If you’re a Medicare beneficiary living in Los Angeles, you’ve probably noticed something over the last few years:

Medicare decisions don’t feel simple anymore.

Between changing doctor networks, rising out-of-pocket costs, and plans that work differently than expected, many Los Angeles seniors are taking a step back and asking a very reasonable question:

“Is there a more predictable way to use Medicare?”

That question is exactly why more seniors in Los Angeles are taking a closer look at Medicare Supplement (Medigap) Plan G.

This article isn’t here to sell you on anything.

It’s here to help you understand what’s really happening, why this trend is growing, and how to decide what actually fits your situation.

Medicare in Los Angeles Is Different — and That Matters

Los Angeles is one of the most complex healthcare markets in the country.

Many seniors here:

- See doctors across multiple hospital systems

- Use highly specialized providers

- Travel frequently or split time between states

- Rely on ongoing outpatient care and testing

It’s common for someone to:

- Have a primary care doctor in one system

- See specialists in another

- Get imaging or procedures elsewhere

Because of that, how Medicare handles access and costs matters more here than in smaller markets.

Why Some Los Angeles Seniors Are Rethinking Medicare Advantage

Medicare Advantage plans can absolutely work well for some people.

But many Los Angeles seniors tell me they start to feel frustrated over time.

Common concerns include:

Changing doctor networks

A doctor or hospital that’s in-network one year may not be the next.

In a city as large as LA, that can mean switching doctors or traveling farther for care.

Referrals and prior authorizations

Many plans require referrals to see specialists and prior approval for MRIs, CT scans, procedures, or infusions.

That can slow things down — especially for people managing chronic conditions.

Less predictable costs

Even with low or $0 monthly premiums, members often face:

- Specialist copays

- Daily hospital copays

- Coinsurance for outpatient care

Over time, some seniors decide they’d rather pay more upfront and worry less later.

What Medigap Plan G Actually Does (In Plain English)

Medigap Plan G works alongside Original Medicare (Part A and Part B).

Instead of managing networks and copays, Plan G focuses on covering most of the gaps Medicare leaves behind.

With Plan G:

- You can see any doctor nationwide who accepts Medicare

- No referrals are required

- No plan networks to worry about

- No prior authorization from the supplement plan

After you pay the annual Medicare Part B deductible, most Medicare-approved medical costs are covered.

For many Los Angeles seniors, that simplicity is the main appeal.

What Does Medigap Plan G Cost in Los Angeles?

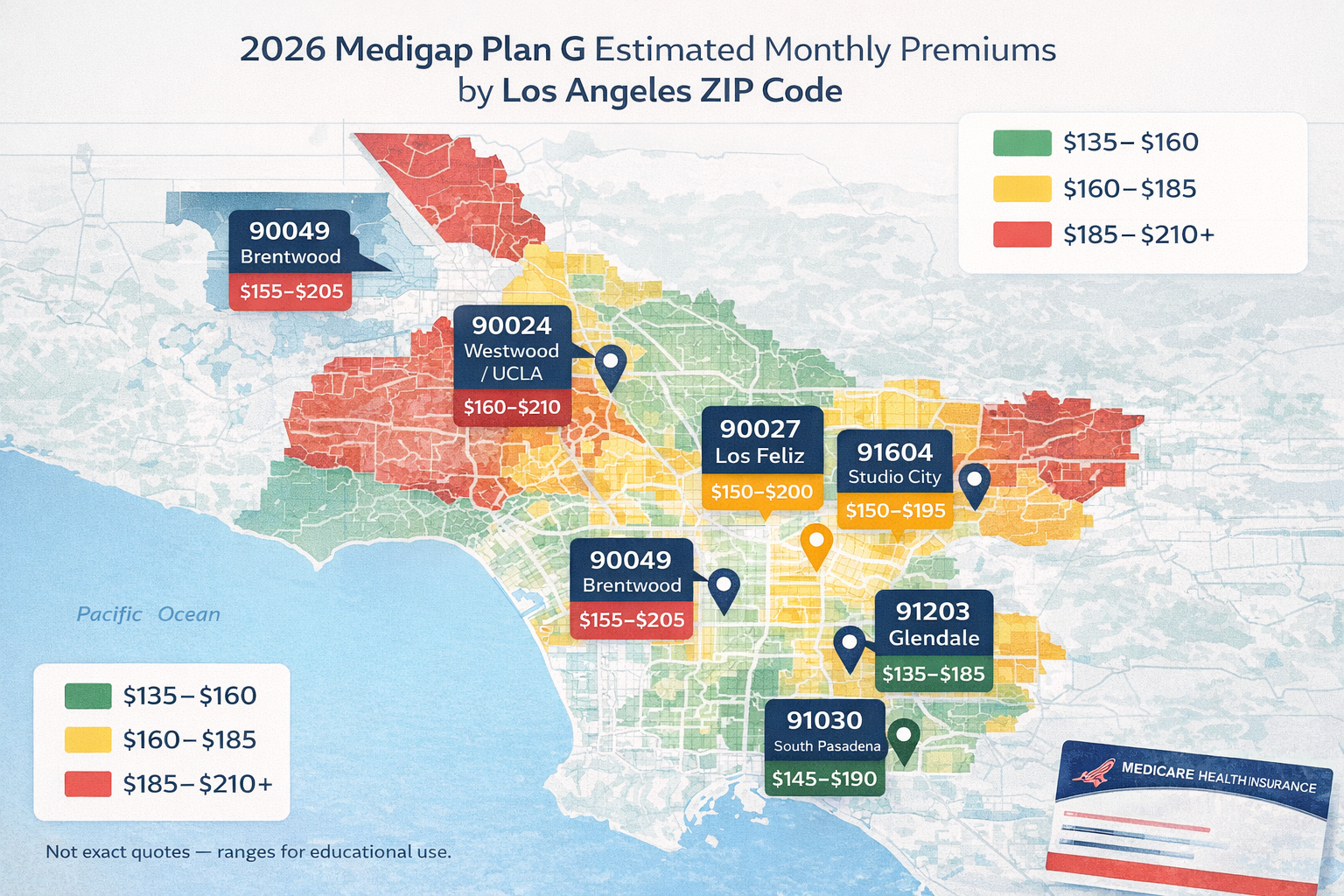

Medigap pricing in California varies by ZIP code, age at enrollment, insurance company, and available discounts.

Below are typical monthly ranges many Los Angeles residents see for Plan G.

These are estimates — not quotes.

Approximate Medigap Plan G Premiums (Los Angeles County)

| Area | Estimated Monthly Range |

|---|---|

| Downtown / East LA | $165 – $215 |

| Hollywood / Silver Lake | $170 – $225 |

| West LA / Santa Monica | $175 – $235 |

| San Fernando Valley | $160 – $215 |

| South Bay | $165 – $220 |

| Pasadena / San Gabriel Valley | $160 – $210 |

| Long Beach | $155 – $205 |

Important note:

Medigap benefits are standardized. A Plan G from one company covers the same medical benefits as Plan G from another. The difference is price, rate history, and service, not coverage.

Plan G vs Plan N: A Simple, Honest Comparison

Most people deciding on Medigap in Los Angeles narrow it down to Plan G or Plan N.

Here’s how they differ in real life:

| Feature | Plan G | Plan N |

|---|---|---|

| Typical Monthly Premium (LA) | ~$165 – $235 | ~$125 – $185 |

| Doctor & Specialist Visits | $0 after deductible | Up to $20 per visit |

| ER Visit | Covered | Up to $50 |

| Excess Charges | Covered | Not covered |

| Doctor Choice | Any Medicare doctor | Any Medicare doctor |

| Cost Predictability | Very high | Moderate |

How to think about this:

- Plan G is often preferred by people who see specialists regularly or want very predictable costs.

- Plan N can work well for people who rarely see doctors and are comfortable with occasional copays.

Neither is “better.”

It’s about how you use healthcare.

A Real-World Los Angeles Example

Let’s say someone in Los Angeles sees:

- A primary care doctor a few times a year

- Two specialists regularly

With Plan N, they may pay $20 per visit each time.

With Plan G, those visits are typically covered after the deductible.

For some people, those copays are no big deal.

For others, the simplicity of Plan G is worth the higher premium.

Who Medigap Plan G Tends to Be a Good Fit For

Plan G often works well for:

- Seniors seeing multiple doctors or specialists

- People who travel frequently

- Those who want nationwide access

- Anyone who values long-term stability and simplicity

When Plan G May Not Be the Right Choice

Plan G may not make sense if:

- You rarely use medical care

- Keeping monthly premiums as low as possible is the priority

- You’re comfortable managing copays and plan rules

Good Medicare choices aren’t about trends — they’re about fit.

Timing Matters in California

In California, when you enroll or switch plans can matter just as much as what you choose.

Certain enrollment periods allow changes without medical underwriting. Missing those windows can limit options later, which is why understanding timing is important.

The Bigger Picture

Los Angeles seniors aren’t switching to Medigap Plan G because it’s popular.

They’re switching because:

- Their healthcare needs are changing

- They want fewer surprises

- They value control over their choices

For many, it’s not about “better coverage.”

It’s about coverage that feels easier to live with.

Get Clear, Local Medicare Guidance in Los Angeles

If you live in Los Angeles County and want help comparing:

- Medigap Plan G

- Medigap Plan N

- Medicare Advantage

I’m happy to walk through your situation with you — doctors, prescriptions, travel, and budget.

There’s no pressure and no obligation.

Just education, clarity, and honest guidance.

📞 Call or Text: 631-358-5793

Schedule a Medicare review (phone or Zoom)

Sometimes the most valuable Medicare benefit is simply understanding your options.