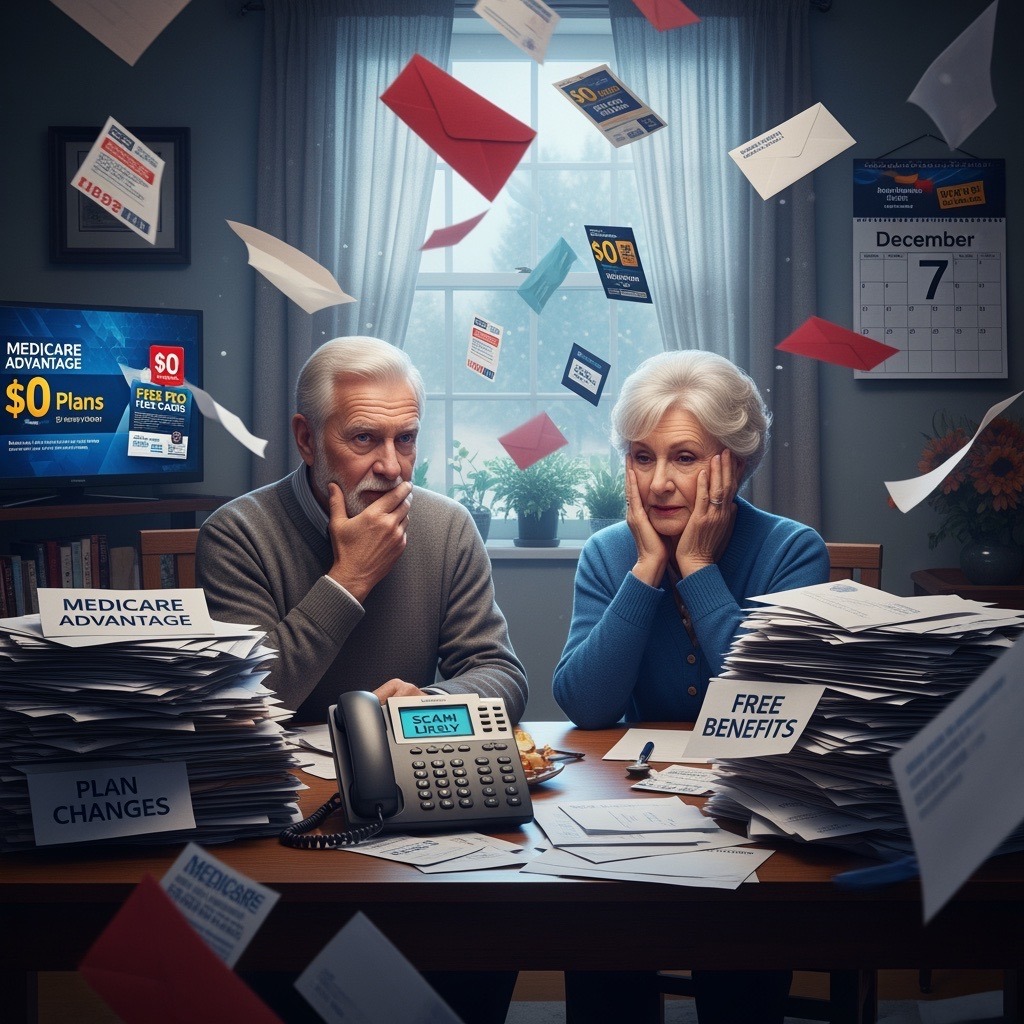

If you’re 65 or older and on Medicare, this is your season to make sure your health coverage still fits your life. The Annual Enrollment Period (AEP) runs from October 15 through December 7, and it’s the one time each year when you can review, compare, and make changes to your Medicare coverage for the coming year.

Last year (2025) brought historic levels of plan changes, cancellations, and carrier cutbacks. Many insurance companies reduced their agent reimbursements, adjusted networks, or discontinued popular plans altogether. And now, with the Inflation Reduction Act coming fully into effect—bringing major changes to Medicare drug costs and out-of-pocket caps—2026 is shaping up to be another year of big shifts.

Even if your plan worked fine in the past, don’t assume it’s still your best fit. Doctors may have left your network, your drug coverage may have changed tiers, or your costs could increase significantly in January. This guide will help you understand what you can do before December 7th, how to avoid common mistakes, and how to make confident, informed decisions.

What You Can Still Do Right Now

During the Annual Enrollment Period, you can:

- Switch from one Medicare Advantage plan to another

- Change from Original Medicare (with or without a supplement) to a Medicare Advantage plan—or vice versa

- Update your stand-alone Medicare Part D prescription drug plan

- Review your provider networks and pharmacy preferences for 2026

What Are the Most Common Medicare Plan Changes for 2026?

- Higher Part D premiums and deductibles

- Some Advantage PPO plans converting to HMOs

- Network reductions in hospitals and specialists

- Carriers consolidating or exiting certain states

- Lower agent reimbursements leading to fewer available local advisors

Quick Self-Check: Should You Keep or Change Your Plan?

Ask yourself these six questions:

- Did your premium or deductible increase more than expected?

- Did any of your prescriptions become more expensive or fall off your plan’s formulary?

- Did any of your doctors or hospitals leave your plan’s network?

- Did you hit your maximum out-of-pocket sooner than expected this year?

- Are you using the extra benefits (dental, vision, hearing, OTC, or gym) your plan offers?

- When you needed help this year, did you get timely, helpful service?

Real Example: (Marie from Huntington)

Marie stayed on the same Medicare Advantage plan for years because “it worked fine.” This fall, she noticed two of her heart medications jumped in cost—by more than $900 for the year.

When we reviewed her options, we found another plan with the same doctors, same network, but much lower drug costs. Marie enrolled before December 7th and will save several hundred dollars next year.

How to Compare Plans Without Feeling Overwhelmed

Here’s a simple step-by-step approach:

- List your doctors – Include specialists and confirm they’re in-network for 2026.

- List your prescriptions – Include names, dosages, and frequency.

- Check your pharmacy – Some plans prefer certain chains or mail-order services.

- Run the numbers – Add up your premium, copays, and expected drug costs.

- Weigh the trade-offs – A lower premium might mean higher out-of-pocket costs.

Common Mistakes to Avoid

- Ignoring the Annual Notice of Change (ANOC) letter

- Listening to friends or neighbors about “the best plan” without checking your own doctors and prescriptions

- Calling 1-800 numbers from TV commercials or national call centers

- Choosing a plan for extra perks without verifying coverage needs

- Assuming nothing changed because the plan name looks the same

- Not asking for help when you feel unsure — there’s no cost for professional guidance

- Waiting until the last week of enrollment, when systems are overloaded

How I Help Clients During AEP

I review each client’s doctors, medications, and preferred pharmacies before running any quotes. My goal is to help you stay covered, keep your doctors, and avoid unnecessary costs.

Whether you’re in Huntington, Melville, or anywhere across Long Island—or another state entirely—I offer personalized Medicare reviews at no cost.

Who Should Review Their Medicare Plan Before December 7th?

- Anyone with new or changed prescriptions

- Those whose doctors or hospitals changed networks

- Seniors facing rate increases on Medicare Supplements

- Anyone who enrolled last year through a TV ad or call center

- Long Island residents affected by plan cancellations or network shifts

Ready to Review Your Plan?

If you’re unsure whether your plan is still the best fit, let’s take a look together. There’s no cost and no pressure — just clear, honest guidance from someone who understands the local options and what’s changing for 2026.

Call me today at 631-358-5793 | visit : paulbinsurance.com to schedule your free Medicare plan review before December 7th.

Frequently Asked Questions About Medicare’s Annual Enrollment Period

Between October 15 and December 7, you can switch from one Medicare Advantage plan to another, move between Medicare Advantage and Original Medicare, or change your prescription drug (Part D) plan. Any changes you make take effect on January 1 of the new year.

If you don’t make changes, your current plan may automatically renew — but benefits, provider networks, or medication coverage could change without notice. Always review your Annual Notice of Change to avoid unwanted surprises in January.

Many of those ads promote plans that only apply in specific ZIP codes or have strict network limits. Some are run by large call centers, not local agents. Before you enroll, make sure your doctors, hospitals, and prescriptions are covered — or talk with a licensed local agent who can verify everything for you.

You’ll usually receive a notice from your insurance carrier before AEP. Use this time to compare your options — you can choose a new plan for January 1 without losing coverage. If you miss the deadline, you might have to wait until the next enrollment period.

Absolutely. Licensed independent agents like myself work with all major carriers and can review your doctors, prescriptions, and costs at no charge. Medicare sets our compensation, so your premium is the same whether you enroll through an agent, a call center, or directly with the company — but you’ll get personalized service when you work locally.

Final Thought

Medicare doesn’t have to be confusing — when you know what to look for, it’s empowering. Whether you stay with your current plan or make a change, the key is making that choice intentionally, not by default.You deserve coverage that fits your needs, budget, and peace of mind. Let’s make sure you start 2026 with confidence.