Medicare.gov

The official government website, Medicare.gov, is a powerful resource packed with information. However, trying to compare hundreds of plan options on your own can quickly become overwhelming. When you take the do-it-yourself route, you are solely responsible for understanding every detail, comparing countless plans, and ensuring you don’t miss a critical deadline or benefit.

Captive Agents vs. Independent Brokers

When seeking professional help, it’s vital to know who you’re talking to. A captive agent works for a single insurance company and can only offer you that company’s plans. An independent broker, on the other hand, works for you. At **The Modern Medicare Agency**, we partner with numerous insurance carriers, allowing us to focus entirely on finding the plan that truly fits your unique healthcare needs and budget, not a sales quota. This unbiased approach ensures your best interests always come first.

Why Partnering with a Broker Simplifies Everything

Working with an independent expert like those at **The Modern Medicare Agency** transforms a stressful process into a simple, clear path forward. We take the burden off your shoulders by handling the complex work for you, at no cost.

- We do the research: We compare plans from multiple top-rated carriers to find the right fit for your doctors, prescriptions, and budget.

- We help you avoid mistakes: We guide you through enrollment to help you steer clear of late penalties and coverage gaps.

- We provide year-round support: Our relationship doesn’t end after you enroll. We’re here to answer your questions and review your coverage annually.

You deserve clarity, not confusion. Let **The Modern Medicare Agency** help you move from feeling overwhelmed to feeling confident in your healthcare choices.

Ready for clarity? Schedule a free, no-obligation call with an expert.

Your Clear Path to Medicare Confidence

Understanding your healthcare options as you approach retirement is the first step toward peace of mind. You now know the fundamentals: the four main parts of the system, the crucial choice between Original Medicare and Medicare Advantage, and why enrolling on time is so important. This knowledge empowers you to ask the right questions.

But you don’t have to find the answers alone. Choosing the right medicare plan can feel like a high-stakes decision, and you deserve a trusted advocate. As an independent broker serving 34 states, we provide the unbiased, expert guidance you need. We represent over 40 carriers, ensuring your best interests-not a sales quota-always come first.

Let us help you move from confusion to confidence with our simple 5-step process. Schedule Your Free, No-Obligation Medicare Review today to get the personalized support you need. Your confident healthcare future starts here.

Your Medicare Questions, Answered with Clarity

What is the difference between Medicare and Medicaid?

It’s easy to get these two confused, but they serve different needs. Medicare is a federal health insurance program primarily for people aged 65 or older and younger people with certain disabilities, regardless of income. Your eligibility is typically based on your work history. Medicaid, on the other hand, is a joint federal and state program that provides health coverage to people with very low income. Eligibility for Medicaid is based on financial need, not age.

Do I have to sign up for Medicare if I am still working at 65?

This is a common source of stress, and the answer depends on your employer’s size. If you have health coverage from an employer with 20 or more employees, you may be able to delay Part B without a penalty. However, if your employer has fewer than 20 employees, you will likely need to enroll. Making the right choice here is critical to steer clear of costly late enrollment penalties, so getting trusted guidance is essential for your peace of mind.

Can I be denied Medicare coverage for a pre-existing condition?

We can put this worry to rest. You cannot be denied Original Medicare (Part A and Part B) due to a pre-existing condition, as federal law guarantees your acceptance. However, it’s important to know that Medigap (Supplement) plans can deny you or charge more based on your health if you apply outside of your guaranteed issue periods. This is why enrolling at the right time is so important for your financial security and confidence in your coverage.

How much does Medicare cost per month?

Let’s simplify the costs. Most people get Part A (Hospital Insurance) for free if they or their spouse paid Medicare taxes for at least 10 years. Part B (Medical Insurance) has a standard monthly premium that can change each year ($174.70 in 2024 for most people). This premium can be higher for individuals with greater incomes. Your total monthly cost will depend on the combination of parts and plans you choose to build your complete coverage.

Is Medicare Part B optional, and should I enroll in it?

While Part B is technically optional, nearly everyone enrolls in it for essential coverage. Part B covers doctor visits, outpatient care, preventive services, and durable medical equipment. Declining it without having other creditable coverage (like from a current employer) can result in significant gaps in your healthcare. It can also lead to a permanent late enrollment penalty, making your premium more expensive for the rest of your life. We provide guidance to ensure you make a confident choice.

What doesn’t Original Medicare cover?

Understanding the gaps is the first step to building complete protection. Original Medicare does not typically cover most routine dental, vision, or hearing care. It also doesn’t cover prescription drugs, which is why Part D plans were created. Another significant gap is long-term custodial care, such as an extended stay in a nursing home. These are the key areas where a Medicare Advantage or Medigap plan can provide crucial financial security and peace of mind.