Key Takeaways for Lindenhurst Medicare Consumers

- Medicare networks in Lindenhurst are local, not national.

A plan that works well in another Long Island town may not include the same doctors or hospitals in Lindenhurst. - Hospitals and doctor groups both matter.

Even if a Medicare Advantage plan includes a hospital like Good Samaritan, your doctor’s medical group may still be out-of-network. - Medicare Advantage works best when providers are in-network.

Premiums alone don’t determine how well a plan works — access to your doctors does. - Medigap offers the easiest access, but at a higher cost in New York.

Medigap plans allow you to see any Medicare doctor, but Long Island premiums have risen sharply in recent years. - Networks, benefits, and costs can change every year.

What works one year may not work the next, making annual reviews especially important. - The “best” Medicare plan depends on your doctors, budget, and comfort with networks.

There is no one-size-fits-all answer for Lindenhurst residents.

If you live in Lindenhurst, New York, choosing Medicare coverage isn’t just about premiums or extra benefits — it’s about access.

Two Medicare plans can look nearly identical on paper, yet work very differently once you actually need care. One may include your doctors and preferred hospitals. Another may not. And that’s often how Lindenhurst residents end up frustrated mid-year, wondering why a plan that sounded great suddenly isn’t working.

This guide breaks down the real Medicare network landscape in and around Lindenhurst, explains how local hospitals and medical groups affect your choices, and helps you understand the tradeoffs between Medicare Advantage and Medicare Supplement (Medigap) coverage.

Medicare Is Federal — But Your Network Is Local

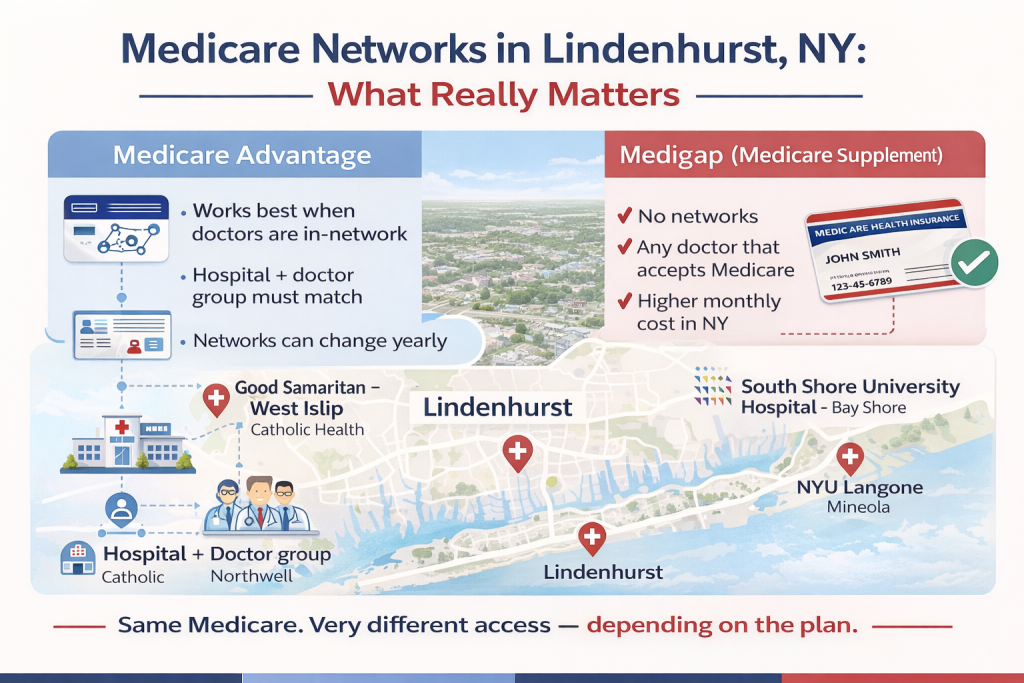

Medicare is a national program, but Medicare Advantage provider networks are local.

That means the plan that works well in one Long Island town may not work the same way in Lindenhurst. Your experience depends on:

- Which hospital system your doctors are affiliated with

- Which medical group your primary doctor belongs to

- Whether your plan is an HMO or PPO

- Whether referrals are required

- And whether your providers are in-network for that specific plan

This is especially important on Long Island, where multiple large health systems operate side by side.

Major Hospitals Lindenhurst Residents Commonly Use

When Lindenhurst residents talk about “keeping their hospital,” they’re usually referring to one of these nearby systems. These hospitals matter because many Medicare Advantage plans are built around them.

Catholic Health (Very Common for Lindenhurst)

- Good Samaritan University Hospital – West Islip

- St. Joseph Hospital – Bethpage

Catholic Health has a strong presence across the South Shore and operates its own physician network, which can affect which Medicare Advantage plans work best.

Northwell Health

- South Shore University Hospital – Bay Shore

Northwell is one of the largest health systems in New York, and many Lindenhurst residents receive care through Northwell-affiliated doctors and specialists.

NYU Langone

- NYU Langone Hospital—Long Island (Mineola)

Access to NYU Langone doctors or facilities is important to many families, but not all Medicare Advantage plans include NYU Langone in their networks.

The Part Most People Miss: It’s Not Just the Hospital — It’s the Doctor Group

This is where Medicare networks get tricky.

Even if a Medicare Advantage plan includes a hospital you like, your doctor may belong to a medical group that is not contracted with that plan. This is one of the most common reasons people run into problems after enrolling.

Large physician groups commonly seen on Long Island include:

- Northwell Health Physician Partners

- Catholic Health Physician Partners

- Optum and other regional physician networks

A plan can be popular, affordable, and well-advertised — and still be the wrong plan if your providers don’t match the network..

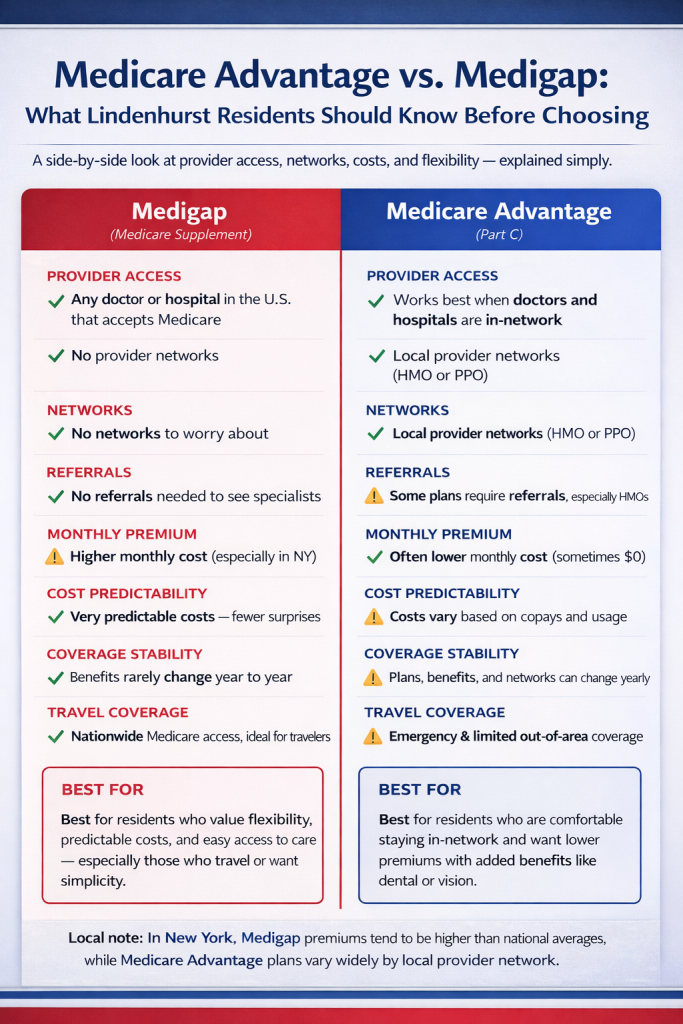

How Medicare Supplement (Medigap) Plans Change the Equation

This is why many Lindenhurst residents ask about Medicare Supplement (Medigap) plans.

Medigap plans do not have provider networks.

If a doctor or hospital accepts Medicare, they accept your Medigap plan. There are no HMOs, no PPO networks, and no referrals required.

Medigap can be especially appealing if you:

- See multiple specialists

- Want access to any Medicare doctor nationwide

- Travel frequently

- Don’t want to worry about annual network changes

But flexibility comes at a cost — especially in New York.

The Cost Reality of Medigap in New York & Long Island

New York — and Long Island in particular — is one of the most expensive areas in the country for Medicare Supplement insurance.

Over the past four years, premiums for popular Medigap plans like Plan G and Plan N have increased by over 50% in many cases, far exceeding normal inflation.

And Medigap costs don’t exist in isolation.

To fully understand the cost, you also need to consider:

- Medicare Part B premiums (which typically increase each year)

- Medicare Part B deductibles

- Stand-alone Medicare Part D prescription coverage

Just a few years ago, many Lindenhurst residents could find Part D plans for under $10 per month. Today, the cheapest options are closer to $35 per month, driven in part by changes under the Inflation Reduction Act and rising drug costs.

While Medigap remains an excellent access option, it has become a much heavier financial commitment for many retirees.

.

Medicare Network Questions Lindenhurst Residents Ask Most

Can I keep my Lindenhurst doctor with a $0 Medicare Advantage plan?

Sometimes, but not always.

$0 premium plans only cover doctors who are in the plan’s network, and providers must be verified for the exact plan name and office location.

Does Good Samaritan Hospital accept all Medicare Advantage plans?

No.

Good Samaritan University Hospital in West Islip works with many Medicare Advantage plans, but not all. Participation depends on the specific plan network and can change year to year.

Why is Medigap so expensive in Lindenhurst?

Because New York is one of the highest-cost states for Medicare Supplement insurance. On Long Island, premiums for popular plans have increased over 40% in recent years, far above typical inflation.

Do Medicare Advantage networks change every year?

Yes.

Plans can change doctors, hospitals, copays, and referral rules annually, which is why yearly reviews are important for Lindenhurst residents.

The Bottom Line for Lindenhurst Residents

- Medigap offers unmatched access and simplicity — but at a rising cost in New York

- Medicare Advantage can be more affordable — but works best when providers are in-network

- There is no one-size-fits-all answer

- The right choice depends on your doctors, budget, and comfort level with networks

This is why working with a local Medicare agent who understands Long Island provider networks can make a meaningful difference.

Need Help Reviewing Your Options?

If you’d like help checking your doctors, hospitals, and prescriptions — or just want a clear explanation of your choices — I’m happy to help.

📞 Call or text 631-358-5793

🌐https://www.paulbinsurance.com/medicare-agent-lindenhurst-ny/