Key Takeaways for Lindenhurst Medicare Consumers

Medicare costs in Lindenhurst are higher than the national average.

Long Island residents face higher premiums, higher Medigap costs, and rising prescription drug expenses compared to many other parts of the country.Everyone pays the Medicare Part B premium — and it increases with income.

In 2026, the standard Part B premium is $202.90 per month, but higher-income retirees may pay significantly more due to IRMAA.IRMAA can dramatically increase Medicare costs — even with $0 premium plans.

IRMAA applies to both Part B and Part D and is based on income from two years ago. Choosing a $0 premium Medicare Advantage plan does not avoid IRMAA.Medicare Part D costs have risen sharply in recent years.

In Lindenhurst, standalone Part D plan premiums now commonly range from $35 to $173 per month, with many plans using the maximum 2026 deductible of $615.$0 premium Medicare Advantage plans are not free.

These plans can still include copays, deductibles, and a Maximum Out-of-Pocket limit, which can reach several thousand dollars per year depending on the plan.Medigap offers broad access — but at a high cost in New York.

Medigap plans allow you to see any doctor who accepts Medicare, but premiums on Long Island have increased over 40% in recent years, making affordability a major consideration.The “best” Medicare plan depends on how you actually use healthcare.

Your doctors, prescriptions, income, travel habits, and risk tolerance matter more than marketing claims or advertised premiums.Local guidance matters.

Medicare decisions in Lindenhurst require an understanding of local costs, provider networks, and income-related rules — not one-size-fits-all advice.

If you live in Lindenhurst, New York, you’ve probably noticed something frustrating: Medicare feels more expensive here than what you hear in TV ads or online.

You’re not imagining it.

While Medicare is a federal program, the real cost of Medicare is very local. Premiums, prescription drug costs, and even which plans make sense can look very different on Long Island than in other parts of the country.

This guide breaks down what Lindenhurst residents actually pay for Medicare, why costs have risen so sharply in recent years, and how to think through your options clearly — without pressure or sales hype.

The Fixed Medicare Costs Almost Everyone Pays

No matter which Medicare path you choose, there are certain costs nearly every Lindenhurst resident will see.

Medicare Part B Premium

Medicare Part B covers doctor visits, outpatient care, labs, imaging, and preventive services.

Most people pay the standard Medicare Part B premium of $202.90 per month in 2026. This premium is paid whether you choose a Medicare Advantage plan or Original Medicare with a Medigap supplement.

Part B premiums are usually deducted directly from your Social Security check (or billed quarterly if you’re not yet collecting Social Security).

Medicare Part B Deductible

In 2026, Medicare Part B also has an annual deductible of $283. After you meet it, Original Medicare generally pays 80% of approved outpatient costs, leaving you responsible for the remaining 20% — unless you have additional coverage..

IRMAA: A Medicare Cost Many Lindenhurst Residents Don’t Expect

If your income is above certain levels, you may pay IRMAA (Income-Related Monthly Adjustment Amount) — an extra charge added to your Medicare premiums.

IRMAA applies to:

- Medicare Part B premiums

- Medicare Part D premiums

It’s based on your tax return from two years ago, not your current income, and it’s charged per person, not per household.

This commonly affects Lindenhurst retirees with pensions, Required Minimum Distributions (RMDs), investment income, or one-time income events like selling property.

2026 Medicare Part B IRMAA Chart

2024 Income (Single) | 2024 Income (Married Filing Jointly) | Monthly Part B Premium (2026) |

$109,000 or less | $218,000 or less | $202.90 |

$109,001–$137,000 | $218,001–$274,000 | $284.10 |

$137,001–$171,000 | $274,001–$342,000 | $405.80 |

$171,001–$205,000 | $342,001–$410,000 | $527.50 |

$205,001–under $500,000 | $410,001–under $750,000 | $649.20 |

$500,000 or more | $750,000 or more | $689.90 |

A Real Lindenhurst IRMAA Scenario

Here’s a situation I see often in Lindenhurst.

John and Mary are both 67 and recently retired. In 2024, their combined income — including pensions, Social Security, and a larger RMD — totaled $285,000.

Because of that income level, each of them pays IRMAA.

- Their Part B premium increases to $405.80 per person per month

- That’s over $4,800 more per year combined for Part B alone

- On top of that, they each pay $37.50 per month in Part D IRMAA, adding another $900 per year combined

What surprised them most? They were enrolled in a $0 premium Medicare Advantage plan — but IRMAA applied anyway.

Medicare Advantage Costs in Lindenhurst, NY

Medicare Advantage plans are popular on Long Island because they often have lower upfront premiums — but how the costs work matters.

Premiums

Many Lindenhurst residents choose $0 premium Medicare Advantage plans, while others opt for plans with small monthly premiums.

A common misconception is that premium level determines plan quality. In reality:

- $0 premium plans can sometimes have excellent provider networks

- Plans with premiums may offer lower copayments, but not always

Premium alone doesn’t tell you which plan is better. Networks, copays, and how you actually use care matter far more.

Typical Medicare Advantage Out-of-Pocket Costs

Most plans include copays for:

- Primary care visits

- Specialist visits

- Labs and imaging

- Outpatient procedures

- Hospital stays (often charged per day)

Maximum Out-of-Pocket (MOOP) – 2026

All Medicare Advantage plans must include an annual Maximum Out-of-Pocket (MOOP). This is the most you’ll pay for covered medical services in a year, not including premiums or prescription drugs.( 9,250 is the max this year, some plans may be lower of course.)

For Lindenhurst residents, MOOP limits typically range into the several-thousand-dollar range per year, depending on the plan.

Lower MOOP plans usually come with either higher premiums or higher copays elsewhere — it’s always a tradeoff.

Medicare Advantage plans tend to work best when your doctors and hospitals are in-network and your usage patterns are well understood.

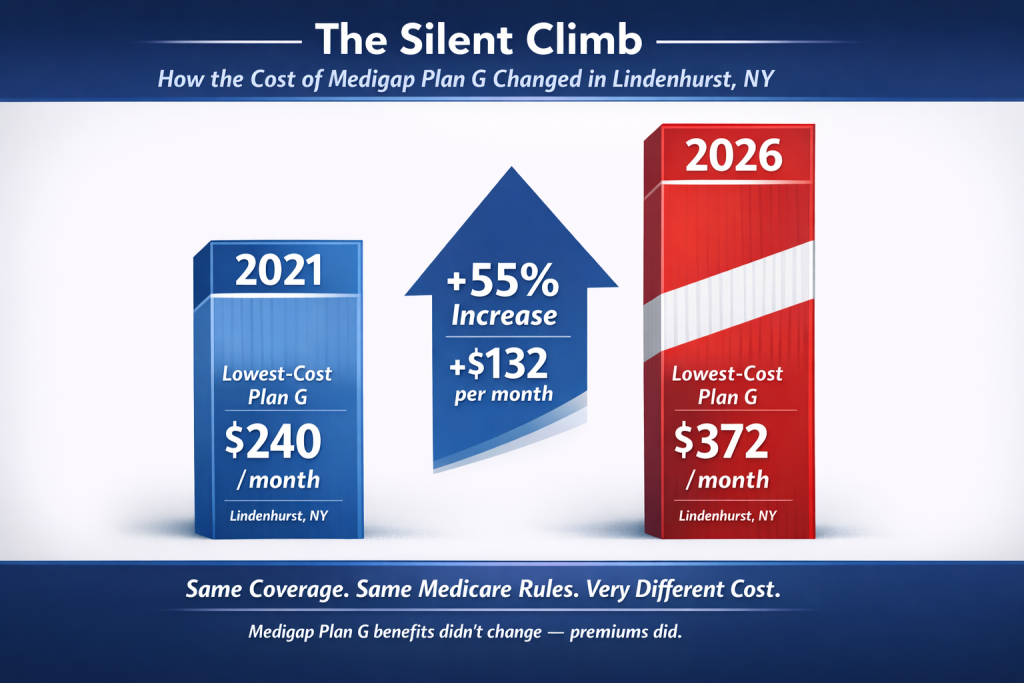

Medigap (Medicare Supplement) Costs in Lindenhurst

Medigap plans are known for simplicity and access. If a doctor or hospital accepts Medicare, they accept your Medigap plan.

However, New York — and Long Island in particular — is one of the most expensive areas in the country for Medigap coverage.

Over the past four years, premiums for popular plans like Plan G and Plan N have increased over 40% in many cases, far outpacing inflation.

Medigap also doesn’t include prescription drug coverage, so you must add a standalone Part D plan.

Medicare Part D Prescription Costs in Lindenhurst

Prescription drug coverage has become one of the fastest-rising Medicare expenses for Lindenhurst residents, and it’s one of the areas where costs have changed the most in just a few years.

Part D Premiums in Lindenhurst

For 2026, Lindenhurst residents typically see standalone Medicare Part D plan premiums ranging from approximately $35 up to $173 per month, depending on the plan’s coverage design.

- The lowest-cost plans generally fall in the $35–$40 per month range

- Mid-range plans with broader formularies or preferred pharmacy access often cost more

- The highest-cost plans can exceed $150 per month for enhanced coverage

Just a few years ago, it was common to find Part D plans under $10 per month. Those ultra-low-cost options are no longer available, largely due to rising drug costs and changes in plan design.

Part D Deductibles

Medicare allows Part D plans to charge an annual deductible, and many plans now use the maximum allowed deductible of $615 in 2026.

That means some plans require you to pay up to $615 out of pocket for covered prescriptions before the plan begins sharing costs.

Your actual prescription costs depend on:

- Your specific medications

- Drug tier placement

- Pharmacy choice

- Whether the plan offers preferred pharmacies

Important: The cheapest Part D premium is rarely the lowest overall drug cost once deductibles, copays, and formularies are factored in.

2026 Medicare Part D IRMAA Chart

2024 Income (Single) | 2024 Income (Married Filing Jointly) | Monthly Part D IRMAA |

$109,000 or less | $218,000 or less | $0 + plan premium |

$109,001–$137,000 | $218,001–$274,000 | $14.50 + plan premium |

$137,001–$171,000 | $274,001–$342,000 | $37.50 + plan premium |

$171,001–$205,000 | $342,001–$410,000 | $60.40 + plan premium |

$205,001–under $500,000 | $410,001–under $750,000 | $83.30 + plan premium |

$500,000 or more | $750,000 or more | $91.00 + plan premium |

Medicare Cost Questions Lindenhurst Residents Ask Most

Can I appeal IRMAA if my income has gone down?

Yes. If your income dropped due to retirement or another qualifying life event, you may appeal IRMAA through Social Security with documentation.

Are $0 Medicare Advantage plans really free?

No. They can still have copays, deductibles, and out-of-pocket costs.

Is Medigap worth the cost in New York?

For some people, yes — especially those who value access and predictability. For others, rising premiums make it harder to afford.

The Bottom Line for Lindenhurst Residents

- Medicare costs on Long Island are higher than many parts of the country

- Premiums, deductibles, and prescription costs have risen faster than inflation

- Medigap offers excellent access, but at a steep cost in New York

- Medicare Advantage can be very affordable when networks are right

The best plan isn’t about marketing or premiums — it’s about how you actually use healthcare.

Want a Personalized Medicare Cost Review?

If you’d like help reviewing your doctors, prescriptions, income, and Medicare costs — or just want clear answers — I’m happy to help.

Call or text 631-358-5793

Visit www.paulbinsurance.com

Education first. Always.