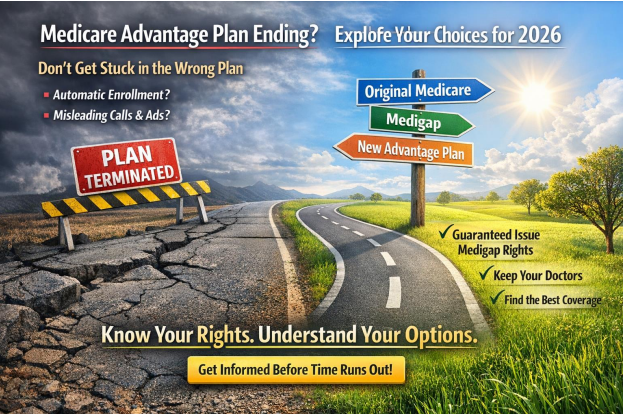

Finding out that your Medicare Advantage plan is ending — or realizing it no longer fits your needs — can feel overwhelming. Many Medicare consumers worry they’re stuck, out of options, or running out of time.

The good news? You are not stuck. Medicare has built-in protections that give you real choices — but only if you understand which enrollment period applies to you and how to use it correctly

This guide explains exactly what to do if your Medicare Advantage plan was terminated for 2026 or if you’re simply unhappy with your coverage, while helping you avoid costly mistakes that many people make during this time of year.

Every year, some Medicare Advantage plans are discontinued, leave certain counties, or exit the market altogether. If your plan will not be available for 2026, Medicare provides you with special protections so you are not left without coverage.

Special Enrollment Period for Terminated Medicare Advantage Plans

If your Medicare Advantage plan was terminated, you qualify for a Special Enrollment Period that allows you to:

- Enroll in a new Medicare Advantage plan

- Return to Original Medicare (Part A and Part B)

- Enroll in a standalone Medicare Part D prescription drug plan

- Enroll in a Medicare Supplement (Medigap) plan using guaranteed issue rights

This enrollment window begins when you receive notice that your plan is ending and runs through the last day of February.

⚠️ Important: If you do nothing, Medicare may automatically enroll you in a replacement plan. These plans are not personalized and may not include your doctors, hospitals, or medications.

Guaranteed Issue Rights for Medigap When a Medicare Advantage Plan Is Cancelled

One of the most important — and most overlooked — protections is guaranteed issue rights for a Medicare Supplement (Medigap) plan.

If your Medicare Advantage plan is terminated, you may have the right to enroll in a Medigap plan without medical underwriting.

What Does Guaranteed Issue Mean?

- You cannot be denied a Medigap plan

- You cannot be charged more due to health conditions

- No health questions are required

This protection exists to ensure you are not penalized because your plan ended through no fault of your own.

How Long Do I Have to Use My Medigap Guaranteed Issue Rights?

If your Medicare Advantage plan is being terminated, you generally have from the time you receive notice that your plan is ending through the last day of February to:

- Return to Original Medicare, and

- Enroll in a Medicare Supplement (Medigap) plan using guaranteed issue rights

⚠️ Timing matters. Waiting too long, enrolling in the wrong order, or defaulting into a replacement plan without understanding your options can cause you to lose these protections.

👉 For many people, this may be a rare opportunity to move from Medicare Advantage to Medigap without health screening

Important Things to Know About Medigap Guaranteed Issue

Before choosing a Medigap plan under guaranteed issue rights, keep these key points in mind:

- Guaranteed issue protects you from medical underwriting

As long as you apply within the allowed window, your health history cannot be used against you. - Medigap plans are standardized by Medicare

The benefits are the same regardless of which insurance company offers the plan. - Prescription drugs are not covered by Medigap

You will need a standalone Medicare Part D plan for prescription coverage. - Medigap offers nationwide access

You can generally see any doctor or hospital in the U.S. that accepts Medicare — no networks, referrals, or prior authorizations. - These rights are time-limited

Missing the window can permanently limit your options. - What If Your Plan Wasn’t Terminated — You’re Just Not Happy?

Many Medicare Advantage plans continue into 2026, but that doesn’t mean they still make sense for you.

Common reasons people reconsider include:

- Doctors or hospitals leaving the network

- Rising copays or out-of-pocket costs

- Prescription drug changes

- Increased referrals or prior authorizations

- Feeling restricted or frustrated by coverage

If this sounds familiar, you still have options.

Medicare Advantage Open Enrollment Period (January 1 – March 31)

The Medicare Advantage Open Enrollment Period runs every year from January 1 through March 31 and applies only to people already enrolled in a Medicare Advantage plan.

During this time, you can:

- Switch from one Medicare Advantage plan to another

- Drop Medicare Advantage and return to Original Medicare

- Add a standalone Part D plan if returning to Original Medicare

- The Medicare Advantage Open Enrollment Period runs every year from January 1 through March 31 and applies only to people already enrolled in a Medicare Advantage plan.

During this time, you can:

- Switch from one Medicare Advantage plan to another

- Drop Medicare Advantage and return to Original Medicare

- Add a standalone Part D plan if returning to Original Medicare

Changes typically take effect the first day of the following month.

A Very Important Warning About Medicare Marketing During This Time

This is one of the most dangerous times of the year for Medicare consumers.

Although licensed Medicare agencies and agents should not be actively marketing or

soliciting plan changes, many third-party marketing organizations continue to contact

consumers anyway.

Every year, people are pressured into switching plans with promises like:

- “You’ll get more benefits”

- “This plan is better”

- “Nothing will change”

- “This is your last chance”

Too often, those promises don’t hold up.

Consumers later discover:

- Their doctors are out of network

- Their prescriptions cost more

- Referrals or prior authorizations are required

- Their coverage is worse, not better

By the time they realize it, this may be the last chance of the year to make changes — or the window may already be closed.

How to Protect Yourself Before Making Any Medicare Change

Before making any Medicare decision during this period:

✔ Slow down — Medicare decisions should never feel rushed

✔ Be cautious of unsolicited calls, ads, or mailers

✔ Never assume “more benefits” means better coverage

✔ Verify doctors, hospitals, and prescriptions in writing

✔ Speak with a trusted, independent Medicare professional

Final Thoughts: Know Your Rights Before This Window Closes

If your Medicare Advantage plan was terminated — or you’re unhappy with your coverage for 2026 — you have options, but the rules are strict and timing matters.

Understanding:

- Which enrollment period applies to you

- Whether guaranteed issue rights are available

- How changes affect your doctors, prescriptions, and costs

can prevent costly mistakes and long-term frustration.

👉 Medicare decisions should feel clear, confident, and informed — not rushed or pressured.

If you’re unsure which path makes sense for your situation, personalized guidance can make all the difference.